This policy brief is based on SSRN Paper “Digital money and finance: a critical review of terminology” (forthcoming in Journal of Financial Market Infrastructures ). The views expressed in this article are not necessarily the ones of the ECB.

Abstract

The digitalisation of payments has accelerated over the last three decades with the internet and ever faster and cheaper computing capacity. At the same time, many believe that decentralised finance (“DeFi”) offers fundamentally new possibilities for trading, payment and settlement. Concurrent to the rise of innovative technologies has been the rapid advent of new terminology, which is widely used, but which often seems to be biased, confusing, or is used inconsistently. By reviewing terminologies, this policy brief clarifies the essence of new technologies in the field of payments to facilitate ongoing discussions about their eventual merits and use cases.

The digitalisation of society has accelerated over the last three decades with the internet and ever faster and cheaper computing capacity. Moreover, since 2008, crypto-currencies and decentralised finance (DeFi) have become popular themes. In parallel, a terminology has developed, which is however often confusing, as a result of (1) the speed of development of the field; (2) the often technical nature of the functional architecture and processes of payment and settlement as well as the desire to represent these with intuitive and catchy terms; (3) the even more technical world of IT architecture, database logic and processes that constitute cryptography, blockchain and DLT; (4) the strong interests of crypto-asset (in particular Bitcoin) owners, DeFi grassroot fans, DeFi investors, and sometimes politicians and public sector organisations wanting to promote new technology and keep momentum and belief; (5) terminological path-dependencies and hysteresis, in particular once terminology has been enshrined in laws and regulations. To contribute to a better debate, this policy brief, which is based on Bindseil, Coste and Pantelopoulos (2024), seeks to address issues in the terminology that contribute to confusion. Our work extends the work of Milne (2023) who also “documents widespread inconsistencies in terminology and misleading use of analogy in current economic and policy discussions of these developments in digital money and payments.”

Smart contracts are not “smart”, as they are merely computer codes that execute tasks upon the fulfilment of preconditions, in which the preconditions pertaining to the terms of the contract may be inputted by humans (Mik, 2017; Grimmelmann, 2019); the smart contract cannot “think for itself” so to speak. The inclusion of the term “contract” in smart contract is also misleading, since smart contracts are not contracts in the legal sense (Bacon et al, 2018). Finally, the term “smart contract” is also somewhat redundant, as the term is used to bring across a concept which is analogous to that of “programmability”. Indeed, the notion of programmability and thus programmable means of payments/payments is not something that is necessarily exclusive to the crypto-verse or crypto-verse technologies/innovations. In other words, the notion that “programmability” is synonymous with forms of DLT is misguided.

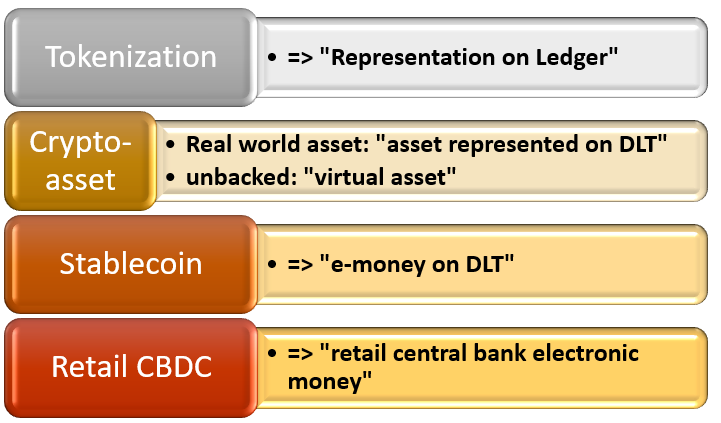

The term “tokenisation” has been used in many ways. That said, the essence of tokenization seems to be the act of moving, from a legal and technical perspective, the representation of ownership in an asset (and the transferability of ownership) into a ledger. The term “token” has traditionally had the connotation of being a representation outside of a ledger, such as in the earlier use in discussions of “token-based vs. account based CBDC”. Using it for issuance in DeFi was meant to suggest that decentralized ledgers are not ledgers at all and that the “tokens” in them could circulate like cash. This was misleading (and partially marketing) because an electronic record will never be like cash in terms of an absence of records of the effectuated transfer and change of ownership. Relating to that, it is not clear why the term “tokenization” should be reserved to DLT (which are ledgers, even if “distributed” ones) and doing so over-emphasizes the specificity and novelty of DeFi. Tokenization is in essence “representation” of ownership on a ledger, that the term is therefore redundant. By not associating the term to the act of moving the representation of ownership of an asset to a traditional ledger, the term is used to over-emphasise the idiosyncratic nature and novelty of DeFi platforms.

The term “crypto-asset” is inconsistently applied; some definitions exclude public sector assets issued on distributed ledgers, while others exclude assets that are not liabilities, like in the case of the Crypto-Asset Task Force (2019, 7). The term “tokenized assets” is often preferred for real-world assets represented on a blockchain, while “crypto-assets” tends to refer to native crypto-assets. This distinction has the advantage of clarifying the nature of the asset – whether it exists independently or is a digital representation of something external, and if useful, the form and nature of the registry which documents ownership can be added as qualifying feature: “a bond held in paper format” (or bearer bond), “a bond held with a bank” (a registered bond) or “a bond represented in a blockchain” (a tokenised bond, if we want to use the term “tokenisation”). Some have argued that “unbacked crypto-assets” is a misleading term in the sense that there would actually not be any assets corresponding to the ledger entries.

