| Stage 1 | Stage 2 | Stage 3 | |

|---|---|---|---|

| Classification | performing | under-performing |

non-performing

|

| Expected Loss | 12 months | lifetime | lifetime |

| Interest Rate Calculation | gross book value | gross book value | net book value |

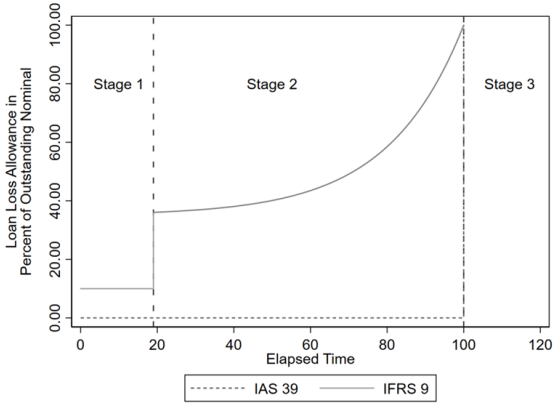

This paradigm shift in the loan loss provisioning has substantial implications for the financial sector, which are empirically analysed in this ECB Working Paper. In more detail, the revised accounting framework unleashes two opposing effects with regard to bank resilience. Figure 2 below illustrates them for the former IAS 39 and the newly implemented IFRS 9 accounting framework (cf. full and dashed line, respectively). On one hand, the recognition of expected, but not yet realised credit losses constitutes a notable front-loading effect in Stage 1. This accounting for unrealised losses possibly diminishes banks’ resilience by reducing their profitability and consequentially constraining their capital generation by means of retaining earnings. On the other hand, this very front-loading effect reduces the volatility of impairments. Because imminent credit losses are already partially reflected in the expected credit losses, the need for additional impairments is reduced as they build up more gradually, in particular in Stages 2 and 3. This feature likely increases banks’ resilience as they remain – in relative terms – more profitable at the onset of a crisis. As both effects are of opposing nature, this paper addresses a gap in the literature and investigates the net impact of the introduction of IFRS 9 in the context of bank resilience.

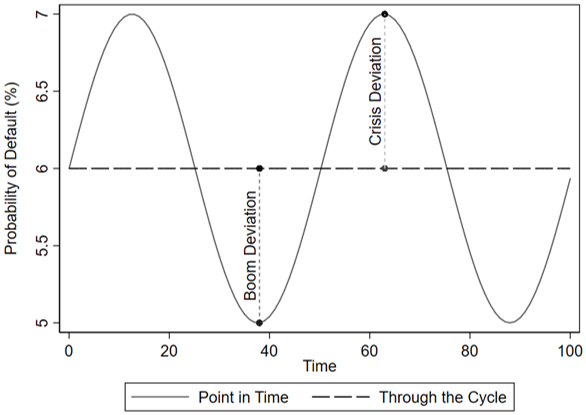

At the same time, our results indicate that, in the long-term, the advantages of a timelier recognition of loan losses under IFRS 9, increases bank resilience. In line with our prediction, the provisioning for expected losses reduces the actual loan loss provisioning at the onset of an economic downturn. As a result, banks become less constrained when the economy slows down, and thereby have the potential to act as a dampening factor, instead of amplifying the economic downturn by selling assets at distressed prices or overly tightening lending standards to maintain capital ratios. We find that this effect grows in magnitude, where the crisis is more severe, which appears also valuable from a macroprudential point of view. Taken together, these long-term benefits outweigh initial negative impacts expected in the short-term.

G20 (2009): Declaration on Strengthening the Financial System at the London Summit.

EBA (2018): First Observations on the Impact and Implementation of IFRS 9 by EU Institutions.

IASB (2018): Conceptual Framework for Financial Reporting 2018 – Basis for Conclusions.

BIS (2022): Countercyclical capital buffer (CCyB) according to: https://www.bis.org/bcbs/ccyb/.