In the wake of the global financial market turmoil in 2007-2009, all major central banks loosened their monetary policies by aggressively cutting the policy rates to historically low levels and by embarking on a series of unconventional monetary policy measures (UMPs) aimed at containing the risks to economic and financial stability. This column discusses the macroeconomic impact of UMPs implemented by the ECB after the crisis. While the effects of these measures are heterogeneous across the euro area economies, their impact on output and inflation has generally decreased over time. However, ECB’s UMPs have helped sustain the economic performance of euro area economies, by attenuating the negative impact of the financial crisis.

In the wake of the global financial market turmoil in 2007-2009 (GFC), all major central banks loosened their monetary policies by aggressively cutting the policy rates to historically low levels and, after reaching the zero lower bound (ZLB) on short-term interest rates, by also embarking on a series of unconventional monetary policy measures (UMPs) aimed at containing the risks to economic and financial stability. As UMPs have increasingly become the most important monetary policy instrument (Gambacorta et al. (2014)), quantifying their macroeconomic impact has posed new challenges to both empirical and theoretical models, the major difficulty being that there exist no well-defined instruments that can fully characterize a central bank’s unconventional policy stance. As to the transmission of UMPs to financial and economic activity, the literature has mainly focused on the interest rate channel, which, in turn, can be broken down in two main components: i) portfolio rebalancing, that operates through the term premia of targeted assets; ii) signaling, that relates to the ability of the central bank to shape expectations about the future path of interest rates.

A recent Banque de France working paper (Pagliari (2021)) assesses the relevance of UMPs announcements in the euro area (EA) between 2007 and 2019 along three dimensions: i) by documenting the relative importance of the portfolio rebalancing and signaling channels and assessing its variation over time in the euro area; ii) by providing evidence of the strong heterogeneity between core and peripheral EA economies; iii) by showing that ECB’s UMPs have improved the economic performance of peripheral economies.

The theoretical link across the portfolio rebalancing channel, the signaling channel and macroeconomic activity derives from the standard New Keynesian model, where both the output gap and inflation depend on expectations as well as on the difference between the policy rate and the natural rate of interest2. This relationship has become evident after the GFC, as it has been shown that market participants can extrapolate relevant information from the central bank’s announcements, with substantial impact on both expectations (Jarocí nski and Karadi (2020)) and the natural rate of interest. This is especially the case for UMP announcements (Nakamura and Steinsson (2018), Andrade and Ferroni (2020)).

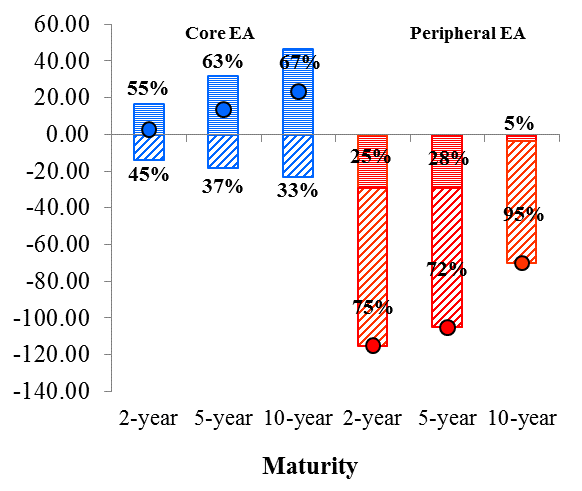

From an empirical standpoint, the portfolio rebalancing and signaling channels are identified by decomposing the European sovereign yields in two main factors: i) a term premium; ii) a risk neutral or expectation component3. In order to account for the inherent cross-country heterogeneity characterizing the Eurozone, member economies are sorted into two groups: core EA and peripheral EA countries4. An analysis of the behavior of term premia and risk-neutral yields around 16 UMP announcements5 highlights different dynamics in the yields of the two groupings. Generally speaking, ECB’s UMPs appear to have a much stronger negative impact on yields of the peripheral EA economies, with decreases mainly driven by risk-neutral yields across all maturities. Conversely, for core EA countries the overall effect is positive and mostly determined by increases in term premia, which are bigger the longer the maturity. Therefore, term premia and risk-neutral yields in core and peripheral EA tend to move in opposite direction around the UMPs announcements. Moreover, portfolio rebalancing seems to be stronger in core EA, whereas the signaling mechanism is more powerful in peripheral EA. Finally, UMPs are more impactful at shorter maturities in peripheral EA and at longer ones in core EA (Figure 1).

