Our study explores the implications of technological shifts towards greener and sustainable innovations on acquisition propensity between firms with different technological capacities. Using a dataset of completed control acquisition deals over the period of 2009-2020 from 23 OECD countries, we find that green acquirors (i.e., firms with green patents) are more inclined to enter into acquisition deals with green firms due to their technological proximity and informational advantages. However, after the Paris Agreement, green acquisitions by non-green acquirors increased especially from those in climate policy-relevant sectors and based in countries with low environmental standards. We also find that green acquisitions after the Paris Agreement do not show any significant impact on their post-acquisition innovation performances, raising concerns related to greenwashing behaviour by investing firms.

Climate change is increasingly impacting people’s lives, disrupting national economies and transforming ecosystems. The need for strong and co-operative action has never been higher. Recent OECD estimates indicate that around USD 6.3 trillion of infrastructure investment is needed each year until 2030 to meet development goals, increasing to USD 6.9 trillion a year to make this investment compatible with the goals of the Paris Agreement (OECD, 2018). In this context, corporate takeovers may foster the green transition as they allow firms to acquire external technological resources, complement internal research and development (R&D) projects, and accelerate the innovation process (Cassiman and Veugelers, 2006). Such technological resources include scientists, patent rights, and tacit knowledge embedded in organizational processes and routines. However, due to information-related frictions, technology acquirors face considerable challenges in identifying suitable target firms and in valuing their resources and synergy potential, particularly in deals which are outside their core areas of expertise (Gans et al., 2008). These challenges raise concerns about adverse selection, which might compromise the suitability of otherwise profitable deals.

In our study (Bose et al., 2023), we empirically explore the acquisition likelihood between firms with green and non-green innovation capacities, and the implications of the resulting technological shifts towards greener innovations on patenting activities post-acquisition. We focus on OECD countries, as OECD firms hold the vast majority of worldwide patents on climate change mitigation technologies. As per OECD (2022), the share of “high-value” climate change mitigation inventions (filed for protection in at least two jurisdictions) over all patented inventions has increased from around 4% in the early 1990s to over 9% in latest years, especially after the Paris Agreement. Our dataset is built using three databases provided by Bureau van Dijk namely Orbis, Zephyr, and Orbis Intellectual Property. It includes completed control acquisition deals (i.e., with a final stake of the target company above 50%) with target firms located in 23 OECD countries over the period of 2009-2020. Our data suggests an increasing trend in patenting activity over time for target and acquiror firms, especially after the Paris Agreement in 2016.

Technological acquisitions provide an opportunity for acquiror firms to avoid the costly process of internal technology development, to gain access to technological resources developed externally, to replace internal R&D, and to match complementary resources (Cassiman and Veugelers, 2006). Hence, empirical evidence shows that acquirors may avoid targets with unfamiliar technologies to lessen frictions in the market for corporate control and instead prefer to acquire technologically proximate firms (Bena and Li, 2014; Chondrakis et al., 2021). We contribute to this literature by exploring the role of green innovation on acquisition probability between acquirors and targets with different portfolios of Intellectual Property (IP). We study the likelihood of an acquisition deal between investor and target firms with overlapping green technology, as set out in hypothesis 1:

Hypothesis 1: Green acquiror firms (i.e., firms with green innovation) are more likely to acquire green target firms due to their overlapping green innovation.

