Using loan-level monthly data covering almost all bank loans to households and businesses in Italy over the past 20 years, we show that credit swings are mostly explained by variations in the extensive margin, i.e. the net variation in the number of borrowers. We then build on a flow approach to decompose the extensive margin into new borrowers (inflows) and obligors exiting the market (outflows). We document four cyclical facts. First, fluctuations in borrower inflows account for the bulk of volatility in the total number of borrowers. Second, the volatility of borrower inflows is two times as large as the volatility of outflows. Third, borrower inflows are procyclical and tend to lead the business cycle. Fourth, the change in the probability of finding a lender explains 90% of the volatility in borrower inflows. Our results inform researchers and policy makers on the key margins through which households and businesses obtain loans over the business cycle.

There is extensive and solid-grounded evidence that private debt is closely intertwined with the business cycle (e.g. Oscar, Schularick, and Taylor, 2016). However, what drives expansions and contractions in private debt remains fundamentally unclear. In principle, a borrower may borrow from a new lender (extensive margin), from a pre-existing lender (intensive margin), or from both. These possibilities raise several questions. What is the role of the extensive and intensive margins in shaping fluctuations in bank credit to the non-financial private sector? Are the number of borrowers that enter or exit the credit market (the participation margin) a key driver of the extensive margin? Do search and matching frictions in the bank credit market matter for macro-financial linkages?

In Cuciniello and di Iasio (2021), we examine the connection between the flow of credit to households and firms (private debt) and employment in Italy using data from the Italian Credit Register and from the Italian Labor Force Survey over the period 1999Q1-2019Q4. We find that private debt expansions typically last for three to four years and are associated with employment expansions. We then assess whether debt fluctuations mainly reflect changes in the average debt per borrower (i.e., the intensive margin) or variations in the number of borrowers (i.e., the extensive margin). Strikingly, the extensive margin emerges as the primary source of debt dynamics, accounting for 91% of total variation in bank credit to the private sector.

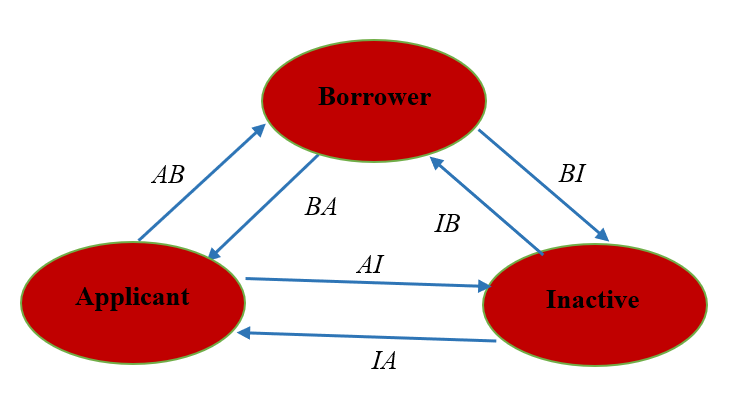

After having provided new empirical evidence showing that in Italy bank debt fluctuations mainly result from changes in the number of borrowers rather than the average debt per borrower, we propose a flow approach to assess the role of the extensive margin. Specifically, we classify individual households and firms into three non-overlapping statuses: borrower (B), applicant (A) and inactive households and firms in the bank credit market (I) (the ovals of Figure 1). In our baseline, borrowers have a credit relationship with a bank at the reporting date; applicants submit a loan application and do not have any credit relationship at the reporting date; inactive households/firms are neither borrowers nor applicants at the reporting date. We then compute gross flows, namely transitions across these three statuses (the arrows of Figure 1). Using an accounting framework allows us to write the variation in the number of borrowers, i.e. ΔB, as follows:

ΔB = (AB+IB) – (BA+BI),

where AB+IB denotes borrower inflows and BA+BI indicates borrower outflows. We find that gross borrower flows (i.e. both inflows and outflows) are about four times larger than net variations.

