This policy brief is based on Deutsche Bundesbank, Discussion Paper No 46/2024 “Banks’ foreign homes”. The views expressed in this brief are those of the authors and do not necessarily reflect the position of the Deutsche Bundesbank or the Eurosystem.

Abstract

Banks have been operating in a low interest rate environment paired with booming housing markets. For the largest banks in the euro area and the period 2015-2022, we assess whether banks reallocate their foreign loan portfolio backed by real estate as a response to differences in local lending spreads across the home and destination country and conditional on reduced information frictions due to borrowing-country exposures. The main result is that the relative share of foreign real estate backed lending increases in case of return opportunities, and this sensitivity depends on local exposures towards the borrowing country. The result is driven by subsamples for which neither the home nor the borrowing country have implemented macroprudential regulation targeting real estate lending, or for which there is a misalignment in macroprudential policies. Nevertheless, we find limited evidence that the riskiness of real estate backed loans goes up during our sample period, and we discuss potential reasons for this result including the possibility of hidden losses.

The financial systems across European countries are dominated by bank-based activities. To promote financial integration, the European Banking Union was established in order to harmonize supervisory and regulatory standards, while discussions about a common European deposit insurance system are still ongoing. Additionally, the European Commission plans with its “Capital Markets Union (CMU)” project to ease the flow of capital across national borders. Yet the implementation of the CMU is complex and rather slow. In such an environment of lagging alternatives to bank-based financing and remaining differences in regulatory stances, the question in which circumstances banks expand their lending activities beyond national borders seems relevant both from the perspective of shaping a higher degree of financial integration in Europe and from a financial stability point of view. The literature has shown that international activities of banks allow for risk-sharing and an efficient allocation of capital. However, financial interlinkages can also transmit shocks across national borders as the financial crisis of 2007/08 has vividly shown (Buch and Goldberg, 2015; Cerutti et al., 2015; Hale et al., 2020).

At the same time, European banks have been operating in a low interest rate environment for several years. The deposit facility rate in the euro area turned negative in 2014 and the main refinancing rate reached the zero lower bound in 2016, which was only reversed in 2022 following geopolitical shocks and rising price levels. In such a business environment, it has been documented that banks reallocate their portfolios to remain profitable (see, e.g., Brei et al., 2020). These findings highlight that banks are sensitive to interest rate spreads that could arise across regions or sectors, and optimize their asset compositions. During the low interest rate environment, especially the real estate sector was characterized by rising housing prices, which increased the collateral value of property, while other macroeconomic developments were relatively stable until the start of the Covid-19 pandemic. The combination of high collateral values, reducing concerns about risk, and return opportunities could result in an increased attractiveness of real estate backed lending.

In our study (Schmidt and Tonzer, 2024), we thus exploit this very specific environment with low interest rates, booming housing markets and otherwise stable macroeconomic conditions, to assess whether banks are sensitive to interest rates spreads between their home and possible destination countries, and consequently reallocate their loan share towards the foreign country offering a higher spread. Knowing from the literature that cross-border activities suffer to a higher extent from information frictions, we hypothesize that the sensitivity to lending spreads might depend on borrower country information advantages. We hence assess whether interest rate spreads are relevant for banks’ foreign real estate lending conditional on borrower-country information advantages.

In a first step, the analysis contributes to the understanding of the drivers of euro area banks’ foreign lending activities backed by real estate, whereas we differentiate between commercial and residential real estate. The analysis draws on data of significant banks, the largest and systemically important banks in the euro area that are supervised by the Single Supervisory Mechanism (SSM). We focus on these banks’ cross-border activities in other euro area countries such that all operations take place in a common currency area with the same monetary policy. Despite facing the same policy rates, we find that geographical differences in countries’ lending spreads can go up to 3.5 percentage points when considering corporate borrowing rates and 2.5 percentage points in terms of borrowing costs for house purchase. Additionally, macroprudential policies can deviate across countries, and we consider these regulatory differences, which could be a relevant determinant for banks’ lending decisions as well. In a second step, we assess implications for bank risk arising from banks’ foreign lending activities backed by real estate. Thereby, we acknowledge that real estate backed loans amount to a substantial share in banks’ loan portfolios and disruptions in real estate markets have often been at the root of financial crises (Jiménez et al., 2020; Jordà et al., 2015).

