This policy brief is based on BIS Working Papers No 1150. The views expressed are those of the authors and do not necessarily reflect the official views of their respective institutions.

Rising markups are not a new topic in public debate but have snapped back into focus following the post-pandemic inflation surge and prompting questions to what extent high markups have shaped the recent inflation dynamics. In a recent paper, we present empirical evidence from the United States on how markups affect the pass-through of global oil supply shocks. We find that higher markups are associated with a lower pass-through of these shocks to producer prices only when the shocks are disinflationary. In addition, high-markup firms are more likely than low-markup firms to increase their markups, revenues, and profits following disinflationary oil supply shocks. However, high- and low-markup firms respond similarly to inflationary oil supply shocks. These results underscore the benefits that high-markup firms reap from disinflationary cost-push shocks, as well as the likely limited potential of high markups to dampen inflationary pressures.

The sharp increase in inflation in 2021–22 came on the heels of a decade-long period of rising corporate power, as reflected by the steady and broad increase in firm-level markups (De Loecker et al 2020). This ignited a debate on whether firms were using their pricing power to pass more of the increased costs to consumers. Some policymakers also expressed concern that high-markup companies could hamper the disinflation process, by retaining the benefits from declining input costs instead of passing them through in their prices. For example, Isabelle Schnabel, a member of the Executive Board of the European Central Bank, in a speech delivered in August 2023 at the “Inflation: Drivers and Dynamics” Conference co-hosted by the Federal Reserve Bank of Cleveland and the European Central Bank, noted:

“[T]here is often an asymmetry between positive and negative cost-push shocks. While firms are quick to pass large cost increases onto consumers, they may be more reluctant to pass on declines in marginal costs.”

In Kharroubi et al (2023), we shed light on these questions, through an analysis of the pass-through of cost-push shocks – in the form of global oil supply shocks – to prices. For this purpose, we first estimate markups for a large panel of U.S. firms, following the production function approach outlined in De Loecker and Warzynski (2012). We then compute sector-level markups as revenue-weighted medians of firm-level markups, where sectors are defined according to the North American Industrial Classification System (NAICS). We also compute producer price index (PPI) inflation using seasonally-adjusted monthly series of PPI for NAICS sectors and merge PPI inflation data with our estimates of sectoral markups and a measure of global oil supply shocks provided by Baumeister and Hamilton (2019). Equipped with these data, we estimate the extent to which the pass-through from global oil supply shocks into sectoral PPI inflation depends on the sectoral markup.

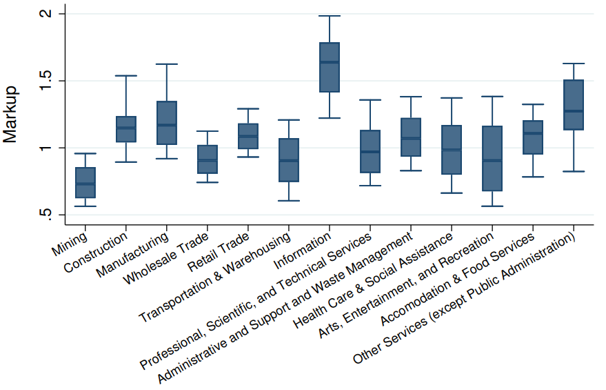

Figure 1 plots the distribution of markups for each NAICS sector. Both the within-sector and the across-sector distributions of markups display significant dispersion, with the latter providing us with substantial variation to define high- and low-markup sectors at various levels of sectoral aggregation.

Figure 1: The distribution of sectoral markups

Source: Authors’ calculations; see the working paper for details. Note: The figure shows the distribution of markups for two-digit NAICS sectors, with revenue-weighted percentiles. The box shows the interquartile range together with the median sectoral markup. The whiskers use the 10th and 90th percentiles as the lower and upper extremes.

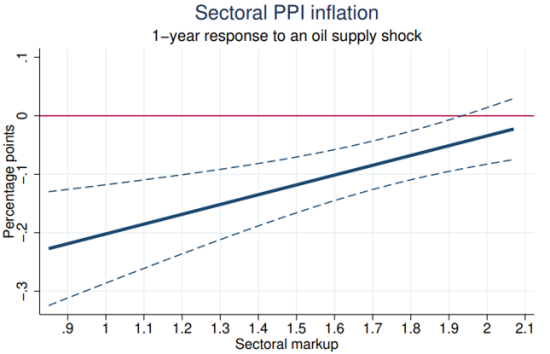

Our first key result is consistent with the view that high markups can act as absorbers of cost-push shocks. Figure 2 summarizes this finding, focusing on the one-year ahead response of PPI inflation to a positive oil supply shock. As expected, PPI inflation falls following such a shock, that is, following a cut in the price of oil. However, PPI inflation is typically less sensitive to oil supply shocks in sectors where firms charge higher markups. For instance, a supply-induced reduction of 1 percentage point in the real oil price leads to a 0.2 percentage point decline in PPI inflation one year later in a sector where the median markup is 1.1, but it does not have any material impact on PPI inflation in a sector where the median markup is 1.9 or more.

