This brief is based on forthcoming NBS and ECB Working Papers. The authors wish to posthumously acknowledge the support of Ivan Jaccard in completing this work. The views expressed are those of the authors and do not necessarily reflect those of the ECB or the National Bank of Slovakia.

Abstract

Following the Global Financial Crisis of 2007-08 and an associated increase in loan delinquencies in the Eurozone, Ireland, Slovenia, and Spain implemented significant delinquent loan purchase programs through Asset Management Companies (AMCs), amounting to about 44%, 16%, and 10% of their GDPs, respectively. While these programs are generally deemed successful, questions have been raised about their principal mechanisms and broader applicability. Was their success due to idiosyncratic combinations of good policy and good luck in the form of rapidly re-bounding economic growth? In this policy brief and the underlying more technical paper, we show that their effectiveness is, instead, due to a systematic advantage of AMCs, namely their ability to reduce pecuniary externalities and costs associated with loan delinquencies. AMCs directly enhance the overall average returns to bank lending. This directly promotes additional lending (bank lending channel) and improves corporate borrowers’ balance sheets (balance sheet channel). We show that the welfare gains of well-designed and well-managed AMC are between 0.16% and 0.63% of steady-state consumption and are independent of whether they are financed through fiscal transfers or sterilized monetary transfers. As the experience of other AMCs demonstrates, however, badly designed and poorly managed AMCs, will not be able to generate these benefits.

Increased delinquencies in banks’ loan portfolios in economic downturns have been mostly addressed by central banks through liquidity support and by governments through bank re-capitalization. In addition, regulatory forbearance is often used to mask the size of the problem and to delay resolution. Often overlooked, the aftermath of the Global Financial Crisis and the associated Eurozone crisis saw the implementation of sizable delinquent loan purchase programs through Asset Management Companies (AMCs) in Ireland, Spain and Slovenia.#f1 In Ireland, the size of the AMC was around 44% of GDP, while in Slovenia and Spain, it was around 16% and 8%, respectively. While generally considered successful, thorough analyses of the mechanisms by which these AMCs operate are largely absent. We show that the AMCs work through a direct positive effect on lending, and an indirect effect via improving the balance sheets of corporate borrowers. Indeed, AMCs are successful because they operate through both the bank lending and balance sheet channels and reinforce each other. Importantly, we show that the funding structure of the AMC (whether fiscal or monetary) is not quantitatively important. Our results suggest that well designed and well-managed AMCs are an efficient alternative policy tool to traditional fiscal and monetary policy when dealing with high stocks and / or large inflows of NPL. Evidently, this finding does not hold, however, for badly designed and poorly managed AMCs.

In the underlying paper, we develop a closed-economy Real Business Cycle (RBC) model, calibrated to euro area data and incorporating distressed assets, and show that an AMC can be welfare improving through mitigating the dead-weight costs associated with loan delinquencies. In our model, the AMC purchases loans from banks, paying a price that depends on the steady-state rate of default rather than the prevailing rate. In a downturn, this means that banks receive a higher-than-market price for their distressed loans, boosting their returns and allowing them to offer higher rates to depositors. This increase in deposit rates results in higher deposit supply, easing credit constraints for firms and spurring greater investment, output, and profits. Improved profits enhance the value of firm equity, which in turn leads to higher repayment rates. This creates a positive feedback loop, reinforcing higher returns for financial intermediaries. Consequently, intermediaries can reduce the lending rates to firms and simultaneously increase returns to depositors.

Over the past 30 years, systemic (multi-bank) AMCs have been used in various parts of the world, but primarily in Europe and Asia, to manage high NPL stocks in banking systems. This has usually happened in the aftermath of major economic and financial crises, such as the Asian Financial Crisis in the late 1990s and the crisis in parts of the eurozone, starting in 2010 (see Fell et al. 2021). The main function of systemic AMCs is to ‘bridge’ the inter-temporal pricing gaps which typically emerge when market prices for NPLs and the related collateral are temporarily depressed (see Fell et al. 2017). This may result from heightened risk aversion and illiquidity in the market or from more fundamental declines in asset prices in, for example, real estate. Market prices should, however, recover as economic conditions improve.#f2 Bridging this inter-temporal pricing gap for distressed assets is accomplished by removing a significant share of NPLs, usually belonging to particular asset classes, from bank balance sheets and resolving them over a time horizon long enough to maximize their recovery value. With assets purchased by the AMC at long-term or ‘real economic’ value, the fire sales resulting from NPL disposals into illiquid markets, can be avoided.

