This paper identifies the priorities to strengthen the European Economic and Monetary Union (EMU) by 2025 and beyond. While the EMU has gone through significant reforms since the recent crisis and has become much more robust, further reforms are necessary to improve the euro area’s capacity to prevent, withstand and absorb shocks. This paper argues for completing the Financial Union, the Fiscal Union and the Economic Union, all based on solid democratic accountability. A brief historical comparison with the US economic and monetary integration allows putting the necessary euro area reforms into perspective and drawing some lessons on timeline and sequencing.

1. Introduction

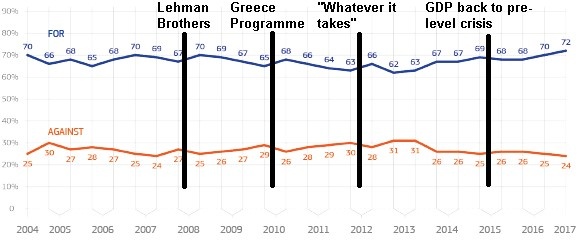

Turning crises into opportunities has been a leitmotiv of the history of the European Union and the recent sovereign debt crisis is no exception. It has been a very strong catalyst for the reforms of the Economic and Monetary Union (EMU). Though the euro area did not have good press during the crisis, the significant and demanding reforms implemented in the Member States have shown the attachment to the single currency and the efforts the countries were prepared to make in order to preserve it. Interestingly, in spite of the costs of the crisis policies, as well as the (sometimes excessive/unfair) criticism they were subject to, the support for the euro has been relatively stable and reached all time high (Graph 1) in the latest survey (Eurobarometer, 2017). This creates a good basis for further reforms and gives us the responsibility to implement them.

Graph 1: Perception of the Euro

Source: European Commission and Eurobarometer 2017

A lot has been done already to correct the weaknesses of the EU economic governance framework, which the crisis revealed forcefully. The crisis did not originate from the euro area but did lay bare the incompleteness of the EMU architecture. The work on reforming and deepening the EMU started early in the crisis. The coordination of the stimulus package in 2009 was soon followed by a comprehensive set of proposals to reform and broaden EU economic governance. The so-called ‘Six-Pack’ has strengthened the ability to prevent and correct economic and fiscal imbalances. The urgent set-up of the European Financial Stabilisation Mechanism (EFSM) in 2010 provided emergency funding. The following years saw the creation of the permanent European Stability mechanism (ESM), the 2012 blueprint for the long-term future of the EMU, the agreement on the Banking Union and further improvements in the economic surveillance framework. The ECB’s Open Market Transactions and intervention in secondary sovereign bond markets contributed to stabilising financial markets.

These urgent measures stabilised the euro area economy and, following the famous “whatever it takes” statement by President Mario Draghi in July 2012, reduced uncertainty and contributed to putting Europe back on the growth path. When the firemen had finished extinguishing the fire, the architects were called in to rebuild the house. In June 2015, the Five Presidents of the EU Institutions (Juncker et al., 2015) released a report about the reforms of the EMU in two stages by 2025. However, just as the first wave of post-crisis EMU reforms started to be implemented, Brexit suddenly broadened the sense of urgency from the future of the euro area to the future of the EU as a whole. The remaining 27 Member States thus started work on renewing their common vision for the EU. The Commission contributed to this process by releasing in March 2017 a White Paper on the future of Europe, followed later by five reflection papers on important policy areas of the EU, such as defence, trade and social policy as well as on the EU finances and the EMU. The reflection paper on EMU deepening of May 2017 developed the long-term vision for the monetary Union, initially sketched in the Five Presidents Report and put it up for further discussions with EU stakeholders.

2. Crisis legacies

The recovery in the euro area has finally materialized. The euro area has seen positive growth for more than four years now and the growth rate is at its fastest in a decade. Unemployment is falling and economic sentiment is positive.