Figure 1. Gross Flows and Stocks

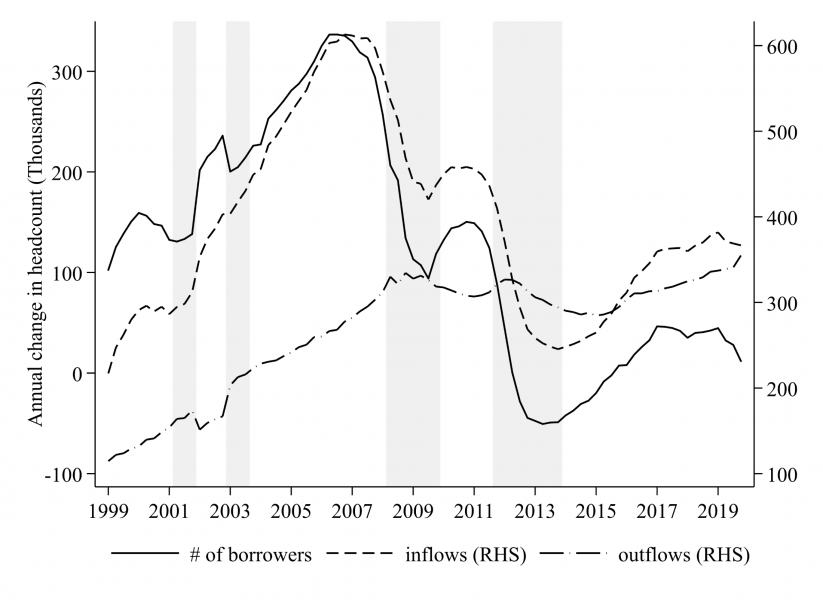

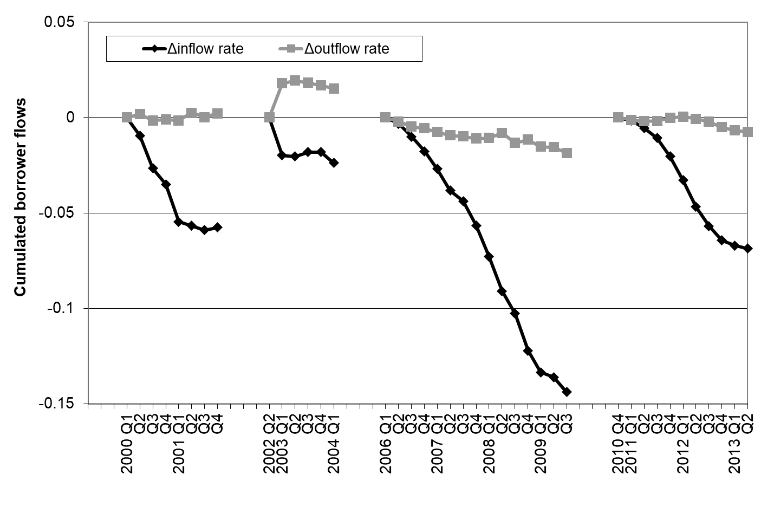

Turning to the cyclical sensitivity of borrower gross flows, we show that inflows of borrowers play a key role in shaping the dynamic pattern of the participation margin in the bank credit market (the left panel of Figure 2). This result suggests that borrower inflows and the business cycle are strictly intertwined. Specifically, we document three facts not previously reported in the literature. First, borrower inflows account for the bulk of volatility in the net variation of borrowers. Second, the volatility of borrower inflows is two times as large as the volatility of borrower outflows. Third, borrower inflows move procyclically and tend to lead the business cycle.

Figure 2. Borrower flows and the business cycle

| Flows decomposition | Recessions |

|

|

Notes: Shaded regions represent recessions which are identified as periods of at least two consecutive quarters of negative real GDP qoq growth. Δinflow rate and Δoutflow rate respectively indicate the cumulative peak-to-through decline in the borrower inflows and outflows relative to their start-of-recession values for each recession.

The dominant role of borrower inflows indicates that the number of borrowers declines during a recession because entering the credit market is particularly hard, not because borrowers exit the market. The right panel of Figure 2 shows that the borrower inflow rate fell in each recession by about 7 percentage points, on average. Moreover, variations in the inflow rate explained almost all the cumulative peak-to-trough decrease in the number of borrowers. The fall in borrower inflows was very large during the global financial crisis. They declined by about 15 percentage points.

Banks have private information about some borrowers and not about others. From a theoretical viewpoint, Dell’Ariccia and Marquez (2006) show that when the proportion of unknown borrowers in the market is high, banks cannot distinguish between first-time applicants with new projects and those rejected by competitor banks. In this case, lenders find profitable to undercut competitor banks and increase their market share by lending more to unknown borrowers. Den Haan, Ramey and Watson (2003) and Wasmer and Weil (2004) emphasize instead the role of matching frictions in the credit market, and the existence of a matching problem between bank funds and applicants. A key finding in this theoretical literature is the powerful nature of the amplification and propagation mechanism associated with search and matching frictions.

We quantify the magnitude of informational and matching frictions in shaping the fluctuations in the inflows of borrowers, decomposing borrower inflows respectively into the product of first-time applicants and the probability for those of getting a new loan. We find that the bulk of volatility in borrower inflows is accounted for by the probability of matching with a new bank, i.e. frictions stemming from imperfect matching between borrowers and lenders, as opposed to the number of applicants.

The new facts in Cuciniello and di Iasio (2021) lend some support to models that emphasize search and matching frictions in the credit market. We argue that theoretical and empirical analyses aimed at explaining economic determinants of credit cycle cannot prescind from understanding why loans are hard to find rather than why borrowers exit the credit market during a recession.

As borrower inflows are calculated from micro data, they can be a key metric that bank supervisors with loan-level data can easily track and monitor. For instance, effective macro-prudential tools aimed at smoothing fluctuations in the credit cycle (such as LTV or DTI ratios) should address the rise in inflows of new borrowers in the boom or their sharp decline in the subsequent bust. During the Covid-19 pandemic, many countries have adopted large-scale policy measures to support liquidity conditions and help to sustain the flow of credit to households and firms. In this respect, understanding how monetary policy decisions affect the intensive and extensive lending margins may be important for assessing the correct functioning of the monetary policy transmission mechanism.

Cuciniello V. and N. di Iasio (2021) “Determinants of the credit cycle: a flow analysis of the extensive margin.” ESRB Working Paper Series, 125, September.

Dell’Ariccia G. and R. Marquez (2006) “Lending Booms and Lending Standards.” The Journal of Finance, 61(5): 2511–2546.

den Haan W. J., G. Ramey and J. Watson (2003) “Liquidity flows and fragility of business enterprises.” Journal of Monetary Economics, 50(6): 1215–1241.

Oscar J., M. Schularick, and A.M. Taylor (2016) “Macrofinancial History and the New Business Cycle Facts.” NBER Macroeconomics Annual, Volume 31, 213–263. University of Chicago Press.

Wasmer E. and P. Weil (2004) “The Macroeconomics of Labor and Credit Market Imperfections.” American Economic Review, 94(4): 944–963.

The views expressed in this paper are those of the author(s) and do not necessarily reflect those of the Bank of Italy or the European Central Bank.