Over recent years, the European Central Bank has repeatedly lowered the deposit facility rate, which is the rate at which banks’ reserves at the central bank are remunerated. A recent Bundesbank discussion paper assesses whether this policy resulted in a differential responsiveness of banks in reallocating reserves into loans. In particular banks that have accumulated more reserves and banks with a more interest-sensitive business model should be more sensitive to changes in the policy rate. While there is evidence for portfolio reallocation, this result is mainly driven by banks in liquidity-rich countries. This in turn suggests that the effectiveness of the deposit facility rate might be hampered in fostering monetary policy transmission across euro area countries.

In September 2019, the European Central Bank (ECB) announced a set of further changes in its monetary policy to foster monetary policy transmission in financial markets (ECB 2019). These changes include, amongst others, that unconventional monetary policy instruments are to be resumed. Under the asset purchase program, net purchases are restarted as of the 1st of November. In addition, the specifics to borrow under the quarterly targeted longer-term refinancing operations are set in order to induce favorable bank lending conditions.

A large strand of recent research has analyzed the effectiveness of such measures falling under the ECB’s unconventional monetary policy.1 However, in addition to unconventional measures, the ECB makes active use of conventional measures, that is, measures that have been in the toolkit already before the financial crisis. These measures include, for example, the rate for reserve requirements as well as the deposit facility rate, a rate that is especially relevant for banks’ reserve holdings.

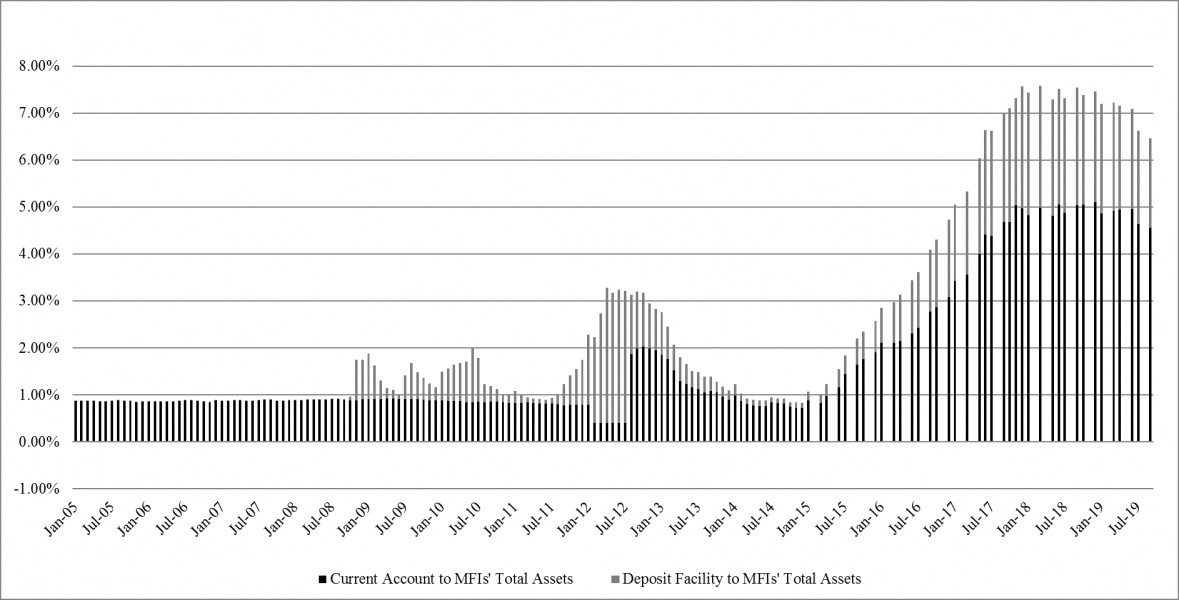

Over recent years, the deposit facility rate has been continuously falling, reaching zero in 2012, and entering negative territory in 2014. Simultaneously, an increase in banks’ reserve holdings can be observed (Chart 1). While before the crisis, banks’ reserve holdings mirrored mainly mandatory reserve requirements, determined by the reserve ratio set by the ECB and a bank’s reserve base, banks’ excess reserves have considerably increased since 2008.

