In this project, we study the effect of the vote in the ECB’s Governing Council on the inflation uncertainty of households. We conduct a randomized controlled trial using the Bundesbank Online Panel Households and provide participants with information about different voting outcomes in the council. Dissent among policymakers causes higher inflation uncertainty.

In most central banks, monetary policy is set by committees. Hence, decisions could be made unanimously or by majority. Majority decisions imply that some members dissented: they did not vote for the policy proposal. Many central banks do not only publish the policy decision, but also the vote in the committee, e.g. the U.S. Federal Reserve or the Bank of England. According to the published vote, dissent occurs frequently.

In a recent research project (Grebe and Tillmann, 2022), we study the impact of dissent in monetary policy committees on household inflation expectations. We concentrate on the case of the European Central Bank (ECB). In contrast to other central banks, the ECB remains opaque about the vote. When asked by journalists, the ECB president only communicates a thin assessment of his or her reading of the majority in the Governing Council (GC) using codewords such as “consensus” or “overwhelming support” to communicate the fact that some members dissented. He or she does not provide information about the identity of the dissenter, nor about the direction of the dissent. As an example, consider the press conference on July 06, 2006. When President Trichet was asked whether the decision was unanimous, he simply replied „Yes, very much.” In other cases, the president said that the decision was supported “overwhelmingly” (e.g. August 03, 2006) or was taken “by consensus” (e.g. June 05, 2008), which implies that there were dissenting votes.

In our research project, we are particularly interested in the effect of dissenting votes on the individual distribution of expected inflation of households. Does dissent lead to a wider distribution of inflation expectations?

In our survey experiment, we provide German households with information about the vote. Though households might not follow the ECB press conference, they are aware of rifts in the GC. This is particularly true for households in Germany, where the disagreement between the president of the Bundesbank, who is a member of the GC, and the ECB president was headline news for more than a decade.

In Grebe and Tillmann (2022), we conduct a randomized controlled trial (RCT) design, which is inspired by the provision of information during the ECB press conference. We use the Bundesbank Online Panel Households, which is a well-established monthly online survey. RCTs are a very popular tool in the literature on information provision experiments, e.g. Coibion, Georgarakos, Gorodnichenko, Kenny and Weber (2021), Coibion, Georgarakos, Gorodnichenko and Weber (2021) and Coibion, Gorodnichenko and Weber (2021).

In the first stage of the survey, participants submit their minimum and maximum inflation projection. After that, each respondent receives information about an ECB decision to keep interest rates unchanged. In the second step, participants receive selective information and submit their probabilistic inflation projections. Each participant assigns probabilities over different inflation bins.

We randomly divide participants into four groups. The control group receives no additional information. Group 1 is informed that the ECB decision was unanimous. Group 2 receives the information that the decision in the GC was a majority decision, i.e. there was at least one dissenting vote. Group 3 is provided the information that the decision of the GC was unanimous despite different views among committee members. Such an information treatment is motivated by remarks of the ECB president in the press conferences that the GC eventually decided unanimously despite members having different views.

From the probabilistic answers of respondents we derive each participant’s individual distribution of expected future inflation following the method introduced in Engelberg, Manski and Williams (2009) and Manski (2018). The RCT design is advantageous for our purpose as we can infer the causal effect of the vote in the GC on households‘ inflation expectations. We concentrate on the effect of the vote on each household’s inflation uncertainty, measured as the interquartile range or standard deviation of inflation projections.

The survey was conducted in July 2021. After eliminating extreme outliers, we are left with more than 2000 responses, which we analyse using regression models. Participants also answer routine questions concerning their age, income, education and other sociodemographic characteristics.

The results from our survey suggest that households consider the vote in the GC informative. Relative to the control group, which does not receive any information about the vote, households receiving information revise their inflation forecasts more.

