The opinions expressed are those of the authors and do not necessarily represent those of the European Central Bank, SSM or the Eurosystem. The authors thank Thomas Broeng Jorgensen, Cristina Triandafil, Huw van Steenis and Isabel von Koeppen Mertes for helpful comments and suggestions. All remaining errors are ours.

Abstract

Banks play a core economic role because they connect savers with borrowers for the financing needs of the real economy. But banks are not the only financial institutions that intermediate between those that supply funds and those that need it. We could substitute the term “investor” for “saver”. And instead of taking the funds and “investing” them in, say, loans to large corporations or residential mortgages, one could equally invest them in securities such as corporate bonds or mortgage-backed securities. The centrality that banks play in this intermediation has been eroding for a long time. Non-bank financial institutions (NBFIs)1 have steadily entered banks’ turf. Given these developments we take stock of the evolution of the intermediation conducted by the banking sector in US and European economies since the Global Financial Crisis (GFC) in 2008. Overall, we argue that non-bank competitors are taking sizable business from banks in low-stress periods. But it’s not clear we can count on the non-banks to continue their intermediation activities in stress episodes when markets freeze. As a consequence banks need to be capable and ready to intermediate in fixed income markets and provide credit through thick and thin – but such a financial system comes at a price: it may actually become more, not less dependent on central banks providing insurance for events far out in the tail of the distribution of systemic risk.

Banks are special. Most agents in an economy want to borrow at long terms (e.g. residential mortgages are 15 to 30 years, commercial bank loans around five years) but lend at short term (e.g. demand deposits), and banks take the other side of that trade. By providing demand deposit accounts, banks borrow at effectively less than overnight maturity, and by granting mortgages or commercial loans, they lend long. This is an inherently unstable trade: At the first sign of trouble, those savers have an incentive to withdraw their funds from their demand deposit accounts, triggering a run on the bank. This run risk is why modern economies typically provide deposit insurance, to stabilize the demand deposits, and central bank lending via a “discount window” to allow banks to turn illiquid long dated assets such as loans into cash. Deposit insurance allows banks to “borrow” very cheaply from savers: most deposit accounts pay no or very low interest rates. The quid pro quo of providing such a stabilization insurance is to require banks to hold more capital and liquidity, and to invest more in risk management and controls than they otherwise would.

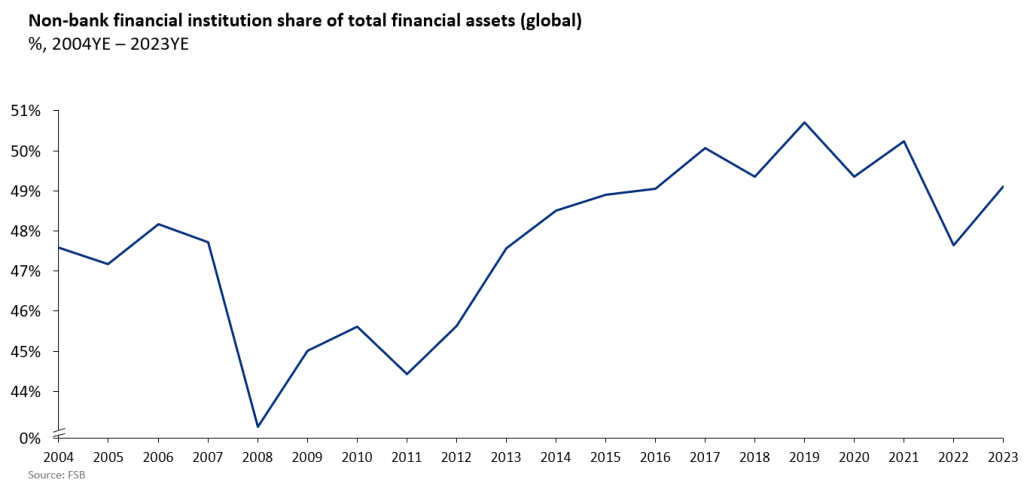

Banks are changing: Since the GFC, a material share of core elements of intermediation has moved to NBFIs. In particular, lending and trading are increasingly conducted outside the banking sector. According to the most recent monitoring exercise by the FSB2, from 2009 to 2022, the size of the NBFI sector increased steadily, with a decrease in 2022 due to of higher interest rates (Figure 1). The relative share of total global financial assets held by the NBFI sector amounts to around 47%. In the US, it is just 23%: $30 trillion of financial assets out of a total of $127 trillion. Fixed income funds are the largest entity type, followed by money market funds.3

