This brief should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Recent research has argued that the COVID-19 shock has also brought about a reallocation shock. We examine the evidence for such an occurrence in the United States, taking a broad perspective. We first consider micro data from CPS and JOLTS; there is no noticeable uptick in occupation or sector switches, nor churn, either at the aggregate level or the cross-section, or when broken down by firms’ size. We then examine whether mismatch unemployment has risen as a result of the pandemic; using an off-the-shelf multisector search and matching model, we find little evidence for an important role for mismatch in driving the unemployment rate during the pandemic. Finally, we employ a novel Bayesian SVAR framework with sign restrictions to identify a reallocation shock; we find that it has played a relatively minor role in explaining labor market patterns in the pandemic, at least relative to its importance in earlier episodes.

COVID-19 rendered an unprecedented shock to the global economy. In the United States, 25 million workers lost their jobs from February to April 2020, especially in contact-intensive sectors, and even more switched to working from home. While the initial shock quickly receded, over a quarter of job losses from the initial shock had not been recovered a year later. Two years later, while employment has fully recovered, the employment-to-population ratio remains one percentage point below its pre-pandemic peak, and almost two percentage points below trend.

An important feature of the policy response in the United States was that policymakers opted to protect workers, not jobs, and implemented generous unemployment insurance schemes (through the CARES Act). By contrast, authorities in EU member states largely opted for the opposite approach and instituted large job retention schemes. As a result, unemployment rose by less, and the employment-to-population ratio had already bounced back to 2019 levels by 2021. This huge destruction of job matches – even of a temporary nature – in the United States, highly unequal across sectors, makes it possible that such effects will be persistent, through, e.g. a steeper adoption of digitalization, or even a switch of innovation towards teleworking technologies. Such structural changes in the labor market could imply the ushering in of a reallocation wave.

Whether a reallocation shock is already under way has important implications for the design of policy. Reallocation is a long process, as it involves search and matching costs and the need for upskilling, generating mismatch unemployment. If certain types of jobs are permanently destroyed, then generous unemployment insurance may disincentivize laid off workers from seeking other employment and building new skills, delaying the needed reallocation. Employee retention policies may also be inefficient in this context, as they provide temporary protection for jobs that will ultimately be lost. Finally, mismatch unemployment implies a higher NAIRU, a smaller output gap and hence calls for less accommodating monetary policy, in the lens of standard New Keynesian models.

In Consolo and Petroulakis (2022), we critically examine the case for a pandemic-induced reallocation wave in the United States. There is no unique way of tackling the issue, so take a broad perspective, and rely on a variety of data sources and methods.1 Across three different sets of exercises, we consistently find no special role for reallocation in driving labor markets during the pandemic. This is not to say reallocation does not matter. On the contrary, reallocation is an integral part of a market economy. Our point is that it did not play an outsize role during the pandemic, relative to other episodes.

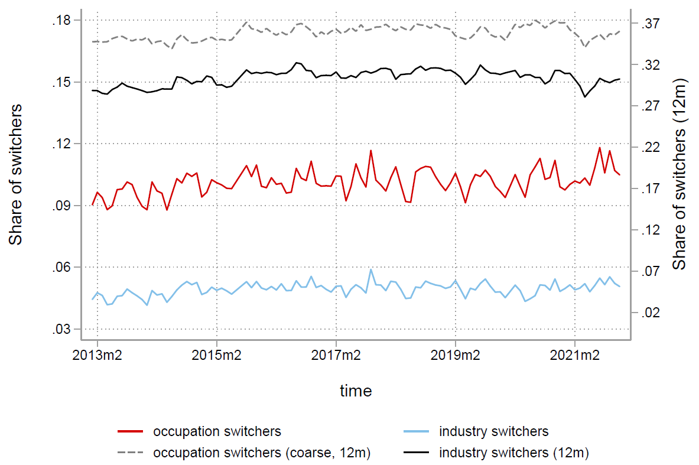

First, we gauge whether reallocation patterns can already be seen in publicly available data. Using microdata from the CPS (Current Population Survey), the main source of labor market data in the United States, we calculate the share of workers switching sector or occupation. This could include employed workers switching to new jobs or unemployed workers finding jobs, in a different sector or occupation than previously. This is shown in Figure 1, which plots the share of workers switching occupations (blue) or sectors (red) in any given month, relative to the previous one. There is no discernible uptick in the share of switchers during the pandemic era, and both lines move about the trend.

Figure 1: Share of workers switching occupations and sectors

Notes: The LHS chart shows the share of workers employed in consecutive months who switch occupations (4-digit, red line) or sectors (2-digit, blue line) from one month to another. The dashed gray line uses a coarse occupation classification and shows occupation switches over 12 months, and the black line does the same for sectors.