How relevant is real estate backed lending in banks’ portfolio?

Our sample is based on the significant institutions in the euro area, which are supervised by the SSM. For the period from 2015 to 2022, we obtain quarterly information on banks’ balance sheets and income statements (FINREP, COREP). Importantly, lending activities consolidated at the headquarter level can be broken down by various dimensions.

First, we can differentiate between loans that are collateralized by commercial real estate (CRE) versus residential real estate (RRE). Second, banks report both aggregate amounts in terms of real estate backed loans but also their activities vis-à-vis borrowing countries, whereas we focus on real estate backed loans provided to other euro area countries. Out of 145 banks reporting to the SSM, 127 institutions report the geographical breakdown of their lending activities. The bilateral reporting, that is each banks reports its real estate backed loan volumes per destination country, allows controlling for confounding factors that might shape credit demand in the respective borrowing country. Further country-level data on lending rates as well as house prices are obtained from the European Central Bank as well as Eurostat.

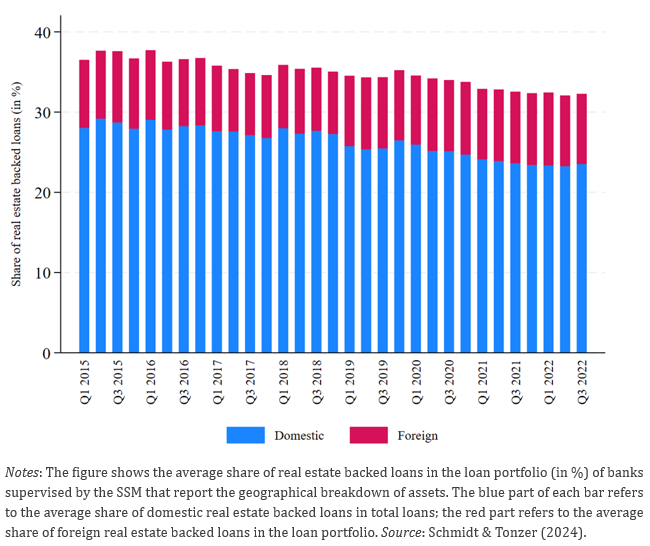

Figure 1 shows the shares of domestic and foreign lending in the total loan portfolio of SSM banks that are backed by real estate. It can be seen that loans collateralized by real estate sum up to a substantial share in the loan portfolio. The ratio is around 33% and relatively constant over time. These facts support findings in the literature that busts in housing markets can quickly become a threat for bank stability and further highlight that there might be spillover risks across countries due to banks’ international activities in this loan segment.

Figure 1. Banks’ real estate backed lending at home and abroad

Next, we study whether banks in a low rate environment are likely to respond to geographical interest rate spreads and whether this response – especially having in mind that we consider foreign lending – is sensitive to information advantages abroad. Empirically, this translates into assessing whether the portfolio share of real estate backed lending in a destination country is more sensitive to interest rate spreads if banks are more active in the borrowing country. We calculate interest rate spreads based on borrowing rates for house purchase when focusing on changes in RRE backed lending, respectively cross-country spreads in lending rates charged to non-financial firms when considering CRE backed lending. Similar to Hau and Lai (2026), we thus exploit that despite a common monetary policy, there are geographical deviations in interest rates. The proxy for information advantages is the foreign deposit exposure vis-à-vis households or non-financial corporations (Gatev et al., 2007; Basten and Juelsrud, 2023; Cao et al., 2024). Both for CRE and RRE backed lending, we find our hypothesis that banks are more sensitive to lending spreads conditional on local exposure confirmed. The positive and significant effect on the foreign real estate backed lending share is present especially during the period from 2015 to 2020, that is, the period before the start of the Covid-19 pandemic and during the height of the low rate environment.

We then expand the analysis by investigating whether the stance of macroprudential regulation targeting the real estate sector plays a role for banks’ real estate backed lending. Hereby, it is important to note that the activation and application of macroprudential policies is a national task and aims at addressing the build-up of systemic risks in the domestic economy. Local and foreign banks are differently affected by macroprudential policies. For example, loan to value ratios implemented in the home country of a bank target domestic real estate backed loans but not cross-border real estate backed loans. Similarly, specific risk weights related to real estate backed lending in the home country do not affect cross-border loans granted to local customers by foreign banks. Only if both the home and foreign country agree to reciprocate the macroprudential measure, the foreign bank would have to take macroprudential policies in the destination country into account.

