This policy brief is based on Disclosure of climate change risk in credit ratings (2022). This policy brief should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Climate change can be a source of financial risk. We examine how credit rating agencies accepted by the Eurosystem incorporate climate change risk in their credit ratings and how they disclose their assessments of climate change risks to rating users. We develop an analytical framework to compare the agencies’ definitions, methodologies, assessment models, data usage and disclosure practices. Leveraging on the analytical framework, we reveal large differences in methodologies and disclosure practices across rating agencies and asset classes and identify three main areas for improvement with respect to climate-related disclosures. These areas concern the level of granularity of definitions of climate change risk, the transparency around models and methods used to estimate the exposure to climate change risk and the disclosure of the magnitude of the impact of material climate change risk on credit ratings.

When conducting its monetary policy operations, the Eurosystem is exposed to financial risks, including credit risk. The Eurosystem mitigates exposure to credit risk in its credit operations by means of risk control measures embedded in both its counterparty framework and its collateral framework1 and, In the Eurosystem’s outright purchase programmes, via the establishment of appropriate eligibility criteria, including a minimum credit quality threshold. Amongst other credit assessment sources, external credit assessment institutions (ECAIs, i.e. credit rating agencies) are these largely used to assess the creditworthiness of marketable collateral. Hence, the Eurosystem, as a user of credit ratings, relies on the credit quality assessments by ECAIs and that they adequately capture the financial risks to which it is exposed in both its credit operations and outright purchases.

Climate change can be a source of financial risk. Following its Strategy Review of 2020-21, the ECB presented an action plan on climate change.2 This action plan echoes the ECB’s commitment to more systematically reflect climate change considerations in its monetary policy framework, on the clear understanding that addressing climate change is a global challenge and a policy priority for the European Union. The detailed roadmap underpinning the ECB action plan on climate change includes, among others, a commitment to investigate whether ECAIs have disclosed the necessary information for the Eurosystem to understand how they incorporate climate change risk (CCR) into their credit ratings. Hence, it can be concluded that the Eurosystem, as an investor, pays close attention to climate change risks and as a consequence is set to achieve a granular understanding on how these are incorporated in credit ratings.

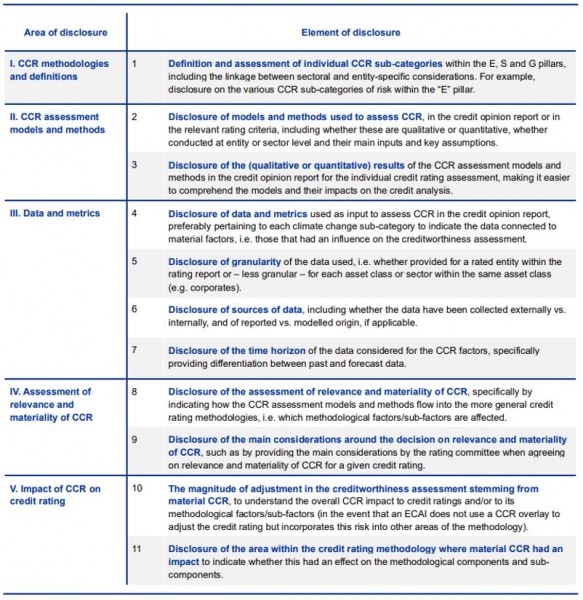

We develop an analytical framework to perform a systematic and consistent assessment of the methodologies and disclosure by credit rating agencies on climate change risk. The framework is based on 11 criteria that together form a holistic approach to classify the level of disclosure from the perspective of a credit rating user. A high level of disclosure under all criteria would allow a user of credit ratings to fully understand the impact of climate change risk on the creditworthiness assessment performed by the rating agencies and, in turn, to perform better internal due diligence. The 11 criteria of the analytical framework map to five disclosure areas, as presented in Table 1.

A high level of transparency in the first area of the analytical framework means providing a clear framing of CCR assessments within the broader ESG assessment frameworks. This would include presenting the definition of the individual CCR subcategories under consideration and explaining how they flow into the assessments of the E, S and/or G pillars. In case a rating agency also assess the exposure of industries/sectors to CCR, the link between sectoral and entity-specific CCR assessments would also be made available. Second, the analytical framework evaluates the disclosure on the models and methods that agencies use for their CCR assessments. High disclosure in this area would help to understand why the rating agency has assessed a certain physical or transition CCR as being low or high. Third, the analytical framework covers CCR assessment models and methods rely on a number of metrics and factors. In a high disclosure scenario, credit rating reports could include the data and the metrics used as input to assess CCR, preferably linked to the sub-category of risk for which it was used, for each of the CCR sub-categories considered for the individual credit analysis. Moreover, it could be made transparent whether such information was available at the entity level or at the sector/industry level and its source of collection, and the time horizon considered.Fourth, the analytical framework “zooms in” on the disclosure of the assessment of relevance and materiality of CCR for a given credit rating. A high disclosure in this area could consist of indicating the magnitude of the adjustments to credit ratings (and/or to its methodological factors/sub-factors) stemming from material CCR.