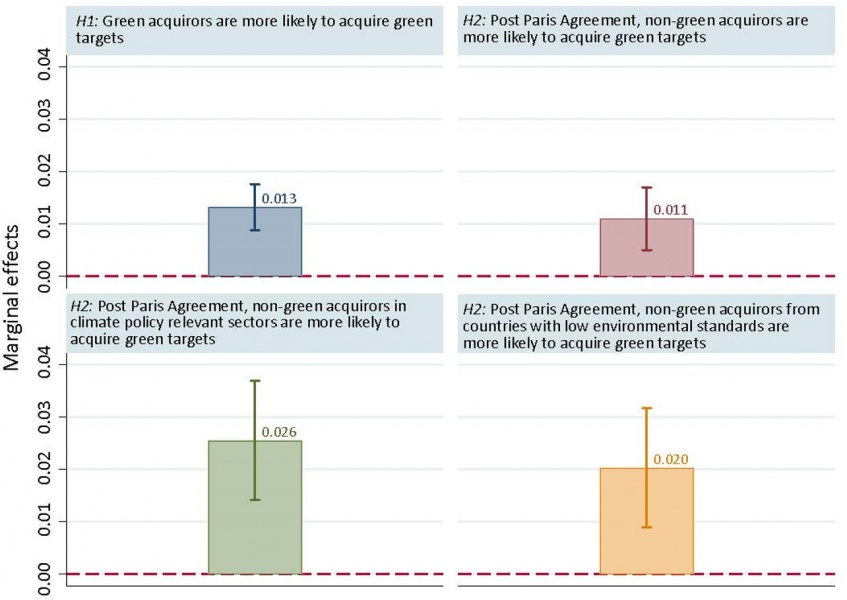

We estimate a probit regression model, which includes inverse probability weights (IPW) in order to account for potential endogeneity issues and self-selection bias in innovation decisions. Our results (as reported in Figure 1, bar 1) support this hypothesis, as they suggest that acquiror firms with green innovation are more likely to acquire green target firms. In terms of the economic magnitudes, green investors are 1.3 percentage points more likely to engage in acquisition deals with green target firms.

Figure 1: Probability of acquiring green targets

Note: This figure displays average marginal effects obtained implementing inverse probability weight probit models for a cross-sectional sample of acquisition deals. The vertical lines indicate 95% confidence intervals (if the confidence intervals contain zero, the coefficient is statistically insignificant). The first bar (on top left) displays the likelihood of a green acquiror of acquiring a green target (hypothesis 1). The remaining three bars display the likelihood of a post-COP21 acquisition of a green target by a non-green acquiror as mentioned in hypothesis 2. Climate policy-relevant sectors are defined following Battiston et al. (2017) and countries with low environmental standards are defined based on the environmental policy stringency index computed by the OECD (Botta and Kozluk, 2014). For further details please refer to Bose et al. (2023).

The Paris Agreement is an international agreement, which came into force in 2016. It represented the increased realisation among countries about the need of increased international cooperative action to fight climate change and to foster green transition. It was expected to result in public and private actions that implemented this green transition, and that promoted green-led economic growth1, using several measures such as government subsidies, environmental regulations, and low-carbon initiatives (Monasterolo and Raberto, 2019). This acceleration towards a greener economy is likely to encourage non-green firms to adopt more sustainable technology (including by through technological acquisitions of firms developing green IP) to continue their businesses while remaining aligned with the green economic and political momentum.

Past literature has established that after the implementation of new polices and regulations on climate, often firms in the most polluting sectors face higher costs related to pollution abatement projects as compared to other firms (Cadez and Guilding, 2017). Moreover, firms based in countries with low environmental standards may increase acquisitions of green firms to promote green innovation efficiency (Feng et al., 2018). Hence, we contribute to this literature by studying the acquisition likelihood between innovative firms after the Paris Agreement as discussed in the following hypothesis:

Hypothesis 2: After the introduction of the Paris Agreement in 2016, non-green acquiror firms are more likely to acquire green target firms, and this is more prevalent in high-carbon sectors and countries with low environmental standards.

The estimates displayed in Figure 1 (bar 2) show that after the introduction of Paris Agreement, non-green firms are more likely to acquire green targets by 1.1 percentage points supporting our hypothesis 2. Further, we show in Figure 1 (bars 3 and 4) that after the introduction of Paris Agreement, non-green acquiror firms in climate-policy relevant sectors and countries with low environmental standards are more likely to acquire green target firms, with an economic magnitude of 2.6 and 2 percentage points, respectively. Hence, we also find evidence in support of hypothesis 2.