Based on the Macroprudential Measures Database by the European Systemic Risk Board (ESRB), we collect information on active policies applying to residential or commercial real estate backed loans for banks’ home and destination countries. This way, we can assess whether geographical differences in the activation and application of such policies matter for banks’ sensitivity to interest rates spread when providing loans backed by property. Results show that the decisions to rebalance the foreign real estate backed lending portfolio to countries offering a higher spread, and in which the bank has an informational advantage, is not disconnected from macroprudential policies. Especially in the case that neither the home nor the destination country have a policy in place, or when there is a misalignment in macroprudential policies, banks tend to respond to differences in local interest rates. Consequently, it seems that banks monitor cross-country discrepancies in macroprudential policies when investing abroad.

Financial stability perspective: (Hidden) implications for risk?

Having found that banks reallocate their real estate backed lending as a response to larger interest rate spreads, we extend the analysis to assess implications for bank risk. Related studies have assessed the risk implications of banks’ domestic real estate backed loans with mixed conclusions (Cuñat et al., 2018; Koetter and Poghosyan, 2010; Zurek, 2022), such that we contribute to the literature by focusing on risks arising from foreign real estate lending activities.

The granularity of the dataset that we draw on allows evaluating various dimensions of risk starting from early signals of potential restructuring needs up to actually defaulting real estate backed loans in a borrowing country of the considered bank. Specifically, we focus on the forbearance ratio measured as loans under forbearance to the gross carry amount (GCA) of real estate backed loans, the accumulated impairment ratio defined as the cumulative impairment to the GCA of real estate backed loans and finally the non-performing loans ratio measured as the share of non-performing-loans in the GCA of real estate backed loans. Figure 2 shows the evolution of these measures over time, and the efforts of the SSM to induce banks to lower the amount of bad loans in their balance sheets become visible in the declining patterns of reported risk measures (see also Baskaya et al., 2023). Yet, there are first signs that with the start of the Covid-19 pandemic, this declining trend comes to a halt, as the amount of non-performing loans is increasing again.

We hypothesize that a higher sensitivity to the lending spread could reflect that banks detect return opportunities and manage to remain profitable in a low rate environment. Optimally, banks should consider related risks. While risk-adjusted returns are not observable to us, we consider ex-post risk outcomes. This strategy, however, has a main caveat as banks might be reluctant to report potential losses and are thus slow in adjusting, for example, their forbearance ratios. In this context, Behn and Couaillier (2023) show that especially well capitalized banks adjust their risk reporting, with the likely reason being that they are not suffering that much from a stigma effect. In a similar vein, Goncharenko and Lukmanova (2024) set up a model that is calibrated to data covering the major European banks being part of the ECB’s comprehensive Asset Quality Review to investigate hidden losses in banks’ loan portfolios. Their results show that banks tend to hide losses of around 0.8% of their loan portfolio.

Figure 2. Risk reporting shows downward trend

At first sight, our analysis does not point towards the build-up of risks in banks’ real-estate backed lending portfolio due to rebalancing to countries with higher lending spreads. However, the result has to be interpreted with caution. On the one hand, the riskiness of loans collateralized by real estate might only be revealed when real estate markets experience a downturn, for example, following lower housing demand when interest rates go up. While our analysis stops in 2022, Figure 2 revealed slight evidence that the downward trend in related risks cannot be taken for granted. On the other hand, once we account for the level of capitalization, our results show that, in the pre-Covid period, it is mostly the well-capitalized banks that increase their forbearance ratios for CRE backed loans as a response to a higher loan share in destination countries offering a larger spread. In contrast, starting from 2020 onwards, the weakly capitalized banks show higher non-performing loan ratios related to their foreign real estate backed lending in case they were more sensitive to lending spreads.

From our analysis, we derive three main insights regarding the relevance of cross-border lending collateralized by real estate, the possibility of regulatory arbitrage, and risk implications that might be relevant for policymakers:

First, housing market turmoil has often been a relevant driver for triggering financial crises. In this regard, we show for the significant banks in the euro area that their exposures to housing markets via real estate backed lending amounts to a sizable share in their loan portfolios. Hence, monitoring these markets and associated risks seems crucial when it comes to bank supervision. Additionally, having documented that banks are active in this loan segment both in their home markets but also abroad, spillovers of risks across national borders are in the realm of possibility.