Figure 1

Un- or lightly regulated NBFIs like asset managers, including private credit funds4 do not enjoy banks’ safety net. Their funding is typically longer term – they lock in their investors through commitments and strict withdrawal limits. This allows the asset manager to “weather the storm” and ultimately provide investors a positive return. If the storm is severe enough, however, investors lose out. Importantly, those investors are hardly content with earning the near zero returns that is paid by a bank to savers. So how can private credit funds survive? After all, they deploy their investors’ funds by lending to middle market companies, commercial real estate (CRE), or to fund buy outs with “leveraged loans”. Those are the same type of customers as banks cater to.

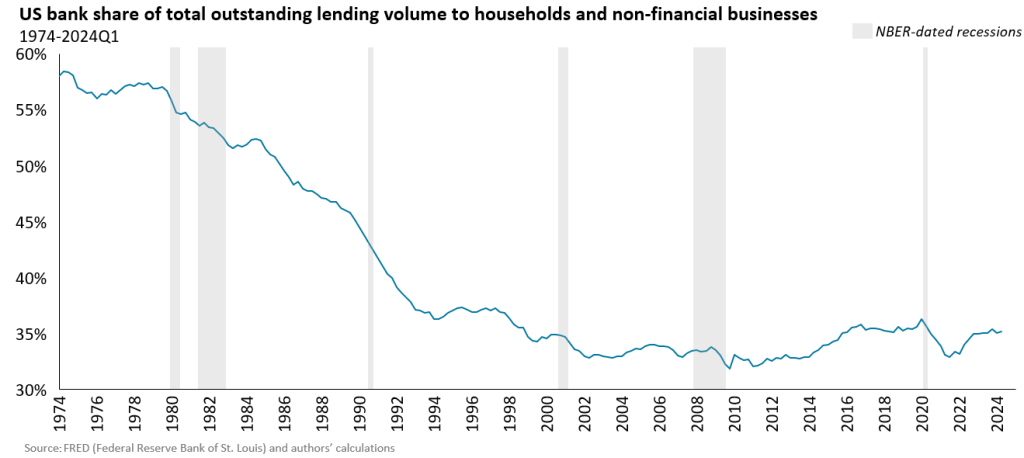

The share of U.S. lending volume to households and non-financial businesses made by banks has been on a steady decline since its peak in 1975 at about 58% to about 33% at year-end 2021 (see Figure 2). Interestingly bank lending gained market share following the financial crisis from a low of about 32% in 2010 to a recent peak of 38% at the dawn of the pandemic (Figure 2).5