Chart 1: Aggregated reserve holdings of euro are banks

This graph shows the evolution of bank reserves of monetary financial institutions (MFIs) in the euro area over the period from January 2005 to September 2019. The analysis is conducted for the period 2009-2014. Bank reserves can be decomposed into the current account holdings (depicted in black) and the deposit facility holdings (depicted in gray). The former are located at the national central banks while the latter are administered by the ECB. The graph shows the holdings of the accounts scaled by total assets (in %) of MFIs in the euro area. Source: Datastream.

Despite the fact that the aggregate amount of reserves is determined by the ECB’s monetary policy, these developments raise the question of whether individual banks respond to declines in the deposit facility rate. Such declines increase opportunity costs of storing liquidity as reserves at the central banks, and increase incentives for banks to reallocate excess reserves into loans. Alternatively, one might ask whether conventional policy tools such as the deposit facility rate turn ineffective during these unconventional times.

The deposit facility rate gained public attention and was acknowledged by the Financial Times (2016) as “one of the most important pillars of Eurozone monetary policy”. Furthermore, recent policy discussions emphasize that a declining deposit facility rate might reduce banks’ net interest margins and thus impact on the sustainability of banks’ business model. In spite of the public attention, research on the effectiveness of this policy measure – to the best of our knowledge – is rather scarce (for a related paper see, e.g., Heider et al. (2019)). In our study (Buchholz et al. (2019)), we aim to fill this gap by asking whether the reduction of the deposit facility rate has prevented banks from holding reserves at the central bank.

Aiming to increase liquidity in the banking system, the ECB has undertaken a set of measures such as switching to the full allotment mechanism for the main refinancing operations, introducing longer-term refinancing operations, introducing asset purchase programs and easing collateral requirements.

Prior to the crisis, the liquidity management of the ECB limited the amount of reserves (within the Eurosystem) close to euro area banks’ mandatory reserves. Mandatory reserves are held at the current account maintained at national central banks and receive the main refinancing rate. Imbalances in individual banks’ mandatory reserve holdings were offset via interbank markets, which have been the main place to exchange liquidity. This setting changed during and after the crisis: banks in liquidity needs now could (or had to) approach the ECB. The fundamental change in the provision of liquidity by the ECB, and monetary policy in general, gave rise to the increased aggregated amount of reserves within the system. Banks placed these excess reserves with the deposit facility at the ECB, which yields the deposit facility rate.

One underlying explanation for holding liquidity as excess reserves relates to the dysfunctionality of the interbank market, which lost its role in reallocating liquidity between banks. This dysfunctionality has been rooted in solvency concerns, preventing banks from lending in the interbank market, combined with the extended role of the ECB as a liquidity provider.2

The new regulatory setting has eased borrowing from the ECB for banks with sufficient collateral, which reduced demand in the interbank market and increased demand for ECB liquidity (Garcia-de-Andoain et al. (2016)). Banks lacking sufficient collateral can turn to the interbank market but since many of those banks are not considered secure counterparts, liquidity-rich banks do not lend money to them (or only at a very high rate) such that no intermediation in interbank markets takes place any more. The latter prefer to hoard liquidity, thus reducing supply in the interbank market (Heider et al. (2015)). These changes are reflected in the development of the Euro Overnight Index Average (Eonia) rate, showing the average rate of overnight loans in the interbank market. During the past eight years, the rate declined substantially, which reflects that only few and very secure banks obtain interbank loans, and it became closer to the deposit facility rate.

These developments in monetary policy and interbank markets resulted in an accumulation of excess reserves by banks in liquidity-rich countries. Consequently, these banks are also more likely to be immediately affected by declines in the deposit facility rate. The reduction of the deposit facility rate to zero in 2012 and further declines below zero in 2014 increase the opportunity costs of holding reserves. Hence, this downward movement in the deposit facility rate creates a “hot potato” effect and might stimulate a bank to shift reserves into more profitable assets (Arseneau (2017), Keister et al. (2008), Lee (2016)). The recent ECB policy to exempt part of banks’ excess reserve holdings from the negative rate might reflect that the negative deposit facility rate has already exerted considerable cost pressure on some banks.