In the euro area, AMCs have been used in Ireland (NAMA), Spain (SAREB), and Slovenia (DUTB) in recent decades. The financing model of these AMCs is relatively straightforward. They are endowed with unissued government bonds, which are used to acquire impaired assets from participating banks at a price close to, but below, real economic value. The banks may be able to pledge the senior bonds with the central bank to access credit operations. Based on available performance criteria, the track record of these eurozone AMCs has, overall, been relatively positive although, as expected, there is some degree of heterogeneity across the three countries (Medina Cas and Peresa 2016). Positive experiences with systemic AMCs can also be found, e.g. in Sweden, a frontrunner in the use of AMCs (Jonung 2009) and in Asia. During the Asian Financial Crisis, systemic AMCs played a very important role in crisis resolution and economic recovery, although there was also some heterogeneity in the performance of Asian AMCs (He 2004).

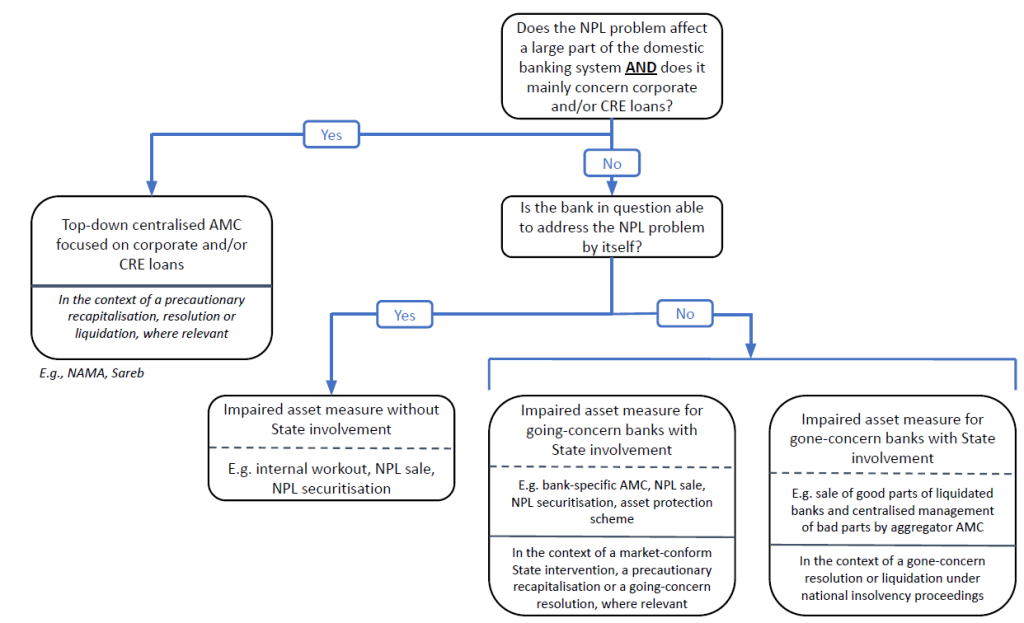

The potential benefits of systemic AMCs were recognized in the 2017 EU Council Action Plan on NPLs, which cited a pivotal role for AMCs in resolving large NPL stocks. In addition, a ’blueprint’ for European AMCs, prepared by staff from the European Central Bank, EU Commission, and European Banking Authority, was published in 2018. The ‘blueprint’ summarises international best practices in setting up and running systemic AMCs and clarifies the relevant EU legal provisions (see European Commission 2018). Figure 1 outlines a decision-tree on NPL management, which illuminates when an AMC may be considered a suitable policy solution.

Despite the considerable expertise with systemic AMCs across various countries, discussions about their economic costs and benefits are still hampered by a lack of model-based evidence and analysis about their macroeconomic and welfare effects. Multiple studies have attempted to quantify the benefits of specific systemic AMCs, but these typically remain partial studies with limited scope. More holistic analyses face the challenge of empirically capturing the various effects of AMCs, including the repercussions on the balance sheets of the sponsoring state, the participating banks, and the debtors acquired by the AMC. Counterfactual analysis is typically not feasible either. One notable exception in this regard is Park et al. (2021), who present evidence that the presence of public AMCs is associated with a reduction in NPL ratios. The paper underlying this policy brief addresses this shortcoming using a dynamic general equilibrium modelling approach.

Figure 1. Decision tree for NPL resolution

Source: Grasmann, et al. (2019). Note: CRE refers to commercial real estate; MPS to Monte dei Paschi di Siena; and GACS to Italy’s Fondo di Garanzia sulla Cartolarizzazione delle Sofferenze.