Monthly transitions may mask slow-moving changes, and so the black and grey lines repeat the same exercise for annual transitions, showing the share of workers in a different sector or occupation than 12 months before. Again, there is no discernible movement after the COVID-19 shock in these series. This is noteworthy, since especially 2021 was a period of rapid increase in employment, and so any reallocation should have been visible in the data. The results here are consistent with administrative data from unemployment insurance claims in California,2 showing that 68% of workers who lost their jobs in 2020Q2 had found jobs in the same sector a year later. More tellingly, the share of displaced workers who found a job in the same sector was almost the same in Accommodation and Food Services and in Professional Services, two sectors which experienced with diametrically opposite shocks during the pandemic.

In Consolo and Petroulakis (2022), we provide a host of further evidence. We show that elevated job separation rates in 2021 are fully driven by quits (the so-called “Great Resignation” narrative, which is driven by labor supply, not reallocation), and that layoffs, which would be harbingers of reallocation, are in fact in multi-year lows. Across firms, we do not find that the hiring behavior of large firms has changed by poaching more workers from small ones, as was hypothesized early in the pandemic. While separations in large firms (over 5000 employees) barely moved in April 2020, hire rates fell, and took over a year to reach pre-pandemic averages. On the other hand, smaller firms resumed hiring rapidly after the initial shock, and overall the picture is consistent with results from the dynamics job ladder literature (Haltiwanger et al. 2018), which posits that small firms suffer more during recessions, grow faster during recoveries, and larger firms grow at the expense of smaller ones when labor markets are tight.

A reallocation shock should also manifest in a persistent increase in labor market mismatch, and mismatch unemployment. The labor market is frictional, and it takes time and effort for firms and job searchers to find suitable matches. This is especially the case for a reallocation shock, which has unequal effects across sectors and occupations. Workers (either unemployed or job switchers) looking to move to growing sectors may be less familiar with the needs of these jobs, lack relevant social networks, and in general have a harder time finding a job relative to their previous sector. At the same time, firms in growing sectors looking to fill vacancies may have to consider different types of workers to screen than usual, hence taking longer to find suitable matches.

An indirect test for the reallocation hypothesis is then labor market mismatch: an increase in mismatch and mismatch unemployment (as a share of total) would be strongly indicative of a reallocation shock. To test this hypothesis, we take the well-known multisector search and matching framework of Sahin et al. (2014) to examine whether mismatch unemployment rose because of the pandemic. This framework identifies the optimal allocation of the unemployed (job searchers) across sectors, taking into account sectoral differences in vacancies, but also matching efficiencies, productivity and destruction rates. By better allocating the same number of unemployed, one can increase the aggregate job-finding rate and achieve more hires compared to the equilibrium. Comparing actual hires with the number of hires that would occur under this optimal allocation gives rise to a mismatch index, the fraction of hires lost due to mismatch, and similarly for mismatch unemployment. This framework is ideally suited to the exercise at hand, as we try to estimate the extent to which frictions are preventing reallocation of workers from declining to booming sectors.3

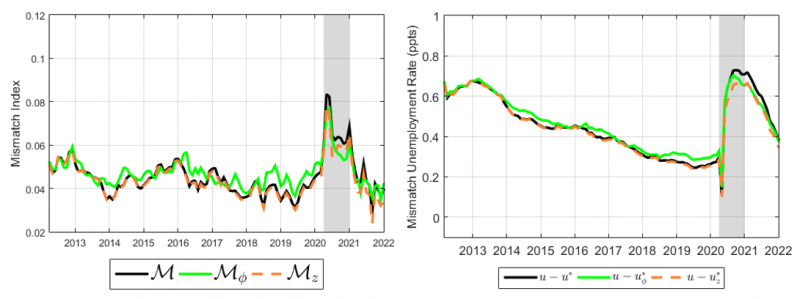

Results are shown in Figure 2, where we show the mismatch index on the left, and mismatch unemployment on the right, according to three different definitions (which allow for three different levels of sectoral heterogeneity). After a slowly diminishing trend after the Great Recession, mismatch rose sharply at the start of the pandemic (shaded area), rising by over 50% relative to February, before falling sharply once the first part of the shock passed and employment started to recover. The further pickup in economic activity in early 2021 led to a further reduction in both measures, which, by summer 2021, were back to pre-pandemic levels, and in line with historical standards.

Figure 2: Labor market mismatch

Notes: Mismatch index (LHS); implied mismatch unemployment (RHS).

Mismatch unemployment fell on impact (reflecting the drop in vacancies) but then followed a similar path. It did remain higher even after mismatch itself had subsided, due to what Sahin et al. (2014) call feedback effect. Essentially, we expect episodes of high unemployment to result in prolonged higher mismatch unemployment, even if mismatch itself has subsided, simply because it takes time for the additional unemployed to be reabsorbed. After all, mismatch captures hires, not unemployment. In any case, mismatch unemployment never accounted for more than 15% of total unemployment during the pandemic, just like during the Great Recession. All in all, the results from this analysis find little evidence in support of the reallocation view.4

In a final exercise, we take a stab at directly gauging the importance of a reallocation shock, in an empirical exercise using time series data, and a novel identification scheme with sign restrictions, in a Structural Bayesian Vector Autoregression (BVAR) model. The novelty of our approach is that we introduce some nuance to supply shocks: in addition to the standard neutral technology (ASTech) and matching efficiency (MatEff) shocks, we separately identify a job reallocation shock (ASJRe). In particular, the reallocation shock is also a technology shock, but one that induces churn, raising both layoffs and hires; the neutral shock instead reduces layoffs, by making the marginal job more productive. On the other hand, the reallocation shock differs from the matching efficiency shock because of the different effects they have on unemployment; both raise layoffs, but as the matching efficiency shock improves matching, it reduces unemployment, while the reallocation shock raises it.

