Authors’ note: The views expressed herein are those of the authors and should not be attributed to the BIS or the IMF.

Monetary policy is often feared to have limited traction in emerging markets. Yet, empirical evidence supporting or disproving these concerns is scarce due to challenges in the identification of monetary policy shocks. In a recent study, we construct novel monetary policy shocks based on analysts’ forecasts of policy rate decisions. Critical for the identification of the shocks, analysts can update their forecasts up to the time of the monetary policy meeting to incorporate any information deemed relevant to the interest rate decision. Using these shocks, we find that monetary policy in emerging markets wields considerable influence on financial and macroeconomic conditions, with a particularly pronounced impact on leveraged firms.

Proverbial concerns remain about the traction of monetary policy in emerging markets due, for example, to lower financial development and weaker institutional credibility (Frankel, 2010). These concerns have been amplified by highly influential studies showing that powerful global financial forces – largely driven by US monetary policy – strongly affect financial conditions in emerging markets, even those with flexible exchange rates (Rey 2013; Bruno and Shin, 2015; Kalemli-Özcan, 2019; Miranda-Agrippino and Rey, 2020). More recently, De Leo, Gopinath, and Kalemli-Özcan (2023) have documented that a US monetary tightening raises borrowing and lending rates in emerging markets even though local central banks react by cutting policy rates.

This evidence has been at times interpreted as indicating severe impairments in the transmission of monetary policy in emerging markets. As discussed in Rey (2013), the strength of the global financial cycle might even transform Mundell’s Trilemma into a Dilemma, where countries can only maintain monetary policy independence by regulating capital flows or adopting stringent macroprudential frameworks. However, as discussed in Obstfeld (2015) and Gourinchas (2018), the fact that emerging markets’ financial conditions are sensitive to global financial shocks does not necessarily imply that monetary policy in emerging markets can no longer influence domestic macroeconomic and financial conditions. Global financial shocks clearly pose challenges – possibly even trade-offs – for emerging markets’ central banks. But domestic monetary policy may still retain traction in steering economic conditions.

An accurate assessment of monetary policy transmission in emerging markets requires carefully identifying domestic monetary policy shocks. This task has proven to be particularly challenging. For example, high-frequency identification techniques that have been successfully used in advanced economies (Kuttner, 2001) are problematic in the context of emerging markets because of limited market liquidity.

To overcome these challenges, in a recent paper (Checo, Grigoli, and Sandri, 2024) we construct a new set of monetary policy shocks for 18 emerging markets, going back in some cases to the early 2000s, using analysts’ forecasts of policy rate decisions. The identification assumption is that analysts construct their forecasts by factoring in the endogenous reaction of monetary policy to economic conditions. Hence, forecast errors can be leveraged to isolate the variation in monetary policy decisions unrelated to economic developments. Critical for identification, we use survey data collected by Bloomberg which allows analysts to update their forecasts up to the time of the monetary policy meeting to incorporate any data releases that could influence the policy rate decision. We find indeed evidence that analysts tend to provide accurate forecasts by finalizing their submissions closer to the policy meeting when the policy rate decision is more uncertain.

To further ensure that forecast errors are free from any endogenous variation in monetary policy linked to macroeconomic developments, we orthogonalize them with respect to a broad range of macroeconomic and financial variables available before each policy meeting, as in Bauer and Swanson (2023). We detect limited predictability of the forecast errors, consistent with the notion that analysts already incorporate the endogenous response of monetary policy to economic conditions.

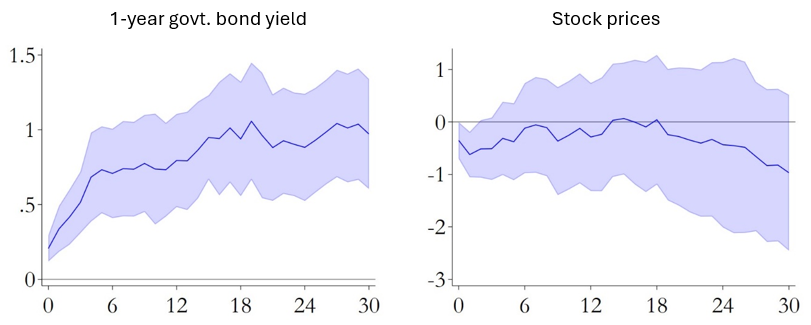

We start by examining the effects of monetary policy shocks on financial markets in the days following monetary policy decisions. We find that monetary policy has pronounced and persistent effects on sovereign bond yields. A one percentage point monetary policy shock raises 1-, 2-, and 5-year bond yields by about 100, 80, and 50 basis points, respectively. Monetary policy also tends to compress bond spreads, appreciate the exchange rate, and reduce stock prices, but these effects are short-lived, dissipating within a few days after the policy announcement.