Figure 2

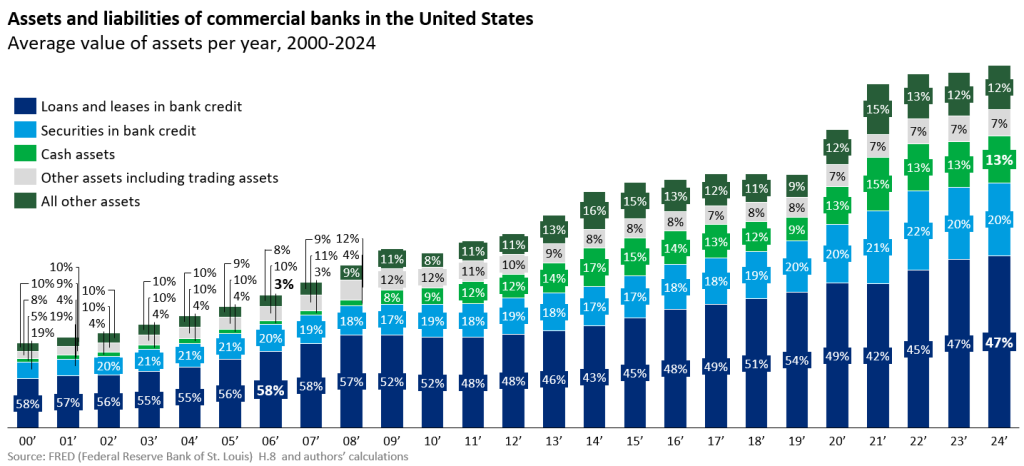

Bank balance sheets have adjusted to the new reality. Loans made up about 58% of bank balance sheets in 2006, just before the onset of the financial crisis, and stand at just 47% today (2024Q3). Instead, the share of cash assets has gone up from 3% to 13% (Figure 3).

Figure 3

Banks re-intermediate in a crisis:6 Because NBFIs are outside of the safety net, in a financial crisis there tends to be a migration back to the banking system as savers / investors seek a safe haven. A good example is the flight from money market funds in the wake of the Lehman default in the fall of 2008, and the corresponding rise in bank deposits (at least at those banks viewed to be either sufficient safe or too “big to fail”), even in the face of broad bank fragility.7 A more recent example came at the onset of the pandemic. From the end of February to the end of May, 2020, at a time when even the US Treasury market was experiencing illiquidity, the Federal Reserve re-opened most of the emergency liquidity facilities from the GFC, and deposits at large banks in the US increased by 18%.8 Li, Strahan and Zhang (2020) point to the sudden and massive draw on bank credit lines and loan commitments in March 2020 at a rate of 50 times the weekly average draw. This demand for credit was funded by a concomitant increase in deposits, especially to the largest banks, and supported by Federal Reserve liquidity injections. This mechanism, driven by uninsured leverage was also at play during the banking stress episode in spring 2023 (cf. Jiang et al, 2024).

We focus on private credit as an example since this NBFI activity closely resembles banking: private credit funds grant loans to (mostly privately held) companies, fund CRE projects or engage in asset backed lending. Private credit funds are growing even though they are at a funding cost disadvantage since banks are able to attract cheap deposits.9 Moreover, they are less levered than banks, making their weighted average cost of capital higher than that of banks. Presumably they have a much lower cost base partly due to a simpler business model, few legacy systems, lower demands on compliance and control infrastructure, and a much lower total regulatory burden.10

In parallel, banks increasingly lend to private credit firms. More favourable regulatory capital treatment when lending to private credit firms rather than directly lending to end borrower is one driver in this trend.11 This is not inappropriate: the private credit firm provides an extra layer of protection for the bank, standing in between the end-borrower and the bank providing the funds. However, because private credit counterparty default is more likely to happen in very bad states of the world when a cluster of end-borrowers default, eroding the capital base of the private credit firm, the shift by banks from lending directly to non-financial companies to lending to private credit intermediaries is ostensibly a shift of risk to the tail of the outcome distribution. Banks may therefore trade off lower near-tail risk for higher far-tail risk.12

The decentralised market structure of bond and swap trading has always put a large onus on effective intermediation matching buyers and sellers. Banks focus on intermediation rather than holding directional positions in proprietary trading. Traditionally, an investor such as asset managers initiated a bond or swap transaction by phoning dealers to find out about current quotes. In this business model dealers have to hold an inventory, which requires repo activity for funding and creates capital requirements (cf. Scheicher, 2023).13

The combination of major post-GFC regulatory overhaul (cf. Borio et al, 2020) raising capital and liquidity requirements and putting constraints on balance sheet usage, increasing “electronification”14 and the market entry of principal trading firms (PTFs) have together impacted the viability of the dealer business model.15 PTFs increasingly facilitate the redistribution of risk by actively buying and selling securities and standardised derivatives on electronic platforms while keeping minimal overnight inventories. The structural changes have reduced incentives for bank dealers to profitably run large inventory positions (and act as a principal in transaction with clients). Because balance sheet intensive activities are expensive, in regulatory capital terms, for banks, bank dealers nowadays often favour more balance-sheet light approaches, such as principal trades, where they only engage in a client transaction when they have lined up opposing trading interest by another client. Despite rising issuance, bank dealer assets are therefore stagnating (cf. Duffie, 2020).

