The digital transformation ranks high on the political agenda of the European Union. In March 2021, the European Commission presented a ‘Digital Compass’, designed to guide Europe through its digital transformation until 2030 (European Commission, 2021). The Compass for the digital era centres on digital skills, the digital transformation of companies, secure and sustainable digital infrastructure, and digital public services. This interest in the digital transformation reflects a belief that digitalisation provides a foundation for technological leadership and international competitiveness.

In recent work (Guarascio and Stöllinger, 2022) we make use of a key concept from trade theory – namely, endowments-based comparative advantage – and link it to digitalisation of the economy. According to the Heckscher-Ohlin model, factor endowments determine countries’ comparative advantage and, with it, global trade patterns. In particular, a country that enjoys a relative abundance of a certain factor of production (say, capital) tends to export capital-intensive goods, resulting in a positive net ‘factor content of trade’ (FCT). In such a case, the country is said to hold a comparative advantage in capital.

The availability of international input-output (IO) data has revived empirical work on the Heckscher-Ohlin theory, and in particular its so-called ‘factor content’ version, most commonly referred to as the Heckscher-Ohlin-Vanek (HOV) theorem, developed by Vanek (1968). This is because international IO data allows for differences in technologies across countries and for the existence of trade in intermediates. These two features make it possible to calculate the factor contents of trade in a theory-consistent manner (Trefler and Zhu, 2010). Incorporating differences in technologies via country-specific input-output data and country-specific factor productivities results in a much better fit of the HOV theorem (Hakura, 2001; Stehrer, 2014; Trefler and Zhu, 2010). The question is whether ‘digital’ and ‘ICT’ endowments – or more precisely, digital tasks performed by workers and ICT capital – are still shaping comparative advantage in the era of digitalisation. Moreover, testing the validity of the HOV theorem for digital endowments provides insights into the distribution of comparative advantage across EU member states, which policy makers may wish to consider.

The HOV predicts that countries with abundant endowments in a certain factor of production will be net exporters of that factor, in this case digital tasks and ICT capital. The approach in our current work is to derive the digital task content of labour inputs from highly granular, occupation-specific data, in combination with a specific survey of the digital tasks performed by workers in different occupations in Italy (Cirillo et al., 2021). This detailed information at the level of occupations is then aggregated to the country-industry level (for details, see Guarascio and Stöllinger, 2022)1. Given the degree of detail of the occupations, it is reasonable to assume that the digital task content of an Italian occupation is comparable to that of the digital task content of the same occupation in other European countries.

The information on ICT capital is derived from the EU KLEMS Release 2019 database and Eurostat. Following Adarov and Stehrer (2019), ICT capital includes computer hardware, telecoms equipment and computer software and databases. Both digital tasks and ICT capital have their counterparts in non-digital tasks and non-ICT capital, which add up to total employment and total capital stocks, respectively. Hence, there are four endowments for which the HOV theorem is tested.

Technically, the HOV test consists of comparing the measured factor content of trade of a country with the predicted FCT of that country. The former uses input-output techniques to calculate the direct and indirect factor requirements that are necessary to produce a country’s imports and exports. The FCT can be negative or positive, with the latter signalling comparative advantage in the factor under consideration. The predicted FCT, by contrast, is the difference between a country’s actual factor endowment with a specific factor (say digital tasks) and its theoretical share in world endowment with that factor, proportional to its share in global income. Then, if the fit of the HOV theorem were perfect, the measured FCT would be equal to the predicted FCT.

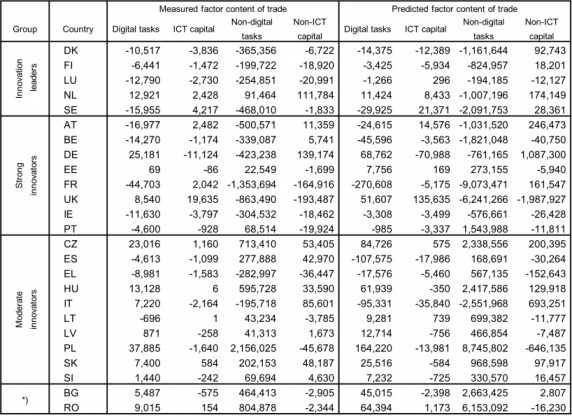

Table 1 summarises the combined results of the test, where each country is assigned to an innovation performance group, as defined by the European Innovation Scoreboard (EIS).2

Table 1: Measured and predicted factor content of trade of EU countries, 2012

Note: *) Bulgaria and Romania are ‘modest innovators’. Digital tasks and non-digital tasks add up to total labour endowment. ICT capital and non-ICT capital add up to total capital endowment. Malta, Cyprus and Croatia missing due to data constraints. Source: Survey on Italian Occupations, EU KLEMS, Eurostat, WIOD Release 2016. Authors’ own work.

