The views expressed are those of the authors and do not necessarily reflect those of the BIS, the Bank of Finland, or Balyasny Asset Management L.P.

In our recent research, we find that deep contractions have highly persistent scarring effects, depressing the level of GDP at least a decade hence. Drawing on a panel of 24 advanced and emerging economies from 1970 to the present, we show that these effects are nonlinear and asymmetric: there is no such persistence following less severe contractions or large expansions. While the potential for scarring after financial crises is well known, we show that scarring also occurred after the deep contractions of the 1970s and 1980s that followed energy price shocks and restrictive monetary policy to combat high inflation. These results are very robust and have important implications for policy making and macro modelling.

From Covid-19 to the war in Ukraine, the global economy has been hit by multiple large shocks in recent years. What is the prognosis for economic recovery in the years ahead? Will we see a rapid bounce-back or will current recessionary forces have lasting scars? Our recent research (Aikman et al (2022)) sheds light on these questions by analysing the preconditions via which scarring has occurred historically. Our key finding is that, more often than not, deep contractions tend to leave long-term economic scars. And it is the depth of a contraction rather than its cause that best predicts whether scarring is likely to occur.

Our results are based on a simple, intuitive test. We first bucket together economic contractions of similar magnitudes in our data, starting with the deepest 5% of contractions. We then compare 10-year ahead growth rates calculated immediately prior to these events with 10-year growth rates from all other points in our sample. If real output eventually recovers its previous trend, there will be no statistical difference between these two long-term growth rates on average. However, if contractions cause scarring, long-term growth rates taken from their eve will be lower than the rest. We then repeat the process for successively milder contractions in 5% intervals until we reach the median.

We apply this test using data on real GDP for 19 advanced economies and five emerging market economies (EMEs) from 1970 to the present. For each series, we remove long-run growth trends and normalise growth rates by country-specific means and standard deviations to make sure that growth rates are comparable across countries.

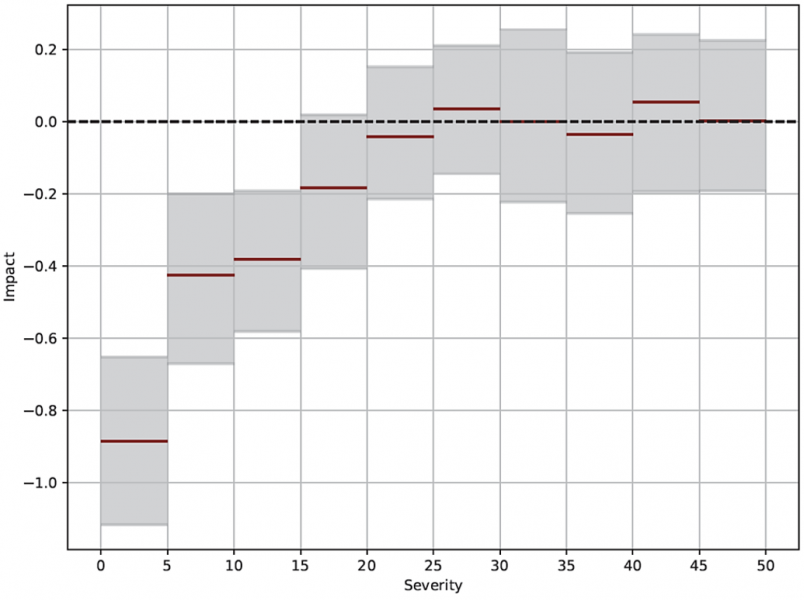

The figure below shows our key finding. The dark red lines are the difference between the average 10-year ahead real GDP growth at the onset of the contraction and the rest of the sample (measured in terms of standard deviations of 10-year growth). The severity of the contraction is shown on the x-axis, with the most severe outcomes on the left. Grey areas are confidence intervals.

The 15% most severe contractions have highly persistent costs whose effects are visible in the level of GDP a decade hence. Moreover, the magnitude of the scarring increases with the size of the initial contraction. For the deepest contractions, GDP growth in the decade that follows is almost one standard deviation below the full sample mean. This translates into a persistent loss of 4.25% in the level of real GDP for an average economy.1

Figure 1: Only severe contractions have scarring effects

Note: Difference in mean 10-year growth rates following contractions of different severity versus that calculated using all other points in the sample. The solid lines show points estimates of this difference for contractions in the severity buckets indicated on the x-axis. The shaded areas are 95% confidence intervals. Severity buckets are based on distribution of annual real GDP growth outcomes starting with the weakest 5% outcomes (“most severe”) to then look at successively milder outcomes in 5% intervals until the 45th to 50th percentile (“mild”). The y-axis is standard deviations of 10-year real GDP growth.

It is well-known that recessions associated with financial crises have highly persistent effects (e.g., Cerra et al (2008)). But do contractions associated with other causes – specifically, inflationary energy shocks and tight monetary policy – also have such effects?

To analyse this question, we classify the most severe recessions in our data as being the result of either: (1) banking crisis; (2) restrictive monetary policy to combat high inflation; (3) oil shocks; or (4) other factors, including natural disasters, wars, political upheaval etc.

Using this classification, we find that the specific cause of the contraction does not drive our results. When conditioning on each event type separately, we find long-run effects of roughly similar magnitude for banking crisis and those related to monetary policy tightening, and somewhat larger effects following energy supply shocks.2

Why should such permanent losses occur? Likely mechanisms historically have included slower technology growth due to lower investment in R&D, bankruptcies of highly productive start-ups, or the erosion of human capital from long spells of unemployment. At this juncture, an additional mechanism could be the process of deglobalisation and fragmentation kickstarted by Covid and given further impetus by the Russian invasion of Ukraine.

A key question is whether policymakers have sufficient tools to avoid a severe recession – and the scarring this could entail – given the competing need to bring inflation back under control. Many current forecasts anticipate that central banks will eventually deliver full recoveries. As such, long-term effects of the current predicament may be limited, with economies around the world eventually reverting to the previous trend. The situation is frail, however. It is not inconceivable that supply disruptions could worsen as the war continues. Weighing these trade-offs is beyond the scope of our work. But what is very clear from our analysis is that relying on standard macroeconomic models that assume the economy will inevitably recover the previous trend can be misleading. While there are many risks ahead, relying on wrong models is certainly one risk that policy makers can avoid.

Aikman, D, Drehmann, M, Juselius, M and Xing, X (2022), “The scarring effects of deep contractions”, BIS Working Papers No 1043. https://www.bis.org/publ/work1043.htm

Cerra, V and S Saxena (2008), “Growth dynamics: The myth of economic recovery,” American Economic Review, 98 (1), 439–457.

We show in the paper that, while the specific tipping point may vary with the test specification, the main takeaway that only severe contractions have scarring effects is very robust across samples, time periods, detrending methods, and approach used to identify contractions.

Growth rate effects following events in our “other” category are imprecisely estimated given the small number of such contractions in question.