Our modelling approach follows the closed economy RBC model of Jaccard (2024) that incorporates a household, corporate, and banking sector that intermediates funds between the two. We extend this by introducing endogenous loan defaults by firms. In addition, we introduce an AMC, that purchases loans from banks at a price that depends on the steady state rate of default. The AMC’s funding structure can be purely fiscal or purely monetary. These two extremes allow us to examine the role of alternative (fiscal or monetary) funding options on the outcomes of the AMC. Most assumptions in our model are standard but there are some important additions to allow the simulation of the impact of an AMC on the economy.

Households maximize the value of consumption and leisure by renting labour to firms. They make deposits at banks in nominal terms and purchase government debt. Deposits pay an intra-period return, but their principal is only available the following period. Government bonds are standard one-period, nominally riskless bonds. The interest rate on government bonds is equivalent to the net cash-flow of firms and the transfer from the monetary-fiscal authority amounts to net seigniorage.

Firms are infinitely lived and pay dividends to owners. Their revenue depends on capital and labour, and they maximize the present discounted value of dividends/profits. Firms take intra-period loans from banks. When debt is due, they can renegotiate with creditors and obtain a haircut (or debt forgiveness). The cost of renegotiating debt, the loss-given-default (LGD) depends on aggregate credit conditions, that vary endogenously with the business cycle through the aggregate equity value of firms. Individual firms do not internalize how their borrowing decisions affect aggregate credit conditions. When aggregate conditions improve, and industry equity value increases, the marginal cost of renegotiating debt increases, and firms choose a lower haircut.

Firms may choose to renege on some of their contractual debt obligations (strategic default), but as a result they incur renegotiation costs, an approach also used by Peiris and Tsomocos (2015). The wedge between the effective cost of debt to the firm, and the total return to the lenders represents the economy-wide inefficiency incurred because of firms deciding to default. This reduces investment, a mechanism which the AMC mitigates.

The commercial banking sector plays a critical role in mediating funds between households and the nonfinancial sector. Banks create credit, using deposits as input. Subsequently they collect the principal and interest on the loans less the fraction that is defaulted upon and repay households’ deposits with interest. When the AMC is operational, the AMC purchases loans from banks, with banks taking the default rate offered by the AMC (as well as the interest rate) as given.

The central bank follows a standard interest rate rule. Fiscal Policy is given by the net (seigniorage) transfer which is also the unified monetary-fiscal authority budget constraint. Unfunded monetary transfers raise the price level and correspond to the budget deficit of the combined fiscal-monetary authority. In the steady state, we set this deficit to be 10%.

Output is distributed between consumption, investment, and the cost of default. Market clearing demands that the supply of deposits by households equals the demand by banks. The supply of loans by banks equals the demand by firms. The supply of labour by households equals the demand by firms, and the supply of money and bonds by the monetary-fiscal authority equals the demand by households (and potentially the AMC). All agents and institutions are price takers and expectations are rational.

The AMC buys loans from banks, receiving payments from firms and paying a price equal to the gross interest rate times the steady state repayment rate. This transaction is equivalent to AMCs subsidizing the return to lenders by increasing the value of delinquent loans to the steady state value. In other words, the AMC guarantees that the default rate on the loans extended by lenders is at the steady state level. When the default rate incurred by borrowers is above (below) the steady state, the AMC is in deficit (surplus).

During economic downturns, real-life AMCs often buy NPLs at a price higher than the market value, thereby decreasing ‘banks’ Loss Given Default (LGD). For simplicity, we assume in our model that the AMC reduces the Probability of Default (PD), the likelihood of assets turning into NPLs, instead of reducing the LGD. This represents a different conceptual approach to diminishing the banks’ overall losses, but the economic effect is similar.

We consider two funding structures for the AMC. The ‘Fiscal’ structure, where AMC expenditures are funded entirely by labour income taxes paid by households, and the ‘Monetary’ structure, where the AMC is funded by money created by the Central Bank. Intertemporally, however, money created must be repaid by the AMC. Hence, intertemporally, aggregate liquidity remains the same. In sum, while the functioning of the AMC in our model is obviously simplified, it follows closely the economic logic that underpinned recent euro area AMCs as well as older AMCs in Asia and Europe.