Figure 1: Financial market responses to a 1pp monetary policy shock

Notes: The figure shows the effects of a one percentage point monetary policy shock on financial variables during the 30 days following the shock. The shaded areas correspond to 90 percent confidence intervals constructed with robust standard errors.

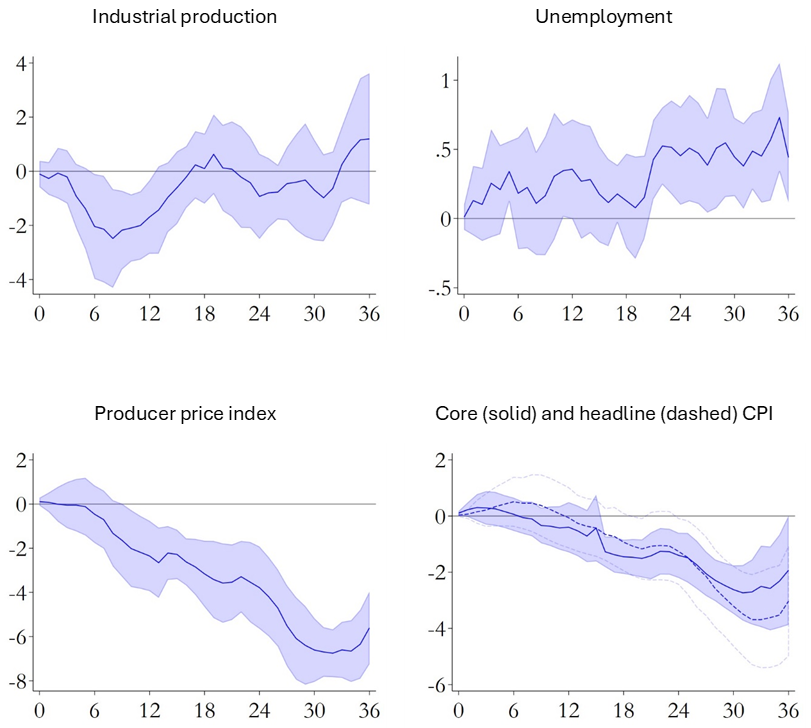

We then assess the transmission of monetary policy to macroeconomic conditions. In line with theoretical predictions, a monetary policy tightening depresses economic activity. Industrial production declines fairly rapidly, reaching a trough after about 3 quarters. The unemployment rate increases more gradually but also more persistently. Tightening monetary policy also reduces inflationary pressures. The impact is relatively rapid on producer prices while consumer prices decline after a longer lag. We also find evidence that the exchange rate tends to appreciate in response to a monetary policy tightening. The transmission lags and the quantitative effects of monetary policy on macroeconomic conditions are broadly in line with the evidence from the US presented in Bauer and Swanson (2023).

Figure 2: Macroeconomic responses to a 1pp monetary policy shock

Notes: The figure shows the effects of a one percentage point monetary policy shock on macroeconomic variables during the 36 months following the shock. The shaded areas correspond to 90 percent confidence intervals constructed with standard errors clustered at the country level.