As a result, market liquidity in crucial segments is increasingly provided via an intermediation mechanism which is less based on bank dealers and rather more on electronic platforms and non-bank dealers. Similar to private credit firms, trading firms have a lower cost base, a simpler business model and also face less stringent regulatory requirements compared to banks.

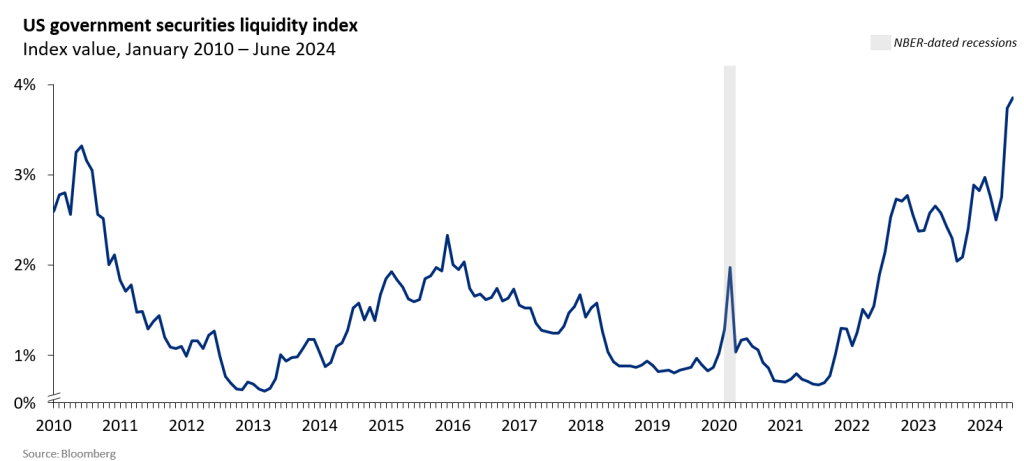

Over the last decade, fixed-income markets have become increasingly vulnerable to dislocations driven by our three factors (regulatory reform, rise of electronic trading and market entry of PTFs), all against a backdrop of extraordinary monetary policy actions of ultra-low interest rates and quantitative easing. Using a price-based measure (Figure 4), illiquidity in the US Treasury market rose sharply following the Pandemic shock in March 2020. At that time, the financial system had to cope with large shifts in the demand and supply for market and funding liquidity as a reaction to the exogenous shock of the pandemic outbreak. Stress in the “world’s safe asset” arose because many forced sellers (Treasuries were among the few assets which could be sold quickly, and even that market experienced significant dislocation) met few traders willing to buy in a highly imbalanced market characterized by extreme uncertainty. As the NBFI sector didn’t provide sufficient capacity to provide liquidity and stop market spirals, ultimately the Fed intervened on a large scale (cf. Duffie, 2020). A similar stress event took place in UK gilts in autumn 2022. These episodes16 point to the increased need for central bank intervention despite more than a decade of post-GFC regulatory capital and liquidity reform.

Figure 4

A “laboratory” for the changes in intermediation is provided by the US corporate bond market, which has around $10 trillion outstanding volume. In 2023 corporate debt issuance amounted to $1.4 trillion whereas equity issuance (excluding SPACs) only amounted to $139.1 billion, highlighting the vital importance of this market for corporate finance.17 At the time of writing, almost half of corporate bond trading is conducted on electronic platforms.18 Over the last decade clients have increased their trading with non-bank dealers who lack access to the Federal Reserve’s operations (cf. Allahrakha et al, 2019). In March 2020 after the shock of the Covid 19 pandemic, widespread selling and high price volatility pushed trading desks at major dealers close to their internal risk limits. The subsequent adjustments in these limits were not enough to offset the sharp increase in dealers’ exposures.19 Bid-ask spreads widened sharply and trading activity fell, bringing the primary market to a standstill. As a result, the Federal Reserve had to step in.20

