This Policy Brief is based on “Do Banks Worry about Attentive Depositors? Evidence from Multiple-Brand Banks,” Review of Finance, Volume 28, Issue 1, January 2024, Pages 353–388.

Panic-based (non-fundamental) spikes in depositors’ attention can be a source of bank fragility in theory, but separating such spikes from underlying fundamentals is challenging empirically. Using online search data, we show that during the Global Financial Crisis, UK banks facing surges in attention respond by increasing retail deposit rates, but only for instant withdrawal deposits. Exploiting variation across brands owned by the same bank (and thus sharing the same fundamentals), we find that banks respond even when surges are not justified by fundamentals. In addition, comparing onshore and offshore deposits by the same brand, we show that bank response is substantially stronger when the lack of deposit insurance and a larger presence of wholesale depositors magnifies potential losses to depositors.

Recent events at Silicon Valley Bank and Credit Suisse have raised questions about the impact of sudden shifts in depositors’ attention towards banks. While “unfounded fears” among depositors have been known to be a source of bank fragility since at least Ricardo (1817), empirically identifying the impact of depositors’ attention on banks and isolating this effect from that of changes in fundamentals is particularly challenging.

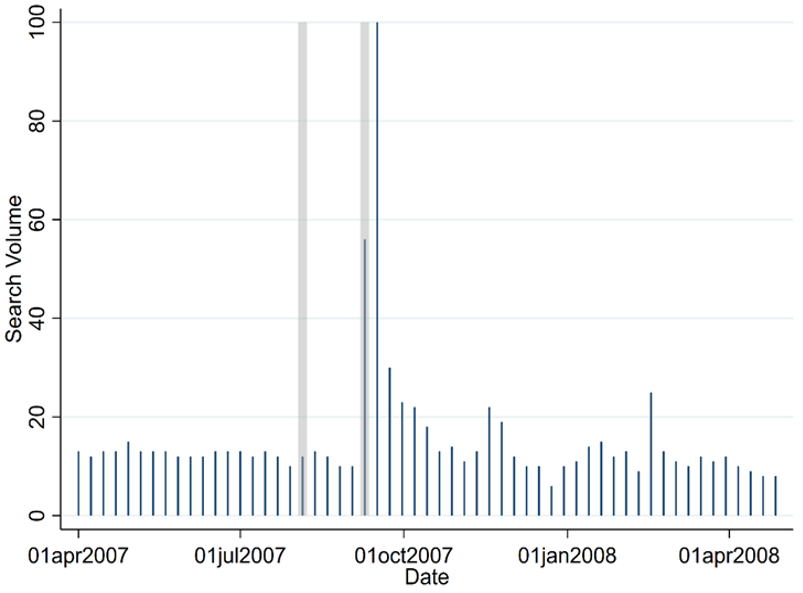

In our work, we examine how banks respond to surges in attention by retail depositors. We address the key identification challenge with three key ideas. First, we proxy for public attention to banks by tracking online searches for UK banks. To illustrate the behavior of our measure, in Figure 1 we plot the evolution of the search volume for the term “Northern Rock” during the early stage of the Global Financial Crisis, when the bank lost more than half of its retail deposits. On August 9, 2007, interbank money markets froze. Four days later, Northern Rock informed its regulator, the UK Financial Services Authority, that it had lost access to the wholesale funding markets, on which it relied heavily. However, this information was not disclosed publicly. Consistent with this timeline, the search volume remains broadly unchanged during that week, despite the run by wholesale depositors depleting the bank’s entire liquid asset buffer during this period. On September 14, 2007, the Bank of England publicly announced the provision of emergency liquidity to Northern Rock, triggering a widely publicized run by retail depositors at the bank’s branches. As Figure 1 illustrates, search volume surged during that week.

Figure 1: Search Volume for “Northern Rock”

Note: This figure shows the weekly Google search frequency for the term “Northern Rock” in the UK between April 2007 and April 2008. The first vertical shaded bar indicates the day during which Northern Rock privately disclosed to the UK Financial Services Authority that it had lost access to wholesale funding markets. The second vertical shaded bar indicates the day during which the Bank of England publicly announced the provision of emergency liquidity assistance to Northern Rock.

The second key idea is to exploit the fact that most large UK banks offer retail deposits using multiple brands. Since these brands are not separate legal entities such as subsidiaries, the fundamental risk to depositors cannot vary across brands of the same bank. However, since banks use brand-specific marketing strategies, depositors’ attention and risk perceptions can vary across these brands. This disconnect allows us to test how deposit rates respond to attention while controlling for fundamentals by including bank-week fixed effects. The third key point is that most large banks offer similar deposits to UK customers onshore and in UK Crown Dependencies (offshore). Since these jurisdictions introduced deposit insurance in a staggered way between 2008 and 2010, we can study how the interest rate for the same deposit product offered by the same brand responds to surges in online search volume depending on insurance coverage.

To examine how banks respond to surges in attention, we use a weekly dataset collected by Moneyfacts covering deposit rates offered by UK deposit-taking brands from 2007 to 2014. We find that banks/brands facing a two standard deviation spike in depositor attention increase deposit rates by 16 basis points, an increase equivalent to 20% of banks’ average interest margin in 2008 and 78% of the median deposit rate in the aftermath of the GFC. The response remains statistically significant when we exploit variation across brands of the same bank by including bank-week fixed effects; in other words, banks respond to surges in attention above and beyond what can be explained by fundamentals. In line with the idea that banks attempt to retain panicky depositors at times of high uncertainty, our main finding is only significant for deposits without withdrawal restrictions and during the global financial crisis. In addition, comparing onshore and offshore deposits by the same brand, we show that banks’ response is substantially stronger when the absence of deposit insurance and a larger presence of wholesale depositors magnifies potential losses to depositors.

Overall, our results point to a previously undocumented source of bank fragility: banks raise deposit rates and erode their profitability in response to spikes in public attention, even when this attention is not driven by changes in fundamental factors and despite the presence of deposit insurance.