This policy brief presents evidence that greater competition can act as a spontaneous market force to reduce the consumption of private benefits by bank insiders and, thereby, the agency problems within banks. Using U.S. bank-level data, we measure the intensity of the agency conflict within a bank by the volume of loans that the bank lends to its insiders (e.g., executive officers, directors and principal shareholders). We first check that these loans are a form of private benefit. Then, we exploit interstate branching deregulation to show that banks react to greater competition by reducing insider lending, especially when the entry of new competitors may more strongly affect bank profitability.

Firm managers may not always act in the best interests of the providers of capital. This misbehavior can take multiple forms including the extraction of private benefits, which is a way for managers to divert corporate resources from providers of funds to themselves. In the banking industry, such opportunistic behaviors may be exacerbated by the presence of deposit insurance, which reduces debtholders’ incentives to monitor bank management. In a recent study (Girotti and Salvadè, 2021), we test whether greater local market competition reduces the consumption of private benefits by bank insiders.

Our main proxy for the agency conflict within a bank, and, specifically, for the private benefits extracted by bank insiders, is the volume of loans that the bank lends to its insiders. In the U.S., bank regulators and members of Congress have focused on insider lending since at least the 1970’s. Indeed, the Financial Institutions Regulatory And Interest Rate Control Act set strict controls on insider lending transactions as back as in 1978. By the end of 1992, such restrictions had materialized into Regulation O, which defines an insider loan as any extension of credit by a bank to its executive officers, directors, principal shareholders, or their related interests (e.g., a company controlled by a director). The objective of Regulation O is to limit insider lending.

In our empirical analysis, we first check that loans lent to insiders are private benefits related to agency problems. We consider U.S. quarterly bank-level data from 1994Q2 to 2005Q2. We show that the volume of insider loans is larger in banks with high free cash flows and low growth opportunities. As highlighted by Jensen (1986), it is precisely in institutions having these characteristics that insiders are more likely to extract private benefits. We also find that greater insider lending is associated with lower bank productivity and profitability, which further supports the view that insider lending is a manifestation of self-dealing.

These findings are in line with previous evidence on the relationship between insider lending and bank risk. According to Murphy (1980), in 1978, the Federal Deposit Insurance Corporation presented several reports to the Congress stating that excessive insider lending represents a major cause of bank failure. Similarly, in a report to the Congress of March 1994, the US General Accounting Office notes that 61% of the 286 bank failures that occurred in 1990 and 1991 had insider problems, such as frauds or loan losses (General Accounting Office, 1994). The most common violations were exceeding the lending limits for insiders and giving loans to insiders with preferential terms, which were instead not available to the general public.

Based on this first set of findings and past evidence, we analyze the impact of greater competition on agency problems within banks by assessing its effect on insider lending. We use the staggered relaxation of interstate branching restrictions as an exogenous shock to banking competition: The Interstate Banking and Branching Efficiency Act (IBBEA) of 1994 favored the penetration of out-of-state banks in local banking markets and significantly increased the number of branches in each state, and thus local banking market competition. The relaxation of the constraints was, however, implemented at different points in time and with different intensity across states, enabling us to draw causal inferences.

