Abstract

We study the impact of global inflation on surveyed inflation expectations of private analysts in emerging market economies (EMEs), and the role that central banks can play to lessen this impact. We find three key results. First, the global inflation component can affect the mean and, to a lesser extent, the dispersion of inflation expectations. For the mean of short-term inflation expectations, this effect rose in late 2021. Second, while the global inflation component does matter for short-term inflation expectations, the idiosyncratic inflation component has a stronger influence on longer-term inflation expectations. Finally, we find that monetary policy can help reduce the transmission of global inflation to inflation expectations in both the short and long term. This underscores that EME central banks have room to shape inflation expectations, even when global factors are the main cause of inflation.

A common (synchronised) global factor can explain a large share of domestic inflation variation in a large set of economies. This factor, often referred to as global inflation (Ciccarelli and Mojon (2010)), is primarily influenced by domestic inflation in advanced economies (AEs) and, to a lesser degree, in emerging market economies (EMEs) (Kamber and Remolona (2018) and Auer et al (2024)).

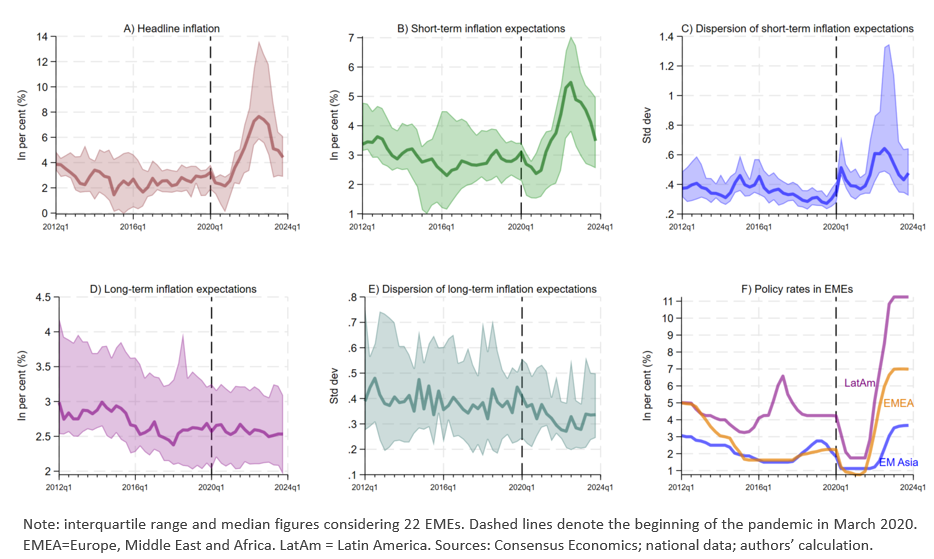

In recent years, global inflation saw a notable rise, reaching highs not seen in 20 years. This sparked concerns about an unmooring of inflation expectations in EMEs. The relevance of global inflation has grown in tandem with global shocks that have shaped headline inflation worldwide. For instance, in 2020 inflation fell globally due to the lockdowns during the Covid-19 pandemic. However, in 2021 and 2022, inflation experienced a substantial and synchronised increase in both AEs and EMEs, on a scale unseen in the past 20 years (Graph 1, panel A). This surge was attributed to both global supply shocks (such as value chain disruptions and the impact on commodity prices of the Russian invasion of Ukraine) and demand shocks (including monetary and fiscal stimulus during the pandemic and pent-up consumption) (see BIS (2022) and Ha et al (2024)). These shocks were in short succession and persistent. The surge in inflation, which was initially thought transitory, was later diagnosed as a long-lasting increase. Accompanying this inflation spike, short-term inflation expectations saw significant upward revisions across EMEs (panel B). Moreover, the variance of short-term inflation expectations among analysts increased due to higher uncertainty about the continuation of supply and demand shocks (panel C). However, not all news was bad: longer-term inflation expectations remained steady during this period, and the variance of long-term inflation expectations even decreased (panels D and E).#f1

Graph 1. Headline inflation, inflation expectations in EMEs and policy rates

This combination of factors created a challenging situation for EME central banks. We thus address two crucial questions: 1) how has the sensitivity of inflation expectations to global inflation recently changed in EMEs, and 2) how can EME central banks reduce the impact of global inflation on inflation expectations? Our recent work (Aguilar et al (2024)) aims to provide the first empirical evidence of the sensitivity of inflation expectations to changes in global inflation after the Covid-19 pandemic. We do so for both the average and the dispersion, and we provide the first empirical evidence of the role of central banks in this regard.#f2 We find strong evidence that EME central banks have room to shape inflation expectations when global inflation surges.