Figure 2: High markups reduce the pass-through of supply shocks to sectoral inflation

Source: Authors’ calculations; see the working paper for details. Note: The figure shows the oil supply shock pass-through to one-year-ahead sectoral inflation across the sectoral median markup distribution. The oil supply shock corresponds to a 1 percentage point decrease in the growth rate of real oil prices. Dashed lines display the 90% confidence interval.

While past research suggests that high markups could absorb inflationary shocks (see, for instance, Kouvavas et al 2021), most studies do not separate shocks that raise the price of oil from those that reduce the price. By contrast, in our study, we distinguish between these two types of oil supply shocks.

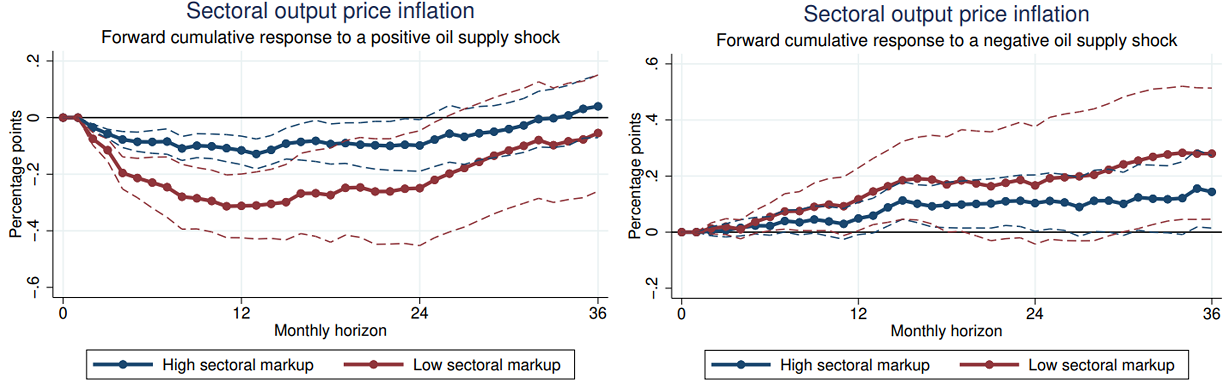

The left-hand panel in Figure 3 shows that positive oil supply shocks – those that cut the price of oil – are associated with lower PPI inflation, but noticeably less so in high-markup sectors. Conversely, the right-hand panel in Figure 3 shows that negative oil supply shocks – those that increase the price of oil – are associated with higher PPI inflation. Yet, markups do not materially affect the extent of pass-through in this case (confidence intervals for red and blue lines overlap).

In a nutshell, high markups act as shock absorbers when input costs are falling, but not when they are rising. Figure 3 also shows a striking difference in the timing of the pass-through. While the peak impact of positive oil supply shocks (left panel) takes place within one year, the pass-through of negative oil supply shocks (right panel) keeps increasing over three years.

Figure 3: High markups reduce the pass-through of positive supply shocks

Source: Authors’ calculations; see the working paper for details. Note: The left-hand panel shows the pass-through of positive oil supply shocks for high- and low-markup sectors defined at the 90th and 10th percentiles, respectively. The right-hand panel shows the pass-through for negative oil supply shocks. The oil supply shock corresponds to a 1 percentage point decrease in the growth rate of real oil prices. Dashed lines display the 90% confidence interval.

The evidence from our analysis leads to the question of: why markups have different effects on the pass-through of the two different types of shocks?

One possibility is that high-markup firms raise their markups following positive oil supply shocks, but not after negative oil supply shocks (intensive margin). If this is so, the sector-wide markup would increase after positive oil supply shocks, and more so in sectors where firms charge higher markups, thereby attenuating the impact of the oil shocks.

Another possibility is that following a positive oil supply shock, firms with relatively high markups grab a larger share of the market (extensive margin). This also would help to increase the sector-wide markup and dampen the impact of disinflationary oil supply shocks.

