In the midst of the current debate about whether an operational loss would impair the ability of a central bank to achieve its goals, we look at the potential result of cumulating such losses over time: the equity position of the institution. We find that a stronger overall financial position is well correlated with a more aggressive tackling of inflation phenomena in the economy. However, central banks that expect higher pressure on the financial position due to participation in asset purchases do not react less decisively to inflationary pressure. We look at determinants of financial strength and find that more independent central banks have higher equity ratios, which is not driven by differences in the stages of economic development.

The current period of high inflation prompted central banks around the world to tighten their monetary policies i.e., modifying their stance after a relatively long period of monetary easing. This change of course, operated in different times and with different intensities across the institutions, came however at the expense of their financial results, with some institutions forecasting a significant damage to equity ratios in the future. While a recent contribution by Bell et al (2023) argues that “losses do not compromise a central bank’s ability to fulfil its mandate”, we ask ourselves whether the strength of the policy reaction to inflation spikes could be somewhat dependent on the financial health of the central bank and could therefore be impacted by a cumulation of losses over a longer period.

In this brief, despite being heavily limited by data availability constraints, we shed light on the relationship between central banks’ equity position and the intensity of the inflation targeting policy reaction during the recent surge of inflation. We build on the findings of Klüh & Stella (2008) that financially weak central banks are associated with a lower ability to effectively react to inflationary pressures, and we look at links between financial strength of a central bank and policy outcomes. Our empirical investigation is embedded in the ongoing topical discussion on central banks’ profitability and financial strength sparked by the losses reported by several institutions around the world for the financial year 2022 (e.g., loss of CHF 132bn of the Swiss National Bank, or the release of EUR 1.6bn of financial buffers resulting in a zero-profit posted by the European Central Bank). We examine the role of central bank equity as an indicator of financial resiliency, i.e., interpreted the ability to withstand a cumulation of losses before a situation with a potential government recapitalization is needed, or a negative capital position arises.

Central banks are special. In contrast to non-financial corporations or commercial banks, the goal of a central bank is not profit maximization but achieving a social goal such as price stability, employment close to full, or financial stability. However, the fact that central bank finances should not matter in theory does not mean they do not matter in practice. The financial strength of a central bank can influence its ability to achieve the desired policy outcomes and ultimately to fulfil its mandate. The channels through which central bank finances could affect conventional policy measures are manifold and include the institution’s credibility, political independence, and self-serving behavior of central bankers (Klüh & Stella (2008), Stella (2005), and Hawkins (2003) among others). The very existence of central bankers’ vested interests signals that they themselves consider financial strength as an important ingredient for achieving policy targets (e.g., Vergote et al (2010)).

Data availability, series length, and reporting gaps constraints prompt us towards a correlation study, rather than a full-fledged causal-comparative approach.1 The analysis is based on data from various sources. We combine data from Orbis Bank Focus on central banks’ equity2 with data on inflation rates from Ha et al (2021) and Eurostat, as well as with information on inflation targets from Siklos (2017)3. To measure the intensity of central banks’ reaction, we rely on data on policy rates from the Bank for International Settlements. Data availability constraints leave us with a sample of 25 central banks, from both advanced (12) and emerging (13) economies.4 The equity ratio in our sample ranges from 34% of the Central Bank of Colombia to -21% of Bank of Thailand. As the current surge of inflation was mainly propelled by the most volatile items of the consumption basket, in particular energy prices, we focus on the official average core consumer price inflation yearly rate for the period from 03/2021 until 09/2022.5 To measure the central bank reaction, at this stage only changes in the policy rates are considered, either by themselves or in deviation units from the inflation target. The degree of reaction is measured as the cumulative change in the policy rate between 06/2021 and 12/2022.