3.1 Sample and empirical set-up

Our study is based on a panel dataset constructed from bank-level data as provided by Bankscope for the period from 2009 to 2014. We start in 2009 because the ECB switched to a full allotment policy in 2008, and end in 2014 due to the change of the data source to Orbis Bankfocus. The dataset includes 1,978 banks from 17 euro area countries. Following the reasoning above, we explore empirically whether the decline of the deposit facility rate leads to a reallocation of reserves, but even more importantly, we assess into which assets these reserves are reallocated. Banks might shift the freed-up liquidity into loans (which would benefit a proper functioning of monetary policy transmission) or into other and more profitable liquid assets compared to reserves. If the latter holds true, such reallocation decisions induced by monetary policy might potentially fuel asset price bubbles and generate risks in the financial system. Thus, the dependent variable in our regression is the change in the respective balance sheet position (reserves, liquid assets, or total loans) relative to the overall size of the balance sheet.

For identification purposes, we exploit that the impact of decreasing the deposit facility rate on liquidity reallocation might be heterogeneous across banks. Especially banks with a more traditional business model, that is banks that rely more on interest-bearing activities, should be more sensitive to interest rate changes.3 Thus, we analyze whether banks with a more interest-sensitive business model respond heterogeneously to changes in the deposit facility rate. Technically, the regression equation contains an interaction term between the change in the deposit facility rate and a bank’s net interest margin. The coefficient of this interaction term then captures whether banks’ incentives to shrink down reserves after a decline in the rate differ significantly depending on the interest sensitivity of the business model.

The interest sensitivity of the business model is captured by banks’ net interest margin (Lepetit et al. (2008)), whereas we assume that the higher the net interest margin, the stronger the reliance of banks on a traditional business model. We show that banks with a higher net interest margin have indeed higher loan ratios, higher deposit ratios and tend to be smaller, which makes them also more vulnerable to a declining deposit facility rate. Additionally, in the longer-run, banks relying more on an interest-sensitive business model should face increased cost pressure (Dombret et al. (2019)). Especially in a competitive environment, banks are likely to reduce loan rates while being unable to reduce deposit rates to the same extent (Claessens et al. (2016, 2018)). The reason is that lending rates are more elastic than deposit rates, which is especially constrictive in a zero lower bound environment (Samuelson (1945)).

The model further controls for time-invariant bank characteristics, common macroeconomic shocks and time trends in the euro area, as well as bank-specific characteristics and the macroeconomic environment at the country level. Importantly, as we analyze the effects of a conventional monetary policy tool during a period of expansionary monetary policy, we control for unconventional measures aimed at easing access to liquidity and reducing funding costs, which might also affect the decisions of banks regarding the allocation of funds.

3.2 Heterogeneity in portfolio reallocation incentives can be detected

Our analysis shows that banks react to changes in the deposit facility rate by adjusting reserve holdings, and the magnitude of the response depends on the interest sensitivity of the business model. The more banks rely on an interest-sensitive business model, that is, the higher their net interest margin, the more they reduce their reserve holdings given a decline in the deposit facility rate. Thus, despite the deposit facility rate being applied uniformly across euro-area countries, the responsiveness of banks to such changes in monetary policy differs.

The results support the hypothesis that the reduction of the deposit facility rate allows to restore monetary policy transmission at the bank level: banks tend to reallocate the reserves into loans, and there is no evidence for a reallocation into liquid assets. This is in line with the finding of a “reserve-induced portfolio balance channel” by Kandrac and Schlusche (2017), who show that the regions of the U.S. that were characterized with higher reserve holdings experienced higher loan growth.