Focusing on the results for the measured FCT, it is easy to see that the innovation leaders in the EU do not necessarily have positive net exports of digital tasks and ICT capital. In fact, it turns out that within this group only the Netherlands is a net exporter of both digital tasks and ICT capital. All other countries in the leader group are net importers of digital tasks, and – with the exception of Sweden – also have a negative factor content of trade in ICT capital.

The results are also mixed across the other innovation performance groups, with no clearly discernible patterns. This is somewhat surprising, but it says nothing about the appropriateness of the HOV theorem. However, this evidence may lend some additional support to theoretical positions that underline the importance of ‘out-of-equilibrium’ explanatory factors (see, among others, Dosi et al., 1990; 2015; Guarascio et al., 2017). This means going beyond production functions to consider factors such as country- and industry-specific capabilities or institutional heterogeneities that are likely to explain real-world specialisation and trade patterns in more detail than the Heckscher-Ohlin model, with its simplifying assumptions. On the other hand, this evidence may also reflect the differentiated pattern of specialisation in digital tasks and ICT capital. Germany and Italy, for example, which have a relatively low share of ICT capital in their overall capital stock, are net importers of ICT capital, but net exporters of digital tasks. Exactly the opposite is true of France, which, like Germany, belongs in the strong innovator group. By contrast, Czechia and Romania emerge as net exporters of digital tasks. It cannot be ruled out that this reflects to some extent Trefler’s (1995) ‘endowment paradox’, which is related to differences in factor productivities across countries. This paradox refers to the phenomenon that most factors tend to be scarce in ‘rich’ countries (owing to their comparatively high factor productivities), while ‘poor’ countries are found to have an abundance of most factors (owing to their comparatively low factor productivities), so that the latter tend to have positive measured factor contents of trade. Despite the fact that the calculation of the measured FCT took account of differences in technology in both direct factor input requirements and the input-output structure, it could possibly be that some traces of this ‘endowment paradox’ are still in the data. Moreover, as the data on digital tasks and ICT capital are defined at a very granular level, measurement error may also be an issue. This is all the more likely, as the employment and capital data had to be aligned with the corresponding values in the WIOD database.

There is, however, an alternative economic explanation for the rather unsystematic distribution of digital comparative advantage across EU member states: a lack of clear digital leadership within the EU (see, for example, Adarov et al., 2021). This concern about digital leadership – or the lack thereof – is not entirely new, and can be regarded as the latest version of the EU’s eternal concern about losing the technology race against the US (as the permanent economic rival) and other emerging economic superpowers of the time, currently China (Landesmann and Stöllinger, 2020). If one accepts the common notion that EU member states struggle to keep up with the ‘digital frontier’, then the mixed pattern of the comparative advantage in digital tasks and ICT capital may be attributable to this weakness. As this paper is confined to EU countries, this assertion remains only a hypothesis for the time being.3

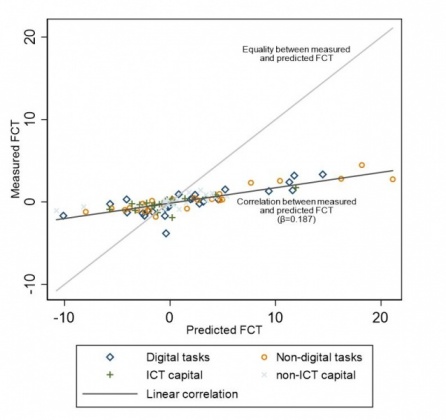

Despite these surprising patterns across countries, it should be emphasised that the fit between the measured and the predicted FCT – that is, the actual HOV test – is quite a good one.