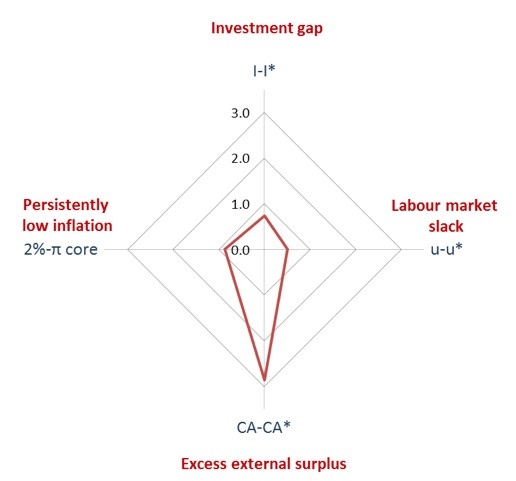

The recovery is, however, still incomplete (Graph 2). The labour market still shows some slack, large external surpluses persist and inflation is far from the ECB’s reference value.

Graph 2: Remaining economic slack

In terms of GDP components, investment was the main victim of the crisis (Buti and Mohl, 2014) and has fallen more markedly in countries most exposed to the crisis. It has since picked up at a rate of almost 4%, driven by favourable financing conditions and decreased uncertainties. The outlook for corporate investment has improved and the Investment Plan for Europe is also expected to boost investment. Nonetheless, investment, particularly public investment, has not recovered fully and differences between countries are very visible. Crisis legacies are still felt strongly in countries like Greece or Portugal. The persistent weakness of investment is striking in large economies where low investment levels prevailed already before the crisis.

Continued, even if moderate, economic growth has led to labour market improvement. The euro area unemployment is falling below 9%, but the headline numbers still hide considerable slack. Broader labour market measures that cover involuntary part-timers and inactive people, point to a labour market slack (Eurofound (2017), ECB (2017)) still above the pre-crisis levels.

In view of these circumstances, there is an agreement between the Commission and the Member States that a broadly neutral aggregate fiscal stance for the euro area as a whole is appropriate. However, the distribution of the aggregate fiscal stance across the euro area countries continues to be uneven. For several years we have seen the mismatch between the needs and the means for fiscal stabilisation: countries that had justifiable needs to expand their fiscal policy did not have room for manoeuvre, while those who did have it, did not want to do use it. This conundrum points to the limits of the tools the euro area has at its disposal. The markets are very effective in putting pressure on debtor countries, but no market mechanism exists to incentivise creditor countries to avoid imbalances. As first proven in Bretton Woods in the debate between J.M. Keynes and H.D. White, constraining creditors is extremely difficult, almost impossible. The EU has been trying to address this problem in the context of the coordination of economic policies and repeated recommendations were made to countries with fiscal space to use it for boosting investments. The focus on investments was justified by its impact on growth on both the demand and the supply sides.

Fiscal and financial fragilities still pose important challenges to the euro area. Large public debt ratios and non-performing loans (NPL) in the banking sector in several Member States signal large deleveraging needs in the public and the private sector. Low interest rates, combined with large NPL stocks, negatively affect bank profitability. However, while the expected increase in interest rates may be welcomed from the point of view of banking profitability, it poses a challenge for countries with high public debt ratios. In those cases, the risk of a snowball effect for debt may return.

3. Taking steps to complete the EMU by 2025

Despite a set of policy responses under the crisis, imbalances persist and the EMU is still not showing its full potential. Long term growth remains subdued and the lack of common stabilisation tools will hinder the ability to effectively tackle the next significant downturn. In the short term, there is a need to avoid the situation where the remaining financial and fiscal fragilities jeopardize the budding recovery.

A new synthesis is therefore needed that should rely on three main building blocks as presented in the Five Presidents Report: a Financial Union, a Fiscal Union and an Economic Union. The Financial Union has to be built on a balance between risk-sharing and risk reduction. The Fiscal Union needs to include a strong commitment to sound budgetary policy at the national level and a common stabilisation capacity at the euro area level. Such stabilisation function would be used in justified cases to help achieving an appropriate fiscal stance for the euro area as a whole and support an orderly policy mix. The Economic Union has to incorporate effective incentives that lead to reform implementation that effectively correct the imbalances.