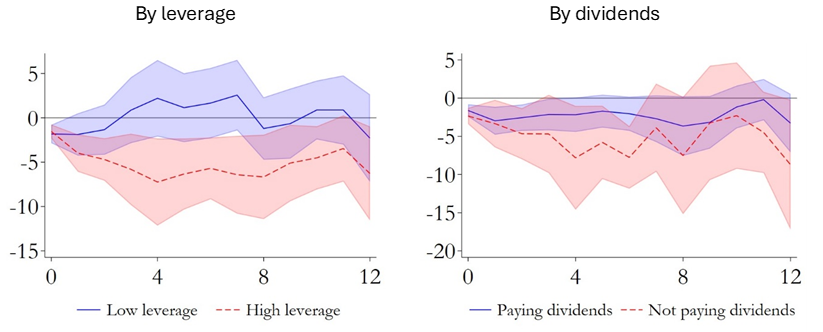

Lastly, we also examine the transmission of monetary policy using firm-level data. This makes it possible to explore the heterogeneity in the impact of monetary policy shocks depending on firms’ financial conditions. Echoing the evidence from advanced economies (Caglio, Darst, Kalelmi-Özcan, 2022), we find that a monetary policy has stronger effects on investment decisions by highly leveraged firms. We also find suggestive evidence of stronger investment responses among firms with lower liquidity or that do not pay dividends. These results confirm the importance of financial frictions in influencing the transmission of monetary policy, even in emerging markets.

Figure 3: Heterogeneous responses of investment across firms

Notes: The figure shows the effects of a one percentage point monetary policy shock on firm-level variables during the 12 quarters following the shock, differentiating across firms’ financial characteristics. Panel (a) compares firms with the leverage ratio equal to the 10th and 90th percentiles of the sample distribution and panel (c) compares firms that paid dividends in their past to firms that never did. The shaded areas correspond to 90 percent confidence intervals constructed with standard errors clustered at the firm and time level.

In summary, the analysis provides encouraging evidence about the strength of monetary policy transmission in emerging markets. Using our newly constructed monetary policy shocks, we show that monetary policy influences financial markets, macroeconomic conditions, and firm-level decisions in line with theoretical predictions. Monetary policy in emerging markets may thus be better positioned to control domestic economic conditions and lean against global financial shocks than commonly assumed. The surprising resilience of emerging markets during the post-pandemic global monetary tightening offers an additional indication of such a success, which is likely underpinned by improvements in macroprudential (Sandri, Grigoli, Hansen and Bergant, 2020) and monetary policy frameworks (Kalemli-Özcan and Unsal, 2024).

Bruno, V and H S Shin, 2015. “Capital flows and the risk-taking channel or monetary policy,” Journal of Monetary Economics, 71: 119-132.

Caglio, C, Darst R M, and S Kalelmi-Özcan, 2022. “Collateral Heterogeneity and Monetary Policy Transmission: Evidence from Loans to SMEs and Large Firms”, CEPR Discussion Paper 17175.

Checo A, Grigoli F, and Sandri D, 2024. “Monetary Policy Transmission in Emerging Markets: Proverbial Concerns, Novel Evidence”, CEPR Discussion Paper 18954.

De Leo, P, G Gopinath, and S Kalemli-Özcan, 2023. “Monetary policy cyclicality in emerging economies”, VoxEU.org, 14 April.

Frankel, J, 2010. “Monetary Policy in Emerging Markets,” Handbook of Monetary Economics, 3: 1439 – 1520.

Gourinchas, P-O, 2018. “Monetary policy transmission in emerging markets: an application to Chile”, Central Bank. Analysis, and Economic Policies Book Series, 25: 279-324.

Kalemli-Özcan, S, 2019. “U.S. Monetary Policy and International Risk Spillovers”, Proceedings of the Jackson Hole Symposium.

Kalemli-Özcan, S and F D Unsal, 2019. “Global Transmission of FED Hikes: The Role of Policy Credibility and Balance Sheets”, NBER Working Paper 32329.

Kuttner, K N, 2001. “Monetary policy surprises and interest rates: Evidence from the Fed funds futures market.” Journal of Monetary Economics, 47(3): 523–544

Miranda-Agrippino, S and H Rey, 2020. “U.S. Monetary Policy and the Global Financial Cycle,” Review of Economic Studies, 87(6): 2745 – 2776.

Obstfeld, M, 2015. “Trilemmas and trade-offs: Living with financial globalization”. In: Raddatz, Claudio, Saravia, Diego, Ventura, Jaume (Eds.), Global Liquidity, Spillovers to Emerging Markets and Policy Responses. Central Bank of Chile, pp. 13–78 Chapter 2.

Rey, H, 2013. “Dilemma not Trilemma: The global financial cycle and monetary policy independence”, VoxEU.org, 31 August.

Sandri D, Grigoli F, N-J Hansen, and K Bergant, 2020. “Macroprudential regulation can effectively dampen global financial shocks in emerging markets”, VoxEU.org, 12 August.