Regulation of Money Market Funds (MMFs) in the EU requires some categories of MMFs to consider applying liquidity management tools if they breach a minimum “weekly” liquidity requirement. Anticipation of the application of such tools is a plausible amplifier of run risks. Using Irish, Luxembourgish and UK MMF data, we assess whether proximity to liquidity thresholds explains differences in redemptions both at the start of the COVID-19 crisis and in the following months. We assess this effect for MMFs subject to and exempt from the liquidity regulation. The evidence shows that out flows can be robustly associated with proximity to minimum liquidity requirements in the peak of the crisis for funds required to consider suspending redemptions if breaches occur. In the post-crisis phase the redemption-liquidity relationship does not appear to be specifically related to mandated consideration of the suspension of redemptions. The evidence supports consideration of countercyclical liquidity requirements or buffers that are more usable in times of stress.

The unintended consequences of financial regulations often only come to light in the next significant crisis. The negative impact of COVID-19 on non-bank intermediation and, in general, financial markets can largely be understood in relation to its shocks on economic fundamentals.1 But there is also theoretical and empirical evidence showing that the impact of negative economic shocks on financial markets could be amplified by certain financial regulations introduced specifically to minimise such adverse reactions.2 In many ways, the COVID-19 pandemic provides a testing ground for regulations that were designed with the best of intentions following the Global Financial Crisis (GFC). Despite the aim of those initiatives being to improve systemic resilience, fears that some post-GFC regulatory initiatives may have contributed to destabilising behaviours deserve to be assessed.

In this brief we outline the results of research uncovering regulation-driven amplification in the Money Market Fund (MMF) sector. This emerged during March of 2020, when the intermediation of short term funding by MMFs to banks and non-financial corporations was significantly impaired. The importance of such intermediation by MMFs is evident from the fact that their large and abrupt redemptions in March 2020 ($ 200 billion in key MMF subsectors) were a key reason behind the approval of extraordinary purchase programs by central banks in the EU, US and UK.3

Regulators expected the post-GFC measures to mitigate rather than exacerbate run-risks of MMFs. Liquidity requirements were introduced in the major MMF jurisdictions (EU, US and UK, for instance) specifically to prevent a damaging repetition of 2008’s fire sales by MMFs. Regulators introduced larger liquidity requirements so that funds would be more prepared to withstand large and persistent outflows in a crisis. The new framework also involved requirements on funds to impose (or consider imposing) limits to redemptions (i.e., Liquidity Management Tools, or LMTs) when MMFs breached liquidity requirements. This linkage between liquidity breaches and LMTs was expected to give comfort to investors so that, in a crisis, they would not be induced to redeem their holdings (adding to stresses). In the US, the then-SEC Chair, Mary Jo White, argued that this would “mitigate risk and the potential impact for investors and markets.” However, the perception of a linkage between liquidity and redemption limits may explain why some funds experienced elevated redemption pressures at the onset of the COVID-19 pandemic. This potential side-effect is the main theme of the evidence presented in this brief.

The research discussed in this brief focuses on the effects of the rule that links liquidity breaches to redemption limits in the EU, but similar effects are present in the US. The EU regulation (i.e., Article 34 of the MMF Regulation of 2017) differs somewhat from that in the US. Rather than mandating LMTs when liquidity thresholds are breached, it requires some categories of MMFs to consider applying LMTs if they breach a minimum weekly liquidity requirement and simultaneously experience daily outflows larger than 10% of net asset value (NAV).4 The categories subject to the EU rule are Low-Volatility NAV funds (LVNAV) and Public-Debt Constant NAV funds (PDCNAV). Variable NAV funds (VNAV) are exempt from it.

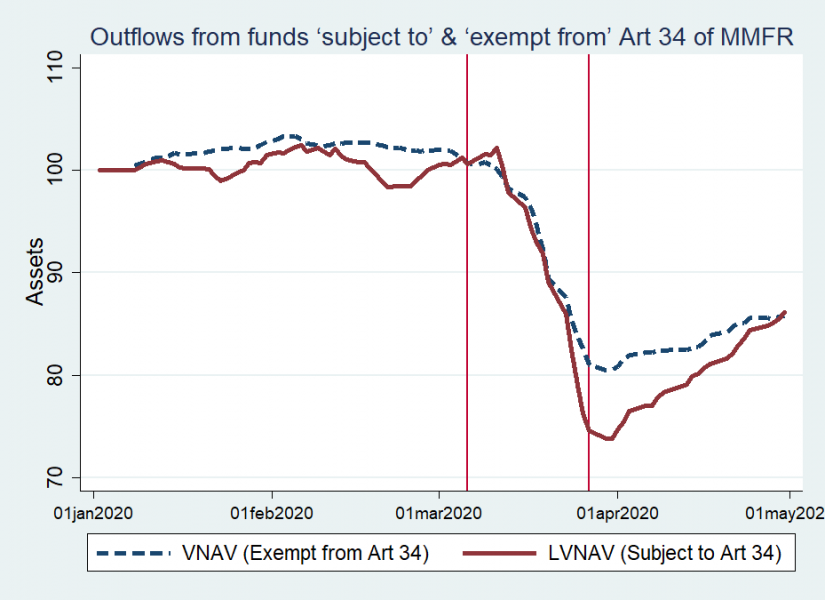

Comparing the cumulative outflows from funds subject to and exempt from the regulation around the onset of the COVID crisis provides initial evidence of a regulation side-effect. Descriptive evidence on European MMF data shows that assets under management of LVNAVs (those investing in USD assets) decreased significantly more than that of similarly focused VNAVs during the peak of the COVID crisis. This result is unrelated to the asset holding profiles of the two groups.