Finally, the analytical framework looks at the impact of CCR on the credit rating: a high disclosure in this area could consist of indicating the magnitude of the adjustments to credit ratings (and to its methodological factors/sub-factors) stemming from material CCR.

Table 1: Analytical framework for the assessment of CCR disclosure in creditworthiness analyses by ECAIs

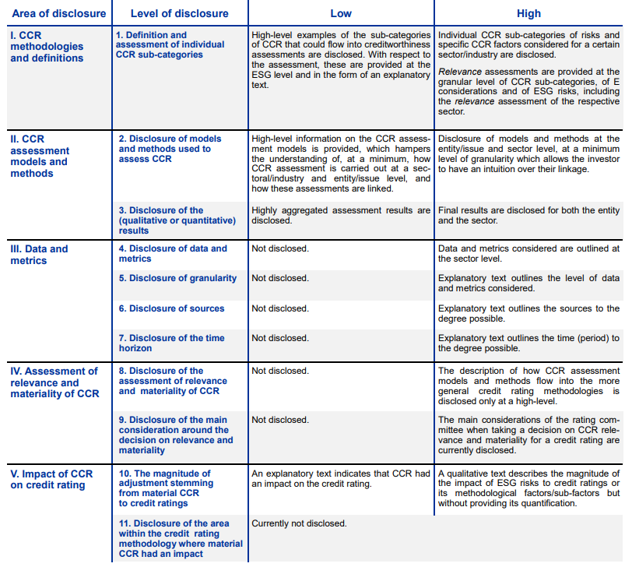

CCR is considered by ECAIs as part of their assessment of environmental risk. CCR sub-categories and their factors are not universally or evenly applied across all sectors and/or industries, as their influence on the entities/issues might vary. CCR assessment methodologies might consist of either qualitative or quantitative assessments or a combination of both ESG risk and CCR are not assessed on a stand-alone basis within the rating methodology but within the already existing analytical categories of the rating methodologies. ESG and specifically CCR are assessed by credit rating agencies also at sector or industry level. The models used for analyses around climate change, which are then employed by ECAIs to assess their relevance and materiality, are also not fully disclosed. However, the rating user can identify to some extent the methodology employed by ECAIs to assess CCR. ECAIs do not currently disclose the data used to assess CCR at a granular level for each individual credit rating. This may be due to either the reliability and consistency of the quantitative data or the fact that rating agencies are still in the process of building up the necessary databases of quantitative CCR metrics. Also, it is not fully clear which data input is qualitative and which is quantitative.

Table 2: Status-quo assessment of ECAIs’ disclosure against the analytical framework

The user of a credit rating would typically take a look at the credit rating report to find information on the CCR sub-categories of risk (and their CCR factors) that were deemed relevant for a credit analysis, meaning those that were considered by the rating agencies as potentially having an influence on the analysis (and its outcome).3 ECAIs disclose to a certain extent whether relevant CCR considerations were also material to a credit rating or not. In most cases the rating agencies provide qualitative statements and/or scores accompanied by explanatory text, although not always with information on the magnitude of the impact that CCR, or its individual sub-categories (i.e. physical and transition), had on the credit ratings and/or its methodological factors/sub-factors. If CCR were deemed to materially affect the creditworthiness assessment, disclosure by rating agencies ensures at least that the user of a credit rating understands it, though without always being able to deduce what the credit rating would have been in the absence of CCR.

The comparative analysis conducted results in a number of horizontal findings. It shows that, while ECAIs have made significant progress with their disclosures and methodologies around ESG, the level of disclosure differs across ECAIs and, for each ECAI, across asset classes. The disclosure on the definition and assessment of CCR is not always granular enough to extract an agency’s assessment of a particular climate change sub-factor. For most ECAIs and asset classes, we believe that the current level of disclosure does not allow a user to draw definite conclusions on the materiality of individual CCR subcategories like transition risk and physical risk. The magnitude of impact of material CCR on credit ratings is rarely disclosed, and similarly it is not fully clear how sectoral assessments inform entity-specific CCR assessments. In addition, ECAIs do not always explain the models and data used for such CCR assessments in sufficient detail.