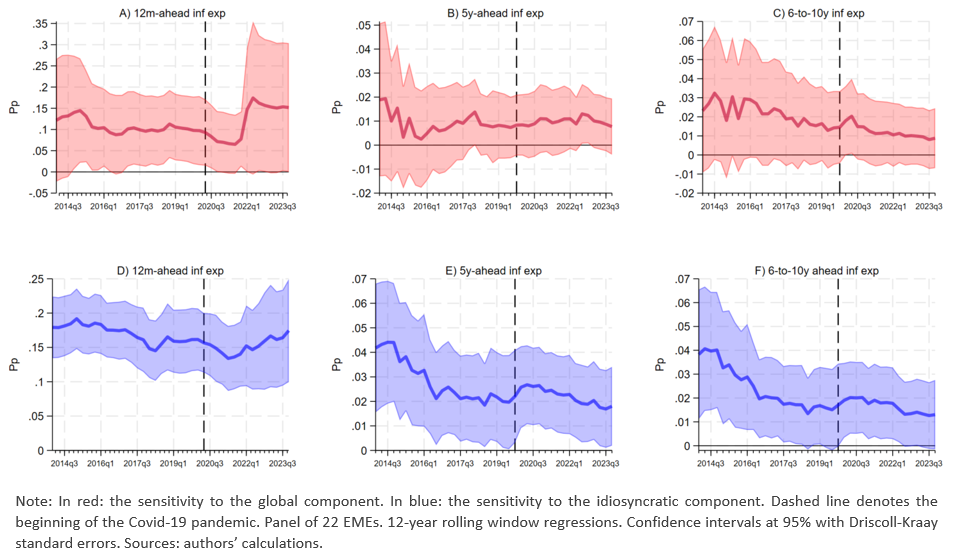

In relation to the first question, we find that after a decade-long stable trend, the sensitivity of short-term inflation expectations to global inflation increased significantly since late 2021. Interestingly, and complementarily, we find that while global inflation has more influence on professional forecasters’ adjustments of their expectations in the short term, forecasters pay more attention to idiosyncratic factors for long-term inflation expectations.

While the sensitivity of short-term inflation expectations to global inflation was stable for much of the sample, it rose sharply after late 2021 (Graph 2, panel A). These results could be explained by the persistent supply and demand shocks that happened in the same year. For long-term inflation expectations, the sensitivity has not been statistically different in almost the entire period (panels B and C). This means that these expectations by professional forecasters remain well-anchored in the presence of global inflation pressures. This latter result is a positive sign that long-term expectations in EMEs have become less sensitive to global shocks despite major trade and financial integration. These findings could be due to the strengthening of monetary policy frameworks in EMEs in the last ten years and to credible monetary policies (Mehrotra and Yetman (2018), BIS (2019), BIS (2021), BIS (2024) and Hardy et al (2024)).

Graph 2. Sensitivity of inflation expectations to a one-standard deviation change in the global and idiosyncratic components of inflation in EMEs.

Do the reactions of expectations to global and idiosyncratic components differ? Our analysis confirms they do. To investigate whether the increased sensitivity of inflation expectations to global inflation was specific to this component, we examine the transmission of the idiosyncratic component to expectations. As illustrated in Graph 2, panels D, E, and F, the coefficients behave differently, with a clear statistical significance for both short and long-term expectations. Particularly in the long term, their sensitivity continues a downward trajectory beyond 2021. This underscores the differentiated impact of both components on expectations. All told, our findings suggest that idiosyncratic inflation matters for the formation of both short and long-run expectations, while the global component only affects those in the short run.

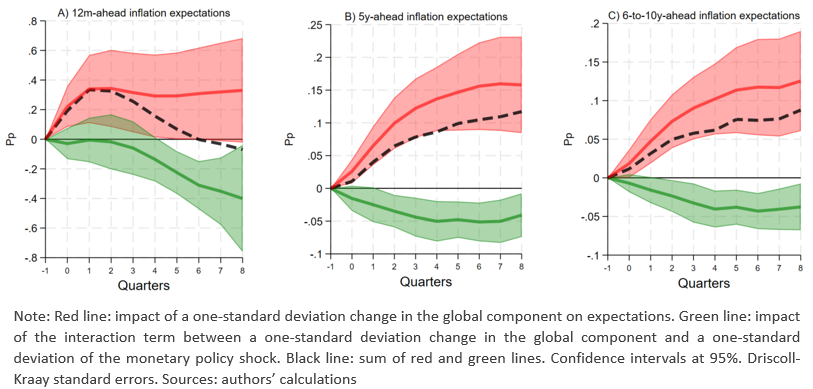

To study whether EME central banks can reduce the transmission of global inflation pressure to domestic expectations, we perform a second exercise on impulse response functions via panel local projections (Jordà (2005)). While the red lines in Graph 3 show the impact of the global inflation component on inflation expectations, the green lines show the interaction term between global inflation and EME monetary policy shocks. With this, we find that monetary policy shocks can reduce the propagation of global inflation, reducing the total net effect (black lines).#f3

Estimations of the interaction term are statistically different from zero for both short and long-term inflation expectations. We estimate that a one standard deviation change in the monetary policy shock can reduce inflation expectations by 0.40, 0.05 and 0.04 percentage points at the one-year, five-year and six-to-ten year ahead horizon when global inflation rises one standard deviation, respectively (Graph 3, Panels A, B and C).#f4

Graph 3. EME central banks can mitigate global inflation pressures.