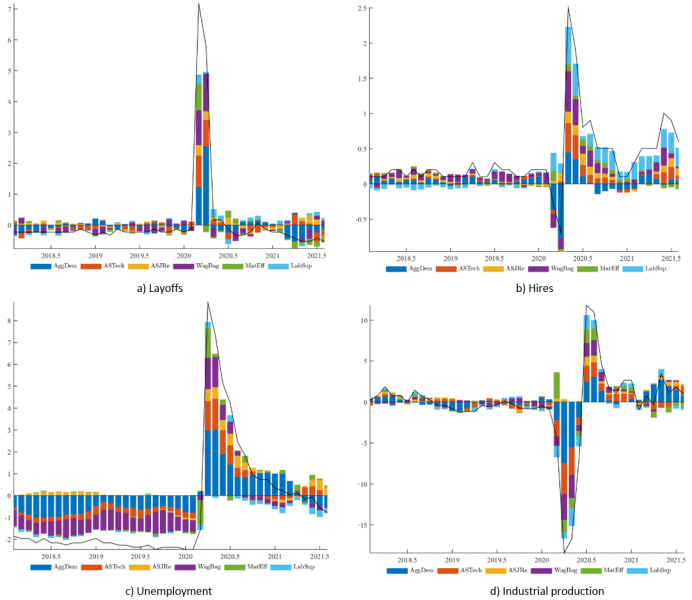

Figure 3 shows results from the historical decomposition of the shock driving selected variables from the model. The spike in layoffs early in the pandemic was not driven by a reallocation shock, but mostly due to aggregate demand (AggDem) and ASTech. This is consistent with the idea that supply bottlenecks and lockdowns induced an aggregate demand shock, as posited by Guerrieri et al (2020). There was also an important role for wage bargaining (WagBag) in driving layoffs, which can be understood through nominal rigidities in the face of a steep reduction in production, which prevented matches from being preserved.

Hires collapse initially largely due to AggDem, and the subsequent rise during the recovery was also due to a combination of AggDem and ASTech, but also lower bargaining power and higher labor supply (LabSup) after the initial lockdowns, when unemployment was still high. The role of reallocation was much smaller during most of the sample, rising somewhat in later stages, driving job turnover (higher layoffs and hires) and hence positively contributing to the unemployment rate, but not in a historically outsize fashion. Finally, there was a small contribution from reallocation on output over the pandemic period, confirming that reallocation is productivity enhancing, but demand, technology and labour supply can clearly explain the lion share of output fluctuations.

Figure 3: Historical Decomposition

Overall, evidence suggests a small role for job reallocation shock during the pandemic, relative to other episodes, in driving the labor market. Aggregate demand and neutral technology shocks were the primary drivers of unemployment, hires and layoffs, consistent with the view of the COVID-19 shock as reflecting cycles in demand, lockdowns restrictions and supply bottlenecks. Our results for the US economy are also in line with Hall and Kudlyak (2022), who acknowledge the large and temporary nature of layoffs as the main driver of the increase in the unemployment rate during the COVID-19 pandemic.

California Policy Lab (2021), December 8th Analysis of Unemployment Insurance Claims.

Consolo, Agostino and Filippos Petroulakis (2022), “Did COVID-19 induce a reallocation wave?”, ECB Working Paper No. 2703.

Forsythe, Eliza, Lisa Kahn, Fabian Lange, and David Wiczer (2021), “Searching, Recalls, and Tightness: An Interim Report on the COVID Labor Market”, NBER Working Paper 28083.

Guerrieri, Veronica, Guido Lorenzoni, Ludwig Straub, and Iván Werning (2022), “Macroeconomic Implications of COVID-19: Can Negative Supply Shocks

Cause Demand Shortages?”, American Economic Review, 112 (5): 1437-74.

Hall, Robert E., and Marianna Kudlyak (2022), “The Unemployed with Jobs and without Jobs”, Labour Economics, Vol. 79.

Haltiwanger, John, Henry Hyatt, Lisa Kahn and Erica McEntarfer, (2018), “Cyclical job ladders by firm size and firm wage”, American Economic Journal: Macroeconomics 10(2), 52–85.

Sahin, Aysegul, Jae Song, Giorgio Topa, and Gianluca Violante (2014), “Mismatch Unemployment”, American Economic Review 104(11), 3529–3564.

Our sample ends in August 2021.

Source: California Policy Labs, 8 December 2021.

Indeed, the original Sahin et al. (2014) model was developed to address essentially the same question for the slow recovery from the Great Recession.