Chart 1.

The chart describes Irish, Luxembourgish and UK Money Market Funds (MMFs) focusing on USD assets. The y-axis depicts an index of assets under management of the two fund categories of interest (set equal to 100 at the beginning of the sample). The two vertical lines denote a period with run-like behaviour between March 6 and March 26, 2020. Article 34 of the MMF Regulation (MMFR) is the rule requiring ‘Low-Volatility’ funds (LVNAVs) and ‘Public-Debt Constant’ funds (PDCNAVs) to consider suspending redemptions if they breach a minimum weekly liquidity requirement and simultaneously experience daily outflows larger than 10% of net asset value. Variable NAV funds (VNAVs) are exempt from it.

In light of this suggestive evidence, Dunne and Giuliana (2021) further develop an econometric analysis to test whether investors’ expectation of the application of the rule is an amplifier of run risks through a mechanism of “first-mover advantage”.5 They analyse this effect for two different periods: one that includes the significant outflows of March 2020 (referred to as the run analysis) and one that begins in April 2020 after several public policy responses were announced and implemented (which, we refer to hereafter as the post-run analysis). Dunne and Giuliana (2021)’s assessment is mostly, but not exclusively, based on Irish MMFs data that has been verified through the use of supervisory reports of the Central Bank of Ireland. The assets of Irish-domiciled MMFs account for more than 40% of the assets held by the European MMF sector and roughly 10% of assets held by MMFs globally. In addition to Irish-domiciled funds, they examine funds covered by Crane data that are based in Luxembourg and the UK.6 The sample covers the three main categories of MMFs, that is, LVNAVs, PDCNAVs and VNAVs, with funds being denominated in the three main currencies in the European MMF sector: USD, GBP and EUR.

The run analysis is based on two steps: (i) estimating whether, during the run, investments into MMFs were significantly reduced by the probability of breaches of liquidity requirements, and (ii) comparing these estimates across MMFs subject to and exempt from the regulation. As to the first step, the regression model in Dunne and Giuliana (2021) estimates if investment flows into MMFs depend on an interaction of two key variables: proximity to minimum liquidity requirements, and the run period in March. These estimates could indicate whether the outflows during the run were larger for MMFs close to the WLA requirement than other funds, i.e., there is an amplification of redemptions during the run.

As to the second step, regarding the comparison across categories, the hypothesis that the regulatory linkage between liquidity and LMTs amplifies redemption shocks during the run would be corroborated by an evidence showing that the proximity to WLA requirement was (i) irrelevant for VNAVs (which are exempt from the regulatory linkage), and (ii) a negative driver of flows into LVNAVs and PDCNAVs (which are subject to the regulatory linkage). However, it is also relevant to acknowledge that the hypothesised effect is more ambiguous for PDCNAVs given that they experienced an abnormally positive phase during the March run period, i.e., the time-window that saw widespread outflows in other MMF categories in several jurisdictions.7

Econometric models in Dunne and Giuliana (2021) show that proximity to WLA requirements amplified redemptions for LVNAVs, while it was an insignificant factor for VNAVs, controlling for any macro time-varying factor (e.g., the VIX) and fund characteristics. This corroborates the presence of a regulatory side-effect since the linkage between liquidity breaches and LMTs incentivises investors to redeem rather than holding their MMF shares during the run period.

The economic significance of these results appears to be mixed. On the one hand, it seem substantial as the LVNAVs’ outflow amplification (i.e., -1.27%) is larger than their average redemptions during the run period (i.e., about 1%). However, changing the comparison benchmark, the outflow amplification appears less prominent when compared to the flow variability during the run period. Additional outflows of LVNAVs are a third of the standard deviation of flows during the run period. Low liquidity is therefore not the only important cause of redemptions in the run period, as confirmed also by Rousová et al. (2021) and ESRB (2020) who have pointed to margin calls and liquidity needs of investment funds as important contributing factors.