This fit of the HOV theorem can be visualised by a (conditional) correlation between the measured and the predicted factor content of trade (Figure 1). The graph illustrates the good fit of the regression but also the ‘missing trade statistic’, which refers to the phenomenon that the variance of the measured factor content of trade is much lower than that of the predicted factor content of trade. This implies that the slope of the fitted line in Figure 1 (obtained from a simple regression of regression of the predicted on the measured factor content of trade) is less steep than the 45-degree line (which indicated equality between the two). This constellation signals an issue with the predictive power of the HOV theorem, and the literature has offered many explanations for this pattern, which centres on deviations from homothetic preferences and (industry-specific) home-market bias more specifically (see Stehrer, 2014). Trefler and Zhu (2010) also analyse the role of non-tradability of some industries as well as trade barriers that are assumed in individual industries, such as agriculture.

Figure 1: Correlation between measured and predicted factor content of trade, 2012

Note: FCT = Factor content of trade.

The digital transformation and its impact on countries’ comparative advantage raises the question of whether factor endowments still play a role in the ‘digital era’. Based on an analysis of digital and non-digital tasks, and of ICT and non-ICT capital within a HOV framework for 25 EU countries, the answer to this question is a resounding yes. A surprising finding, though, is that the EU’s innovation leaders are not necessarily those that enjoy an abundance of digital tasks and ICT capital. Rather, what emerges is a mixed picture, with both innovation leaders and modest innovators holding a comparative advantage in digital tasks or ICT capital. We believe this to be a very important finding. A working hypothesis could be that this mixed pattern is due to a lack of digital leadership in any of the EU member states (and hence the EU as a whole). This would have severe implications for the future economic development of the EU; but at this stage it remains only a hypothesis.

Adarov, A. and R. Stehrer (2019), Tangible and intangible assets in the growth performance of the EU, Japan and the US, wiiw Research Report 442, October. Available at: https://wiiw.ac.at/tangible-and-intangible-assets-in-the-growth-performance-of-the-eu-japan-and-the-us-dlp-5058.pdf

Adarov, A., D. Exadaktylos, M. Ghodsi, R. Stehrer and R. Stöllinger (2021), Production and trade of ICT from an EU perspective, wiiw Research Report 456, October.

Cirillo, V., R. Evangelista, D. Guarascio and M. Sostero (2021), Digitalization, routineness and employment: An exploration on Italian task-based data. Research Policy, 50(7), 104079.

Dosi, G., K. Pavitt and L. Soete (1990). The Economics of Technical Change and International Trade. New York University Press

Dosi, G., M. Grazzi and D. Moschella (2015). Technology and costs in international competitiveness: From countries and sectors to firms. Research Policy, 44(10), 1795-1814.

European Commission (2021), 2030 Digital Compass: The European way for the Digital Decade, Communication from the Commission, COM (2021) 118 final, Brussels, 9.3.2021.

Guarascio, D. and R. Stöllinger (2022), Comparative advantages in the digital era. A Heckscher-Ohlin-Vanek approach, wiiw Working Paper 217, July.

Guarascio, D., M. Pianta and F. Bogliacino (2017), Export, R&D and new products: A model and a test on European industries. In: A. Pyka and U. Cantner (eds), Foundations of Economic Change. Cham: Springer, pp. 393-432.

Hakura, D.S. (2001), Why does HOV fail? The role of technological differences within the EU. Journal of International Economics, 54, pp. 361-382.

Landesmann, M. and R. Stöllinger (2020), The European Union’s industrial policy. In: A. Oqubay, C. Cramer, H.-J. Chang and R. Kozul-Wright (eds), The Oxford Handbook of Industrial Policy. Oxford: OUP.

Stehrer, R. (2014), Does the home bias explain missing trade in factors, wiiw Working Paper 110, December 2014. Available at: https://wiiw.ac.at/does-the-home-bias-explain-missing-trade-in-factors–dlp-3543.pdf

Trefler, D. (1995), The case of the missing trade and other mysteries. American Economic Review, 85(5), pp. 1029-1046.

Trefler, D. and S. Zhu (2010) The structure of factor content predictions. Journal of International Economics, 82, pp. 195-207.

Vanek, J. (1968), The factor proportions theory: The N-factor case. Kyklos, 21, pp. 749-756.

The full dataset comprises 130 occupations across 56 industries in 25 EU countries

See: https://ec.europa.eu/commission/presscorner/detail/en/QANDA_20_1150

In future work, similar analyses of the factor contents of trade for the US and the EU will be undertaken; this could then provide empirical evidence for or against this hypothesis.