In addition, the governance structures and their legitimacy in the eyes of national constituencies and the population at large will also determine the efficiency and acceptability of the EMU reforms going forward. These different domains should not be seen in isolation but as complementary. Achieving the Financial Union is key for the good functioning of the EMU, due to the systemic importance of the financial sector. Also, as put forward by the Reflection Paper on EMU, better integration between Fiscal and Economic Unions would improve overall shock absorption capacity of the euro area due to a better combination of private, market-based tools and public mechanisms.

3.1 Financial Union

3.1.1. Risk reduction and financial markets in the euro area

The European economy has traditionally relied predominantly on bank finance, with total banking sector assets far exceeding those in the US. For instance, total bank assets as % of GDP were above 300% in the euro area in 2011 and less than 100% of GDP in the US (EBF-FBE, 2014). Not surprisingly then, the banking sector was the main channel transmitting the cross-border shocks during the crisis. For the same reason, the decision to set up the Banking Union is seen by many as the game-changer in the EMU architecture (Véron, 2015). Two building blocks of the Banking Union have been already established and are up and running: the Single Supervisory Mechanisms and the Single Resolution Mechanisms, with the Single Resolution Fund being gradually filled in by banking sector contributions. Nevertheless, there are still two important elements of the Banking Union, which are missing: a common deposit insurance mechanism (European Deposit Insurance Scheme also known as EDIS) and a common fiscal backstop to the Single Resolution Fund. As to the latter, there is an agreement among the euro area Member States to establish a common backstop, but the discussions have been underway – and are close to a successful conclusion – on the modalities of the backstop. On the EDIS, however, while the Commission proposal has been on the table since end-2015, there is less agreement among Member States.

The role of the banking sector in the crisis and its aftermath, when due to structural problems the sector was unable to efficiently provide financing to the economy, highlighted the risks related to excessive reliance on one source of financing. This has given rise to the Capital Markets Union project, which aims to create a single market for capital in the EU. While being a project for the whole EU, it has particular importance for the euro area as it can provide significant adjustment mechanism. The US serves here as a useful example. Buti et alii (2016) estimate that shock absorption via cross-border capital and labour income amounts to around 40% in the US in comparison with 6% in the euro area. Also, CMU would facilitate the recycling of the euro area internal imbalances via equity rather than debt, lifting the negative narrative attached to indebtedness, in particular in some parts of Europe.

3.1.2. Tackling further the sovereigns- banks feedback loop

The main rationale behind the Banking Union was to sever the infamous “doom loop” or the “vicious cycle” between the euro area sovereigns and the banks. Indeed, the common banking supervision and the common resolution have already reduced the risks of spill-overs from the banking sector to the sovereigns, compelled to rescue the banks. But the risks stemming from the strong home bias in sovereign bonds holdings by the banks (i.e. the banks’ exposures to the country in which they are headquartered) could be tackled even further, namely through greater diversification of banks’ balance sheets.

The Reflection Paper on EMU suggests using the idea of sovereign bond-backed securities (SBBS) for this purpose. As suggested by Brunnermeier et al. (2016), those financial products could be issued by a commercial entity or a public body by pooling a portion of national bonds and tranching the new issuance into senior and junior tranches. At the same time it is recognised that SBBSs will not reach a potential equivalent to US treasuries or Japan’s government bonds, which for an area of comparable economic size, comes with opportunity costs. Individual euro area Member States issue bonds with heterogeneous risk characteristics, generating an asymmetric provision of safe assets. Experience has shown that at times of stress, the current structure of the sovereign bond market has amplified market volatility, affecting the stability of the financial sector. That’s why the Reflection Paper advances the idea of a genuine European Safe Asset that could be pursued to complete the financial market architecture and ultimately break the link between sovereigns and banks. A truly European safe asset should preserve the capacity of governments to finance themselves at reasonable costs and with continuous market access, but at the same time should improve the incentives for sound budgetary policies. Several specific proposals exist of European safe assets with different characteristics. Some models reduce the degree of mutualisation while others are based on joint liabilities (European Commission (2011), Buti et al. (2017)).