As the Paris Agreement highlighted the willingness of governments to move towards a more sustainable world, is likely that non-green businesses felt the increasing pressure to implement or disclose information about their environmental-friendly production processes and environmental-friendly products. Sustainable green development requires firms to keep making capital investments on physical capital but also on R&D, which adds to their operational and management cost creating a financial burden (Zhang, 2022). However, green technology and products require verified evaluation standards, so greenwashing behaviour that could “rapidly improve” economic effects and the corporate image without taking up too much capital turns into a shortcut for some enterprises to implement “green development” (Zhang, 2022). The phenomenon of greenwashing among businesses can be defined as a discrepancy between words and deeds, which combines poor environmental performance and positive communication about the environmental performance (Guo et al., 2017). Hence, we focus on post-acquisition green innovation performance for both acquiror and target firms after the Paris Agreement as follows:

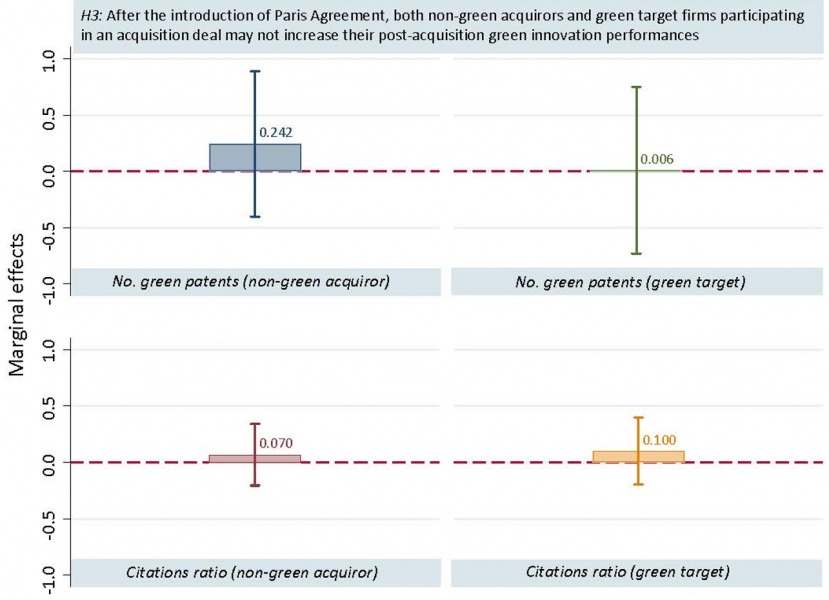

Hypothesis 3: After the introduction of Paris Agreement, both non-green acquirors and green target firms participating in an acquisition deal may not increase their post-acquisition green innovation performances.

As shown in Figure 2, we find that acquisitions of green targets by non-green acquirors after the Paris Agreement do not have any significant impact on the post-acquisition innovation performances of either party involved in the deal (regardless of the metric of innovation performance used), raising concerns related to greenwashing behaviour by firms. This result could also be indicative of a lack of complementarity between technologies of the investor and the target firm, which could explain a reduced number of green innovations post-acquisition.

We examine how the technological shifts towards greener innovation can influence the likelihood of acquisition between firms with different technological specialisation. We find that green innovative acquiror firms are more likely to enter into acquisition deals with target firms with overlapping green innovation, possibly due to their technological proximity and informational advantages. However, after the 2016 implementation of the Paris Agreement, we find an increase in the likelihood of acquisitions of green targets by non-green acquirors, which is more pronounced for firms in climate policy-relevant sectors and countries with low environmental standards. Further, acquisitions of green targets by non-green acquirors after the Paris Agreement do not show any significant impact on post-acquisition innovation performances, raising concerns about the suitability of these type of green technological acquisitions to help foster the green transition. We argue that this lack of impact could be related to greenwashing behaviour by non-green investing firms, or to issues related to post-acquisition dis-synergies.