Our findings suggest that even if an inflation shock is global and central banks cannot reduce imported inflation directly, their actions can dampen the effect on inflation expectations. In other words, central bank actions that confirm their commitment to low and stable inflation contribute to keeping expectations anchored even if headline inflation rises. This is by reducing the likelihood of second-round effects that make inflationary shocks more persistent. Also, monetary policy can keep expectations better anchored by reducing the dispersion between forecasters. So, to add to the policy debate started by Borio and Filardo (2007) and recently highlighted by Auer et al (2024), we give empirical evidence that EME central banks have room to manoeuvre and can influence expectations from the public, even if global inflation surges.

In this regard, it is worth mentioning the first EME central banks to respond to global inflation pressures in early 2021 were those in Latin America. Most central banks in this region hiked interest rates at a faster pace and by larger magnitudes than EME peers and predicted standard Taylor rules (Guerra et al (2024)). This has likely equipped them well for the path ahead.

Aguilar, A, R Guerra, B Martinez (2024): “Global inflation, inflation expectations and central banks in emerging markets”, BIS Working Papers, no 1217, 14 Oct 2024.

Auer, R, M Pedemonte and R Schoenle (2024): Sixty years of global inflation: a post-GFC update”, BIS Working Papers, no 1189, 16 May 2024.

Bank for International Settlements (BIS) (2019): “Monetary policy frameworks in EMEs: inflation targeting, the exchange rate and financial stability”, Annual Economic Report, Ch II, June.

——— (2021): “Capital flows, exchange rates and monetary policy frameworks in Latin American and other economies”, report by a group of central banks including members of the BIS Consultative Council for the Americas (CCA) and the central banks of South Africa and Turkey.

——— (2022): “Old challenges, new shocks”, Annual Economic Report 2022, Chapter I.

——— (2024): “Laying a robust macro-financial foundation for the future”, Annual Economic Report 2024, Chapter I.

Borio, C, and A Filardo (2007): “Globalisation and Inflation: New Cross-Country Evidence on the Global Determinants of Domestic Inflation”, BIS Working Papers, no 277, September.

Ciccarelli, M and B Mojon (2010): “Global Inflation”, The Review of Economics and Statistics, vol 92, no 3, pp 524-535.

Guerra, R, S Kamin, J Kearns, C Upper and A Vakil (2024): “Latin America’s non-linear response to pandemic inflation”, BIS Working Papers, no 1209, 9 September 2024.

Ha, J, M A Kose, F Ohnsorge and H Yilmazkuday (2024): “What explains global inflation”, IMF Economic Review, https://doi.org/10.1057/s41308-024-00255-w.

Hardy, B, D Igan and E Kharroubi (2024): “Resilience in emerging markets: what makes it, what could shake it?” BIS bulletin, no 88, 06 June 2024.

Jordà, Ò (2005), “Estimation and Inference of Impulse Responses by Local Projections”, American Economic Review, vol 95, no 1, pp 161–82.

Kamber, G and E Remolona (2018): “Global inflation and emerging markets”, mimeo.

Mehrotra, A and J Yetman (2018), “Decaying expectations: What inflation forecasts tell us about the anchoring of inflation expectations”, International Journal of Central Banking, 11(S1), 55-101.

In this recent episode of post-Covid shocks, Latin American central banks started earlier than other EMEs and hiked to higher levels (Graph 1, panel F). These actions have likely contributed to bringing inflation back toward targets and keeping inflation expectations anchored.

To see the analysis on the dispersion on inflation expectations, see Aguilar et al (2024).

If the likely sign of the impact of global inflation on expectations is positive (red lines), we would expect that the sign of the interaction term between global inflation and monetary policy shocks is negative (green lines). This would mean that EME central banks are able to reduce the transmission of global inflation to expectations (black lines). To see further technical details see Aguilar et al (2024).

To make our results on the evidence of EME central banks curbing global inflation pressures more robust, we use different versions of monetary policy shocks from different Taylor rule configurations. We report that our baseline results are consistent, statistically significant and of broadly comparable magnitude to our baseline estimations. In addition to these robustness checks, and to further address endogeneity concerns, we also estimate the impact of global inflation estimated by a principal component analysis (PCA) excluding EMEs and only considering AEs. We confirm all our results.