3.2 Fiscal Union

As mentioned earlier, the crisis has revealed two main missing elements in the fiscal construction of the EMU. First, the lack of a fiscal instrument at the centre, which could support stabilisation role of national fiscal policies and the monetary policy once it ran out of ammunition. Second, in the aftermath of the crisis the coordination of fiscal policies at the euro area level showed its limits in achieving a coherent overall fiscal stance – coherent in terms of its relation to the monetary policy stance and in terms of its breakdown across countries.

These findings have led to calls for a stabilisation capacity for the euro area, first in the Five Presidents Report and then in the Reflection Paper on EMU. The Five Presidents argued that the function should be conceived in such a way that it does not lead to permanent transfers and minimises moral hazard. It should not duplicate the role of the ESM in crisis management and it should fall under the EU framework. Access to the capacity should be strictly conditional on clear objective criteria and sound policies.

The Reflection Paper went one step further and put forward different options for a stabilisation capacity:

One additional benefit of a common stabilisation function is related to the EU fiscal rules, which have over the past grown in sophistication and complexity. One of the reasons for this development was the attempt to marry stabilisation and sustainability objectives of the rules, which initial design was strongly tilted towards sustainability. The establishment of the common stabilisation facility would take some of the stabilisation burden out of national budgets and would thus allow re-focusing EU fiscal rules on sustainability. This could also lead to their simplification and what follows – transparency and effectiveness.

3.3 Economic Union

After a stall in reforms during the first EMU decade, crisis-hit countries that were the most vulnerable economically have been the most active in reforming product and labour markets. This is an illustration of a well-known, but sub-optimal behaviour that policy-makers act decisively only when the situation is unsustainable. One of the objectives of governance reforms implemented after the crisis was to overcome this “ultima ratio” approach. One of the main challenges of this recovery is to identify how to overcome complacency and use the recovery to step up the reforms and not otherwise.

To increase the impact of reforms in the EMU, greater attention has been turned towards the challenges of the euro area as a whole, through policy recommendations for the euro area, issued in the context of the EU framework for multilateral country surveillance. The crisis has demonstrated the importance of spillovers in the euro area through trade and financial channels. The recommendations aim at improving the coordination of policies among the euro area countries and provide guidance for the implementation of a coherent aggregate policy mix in the euro area. Second, the EU budget can provide further incentives for reforms by reinforcing the links between funding and structural reforms. Third, a new approach to structural reforms (sometimes labelled “structural reforms 2.0”) can put more emphasis on human capital and other factors that contribute to total factor productivity. Fourth, reforms that increase economic resilience are essential to prepare for potential future crises. Greater resilience can also improve cyclical convergence and in this way increase the effectiveness of the single monetary policy.

4. Lessons from the US

Charting the future of the EMU is a particularly difficult task, as no similar project has been undertaken. However, the US history is the closest existing proxy and could offer some pointers in this regard.

From a historical standpoint, the Euro area is still in its infancy. The US has had more than 200 years to achieve the current stage of integration. The U.S. is not a model but more a source of reflection and inspiration for the “architects” of the euro. The length of the process in the US is an indication of the complexity ahead.

Table 1: Building a monetary Union: a brief EU-US historical comparison

The first lesson from the US fiscal integration is that fiscal unions do not emerge suddenly at a single point in time. As shown in Table 1, many historical events, especially crises, have triggered radical and incremental changes. America’s early “Hamiltonian moment” that saw the establishment of common federalized government debt instruments as early as 1791 did not immediately lead to a fully-fledged fiscal union. The fiscal-economic programs of Hamilton were not an end, just a milestone in the US fiscal and federal history.

The second lesson is the incremental nature of the construction, whereby trial and errors and successive steps are necessary to build a continental-sized Union. The US created a safety net at the federal level gradually, in the 1860s, the 1910s and the 1930s. A PIIE study (2018, forthcoming) mainly links the US leaps in fiscal, economic and monetary history to specific political events, economic crisis and especially wars. The first wave was related to the US civil war. The second corresponded to the commitment of the US to the First World War. In fact, there was no sizeable US federal budget before 1917, which was then still below the threshold of 5% of GDP. The third wave of fiscal centralisation was an answer to the great recession. Through the New Deal, the difference between the US federal budget and the current EU budget became more marked. More than 120 years were necessary for the US federal government’s non-war expenditures to permanently exceed a size comparable to the current EU budget (about 1.17% of GDP).