We investigate how firms adjust their markups in response to oil shocks by estimating the likelihood that a firm raises or cuts its markup. We do so by using a multinomial logit model that allows firms with different markups to respond differently to positive versus negative oil supply shocks.

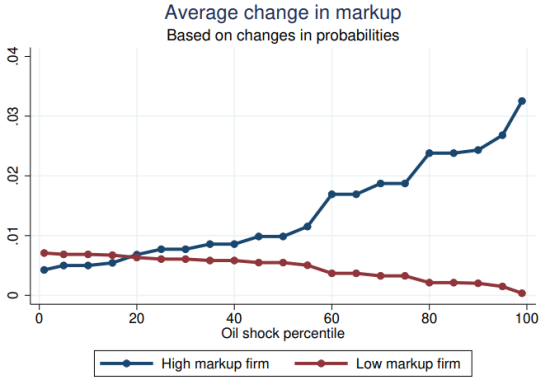

Figure 4 plots the estimated change in the markup following positive oil supply shocks of different intensities for firms that start with a high markup (blue line) and those that start with a low markup (red line). Positive oil supply shocks typically lead firms that charge relatively high markups to raise their markups, while firms that charge relatively low markups barely change theirs. However, even the markup change for high-markup firms is relatively small: they raise their markups by about 2 percentage points more than low-markup firms for high-intensity oil shocks, that is, shocks at the 75th percentile of the sample distribution. To put this number in perspective, the standard deviation of markup changes observed in the sample is about 0.2, or 10 times larger.

Figure 4: High-markup firms raise their markups more in response to positive supply shocks

Source: Authors’ calculations; see the working paper for details. Note: The blue line shows the average change in markup for a firm whose markup is at the 90th percentile of the initial markup distribution. The red line shows the average change in markup for a firm whose markup is at the 10th percentile of the initial markup distribution.

Next, we investigate the possibility that the pass-through of disinflationary oil shocks could be lower in high-markup sectors because firms with relatively high markups outgrow their low-markup peers. We do this by estimating how firm revenues respond to oil shocks, allowing the sensitivity of firm revenues to oil shocks to depend on the firms’ markups.

Our results show that firms that start with higher markups tend to systematically outgrow their low-markup peers following positive oil supply shocks, implying that sector-wide markups are more likely to increase in sectors where firms already charge high markups. Consistent with this result, our evidence indicates that high-markup firms grow their profits more relative to low-markup firms following positive oil supply shocks.

Together, these results suggest that the asymmetric impact of markups on the pass-through of oil supply shocks reflects a combination of intensive and extensive margin effects. On the intensive margin, positive oil supply shocks, especially large ones, allow high-markup firms to raise their markups more relative to low-markup firms. Similarly, on the extensive margin, positive oil supply shocks allow high-markup firms to outgrow their low-markup peers.

High margins are often considered to be effective buffers against sudden and unexpected inflationary pressures. Yet, looking at the experience of the United States over the last two decades, we find little empirical support for this belief. On the contrary, we find that high markups significantly reduce the pass-through (into sectoral PPI inflation) of disinflationary oil supply shocks, while they barely affect the pass-through of inflationary oil supply shocks. Moreover, firms that charge high markups display a greater propensity to raise their markups after disinflationary oil supply shocks. They also expand their revenues and enhance their profitability more relative to their low-markup peers following such shocks. These findings suggest that strong market power allows firms to draw tangible benefits from favorable cost-push shocks, thereby reinforcing their market position. Our results also suggest that the conventional view about markups – that they can cushion price pressures – may not be entirely correct and would benefit from a nuanced refinement recognizing the asymmetries involved.

Baumeister, C and J D Hamilton (2019): “Structural interpretation of vector autoregressions with incomplete identification: Revisiting the role of oil supply and demand shocks”, American Economic Review 109(5): 1873–1910.

De Loecker, J, J Eeckhout, and G Unger (2020): “The rise of market power and the macroeconomic implications”, Quarterly Journal of Economics 135(2): 561–644.

De Loecker, J and F Warzynski (2012): “Markups and firm-level export status”, American Economic Review 102(6): 2437–2471.

Kharroubi, E, R Spigt, D Igan, K Takahashi, and E Zakrajšek (2023): “Markups and the asymmetric pass-through of cost push shocks”, BIS Working Papers No. 1150.

Kouvavas, O, C Osbat, T Reinelt, and I Vansteenkiste (2021): “Markups and inflation cyclicality in the euro area”, ECB Working Paper No. 2021/2617.

Olley S and A Pakes (1996): “The dynamics of productivity in the telecommunications equipment industry”, Econometrica 64(6): 1263–1297.