Going forward, sharply rising government debt21 and simultaneous and widespread reduction in central bank purchase programs imply that the market needs to absorb a higher volume of government bonds placing further strain on fixed income markets. These trends together increase bank tail risk also in their trading business: Banks are expected to provide the private sector backstop for market making, but any sudden wave of widespread selling may quickly overwhelm their balance sheet capacity (cf. Duffie et al, 2023).22

Our basic thesis is that the real economy needs banks especially for stress periods, and banks therefore need to be really resilient to re-intermediate for the economy as investors shun NBFIs and seek the safety of banks when “things fall apart”. Even a modern financial system which is less bank centric is still bank dependent in a crisis. Therefore, banks provide some tail insurance to the financial system – with the central bank, plus the fiscal authority, providing ultimate tail insurance. In this way, banks are particularly and increasingly long systemic risk, and the larger and more complex the NBFI ecosystem, the more important become the banks and the more we are ultimately dependent on them – in a crisis.

We close by asking whether this crisis-only role for banks is desirable or even viable for a healthy financial system. In this new ecosystem, banks are incentivized to become even larger. Banks have more stringent risk management and control requirements than NBFIs. Because many risk management activities enjoy economies of scale, particularly those that are technology intensive23 such as infosec and cyber, those elevated demands can be spread over a larger commercial footprint. Larger banks are more likely to be seen or even treated as too big to fail, so investors / savers are more comfortable running to the largest banks in a crisis. This happened most recently in US during the spring 2023 regional banking turmoil as there was a shift of deposits from smaller regional to money centre banks.

So the stylized picture of the financial / banking system that is emerging is one where NBFIs compete effectively with banks on many elements of the core business of banking. The funding disadvantage is more than made up for by lower regulatory burden (and thus the lower demands on risk management and controls infrastructure), few legacy systems, and a more focused and thus simpler to run business model. NBFIs lower runability risk through longer term funding. Banks can borrow overnight, through demand deposits, cheaply and, thanks to deposit insurance and other elements of the safety net, safely.

At the first sign of stress, NBFIs pull back from the market and try to ride out the storm. Banks step in to reintermediate (in particular for new lending). To the degree banks can’t or won’t, the central bank needs to step in. In low-volatility periods, the profits migrate to NBFIs, banks load up more and more on tail risk – without necessarily getting paid for it. This risk transformation makes it harder to profitably provide that rainy day insurance to the system, putting more onus on central banks to step in when there is an aggregate adverse liquidity shock. As a result we may have become more, not less dependent on central bank intervention which has indeed been occurring with surprising frequency.

Is this the financial / banking system we want in order to support the real economy? Smooth functioning of intermediation places acute demands on the central bank’s balance sheet to absorb some (or a lot) of the risk as they play the role of “market-maker of last resort” buying (temporarily) illiquid securities out of the system for central bank reserves (Hauser, 2021; Barr, 2024)). But this should be rare – and it is not.

The rising systemic importance of NBFIs is a priority topic in international fora. The Financial Stability Board, which has been working on NBFIs since the GFC24 has created a system-wide monitoring framework. In parallel, policy work at the FSB aims to develop a systemic risk perspective in NBFIs, with a focus on inter alia mitigating spillovers between banks and NBFIs and reducing vulnerabilities in key NBFI categories such as money market funds. The FSB has also begun analysis of private credit vehicles.25

Stress testing is a key tool to manage the risks driven by the systemic transformation. The Bank of England has just completed a system-wide exploratory scenario exercise with the explicit objective of exploring spillover effects from one part of the financial system to the other.26 As the first exercise of its kind globally, the analysis investigated the UK financial system’s response to a sizable market shock. It zooms in on the risks to and from NBFIs, and the behaviour of NBFIs and banks in stress, highlighting the vital importance of resilient repo markets.