We have identified three areas for possible further transparency and disclosure. However, not all proposed improvements are applicable to all agencies and improvements would need to be implemented in a way that is compatible with the individual methodological approaches used by each of the rating agencies. First, we believe that ECAIs could be more transparent in a credit rating report and/or press release about both the definition and the assessment of the individual CCR factors within the E pillar. ECAIs could disclose (i) the individual CCR factors within the E pillar considered for the individual entity’s creditworthiness assessments; (ii) the link between sectoral and entity-specific CCR assessments; and (iii) whether the individual CCR factor was assessed as relevant to the credit rating and how materially it affected the creditworthiness of the entity’s assessment, for each CCR factor considered. Elements (i) and (iii) would add granularity to the current level of disclosure, which is often only at the level of the E pillar, i.e. without going to the level of detail of the individual CCR factors considered for the specific creditworthiness assessment. In relation to element (ii), while it is somewhat known that sectoral assessments inform entity-specific CCR analysis, the linkage between the two is not fully disclosed. This would be especially important for a rating user to understand for which entities/assets ESG risk assessments fully rely on an assessment at sector or industry level because more granular information is not available. The implementation of further transparency around these three elements would not be entirely consistent with ECAI transparency on other aspects flowing into their credit assessments. Disclosing (i) would be comparable to current practices regarding the other individual factors flowing into the credit assessment. The disclosure of (iii) – and potentially (ii) – could go beyond the status quo of explaining which methodological factors were informing the individual credit assessment, as it would require ECAIs to outline not only how individual factors are assessed but also how these affected other methodological factors. However, transparency on (iii) and (ii) is considered useful to understand ECAIs assessments and judgement around CCR, thus avoiding mechanistic reliance among investors. Additionally, since (ii) and (iii) are expected to be well known to ECAIs, as any other element of their credit rating methodologies, the additional challenge for them would lie in the operational process supporting an enhanced disclosure. Second, we believe that ECAIs could enhance their disclosure on the magnitude of adjustments to the credit rating (or its methodological factors/sub-factors) stemming from material CCR. ECAIs could present such information (i) in each credit rating decision where an adjustment was applied and, (ii) showing where in the rating methodology such adjustment was applied (as CCR is one of the aspects considered in it). At present, while ECAIs tend to disclose whether ESG risk is material to a credit rating, this is usually reported in a qualitative and descriptive manner, often without disentangling the materiality stemming exclusively from CCR (if applicable). Also, the size of the adjustments applied to an entity’s creditworthiness assessment – in terms of notches – is not known. Disclosing (i) and (ii) would be somewhat in line with current practices. ECAIs currently present the assessment of each methodological factor in credit rating decisions, thus disclosing their contribution to the final credit rating, and also partially elaborate on any adjustments applied and explain where these took place (i.e. in which methodological factor or sub-factor). As a result, (i) and (ii) would go to some extent beyond the present level of transparency, as they would entail homogeneity of disclosure across sectors and rating decisions for all adjustments driven by CCR. We understand that there are methodological limitations for rating agencies in identifying the quantitative impact of climate change on ratings. Third, the methods and models used for the CCR assessments could be further explained. ECAIs could elaborate further, either within the ESG assessment criteria or within the credit rating methodologies, by describing the models and methods used to assess CCR, outlining the data input and sources used. This would allow users to unequivocally deduce the significance and consideration of CCR assessment methods and models within credit rating assessments. It is noted that this area could not be achieved by those rating agencies only relying on qualitative CCR assessments. Additionally, this aspect is recognised as a challenge for all credit rating agencies in view of the existing caveats regarding climate change data.

The counterparty framework ensures that the Eurosystem is lending only to financially sound counterparties, thus reducing the counterparty’s default risk. The collateral framework is there to mitigate financial risks stemming from counterparties’ collateral upon their default, and consists of eligibility criteria, valuation and risk control measures (e.g. haircuts).

It is recalled that ECAIs need to comply with the ESMA Guidelines on ESG disclosure, which became applicable in March 2019. The Guidelines provide that rating agencies need to indicate it in the accompanying press release, or report, when ESG factors were a key driver behind a change to rating or rating outlook. They should also identify the key factors that were considered to be ESG factors (as per the rating agencies’ definition) and explain why these were material to the credit rating or rating outlook. They should also include a link to the website or a document in the publication that explains how ESG factors are considered within methodologies or associated models.