This SUERF Policy Brief summarizes ACPR Analyse et Synthe ses N°142-2022, August 2022. This article uses data collected by the ACPR on key digital players operating in France. The views expressed in this study reflect the authors’ opinions and are not necessarily those of the Autorite de Contro le Prudentiel et de Resolution.

We study the evolution of the role of digital players in the financial sector in France. We observe that in recent years, digital players have dramatically increased their market shares. As an illustration, 35% of new current accounts opened in 2020 were opened with a digital player. In a French banking market characterized by high concentration, large banks have been able to capitalise on their experience and reputation to build customer loyalty. Nevertheless, new players have managed to emerge through a dynamic of specialization. These new players make profits when they manage to be competitive on both sides of a two-sided market: the product side and the customer side (Rochet and Tirole, 2003). In addition, we observe a new trend, which is the development of strategic partnerships between digital and market players, to expand the range of financial products and services offered to their customers, in a market platformization perspective.

New information technologies have profoundly transformed our daily lives. In recent years, the ways of making and paying for purchases, conducting financial transactions, and managing wallets and bank accounts have undergone profound changes. The growth of the digital economy has also entailed a shift from a supply-side logic, in which financial services were offered by intermediaries to their customers, to a demand-side logic, more focused on customer needs, in which financial products and services are directly accessible to customers, via computer applications available on smartphones or tablets, without necessarily having to resort to “physical” access to an intermediary or financial advisor.

In a recent study (Clerc et al. 2022), we analyze the evolution of the market for digital players in the financial sector in France. This study is based on a survey of a sample of 15 institutions carried out in 2021, focusing on financial players and intermediaries that provide services that are 100 percent online or accessible via mobile applications. The survey covered both subsidiaries of large banking groups and digital native actors.

The main trends we observe are as follows. First, we note the remarkable adaptability of traditional banks in the face of the spread of online banking and the almost systematic acquisition of new players. For example, several players in our sample were either created directly or acquired by traditional banks over the past 20 years. The latter are extremely dominant in the French banking market, which is highly concentrated.

Nevertheless, new players have managed to emerge through a dynamic of specialization. Some offers from natively digital players propose limited banking services (current account, credit card, cash withdrawals and transfers), while other, from specialized Fintechs, offer payment services or propose niche products, in direct competition with certain segments of traditional banking (consumer loans and financing of professionals and small businesses).

The financial sector digital players included in this study experienced a significant increase in their market presence in 2020 compared to previous years.

The number of their customers doubled between 2018 and 2020. At the beginning of 2018, about 8 million customers (exclusively retail, including individuals and SMEs) had an account opened with one of the institutions in our sample. This figure increased to 11.5 million at the beginning of 2019 and reached about 16 million customers at the beginning of 2020 that is a 100 percent increase in a two-year period. By comparison, the total number of retail accounts at the six major French banking groups stood at 74 million at the beginning of 2020.

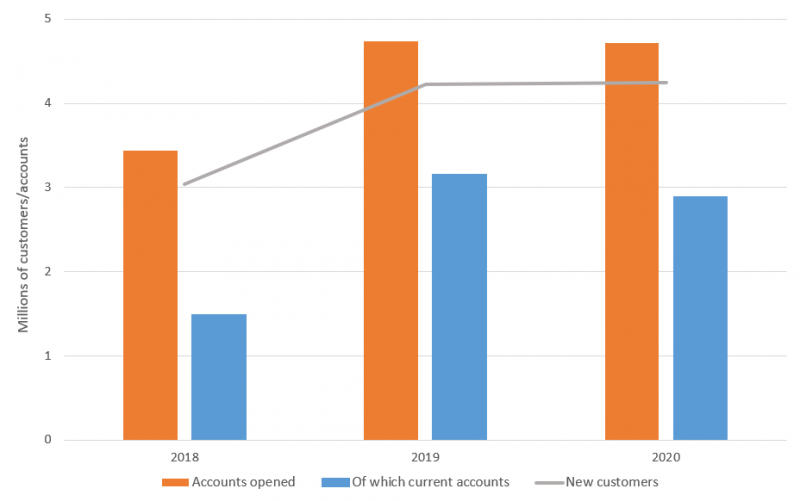

Digital finance players have thus managed to strengthen their market share through increasingly comprehensive product offerings, fostering customer autonomy in the areas of everyday banking and savings products. Regarding the opening of new accounts in the institutions included in our sample, 4.7 million accounts were opened during 2020, of which 2.9 million were current accounts (Chart 1). These figures can be compared with the 5.5 million new current accounts opened by retail customers at the six major French banking groups in the same year. It thus turns out that about 35 percent of the new current accounts opened in 2020 were opened at one of the digital players included in our sample.

Chart 1: New customers and number of account openings with digital institutions included in our sample, 2018-2020

Source: Clerc et al. (2022)

The market is still maturing. As a result, some players exited the market because they failed to reach their goals in terms of the customer base, some of which proved overly optimistic. Those that have remained and consolidated are of two types, in terms of business model.

First, generalist players, mostly subsidiaries of large banking groups,which offer a wide range of financial products to a diversified customer base; second, specialized players, which do not offer such a wide range of products and services but rather focus on a narrower customer base, positioning themselves in market segments considered more profitable. Another feature of the business models is the change in the composition of the customer base, with an increasing share of young customers and a decreasing trend in the relative share of executives in the number of both existing and new customers. Thus, at the aggregate level, the strong growth in the number of customers in 2020 has not necessarily been associated with improvements in operating profitability: net interest and other banking income (NBI) have been growing at an insufficient pace compared to overhead costs that have remained very high.

