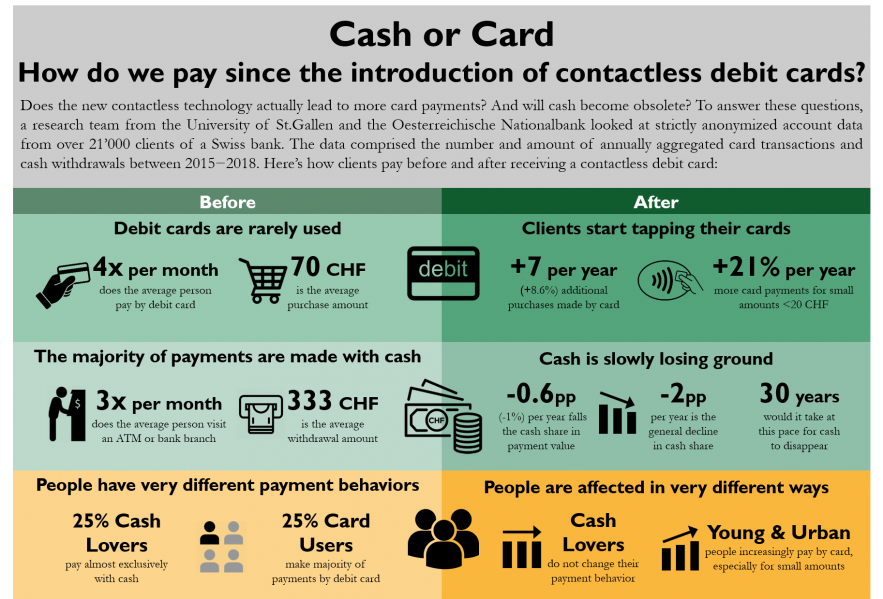

Are recent digital payment innovations accelerating the move to a cashless society? Our new study presents causal evidence from the staggered introduction of contactless debit cards by a Swiss retail bank. We find only a modest reduction of cash use after clients receive a contactless card. The results suggest that central banks – in cash-affine countries – might still have some time to get ready for the cashless society.

Since the outbreak of the Corona crisis shops around the world have increasingly asked their customers to pay by tapping their card on a terminal instead of exchanging cash. In April, various countries like Switzerland, Germany, Austria and the UK have raised the contactless spending limit that require no additional authentication. The pandemic is accelerating the spread of contactless payments.

However, do new payment technologies actually lead to more card payments in “normal” times? And will cash therefore become obsolete? To answer these questions, we examined bank-account data for a random sample of over 21,000 customers of a Swiss retail bank. To ensure anonymity, all identifying client information was removed and the transactions aggregated on a yearly basis. The data covers all card transactions and cash withdrawals between 2015 and 2018. This is an interesting period, because starting 2016, the bank rolled out contactless debit cards to clients as their existing card expired.

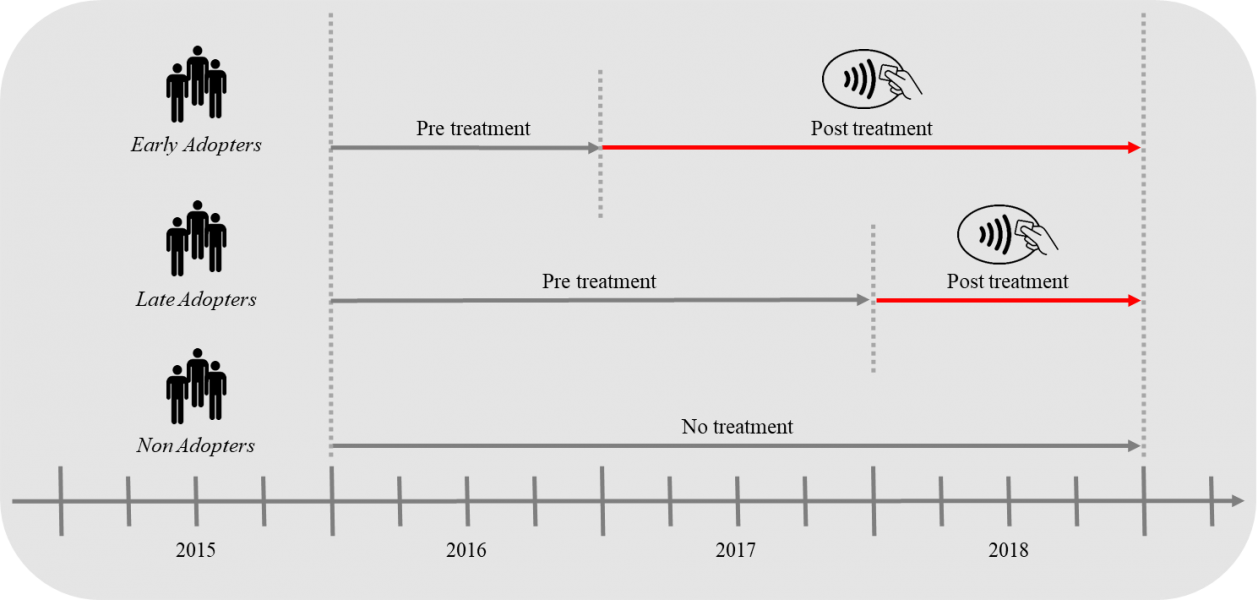

This setting constitutes a “natural experiment” that allows us to isolate the causal effect of the new payment technology on customers’ payment behaviour. The bank issues new debit cards at year-end, thus we could divide the clients in three groups: Early Adopters received a new contactless-enabled debit card at the end of 2016, Late Adopters at the end of 2017 and Non Adopters only at the end of 2018, which is outside of the observation period (Figure 1). Because expiry dates are random, the three groups are very similar with regard to socio-demographic characteristics such as gender, age or income and their payment habits and money demand. Thus, any change in behaviour after receiving the new debit card can be attributed to the contactless function.