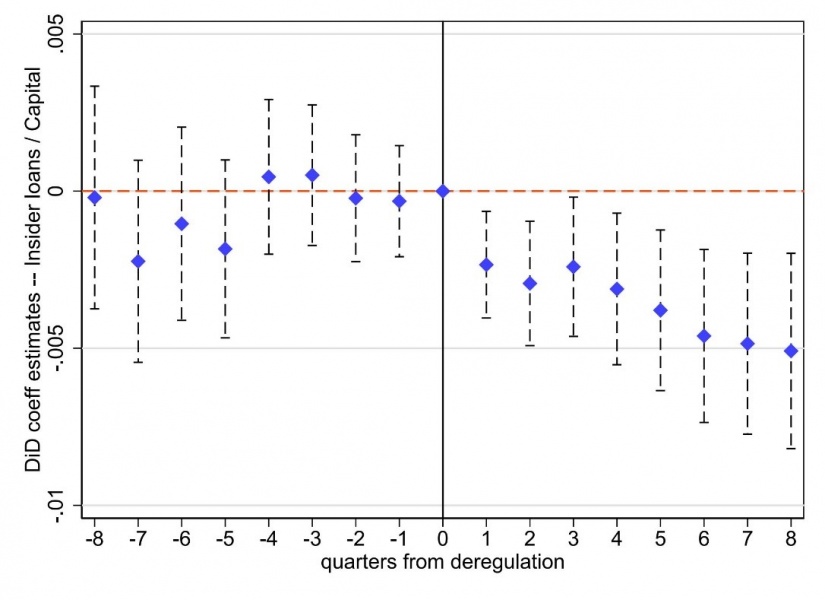

We implement a difference-in-differences approach and compare the level of insider lending between commercial banks headquartered in different states, which are thus exposed to different degrees of local banking market contestability depending on whether and how the home state implemented the IBBEA, at the same point in time. Figure 1 summarizes our findings. The blue dots describe the evolution of insider lending depending on the time distance from the quarter in which the bank’s home state deregulates. The figure also reports 95% confidence intervals. We can see that a significant decrease in the lending to insiders starts exactly after the bank’s home state deregulates, and that the effect increases in magnitude over time. Overall, our estimations indicate that following full deregulation, the average bank decreases insider lending by at least 3.2%.

Figure 1. The Effect of Greater Competition on Insider Lending

Notes: The figure shows the effect of greater competition on insider lending, estimated using our difference-in-differences approach. Time 0 is the last quarter before the bank’s home state deregulates for the first time and is taken as the reference quarter. The regression is estimated on a sample composed of commercial banks only, which runs from 1994Q2 to 2005Q2.

Source: Girotti and Salvadè (2021)

We also show that the reduction in insider lending is more pronounced for banks that are a priori more challenged by the entry of new competitors, corroborating the idea that banks reduce insider lending precisely to cope with greater market contestability. Specifically, we differentiate among banks depending on their market power and their funding structure. The entry of new competitors is a threat to monopolistic rents. Therefore, especially dominant banks and banks located in more concentrated markets should reduce wasteful corporate practices to preserve their level of profitability. Similarly, banks that obtain a larger part of their funding in the form of local retail deposits are more challenged by the entry of new competitors and should more strongly react to deregulation. In line with our conjectures, we find that the effect of deregulation on insider lending is stronger in banks with greater market power and banks that rely more heavily on retail deposit funding.

As a last step, we investigate the effects of deregulation on alternative measures of agency costs. The first measure we consider is the level of bank executive compensation. Agency problems can lead to higher executive compensation as managers may exert their power to extract rents in the form of higher pay. In line with the presence of lower agency costs when competition intensifies, we show that the level of bank executive compensation reduces after deregulation, and it is especially the part of pay more prone to rent extraction (i.e., perks and other personal benefits) to be affected. Agency problems may also cause cost inefficiencies as managers can put low effort to minimize costs and engage in non-profit maximizing behaviors. We consider the average cost of operating a branch office as a proxy for a bank’s operational inefficiencies. We document that a drop in such cost materializes right after deregulation, which suggests lower cost inefficiencies when competition intensifies. Overall, these results confirm that greater competition enforces discipline on bank insiders.

Our findings have at least two policy implications. First, they indicate that policies aimed at increasing banking market competition can be socially beneficial in reducing the misappropriation of bank resources by insiders. Second, they question whether a total prohibition of insider lending should be imposed.

General Accounting Office, 1994. “Bank Insider Activities: Insider Problems and Violations Indicate Broader Management Deficiencies.” Report, General Accounting Office, Washington, DC.

Girotti, M., & F. Salvadè, 2021. “Competition and Agency Problems Within Banks: Evidence from Insider Lending,” Management Science, forthcoming. https://doi.org/10.1287/mnsc.2021.4043

Jensen, M. C., 1986. “Agency costs of free cash flow, corporate finance, and takeovers.” The American Economic Review, 76(2), 323-329.

Murphy, P. A., 1980. “Insider loans: How restricted is the banker?,” Fordham Urban Law Journal, 9, 431.