Within our sample, however, we find strong heterogeneity in this respect. Operators that are not part of a banking group are virtually all, without exception, already profitable or claim to break even by 2022-2023. The 100% mobile operators in particular are the most profitable due to their low operating costs and specialization in specific market segments.

Among operators belonging to a traditional banking group, only two appear profitable. For these operators, controlling overhead and acquisition costs appears to be a winning strategy in the medium term. One of these two operators has based its business model on a mixed distribution network, relying on both digital and physical networks (“phygital” model), with high volumes and fee-only services. The other, a market incumbent, is characterized by good cost control and a particularly stable customer base.

Other online banks have not made profitability an immediate goal, focusing more on acquiring new customers by offering services at reasonable/no cost to customers in order to generate network effects. Finally, some operators failed to achieve positive returns because low interest rates or expensive IT investments have negatively affected their profitability.

One of the major market developments in recent years has been the diversification of product supply through the development of strategic partnerships. Branches of major banking groups are able to offer a wide range of banking and financial services developed within the group. New digital players (payment institutions, etc.) could not offer the same range of services to their customers at the time of their creation due to their legal status.

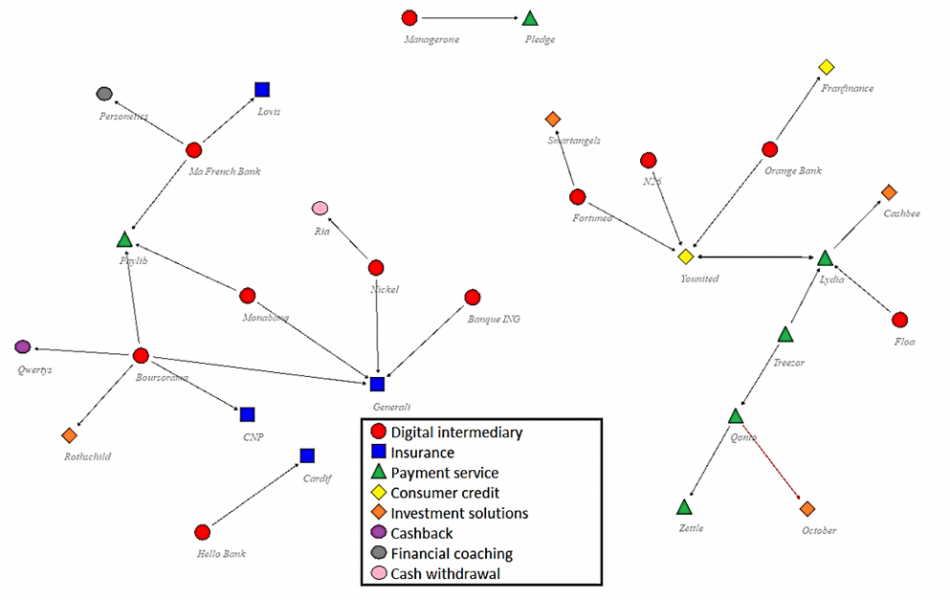

In order to grow in this highly competitive environment and catch up with the large and traditional banking groups in the platformization of their business model, strategic partnerships were created with companies holding complementary licenses, thus enabling new entrants to expand the range of services offered to their customers. The resulting network reflects a market in which interdependencies and complementarities are created not only within groups or between business partners, but also among competitors themselves. Chart 2 shows the structure of this network, reconstructed from public information.

Chart 2: Map of the network of digital finance partners

Note: The chart has been designed using public data only. We have excluded intra-group partnerships, bank card partnerships and partnerships with BigTechs from this map.

However, chart 2 is not exhaustive: it was compiled based on information published by market participants and does not take into account intra-group partnerships (particularly ties with parent companies) or those with bank card networks and BigTechs. Regarding the two latter cases, since the offers are focused on a few key players (Visa, Mastercard or American Express) or payment systems offered by BigTechs (such as Apple-Pay or Google-Pay), these services are integrated into almost all offerings. Overall, the graph shows that a digital intermediary (red dot) can lean on a payment institution (green triangle), offer credit insurance to its customers (blue square) and, at the same time, offer them investment solutions (orange diamond), a financial coaching service (gray ellipse) or consumer credit products through a partnership with a specialized institution (yellow diamond).

In conclusion, it is likely that future market evolutions will continue along these lines. On the one hand, operators belonging to large banking groups will continue to increasing their customer base. The aim is to make profits by exploiting the heterogeneity of their large customer base by offering increasingly specific and monetisable services (Hagiu 2009, Chao and Derdenger 2013). On the other hand, independent players will continue in the creation of partnerships to broaden the offering to their clientele in a logic of high specialization on customer and product, which allows for high cost control.

Chao, Y., & Derdenger, T. (2013). Mixed bundling in two-sided markets in the presence of installed base effects. Management Science, 59(8), 1904-1926.

Clerc, L., Dufour, T., Harguindeguy, P., & Ungaro, S. (2022). Digital players in the financial sector: a step towards profitability? ACPR “Analyses et Synthèses” no. 142.

Hagiu, A. (2009). Two‐sided platforms: Product variety and pricing structures. Journal of Economics & Management Strategy, 18(4), 1011-1043.

Rochet, J. C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economic Association, 1(4), 990-1029.