What can be done to reduce the dependence on banks in stress episodes? Because we depend so much, and so much more, on banks in bad states of the world, reducing their regulatory burden is not necessarily the answer. However, banks are effectively being forced to internalize some of the systemic spillovers generated by NBFIs. Put differently, NBFIs generate negative externalities but don’t really pay for them.

Acharya, V.,Cetorelli and B. Tuckman, 2024, Where Do Banks End and NBFIs Begin? Federal Reserve Bank of New York, Staff Reports Number. 1119.

Allahrakha, M., J. Cetina, B. Munyan, and S. Watugala, 2019, The Effects of the Volcker Rule on Corporate Bond Trading: Evidence from the Underwriting Exemption, Office of Financial Research, Working Paper Number 19-02.

Anderson, C., D. C. McArthur, K. Wang, 2023, Internal risk limits of dealers and corporate bond market making, Journal of Banking & Finance, Volume 147, 106653.

Aramonte, S., A. Schrimpf and H. Song Shin, 2021, Non-bank financial intermediaries and financial stability, BIS Working Papers, 972.

Barr, M., 2024, Supporting Market Resilience and Financial Stability, Speech at the 2024 U.S. Treasury Market Conference, Federal Reserve Bank of New York.

Borio, C., M. Farag, and N. Tarashev, 2020, Post-Crisis International Financial Regulatory Reforms: A Primer, BIS Working Papers, 859.

Copeland, A, D. Duffie and Y. Yang, 2021, Reserves Were Not So Ample After All, National Bureau of Economic Research, Working Paper, 29090.

Duffie, D., 2020, Still the World’s Safe Haven?, Hutchins Center, Working Paper Number 62.

Duffie, D., M. J. Fleming, F. M. Keane, C. Nelson, O. Shachar, and P. Van Tassel, 2023, Dealer Capacity and U.S. Treasury Market Functionality. Federal Reserve Bank of New York, Staff Reports Number 1070.

ECB, 2024, Private markets, public risk? Financial stability implications of alternative funding sources, Financial Stability Review Issue 1, 2024.

Egan, M., S. Lewellen and A. Sunderam, 2022, The Cross-Section of Bank Value, The Review of Financial Studies, Volume 35, Issue 5, 2101–2143.

Gatev, Evan, Til Schuermann, Philip E. Strahan, 2009, Managing Bank Liquidity Risk: How Deposit-Loan Synergies Vary with Market Conditions, The Review of Financial Studies, Volume 22, Issue 3, Pages 995–1020

Gonzalez, F. and C. Morar Triandafil, 2024, The European significant risk transfer securitisation market. ESRB Occasional Paper Series No 23.

Hauser, A., 2021, From Lender of Last Resort to Market Maker of Last Resort via the Dash for Cash: Why Central Banks Need New Tools for Dealing with Market Dysfunction, Speech at Thomson Reuters Newsmaker, London, 7 January.

Jiang, E. , G. Matvos, T. Piskorski and A. Seru, Amit, 2020, Which Banks are (Over) Levered? Insights from Shadow Banks and Uninsured Leverage. Mimeo.

Jiang,E., G. Matvos, T. Piskorski, A.Seru, 2024, Monetary tightening and U.S. bank fragility in 2023: Mark-to-market losses and uninsured depositor runs?, Journal of Financial Economics, forthcoming.

Kashyap A. K. Rajan R. G. Stein J. C., 2002, Banks as Liquidity Providers: An Explanation for the Co-Existence of Lending and Deposit-Taking, Journal of Finance, vol. 57, 33-74.

Li, Lei, Philip Strahan and Song Zhang, 2020, Banks as Lenders of First Resort: Evidence from the COVID-19 Crisis, Review of Corporate Finance Studies 9(3), 472-500.

OECD (2024): Global debt report 2024: bond markets in a high-debt environment.

O’Hara, M. and A. Xing Zhou, 2023, Things Fall Apart: Fixed Income Markets in the COVID-19 Crisis. Annual Review of Financial Economics, Vol. 15:55-68, 368-390.