3.3 Different reliance on reserves drives effectiveness of policy tool

To study potential differences in the effectiveness of the deposit facility rate across countries, we further differentiate between banks in Greece, Ireland, Italy, Portugal, and Spain (GIIPS), and non-GIIPS countries of the euro area. The underlying reasoning is that liquidity in the form of excess reserves seems to accumulate more at banks in non-GIIPS countries, with the possible implication that these banks might be affected to a different extent by the ECB’s policy. Banks from GIIPS countries, by contrast, are more likely to be in liquidity needs. Limited access to interbank markets due to weak fundamentals increases their reliance on the ECB as a liquidity provider.

For the non-GIIPS countries, the study confirms the higher responsiveness of banks with a more interest-sensitive business model to changes in the deposit facility rate. Hence, for banks with supposedly larger reserve holdings, a reduction in the interest rate on reserves results in stronger incentives to rebalance asset positions away from reserves. This finding supports the “hot potato” effect of reserve holdings. Reversely, there is limited evidence that portfolio rebalancing incentives exist in GIIPS countries, which is consistent with the earlier study of Al-Eyd and Berkmen (2013) who show that monetary policy transmission is impaired in the stressed countries of the euro area.

Our results reveal that a conventional monetary policy instrument such as the deposit facility rate can work as intended during crisis times. Banks with a more interest-sensitive business model are more likely to reduce reserves and increase loans following a decline in the deposit facility rate. Hence, the deposit facility rate can be a useful tool to restore the transmission mechanism of monetary policy. Compared to unconventional measures, it has the advantage that it is a rather transparent tool, which is uniformly applied across euro area countries. At the same time, our study shows that its effectiveness has limitations. We find that the results are driven by banks in the non-GIIPS countries. This finding makes sense because in those countries banks accumulated more reserves such that declines in the deposit facility rate actually affect them and might have prompt them to adjust their portfolios. By contrast, banks in the GIIPS countries, that is in countries hit by the financial and sovereign debt crisis more severely, are less responsive to the policy instrument. Consequently, this differential response impedes the effectiveness of the deposit facility rate in particular in more distressed countries, and it might explain the extended use of unconventional monetary policy by the ECB.

Abbassi, P., Fecht, F., Bräuning, F., & Peydro, J.-L. (2014). Cross-Border Liquidity, Relationships and Monetary Policy: Evidence from the Euro Area Interbank Crisis. Bundesbank Discussion Paper No. 45/2014.

Acharya, V. V., & Merrouche, O. (2013). Precautionary Hoarding of Liquidity and Interbank Markets: Evidence from the Subprime Crisis. Review of Finance, 17, 107-160.

Acharya, V. V., Eisert, T., Eufinger, C., & Hirsch, C. W. (2019). Whatever it takes: The real effects of unconventional monetary policy. The Review of Financial Studies, 32(9), 3366-3411.

Afonso, G., Kovner, A., & Schoar, A. (2011). Stressed, Not Frozen: The Federal Funds Market in the Financial Crisis. The Journal of Finance, 66(4), 1109-1139.

Al-Eyd, A. J., & Berkmen, P. (2013). Fragmentation and Monetary Policy in the Euro Area. IMF Working Paper No. 13/208.

Arseneau, D. M. (2017). How Would US Banks Fare in a Negative Interest Rate Environment? Finance and Economics Discussion Series 2017-030. Washington: Board of Governors of the Federal Reserve System.

Ashcraft, A., McAndrews, J., & Skeie, D. (2011). Precautionary Reserves and the Interbank Market. Journal of Money, Credit and Banking, 43(s2), 311-348.

Borio, C. E., Gambacorta, L., & Hofmann, B. (2017). The influence of monetary policy on bank profitability. International Finance, 20, 48-63.

Buchholz, M., Schmidt, K., & Tonzer, L. (2019). Do Conventional Monetary Policy Instruments Matter in Unconventional Times? Deutsche Bundesbank Discussion Paper 27/2019.

Busch, R., & Memmel, C. (2017). Banks’ Net Interest Margin and the Level of Interest Rates. Credit and Capital Markets, 50(3): 363-392.