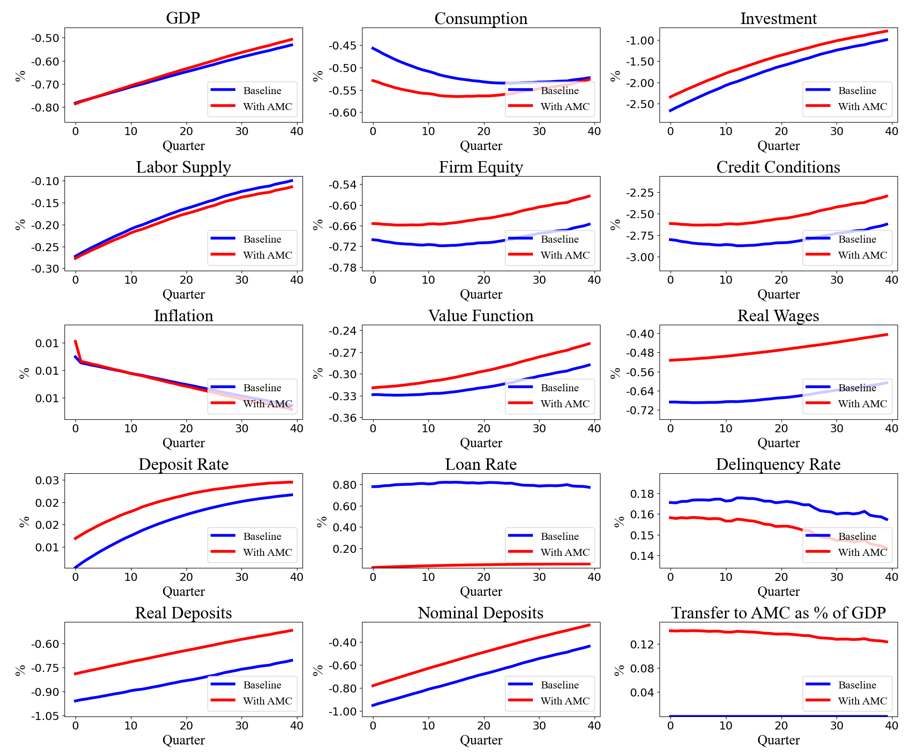

We calibrate the model based on the method of Jaccard (2024) using data from the mid to late 1990s to 2018 and simulate two different AMC funding options as mentioned above (‘fiscal’ and ‘monetary’). The economic outcomes are similar, so we only show the results for the fiscal option (Figure 2).

The AMC enhances the returns of financial intermediaries after accounting for defaults. These intermediaries then offer higher interest rates to depositors, which increases deposit supply and eases credit constraints for businesses. This leads to more investment, higher output, and increased profits, which in turn boosts firm equity. Improved equity enhances credit conditions and increases repayment rates, further benefiting financial intermediaries. These intermediaries can then offer lower lending rates to firms and provide better returns to depositors.

In our model, the AMC doesn’t lower the rates of loan delinquency. Instead, it effectively reduces the default rates banks encounter by buying NPL from banks above the market value. This strengthens depositor confidence and increases deposits. With (de facto) fewer NPLs, banks can also raise deposit rates to attract more savers and extend more loans.

We also evaluate the welfare effects of an AMC, using both conditional and unconditional measures under the two financing regimes. Unconditional welfare represents the long-term average outcome, while conditional welfare accounts for anticipated future shocks. We find that the welfare gains of well-designed and well-managed AMC are 0.16% and 0.63% of steady-state consumption respectively for these two measures. This outcome is independent of whether the AMC is financed through fiscal transfers or sterilized monetary transfers. These welfare gains, underscore the AMC’s significant role in increasing loan supply in the economy.

Figure 2. Impulse Response Functions to a negative TFP shock with ‘fiscal’ funding for the AMC

We address the need for rigorous empirical analysis of the potential for AMCs to mitigate the economic consequences of downturns that result in high NPL stocks. Whereas the debate about AMCs is too often dominated by moral hazard and adverse selection considerations – and without denying that these aspects play an important role when it comes to AMCs – we set out a welfare-based, general equilibrium perspective to this debate. In a nutshell, our results show that an AMC can positively impact welfare by increasing the supply of loanable funds, improving firm balance sheets, and stimulating capital investment.

NPL levels in the euro area are currently rather low and the regulatory framework has improved substantially since the start of the common banking supervision in the euro area. Nevertheless, the potential for substantial future NPL increases remains, thus vigilance is warranted for crisis pre-emption. The Covid-19 pandemic in early 2020 raised concerns about asset quality due to the severe recession it triggered. It turned out that supervisory leniency, supportive monetary policies, and expansionary fiscal measures prevented a ‘Covid spike’ in NPLs. Moving forward, however, the continuation of such policies is questionable, especially given the limited fiscal space in many European countries and the fact that accommodative monetary policy may not always be compatible with the ECB’s primary mandate of price stability. It may be preferable, therefore, to have an established AMC, as outlined here, to efficiently tackle nonperforming loans as they arise, thereby avoiding the build-up of large NPL stocks, as in the recent past in Europe. In a severe crisis context, the capacity of the AMC can be increased accordingly.