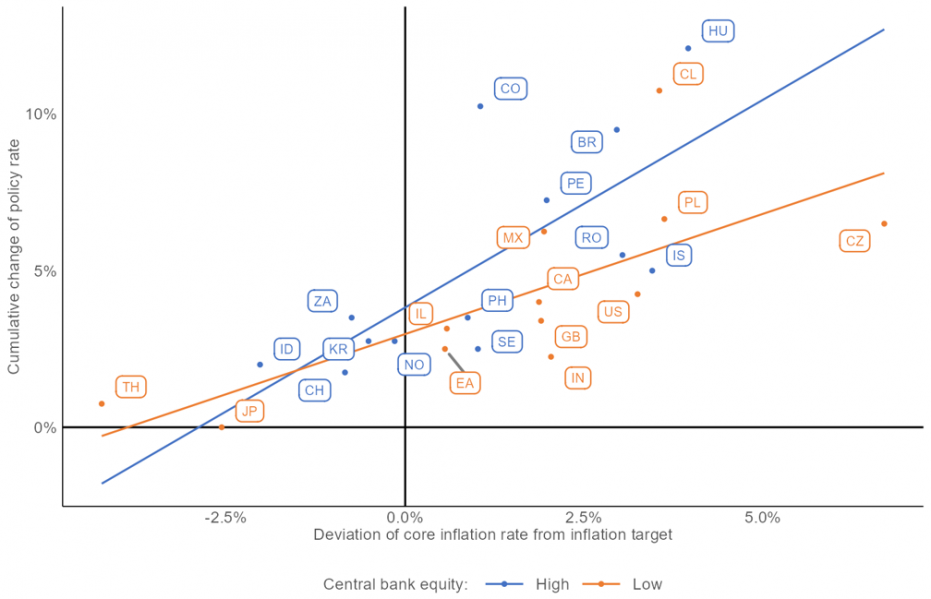

We find an unsurprisingly positive correlation between how much the inflation rate deviates from its target and the strength of the tightening enacted by the central bank, with marked differences between high and low equity institutions (Chart 1). Following Klüh & Stella (2008), we find that when a central bank has a more solid financial position, it generally reacts more decisively to the same degree of deviation from its inflation target.

Chart 1: Amount of equity and central bank performance

Note: Central bank equity is classified as high (low) if the equity ratio is above (below) the median equity ratio. Data for central bank equity is as of reference year 2020. The core inflation rate is measured as the official average core consumer price inflation yearly rate for the period from 03/2021 until 09/2022. Cumulative change of policy rate is measured for the period between 06/2021 and 12/2022.

If the overall effect is clear, the channels of transmission through which the financial position can alter a bank’s effectiveness are diversified and likely endowed with a different relevance across countries. To gain a better insight in the determinants of equity level and performance, we will focus on unconventional monetary policy instruments, and some relevant institutional features, as the degree of independence and the degree of maturity of the economic system.