Second, our findings highlight that differences in national macroprudential policies can be a driver of banks’ international lending decisions. Banks facing real estate related macroprudential policies affecting their domestic activities might expand into foreign markets in which the regulatory stance is more lenient. While such behavior could be interpreted as some kind of “regulatory arbitrage”, it is in line with the macroprudential policy objective of re-directing credit to (real estate) markets with less or no systemic risk. However, this only holds if national discretion in activating these policies to target country-specific risks is applied homogenously across countries. Hence, our findings support the ESRB’s efforts to ensure harmonization regarding the activation and application criteria of macroprudential policies across European countries. Monitoring consequent lending behavior at home and abroad in the regulated sector could contribute to the understanding whether banks invest in less regulated risky activities abroad, or whether foreign banks threaten the effectiveness of domestic policies.

Third, we find limited evidence that reported losses and non-performing loans go up during the low rate environment after banks reallocated real estate backed lending to countries with higher lending spreads. However, the result does neither rule out that risks accumulate as banks might hide losses nor that risks will show-up in the longer-run. Further research on the effects of interest rate increases and potentially arising losses in real estate backed lending seems needed in that respect.

Baskaya, B., J. E. Gutierrez, J.-M. Serena and S. Tsoukas (2023). Unloading NPLs, unlocking credit? Evidence from the ECB provisioning guidelines. Mimeo.

Basten, C. and R. Juelsrud (2023). Cross-selling in bank-household relationships: Mechanisms and implications for pricing. The Review of Financial Studies, hhad062.

Behn, M. and C. Couaillier (2023). Same same but different: credit risk provisioning under IFRS 9. ECB Working Paper Series No 2841.

Brei, M., C. Borio and L. Gambacorta (2020). Bank intermediation activity in a low-interest-rate environment. Economic Notes, 49:e12164.

Buch, C. M. and L. S. Goldberg (2015). International banking and liquidity risk transmission: Lessons from across countries. IMF Economic Review 63(3), 377–410.

Cao, J., E. Garcia-Appendini, and C. Huylebroek (2024). Banking on Deposit Relationships: Implications for Hold-Up Problems in the Loan Market. Norges Bank Working Paper 04/2024.

Cerutti, E., G. Hale, and C. Minoiu (2015). Financial crises and the composition of cross-border lending. Journal of International Money and Finance 52, 60–81.

Cuñat, V., D. Cvijanović, and K. Yuan (2018). Within-Bank Spillovers of Real Estate Shocks. The Review of Corporate Finance Studies 7(2), 157–193.

Hau, H. and S. Lai (2016). Asset allocation and monetary policy: Evidence from the Eurozone. Journal of Financial Economics, 120(2), 309-329.

Gatev, E., T. Schuermann, and P. E. Strahan (2007, 11). Managing Bank Liquidity Risk: How Deposit-Loan Synergies Vary with Market Conditions. The Review of Financial Studies 22(3), 995–1020.

Goncharenko, R., and E. Lukmanova (2024). Masters of Illusion: How Much do Banks Hide? Available at SSRN: https://ssrn.com/abstract=4792462.

Jiménez, G., A. Mian, J-L. Peydró, and J. Saurina (2020). The real effects of the bank lending channel. Journal of Monetary Economics 115, 162-179.

Jordà, O., M. Schularick, and A. M. Taylor (2015). Leveraged bubbles. Journal of Monetary Economics 76, Supplement, S1-S20.

Hale, G., T. Kapan, and C. Minoiu (2020, 12). Shock Transmission Through Cross-Border Bank Lending: Credit and Real Effects. The Review of Financial Studies 33(10), 4839–4882.

Koetter, M. and T. Poghosyan (2010). Real estate prices and bank stability. Journal of Banking & Finance 34(6), 1129–1138.

Schmidt, K. and L. Tonzer (2024). Banks’ Foreign Homes. Bundesbank Discussion Paper 46/2024.

Zurek, M. (2022). Real estate markets and lending: Does local growth fuel risk? Journal of Financial Services Research 62(1), 27–59