Similarly, the US Banking Union is also characterized by a stepwise approach. The U.S. took more than 200 years to approximate a Banking Union. An important milestone was the Federal Reserve Act of 1913. But this Federal Reserve System created in 1913 failed to reduce the risks of financial crisis. Banking panics spread in 1930–33 because of the Great Depression. The Federal Deposit Insurance Corporation (FDIC) was thus established in 1934.

The third lesson relates to the sequencing of steps. The US history tells us that once there is political agreement on the need to finance some expenditure from the centre, revenues will be found. The political acceptance was reinforced by tying the tax collection to the earmarked expenditure. In such a system what the money is used for is very visible. There was less perception that money disappeared in a big pot of the distant federal budget.

5. Conclusion

Better economic times and stronger financial stability create a favourable context to complete the architecture of the EMU based on a comprehensive and consistent framework of Financial, Fiscal and Economic Unions. But while the recovery helps, it is not a silver bullet. The crisis legacies are to be addressed to make the recovery more sustainable. Moreover, greater democratic accountability and higher transparency about decision-making are also essential to make the EMU deepening project more concrete and acceptable at national and European levels. The US history is a reminder that in the tasks of creating fully-fledged currency unions, patience is a virtue. In the US’s case, wars have been the factor that catalysed the “federalisation” of the country US, but this is a lesson Europe does not want to use. However, in the vein of Winston Churchill’s advice to “Never allow a good crisis go to waste” the current challenging political environment generated by the geopolitical tensions, security and populist threats in the EU should be used as a catalyst of unity to successfully build on the ongoing economic expansion.

Brunnermeier, M., K., S. Langfield, M. Pagano, R. Reis, S. Van Nieuwerburgh, D. Vayanos (2016), ’ESBies: Safety in the tranches’, Working Paper Series No 21, European Systemic Risk Board

Buti, M. and P. Mohl (2014), ‘Lacklustre investment in the Eurozone: Is there a puzzle?’, VoxEU.org, 4 June

Buti, M. (2014) ’Lacklustre investment in the Eurozone: The policy response’, VoxEU.org, 22 December 2014

Buti, M, J. Leandro and P. Nikolov (2016), ‘Smoothing economic shocks in the Eurozone: The untapped potential of the Financial Union’, VoxEU.org, 25 August

Buti, M, S. Deroose, J. Leandro and G. Giudice (2017), ‘Completing EMU’, VoxEU.org, 13 July

EBF-FBE (2014), International Comparison of Banking Sectors

Enderlein, H., E. Letta et al. (2016) ’Repair and Prepare: Growth and the Euro after Brexit’, Gu tersloh, Berlin, Paris: Bartelsmann Stiftung, Jacques Delors Institute – Berlin and Jacques Delors Institute in Paris

Eurobarometer (2017), Standard Eurobarometer, August 2017

Eurofound (2017), ‘Estimating labour market slack in the European Union’, July 2017

European Central Bank (2017), ‘Assessing labour market slack’, Economic Bulletin 3/2017, May 2017

European Commission (2011), ‘Green paper on the feasibility of introducing stability bonds’, COM(2011) 818, 23/11/2011

European Commission (2017), ‘Reflection paper on the deepening of the economic and monetary union’, May 2017

Juncker, J., Tusk, D., Dijsselbloem, J., Draghi, M., & Schulz, M. (2015). Completing Europe’s Economic and Monetary Union – Five Presidents’ Report.

PIIE (2018), ‘Lessons from the US for the functioning of EMU’ (forthcoming)

Véron, N. (2015), ’Europe’s radical Banking Union’, Bruegel Essay and Lecture Series, Bruegel

Director General for Economic and Financial Affairs, the European Commission. This Policy Note is based on an address at a SUERF conference, organised in cooperation with Columbia University | SIPA, the European Investment Bank and Société Générale on “Globalisation Dynamics – EU and US perspectives” on 11 October 2017. The note reflects the proposals of the European Commission until October 2017. The author would like to thank Maya Jollès and Marcin Zogala and the organisers and participants of the SUERF conference for useful discussion and input.