Sánchez Serrano, A.,2020. High-Frequency Trading and Systemic Risk: A Structured Review of Findings and Policies, Review of Economics, vol. 71, no. 3, 169-195.

Scheicher, M., 2023, Intermediation in US and EU bond and swap markets: stylised facts, trends and impact of the COVID-19 crisis in March 2020. ESRB Occasional papers, Number 24.

Shiller, R., 1988 Portfolio Insurance and Other Investor Fashions as Factors in the 1987 Stock Market Crash. National Bureau of Economic Research, Macroeconomics Annual 1988, Volume 3.

Todorova, Z. and A. Diaz Lafuente, 2024, The human touch: Why the bond market will continue to have a voice. Barclays FICC Research.

The NBFI sector covers a heterogeneous set of firms with different business models and subject to different regulatory regimes (cf. Aramonte et al., 2021). Key segments are asset managers, insurers, hedge funds or trading firms. Acharya et al (2024) provide detailed empirical analysis of the links between NBFIs and banks.

https://www.fsb.org/2023/12/global-monitoring-report-on-non-bank-financial-intermediation-2023/

In the EU, total assets of investment funds amount to €44.8 trillion, accounting for 41% of the EU financial sector. https://www.esrb.europa.eu/pub/pdf/reports/nbfi_monitor/esrb.nbfi202406~2e211b2f80.en.pdf

An overview of private markets is provided by ECB (2024).

According to Egan et al, 2022, lending’s share in the creation of bank value exceeds income from securities.

See Kashyap et al (2002) for the theory and Gatev et al (2009) for empirical analysis.

In the two weeks following the Lehman bankruptcy, deposits at US banks rose by over 5% (over $350 billion).

Source: FRED

The success of private credit firms also risks turning on its head the long-established view that banks have a comparative informational advantage in credit underwriting.

Note that NBFIs are typically less levered. Jiang et al. (2020) report that they employ twice the amount of equity capital compared to equivalent banks.

As capital requirements are to a large degree driven by the PD and LGD, the typically lower PD and LGD of PC firms implies a lower capital requirement for indirect lending. Furthermore, in some jurisdictions, PC firms may be categorised as “financial institutions”, which also improves their capital requirement.

Synthetic securitisation, which has been growing strongly in the EU is also a mechanism which increases tail risk (cf. Gonzalez and Morar -Triandafil, 2024).

Banks also engage in risk management for the real economy, using FX and interest rate derivatives to allow companies to hedge FX and interest rate risk. Here too banks do not take position risk. Rather they aim to lay off any risk incurred through a given transaction by finding a party who has the opposite hedging need or investment interest.

Trading of bonds and derivatives has steadily migrated to electronic platforms, with some segments still relying on voice-based intermediation (cf. Todorova and Diaz Lafuente, 2024).

These developments therefore mirror the evolution of equity trading, where banks withdrew with increasing use of electronic platforms, leaving the field to high-frequency trading firms (for a survey see Sánchez Serrano, 2020).

In addition to the March 2020 stress event, US repo rates also spiked sharply in September 2019, driven in part by a decline in major banks’ reserve balances at the Federal Reserve (cf. Copeland et al, 2021).

https://www.sifma.org/resources/research/statistics/fact-book/ Version of July 30, 2024.

See Todorova and Diaz Lafuente, 2024.

See Anderson et al (2023) for empirical evidence on internal limits at Dealer banks.

O’Hara and Zhou’s paper “Things falling apart” provides a comprehensive overview and clearly illustrates our main argument about rising tail risks (cf. O’Hara and Zhou, 2023).

According to OECD (2024), outstanding government bonds increased from $26 trillion in 2008 to $64 trillion in 2023.

An additional concern is the impact of AI-based trading models, which may further increase traders’ herding behaviour. A related debate about the impact of quantitative models on market liquidity has been active for quite some time, starting in the aftermath of the October 1987 crash (cf. Shiller 1988).

The imperative of investing heavily in technology is a strong incentive for banks to grow in scale.