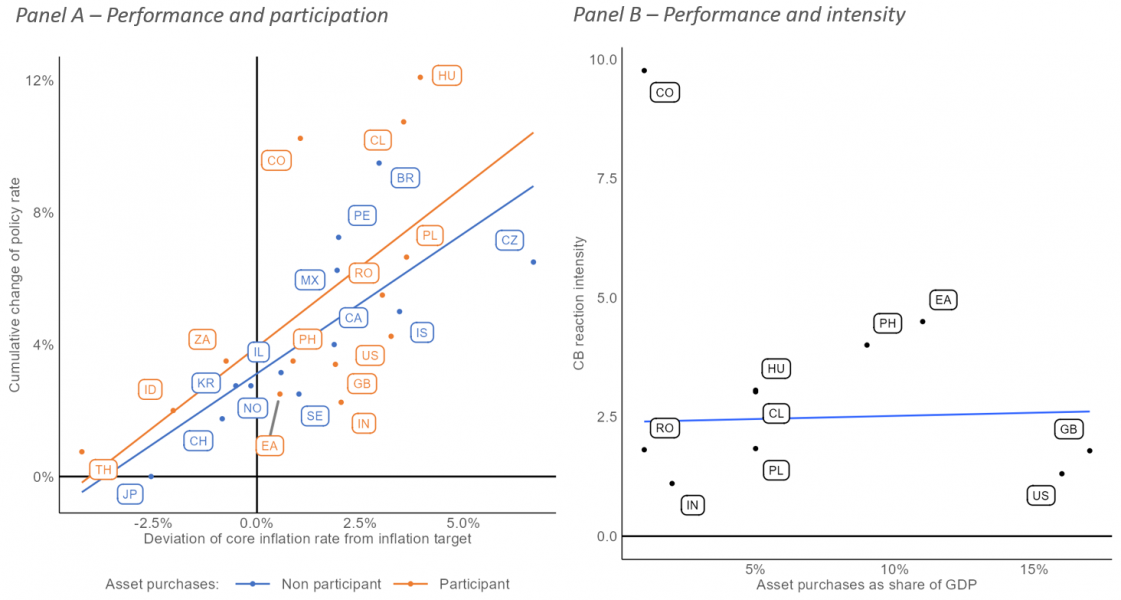

We investigate whether the decision (Panel A) and the magnitude (Panel B) of participation in an asset purchase program (APP) correlates with a less decisive policy reaction to inflation (Chart 2). Participation in an APP influences the financial position of a central bank mainly via revaluations from securities due to changes of the interest rates. A robust increase in interest rates to fight strong inflationary pressures will worsen the financial result for central banks that inflated their balance sheets with securities (Anderson et al (2022). It stands to reason that the more exposed a central bank is, the higher would be the incentive to not raise the rates when needed. This is not the case. On the contrary, central banks that participated in an APP have reacted more strongly for the same level of inflation deviation. One potential explanation could be that a stronger financial position gives any institution more freedom in deciding whether to deploy its own asset balance for monetary policy purposes.

Chart 2: Asset Purchasing Program

Note: The core inflation rate is measured as the official average core consumer price inflation yearly rate for the period from 03/2021 until 09/2022. Cumulative change of policy rate is measured for the period between 06/2021 and 12/2022. Data on participation in asset purchases is obtained from Adrian et al (2021). Decision and magnitude of participation is based on asset purchases during the period of March 2020 to March 2021. CB reaction intensity is calculated as the cumulative change of policy rates over the deviation of core inflation rate from inflation target. For Panel B, only economic regions with positive deviation of core inflation rate from target are considered. Fitted line in Panel B is excluding the Central Bank of Colombia (CO).

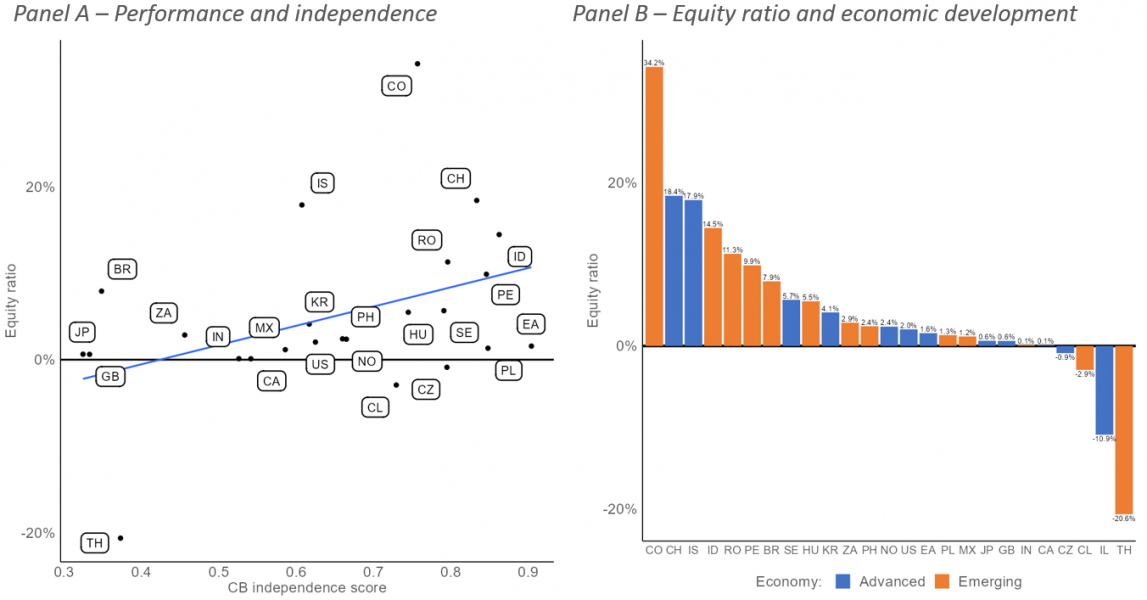

With respect to central bank independence, it is not a surprise that a higher degree of independence is correlated with a stronger financial position and therefore to the ability of reacting stronger to any inflation deviation (Chart 3, panel A). A healthy balance sheet, as already pointed out by Fry (1998) and reiterated among others by Hawkins (2003), shields the institution from usual horse-trading activities, where government funding is exchanged with opportunistically weak policies in response to inflation, or the government need of seigniorage transfers prevents to optimally hike the rate to counteract inflationary outbursts. As shown by Siklos (2011) and Dincer & Eichengreen (2014), advanced economies tend to have more independent central banks. However, we are satisfied that the distribution of central banks’ equity ratios in our sample is comparable across different stages of economic development (Chart 3, panel B) and that the nature of the economic environment is not driving the result.