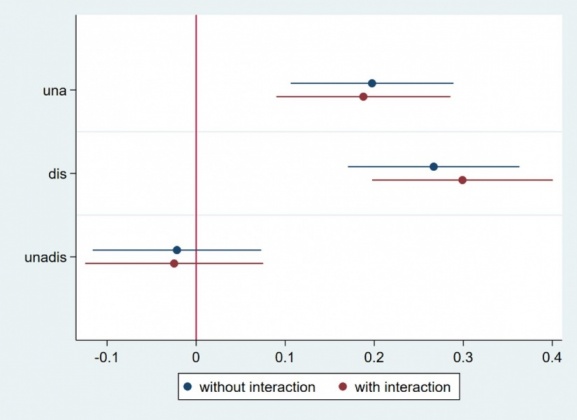

A key finding is that information about the vote in the GC affects how uncertain individuals are about future inflation. The group of households, which we provide with information about dissenting votes, exhibits a stronger revision of inflation expectations than the group that receives information about a unanimous vote. When participants learn about dissent, they become more uncertain about future inflation as reflected in the wider distribution of their individual forecasts. This effect is shown in Figure (1).

In our baseline model, the difference between the impact of dissenting votes and the impact of unanimous votes on individual uncertainty is insignificant. However, the effect becomes strongly significant if we include control variables such as respondents‘ age or years of education and let the information treatment interact with these characteristics. Hence, dissent among policymakers causes a higher uncertainty of households about the future path of inflation.

It is also important to stress that information about a unanimous vote either remains an insignificant or, in most cases, a significantly positive determinant of inflation uncertainty. Revealing information about a unanimous vote does not reduce inflation uncertainty, at least relative to remaining completely silent about the vote.

Figure (1): The response of inflation uncertainty to the vote in the Governing Council

Notes: The graph shows the estimated level effects of the treatments, i.e. unanimity (una), dissent (dis) and unanimity despite different views (unadis) on the individual interquartile range of respondents. We report the results from a model with and without interaction terms between the treatments and sociodemographic characteristics of respondents. The graph shows the point estimate and 95% confidence bands.

We find that dissent among policymakers causes a higher uncertainty of households about future inflation. The vote in the council is a determinant of household expectations besides the policy itself. If uncertainty about future inflation translates into uncertainty about the current real interest rate, it could affect households‘ spending decisions.

Currently, the ECB does not provide information about the vote in a systematic way. Whether or not the ECB president mentions the vote in the GC during the press conference and how she assesses the views of GC members lies in the discretion of the president. This discretion contributes to inflation uncertainty. Observers of the central bank who want to learn about the views in the committee have to wait a few weeks until the Monetary Policy Accounts are released, which contain a summary of the discussion in the Governing Council.

If the vote of the council is released routinely, our results suggest that a unanimous vote contributes to a reduction of the uncertainty of households about inflation. Hence, to maximize the impact of policy, the Governing Council should speak with one voice.

Coibion, O., D. Georgarakos, Y. Gorodnichenko, G. Kenny and M. Weber (2021): “The effect of macroeconomic uncertainty on household spending”, unpublished, University of California Berkeley.

Coibion, O., D. Georgarakos, Y. Gorodnichenko and M. Weber (2021): “Forward Guidance and household expectations”, unpublished, University of California Berkeley.

Coibion, O., Y. Gorodnichenko and M. Weber (2021): “Monetary policy communications and their effects on household inflation expectations”, unpublished, University of California Berkeley.

Engelberg, J., C. F. Manski and J. Williams (2009): “Comparing the point predictions and subjective probability distributions of professional forecasters”, Journal of Business and Economic Statistics 27, 30-41.

Grebe, M. and P. Tillmann (2022): “Household expectations and dissent among policymakers”, MAGKS Discussion Paper, No 26-2022, https://www.uni-marburg.de/en/fb02/research-groups/economics/macroeconomics/research/magks-joint-discussion-papers-in-economics/papers/2022-papers/26-2022_grebe.pdf.

Manski, C. F. (2018): “Survey measurement of probabilistic macroeconomic expectations: progress and promise”, in: M. Eichenbaum and J. Parker (eds.), NBER Macroeconomics Annual 32.