The evidence provided in our study can be of interest to policymakers, as achieving net-zero emissions requires rapid economic and technological transformations. Given that green innovation is a strategic tool through which firms can achieve sustainable development, our findings support the view that corporate takeovers can foster green transition, as they constitute means for firms to acquire external technological sources that help to accelerate the innovation process. In particular, it is likely that the Paris Agreement helped to raise interest of non-green investors in acquisitions of green targets in the short-term, however it remains to be seen whether it also will help to achieve a higher green innovation momentum in the long-term. Therefore, the policy discussions highlighting potential concerns of greenwashing behaviour by businesses after the Paris Agreement that may undermine the green transition process are of relevance.

Figure 2: Absence of post-acquisition green innovation performances after the Paris Agreement: is it greenwashing?

Note: This figure reports coefficient values, after the Paris Agreement, implementing inverse probability weight OLS models for a cross-sectional sample of green acquisition deals (i.e. non-green investors acquiring a green target, as in Hypothesis 3). The vertical lines indicate 95% confidence intervals. The first two bars (top left and top right) display the increase in the total number of green patents post-acquisition for non-green investor and green target firms, respectively. The third and fourth bars (bottom left and bottom right) display the increase in the ratio of forward citations of green patents over the total number of green patents post-acquisition for non-green investor and green target firms, respectively. Considering that confidence intervals cross the zero lines, we find that acquisitions of green targets by non-green acquirors after the Paris Agreement do not have any significant impact on the post-acquisition innovation performances of either party involved in the deal, raising concerns related to greenwashing behaviour by firms. Source: Bose et al. (2023).

Battiston, S., Mandel, A., Monasterolo, I., Schütze, F., & Visentin, G. (2017). A climate stress-test of the financial system. Nature Climate Change, 7(4), 283-288.

Bena, J., & Li, K. (2014). Corporate innovations and mergers and acquisitions. The Journal of Finance, 69(5), 1923-1960.

Bose, U., Gregori, W. D. & Martinez Cillero, M. (2023). Does green transition promote green innovation and technological acquisitions?. Banco de Portugal, Working Paper, 2023/5.

Botta, E., & Kozluk, T. (2014), “Measuring Environmental Policy Stringency in OECD Countries: A Composite Index Approach”, OECD Economics Department Working Papers, No. 1177, OECD Publishing, Paris.

Cadez, S., & Guilding, C. (2017). Examining distinct carbon cost structures and climate change abatement strategies in CO2 polluting firms. Accounting, Auditing & Accountability Journal, 30(5), 1041-1064.

Cassiman, B., & Veugelers, R. (2006). In search of complementarity in innovation strategy: Internal R&D and external knowledge acquisition. Management science, 52(1), 68-82.

Chondrakis, G., Serrano, C. J., & Ziedonis, R. H. (2021). Information disclosure and the market for acquiring technology companies. Strategic Management Journal, 42(5), 1024-1053.

Feng, Z., Zeng, B., & Ming, Q. (2018). Environmental regulation, two-way foreign direct investment, and green innovation efficiency in China’s manufacturing industry. International journal of environmental research and public health, 15(10), 2292.

Gans, J. S., Hsu, D. H., & Stern, S. (2008). The impact of uncertain intellectual property rights on the market for ideas: Evidence from patent grant delays. Management science, 54(5), 982-997.

Guo, R., Tao, L., Li, C. B., & Wang, T. (2017). A path analysis of greenwashing in a trust crisis among Chinese energy companies: The role of brand legitimacy and brand loyalty. Journal of Business Ethics, 140(3), 523-536.

Monasterolo, I., & Raberto, M. (2019). The impact of phasing out fossil fuel subsidies on the low-carbon transition. Energy Policy, 124, 355-370.

OECD (2018). Financing Climate Futures: Rethinking Infrastructure. OECD Publishing, Paris. https://doi.org/10.1787/9789264308114-en.

OECD (2022). “Climate change” in Environment at a Glance Indicators. OECD Publishing, Paris. https://doi.org/10.1787/5584ad47-en.

Zhang, D. (2022). Environmental regulation and firm product quality improvement: How does the greenwashing response?. International Review of Financial Analysis, 80, 102058.

For further details on green growth, see: https://www.oecd.org/greengrowth/.