Chodorow-Reich, G. (2014). Effects of unconventional monetary policy on financial institutions. Brookings Papers on Economic Activity (Spring): 155-204.

Claessens, S., Coleman, N., & Donnelly, M. (2016). Low interest rates and banks’ net interest margins. http://voxeu.org/article/low-long-interest-rates-and-net-interest-margins-banks.

Claessens, S., Coleman, N., & Donnelly, M. (2018). “Low-for-Long” Interest Rates and Banks’ Interest Margins and Profitability: Cross-Country Evidence. Journal of Financial Intermediation 35(Part A), 1-16.

Dombret, A., Gündüz, Y., & Rocholl, J. (2019). Will German banks earn their cost of capital? Contemporary Economic Policy, 37(1), 156-169.

European Central Bank (2019). Monetary policy decisions. Press release. 12 September 2019.

Financial Times (2016). European banks uneasy over deeper negative interest rates. Article published in the Financial Times, 9 February, 2016.

Gambacorta, L., & Marqués-Ibáñez, D. (2011). The bank lending channel: lessons from the crisis. Economic Policy, 26(66), 135-182.

Garcia-de-Andoain, C., Heider, F., Hoerova, M., & Manganelli, S. (2016). Lending-of-last-resort is as lending-of-last-resort does: Central bank liquidity provision and interbank market functioning in the euro area. Journal of Financial Intermediation, 28, 32-47.

Genay, H., & Podjasek, R. (2014). What is the impact of a low interest rate environment on bank profitability? Chicago Fed Letter, July 2014, No 324.

Heider, F., Hoerova, M., & Holthausen, C. (2015). Liquidity Hoarding and Interbank Market Spreads: The Role of Counterparty Risk. Journal of Financial Economics, 118, 336-354.

Heider, F., Saidi, F., & Schepens, G. (2019). Life Below Zero: Bank Lending Under Negative Policy Rates. Review of Financial Studies, 32(10), 3728-3761.

Kandrac, J., & Schlusche, B. (2017). Quantitative easing and bank risk taking: Evidence from lending. Finance and Economics Discussion Series 2017-125. Washington: Board of Governors of the Federal Reserve System.

Keister, T., Martin, A., & McAndrews, J. (2008). Divorcing Money from Monetary Policy. FRBNY Economic Policy Review / September 2008.

Lambert, F., & Ueda, K. (2014). The effects of unconventional monetary policies on bank soundness. IMF Working Paper No. 14-152.

Lee, J. (2016). Corridor System and Interest Rates: Volatility and Asymmetry. Journal of Money, Credit and Banking, 48(8), 1815-1838.

Lepetit, L., Nys, E., Rous, P., & Tarazi, A. (2008). The expansion of services in European banking: Implications for loan pricing and interest margins. Journal of Banking & Finance, 32(11), 2325-2335.

Mamatzakis, E., & Bermpei, T. (2016). What is the effect of unconventional monetary policy on bank performance? Journal of International Money and Finance, 67, 239–263.

Nucera, F., Lucas, A., Schaumburg, J., & Schwaab, B. (2017). Do negative interest rates make banks less safe? Economics Letters, 159, 112-115.

Nyborg, K. G., & Östberg, P. (2014). Money and liquidity in financial markets. Journal of Financial Economics, 112(1), 30-52.

Samuelson, P. A. (1945). The effect of interest rate increases on the banking system. American Economic Review, 35(1), 16-27.

See, e.g., Acharya et al. (2019), Chodorow-Reich (2014), Lambert and Ueda (2014), Mamatzakis and Bermpei (2016).

See, e.g., Abbassi et al. (2014), Acharya and Merrouche (2013), Afonso et al. (2011), Ashcraft et al. (2011), Nyborg and Östberg (2014).

See, e.g., Arseneau (2017), Borio et al. (2017), Busch and Memmel (2017), Claessens et al. (2016), Gambacorta and Marqués-Ibáñez (2011), Genay and Podjasek (2014), Nucera et al. (2017).