Furthermore, when fiscal support is employed to address a banking crisis, recapitalised banks may opt to retain the NPLs on their balance sheets, harbouring unrealistic expectations regarding their recovery values. This in turn may lead to a misallocation of resources and the erosion of value in the collateral of distressed borrowers. AMCs, by contrast, if they are well designed and well managed, offer a distinct advantage by aligning incentives between the various stakeholders. In addition, AMCs do not necessitate immediate fiscal expenditures. The state assumes a contingent liability, with a strong preference for maintaining its contingent status. By transferring the troubled assets to an AMC, banks are disentangled from the original, but now impaired, credits. This contrasts with a ‘bad bank’ approach, where good assets are transferred to a new entity or sold, leaving the impaired assets in a rump entity. Managed independently and with a focus on commercial success, an AMC mitigates the risk of misaligned incentives inherent in banking operations and addresses potential principal-agent dilemmas, which could otherwise result in suboptimal outcomes.

Directive of the European Parliament and of the Council establishing a framework for the recovery and resolution of credit institutions and investment firms, 2014, L173/190.

European Commission (2018), Commission Staff Working Document, AMC Blueprint, Communication From the Commission To the European Parliament, The European Council, The Council and the European Central Bank”, 14 March 2018 (SWD(2018) 72 final).

Fell, J., M. Grodzicki, J. Lee, R. Martin, C.-Y. Park and P. Rosenkranz, eds (2021), Non-performing loans in Asia and Europe – causes, impacts, and resolution strategies, Asian Development Bank and European Central Bank.

Fell, J., M. Grodzicki, R. Martin and E. O’Brien (2017), ‘A role for systemic asset management companies in solving Europe’s nonperforming loan problems’, European Economy 2017.1.

Grasmann, P., M. Aspegren and N. Willems (2019), ‘Tackling non-performing loans in Europe’, SUERF Policy Note No. 107

He, D. (2004), ‘The role of KAMCO in resolving nonperforming loans in the Republic of Korea’, Working Paper WP/04/172, International Monetary Fund.

Hryckiewicz, A., N. Kryg and D. P. Tsomocos (2023), ‘Bank resolution mechanisms revisited: Towards a new era of restructuring’, Journal of Financial Stability, 67

Jaccard, I. (2024), ‘Monetary asymmetries without (and with) price stickiness’, International Economic Review, 65(2)

Jonung, L. (2009), ‘The Swedish model for resolving the banking crisis of 1991-93. Seven reasons why it was successful’, Economic Papers 360, European Commission.

Medina Cas, S. and I. Peresa (2016), ‘What Makes a Good ‘Bad Bank’? The Irish, Spanish and German Experience’, European Economy Discussion Papers, 036, European Commission

Park, D., J. Lee and P. Rosenkranz (2021), ‘Assessing macrofinancial implications and resolution policies of nonperforming loans’, in ‘Nonperforming loans in Asia and Europe – Causes, Impacts, and Resolution Strategies’, Asian Development Bank, Chapter 3.

Peiris, M. U., and Tsomocos, D.P. (2015), ‘International monetary equilibrium with default,’ Journal of Mathematical Economics, 56, 47-57

The terms ‘AMC’ and ‘bad bank’ have often been used interchangeably. A key difference, however, relates to the sequencing of establishment. An AMC is typically set-up to remove impaired assets from one or – more commonly – more than one troubled bank, thereby cleaning-up their balance sheets and allowing them to recover. AMCs are often selective regarding the assets they accept. A bad bank is typically what remains when good assets and liabilities are sold from a single troubled bank, leaving behind a rump entity, for managed wind-down (see, for example, Hryckiewicz, et al. 2023). In the European Union, the 2014 Bank Recovery and Resolution Directive takes a similar perspective: “in a ‘closed bank resolution’ the bank would be split in two, a good bank or bridge bank and a bad bank. The good bank (bridge bank) is a newly created legal entity which continues to operate, while the old (bad) bank is liquidated”.

A key condition for the success of systemic AMCs is that they purchase NPLs with values inherently linked to real economic outcomes. As the economy recovers, so too should the value of the underlying collateral. Too high transfer prices for assets from the originating banks to the AMCs typically lead to commercial performance problems for the AMC.