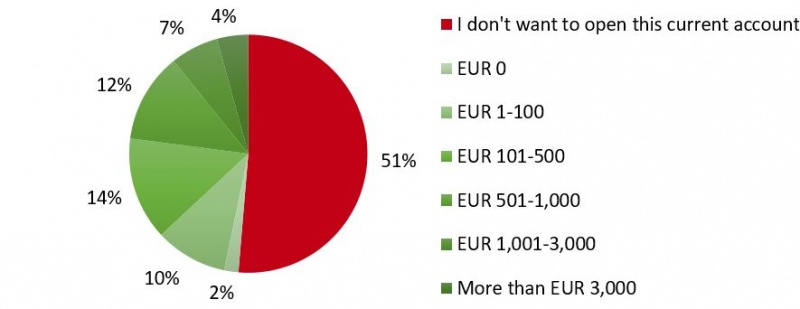

Central banks around the world are examining the possibility of introducing Central Bank Digital Currency (CBDC). The public’s preferences concerning the usage of CBDC are essential determinants of its success. However, research about CBDC has been silent about consumers’ willingness to use CBDC and what triggers usage. Our research among a representative group of Dutch citizens aims to fill this gap.2 It complements the growing list of policy-oriented studies that discuss CBDC design issues such as the governance, cybersecurity and legal aspects. We find that about half of the Dutch population would be willing to open a current account for digital euros at the central bank.

The amount willing to deposit on a current account for digital euros

Source: CentERpanel 2021. Note: 2,523 respondents.

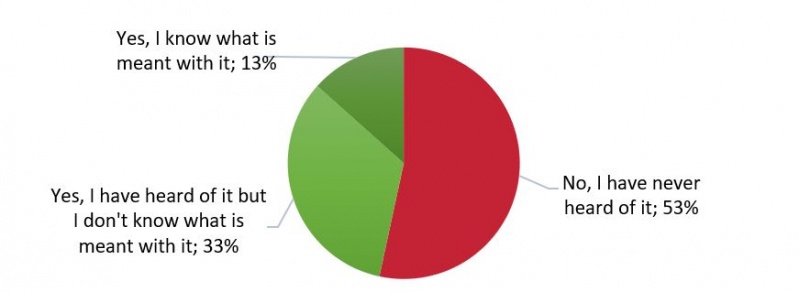

Source: CentERpanel 2021. Note: 2,546 respondents.

European Central Bank (2021). Eurosystem report on the public consultation on a digital euro.