Figure 1. Staggered rollout of contactless debit cards (research design)

By 2018, the majority of everyday payments by value were still conducted in cash – although all clients in the sample had a debit card. The average customer visited an ATM 3 times a month to withdraw on average 333 Swiss Francs. By comparison, the average customer paid only 4 times per month by debit card for an average amount of 70 Swiss Francs. Cash is slowly losing ground; its value share in payment fell from 2015 to 2018 by about 2 percentage points a year. Continuing at this pace it would take another 35 years for the average Swiss consumer to ditch cash completely.

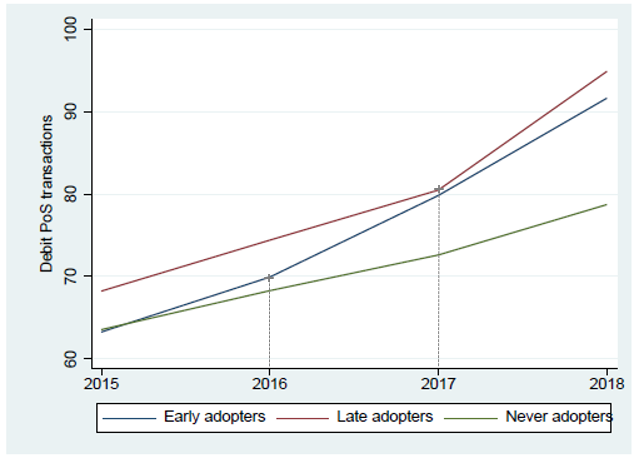

Indeed, the contactless payment function does lead consumers to use their debit cards more often. After receiving a contactless card, clients made on average 7 additional purchases by card per year (+8.6% relative to the sample mean of 79 transactions). The increased card use is most pronounced for small, PIN-exempt payments under CHF 20, which rose by 21%. Figure 2 shows that the increase in card transactions is clearly related to the time at which consumers receive a contactless card.

Figure 2. Number of debit card transactions at the point of sale (PoS) by adopter group

Contactless cards do reduce the overall cash share of payments, but only by an additional 0.6 percentage points per year (on top of the 2 percentage points trend decline). At this pace, even with a contactless card the average Swiss consumer would take 30 years to stop using cash entirely. Why isn’t the impact on cash use bigger? Most additional card payments that are triggered by the availability of contactless cards are small ticket items and make up only a negligible portion of total spending. Therefore, it isn’t surprising that we find no causal effect on cash demand, i.e. the average size or frequency of withdrawals.

There is huge variation in payment behaviour across consumers: One quarter of the sample population relied almost exclusively on cash, while another quarter made their purchases already predominantly by card. The impact of contactless technology on these groups differs considerably: Cash lovers hardly changed their payment behaviour, but intermediate users increasingly paid cashless, especially for small amounts. And who are those contactless card lovers? As expected, young people are more likely to adopt new technologies and their cash use dropped the most. Surprisingly though, contactless cards only changed payment behaviour of the youth in urban settings, while the youth living in the countryside did not change their payment habits.

In the last century, we have witnessed major innovations in payment technology, such as credit cards (late 1950s), ATMs (late 1960s) and debit cards (1970s). None of these innovations have questioned the future of physical central bank issued money. However, it is a widely held presumption that the recent innovations of contactless, mobile and instant payments will accelerate the move to a cashless society. This would pose challenges to central banks who have a mandate to guarantee a safe, efficient and broadly accessible payment system. To counterbalance ongoing payment innovations and an expected strong decline in cash demand – as has been observed in Sweden for example – many central banks are now contemplating the introduction of electronic cash substitutes, i.e. central bank digital currencies.

Our results suggest that it still might be a long way to a cashless society – even when considering that the trend decline in cash use might accelerate. This conjecture applies to those economies where cash is still much used like Germany, Switzerland, Austria or several other European countries (Esselink and Hernandez, Deutsche Bundesbank, Swiss National Bank). For consumers in countries that are much less cash affine than Switzerland, like the UK, Sweden or Canada, these high cash use rates might be a reminiscence. However, our results also document significant and persistent heterogeneities in payment choice across consumers which points towards the importance of habit and / or behavioural motives. We conjecture that such persistent behaviour may also apply to specific socio-demographic subgroups (e.g. older cohorts) in countries were cashless payments are more prevalent.

During the ongoing Corona pandemic many countries have raised the limits for contactless payments. Our results do not allow us to make evidence-based predictions about the (permanent) impact of these policies on payment behaviour. However, our evidence does show that card payments increase mostly among those consumers who already use cards and only marginally for cash lovers. We may therefore expect a similar effect of increased thresholds for contactless payments: Existing card users may substitute conventional card payments for contactless ones up to the new PIN-exempt amounts, while cash lovers may tend to stick with their coins and notes.