The run analysis in Dunne and Giuliana (2021) shares certain common features with certain specifications in Cipriani and La Spada (2020) examining offshore USD funds (mainly those domiciled in Ireland and Luxembourg). They find that offshore USD-VNAV funds (which are not subject to considerations of LMTs) do not have as large an outflow as funds subject to LMT considerations during the most stressed period of the COVID-19 market turbulence. However, the new evidence can be regarded as more comprehensive in three main ways. Firstly, rather than assessing the effects of a single liquidity cross-section as of end-2019 on net-redemptions in March 2020, the specification in Dunne and Giuliana (2021) assesses the ongoing impact of one-day lagged liquidity throughout the run period. This approach recognises the interaction between “real-time” liquidity developments and subsequent redemption flow. Second, the analysis described here includes a wider sample of European funds (beyond those reporting in USD) and from higher quality fund-by-fund supervisory reports. Third, the analysis allows for an assessment, and comparison, of the effects of liquidity regulation both in the so-called run- and post-run phases. The evidence from the post-run phase is described below and has relevant from a policy perspective (i.e., it could be regarded as supporting a countercyclical approach to liquidity regulation). In addition to these three contributions, the EU focused analysis sheds light on causes of first-mover advantage in another way. The regulatory linkage between WLA and LMTs is more nuanced in the EU compared with the US. The evidence of side-effects in the EU context therefore confirms that even less deterministic linkages between liquidity and suspensions can trigger first-mover incentives during crises.

The econometric method applied in the post-run analysis assesses whether redemption dynamics become less stable near liquidity requirements by examining the difference in the autocorrelation of investment flows at low liquidity levels.8 In fact, such increased instability could materialise if redemption gating becomes more likely as liquidity levels approach the minimum liquidity requirements. If the tendency for large redemptions to be followed by more large redemptions increases at lower liquidity levels, then there is a risk that funds will start to experience more persistent and destabilising net-outflows. The analysis specifically assesses whether incipient instability of investment flows is associated with a combination of larger outflows and significantly more positive autocorrelation of flows near liquidity requirements. Results in Dunne and Giuliana (2021) indicate that although the proximity to liquidity requirements increases the instability of the flows, such effects are present in both the MMFs exposed to the rule (LVNAVs or PDCNAVs) and in categories exempted from it (VNAVs). So there is evidence of a tendency for outflows to be related to low liquidity levels in more normal conditions regardless of the implications of being near to regulated liquidity thresholds.

The results in Dunne and Giuliana (2021) overall are suggestive of an effect stemming from proximity to regulatory thresholds during the peak of the turmoil. Liquidity regulations can therefore be implicated in exacerbating outflows during the run-period. The low-liquidity effect however, is not significantly related to the regulation in the post-run period and it is insignificant in economic terms. These findings could be considered favourable to the implementation of countercyclical liquidity regulation with the objective of making liquidity buffer requirements for MMFs more usable in times of stress, to guard against potential first-mover advantage dynamics.

Baker, S R, N Bloom, S J Davis, K Kost, M Sammon and T Viratyosin (2020), “The unprecedented stock market reaction to COVID-19”, NBER Working Paper No. 26945.

Beber, A and M Pagano (2009), “Short-Selling Bans around the World: Evidence from the 2007-09 Crisis”, CEPR Discussion Paper 7557.

Capelle-Blancard, G, and A Desroziers (2020), “The stock market is not the economy? Insights from the COVID-19 crisis”, Covid Economics: Vetted and Real-Time Papers, CEPR.

Cipriani, M. and G. La Spada (2020), Sophisticated and unsophisticated runs. Federal Reserve Bank of New York Staff Reports 956.

Dunne, P. G. and R. Giuliana (2021), Do liquidity limits amplify money market fund redemptions during the COVID crisis? ESRB Working Paper Series No. 127.

ESRB (2020), Liquidity risks arising from margin calls. European Systemic Risk Board, ESRB Report.

FSB (2021), “Holistic Review of the March Market Turmoil”.

Rousova, L., M. Ghio, S. Kordel, and D. Salakhova (2021), Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds. ECB Financial Stability Review, November 2020.

Schmidt, L., A. Timmermann, and R. Wermers (2016), Runs on money market mutual funds. American Economic Review 106(9), 2625{2657.

Baker, S R, N Bloom, S J Davis, K Kost, M Sammon and T Viratyosin (2020), “The unprecedented stock market reaction to COVID-19”, NBER Working Paper No. 26945.

Capelle-Blancard, G, and A Desroziers (2020), “The stock market is not the economy? Insights from the COVID-19 crisis”, Covid Economics: Vetted and Real-Time Papers, CEPR.

Beber, A and M Pagano (2009), “Short-Selling Bans around the World: Evidence from the 2007-09 Crisis”, CEPR Discussion Paper 7557.

FSB (2021), “Holistic Review of the March Market Turmoil”.

Weekly liquid assets include cash-like securities or assets that mature within a week.

Schmidt, L, A Timmermann, and R Wermers (2016), “Runs on money market mutual funds”, American Economic Review, 106(9): 2625.

However, the coverage of UK funds is very limited.

Dunne and Giuliana (2021) show that PDCNAVs experienced an overall increase in AUM of 70% in March 2020.

The method of the post-run analysis differs from that of the run period because the former period lacks a phase of exogenous widespread shock and, thus, it cannot use a Run dummy variable.