The use of the term “coin” for both unbacked crypto-assets (“Bitcoin”) and in “stablecoin” seems misleading because a coin is a bearer instrument while a blockchain/DLT rely on entry in ledgers. The choice of the term “coin” aimed at overselling decentralization achievable through DeFi. Moreover, “stability” refers to a displayed goal but not necessarily to a credible attribute of the token which is often used as a marketing-like argument rather than to describe the intrinsic credibility of the peg. Fully backed stablecoins (i.e. those who indeed have credibility to be stable) are similar to e-money, and the fact that a financial asset is registered and transferable on a distributed ledger is not per se changing its nature. Therefore, a better expression could be for example “e-money on a distributed ledger”, or, if the stablecoin refers to another asset, such as gold: “gold represented on a distributed ledger”, etc.

The term “CBDC” could be generally ambiguous in that the term “digital” was initially used in the sense of “central bank money being distributed via DeFi”. In the field of retail CBDC, this ambiguity continues to a limited extent until today: while most now use the term “retail CBDC” for the idea to make central bank money accessible electronically to everyone (e.g. via a mobile phone, the money being recorded and settled electronically in some presumably central ledger), few sometimes still interpret the term “digital” in “CBDC” as referring to “crypto” technology (i.e. blockchain and DLT). In line with Dyson and Hodges (2016), retail CBDC means granting access to central bank money in electronic (non-paper) form to parties (in particular natural persons, but possibly also non-bank firms) who previously had only access to central bank money in the form of banknotes (i.e. households in particular). It should be considered to replace the term “digital” in CBDC by “electronic” to remove ambiguity on whether retail CBDC means central bank money held on a DeFi platform (it does not). Moreover, the term “currency” should be replaced by “money” as “central bank money” is a common and well-fitting term while “central bank currency” is not. “Retail central bank electronic money” (rCBEM) would be defined as means of payments issued by the central bank in electronically accessible and usable form with broad access including in particular by natural persons.

Ever since the 2018 report of CPMI-MC (2018), most central banks etc. have used the term “digital” inconsistently across retail CBDC and wholesale CBDC. For retail CBDC, it is used without any connotation to DLT/blockchain, i.e., simply meaning the access to electronic central bank money for all, while for wholesale CBDC, it is used with strict connotation to DLT (“or similar technology”), since electronic central bank money has been the reality for banks for many decades. Following Panetta (2022), a meaningful definition of “wholesale CBDC” which avoids inconsistency with the common understanding of “retail CBDC” (and the definition given to it by CPMI-MC (2018)) would be: “central bank money in electronic form only accessible to banks and a well-defined set of market infrastructures, public authorities and possibly non-bank financial institutions”. The CPMI-MC (2018) meaning of “wholesale CBDC” could be called “wholesale central bank money represented on a DLT platform”. As there is no paper-based wholesale central bank money (i.e. all wholesale central bank money is electronic), a qualifier “electronic” would not be needed at all in the context of wholesale central bank money.

Figure 1. Digital money and finance: alternative vocabulary

Public sector institutions should be free of financial interests and marketing intentions and have a responsibility to help the public understand new technologies within the scope of their mandates. Sound terminology is the very basis for this. In a world of rapid innovations, terminology can initially appear adequate, but at a later stage turn out to be suboptimal or even inadequate and there is no reason to fatalistically accept path dependencies in this case, and thereby perpetuate confusion. We hope that this paper triggers further discussions on terminology in the field of digital money and finance and related definitions to allow the debate about its undoubted merits to become more focused, neutral, and ultimately, productive.

Bacon, J., Michels, J. D., Millard, C., & Singh, J. (2018). Blockchain demystified: a technical and legal introduction to distributed and centralized ledgers. Richmond Journal of Law and Technology., 25, 1.

Bindseil, U., Coste, C and Pantelopoulos, G. (2024). Digital money and finance: a critical review of terminology”, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5007868 (forthcoming in Journal of Financial Market Infrastructures).

BIS. (2023). The crypto ecosystem: key elements and risks, report submitted to the G20 Finance Ministers and Central Bank Governors, Bank of International Settlements, Basle.

CPMI and Markets Committee. (CPMI-MC). (2018). Central Bank Digital Currencies, CPMI Paper No. 174.

Dyson, B. and Hodgson, G. (2016). Digital cash: why central banks should start issuing electronic money. Positive Money. https://positivemoney.org/publications/digital-cash/

ECB Crypto-Asset Task Force. (2019). Crypto-assets: Implications for monetary policy, financial stability, monetary policy, and payments and market infrastructures. ECB Occasional Paper Series No. 223

Grimmelmann, J. (2019). All smart contracts are ambiguous. Journal of Law & Innovation, 2, 1.

Hojo, M., & Hatogai, J. (2022). Realizing Programmability in Payment and Settlement Systems. Bank of Japan Review, No. 8, 2022.

Mik, E. (2017). Smart contracts: terminology, technical limitations and real world complexity. Law, innovation and technology, 9(2), 269-300.

Milne, A. (2023). Argument by False Analogy: The Mistaken Classification of Bitcoin as Token Money. Journal of Money, Credit and Banking. https://doi.org/10.1111/jmcb.13061.

Panetta, F. (2022). Demystifying wholesale central bank digital currency, Speech, Frankfurt am Main, 26 September 2022.