Chart 3: Independence and economic development

Note: Data for central bank equity is as of reference year 2020. The central bank independence index is calculated as of 2017 and used from Romelli (2022). For the euro area, the index is calculated as the mean of the independence indexes of the members of the euro area (excl. Croatia).

Central banks are special, and assessing their performance is all but easy. Our metric gauges the intensity of conventional policy reaction to inflation deviation from its target and shows that financially healthier central banks are able to tackle inflation more aggressively than their counterparts. This holds true even when considering their independence, or the status of the economic systems in which they operate. Our analysis is limited by heavy data availability constraints preventing us from properly estimating causality relationships. This is something we leave for future work once data availability improves. Understanding the underlying forces that generate this correlation remains a potentially interesting research agenda.

Adrian, MT, Erceg, CJ, Gray, MST, & Sahay, MR (2021). Asset purchases and direct financing: Guiding principles for emerging markets and developing economies during COVID-19 and beyond. International Monetary Fund.

Anderson, A., Na, D., Schlusche, B., & Senyuz, Z. (2022). An Analysis of the Interest Rate Risk of the Federal Reserve’s Balance Sheet, Part 1: Background and Historical Perspective.

Bell, S., Chui, M., Gomes, T., Moser-Boehm, P., & Tejada, A. P. (2023). Why are central banks reporting losses? Does it matter? (No. 68). Bank for International Settlements.

Dincer, N. N., & Eichengreen, B. (2014). Central Bank Transparency and Independence: Updates and New Measures. International Journal of Central Banking, 10(1), 189-259.

Fry, M. J. (1998). Assessing central bank independence in developing countries: do actions speak louder than words?. Oxford Economic Papers, 50(3), 512-529.

Ha, J., Kose, M. A., & Ohnsorge, F. (2021). One-stop source: A global database of inflation.

Hawkins, J. (2003). Central bank balance sheets and fiscal operations. BIS papers, 20

Klüh, UH, & Stella, P. (2008). Central bank financial strength and policy performance: an econometric evaluation. Available at SSRN 1266509.

Romelli, D. (2022). The political economy of reforms in Central Bank design: evidence from a new dataset. Economic Policy , 37 (112), 641-688.

Siklos, P. L. (2011), “Central Bank Transparency: Another Look.” Applied Economics Letters 18 (10): 929–33.

Siklos, P. L. (2017). Central banks into the breach: from triumph to crisis and the road ahead. Oxford University Press.

Stella, P. (2005). Central bank financial strength, transparency, and policy credibility. IMF Staff Papers, 335-365.

Vergote, O., Studener, W., Efthymiadis, I., & Merriman, N. (2010). Main drivers of the ECB financial accounts and ECB financial strength over the first 11 years. ECB Occasional Paper, (111).

Given the correlation design of the study, we are unable to fully rule out contemporaneous and endogenous effects. Despite the lack of empirical evidence, reverse causality issues could theoretically be at play.

For the euro area and the United States, we use the combined level of equity for the Eurosystem and the Federal Reserve System, respectively. In case of reporting of different levels of consolidation for a central bank, the median equity ratio across all levels of consolidation is considered. Reference year is 2020.

Several central banks such as the Czech National Bank or the Central Bank of Chile do not have a point inflation target, but a target range (e.g., 1-3%). In this case, we use the median inflation rate within the target.

The Central Bank of the Republic of Türkiye is excluded in the visual analysis. During the investigated period Türkiye observed an average deviation from the inflation target of 31.8 percentage points and the Central Bank of the Republic of Türkiye reduced the policy rate by 10 percentage points.

Arguably, the policy reaction function of the authorities could be to some degree forward-looking. The use of contemporaneous core inflation rates in our simple analysis can be justified to the extent they carry information about the persistence of the overshoot of inflation targets looking ahead.