Figure 1: Changes of yields, term premia and expectation components for 2, 5 and 10-year maturities around UMPs announcements

Notes: for 2, 5 and 10-year maturities for all the UMPs events. All figures are in basis points. Percentage figures indicate the share of total change due to changes in the subcomponents. Legend: blue: Core EA; red: Peripheral EA; dots: fitted yields; horizontally striped bars: term premium; slanted striped bars: expectation component.

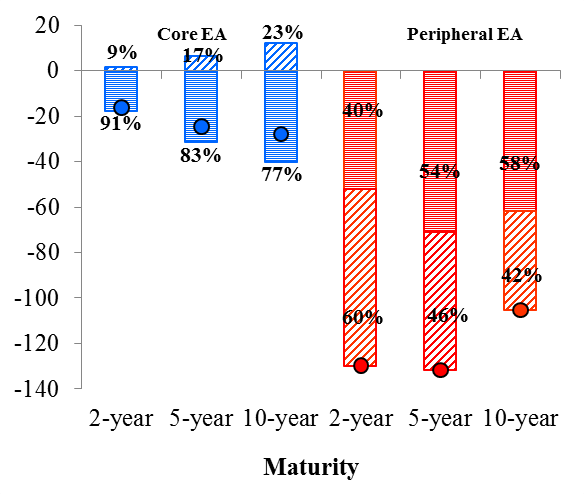

Figure 2: Event study results – changes of fitted spreads, term premium spreads and expectation component spreads for 2, 5 and 10-year maturities around UMPs announcements

Notes: Bars represents the sum of the event study regressions coefficients around the relevant policy announcements (significant at least at 10% confidence level). All figures are in basis points. Percentage figures indicate the share of total change due to changes in the subcomponents. Legend: blue: Core EA; red: Peripheral EA; dots: fitted spread; horizontally striped bars: term premium spread; slanted striped bars: expectation component spread.

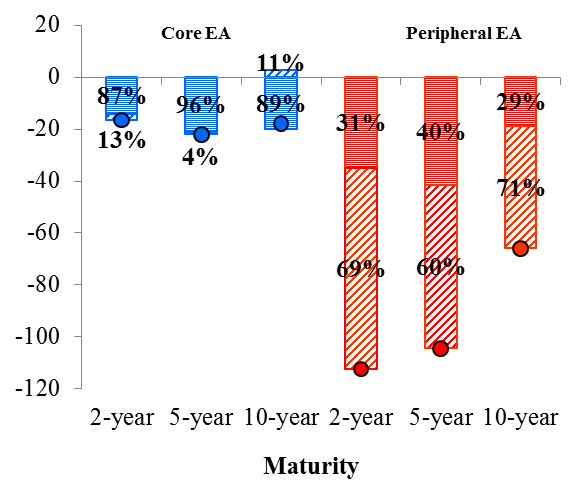

As Eurosystem’s unconventional monetary policy tends to influence intra-euro area spreads vis-à-vis Germany more than yields (Rogers et al. (2014)), additional evidence on the impact of UMPs is gathered by means of an event study for spreads around the main announcements from 2008 onward. Results show that term premia and risk-neutral spreads have reacted in a different manner across the two groupings, with the signaling channel being much stronger in the peripheral economies compared to the core countries. In addition, the portfolio and the signaling channels seem to operate in opposite directions for core EA economies, especially at longer maturities (Figure 2). However, the effect of UMPs have grown weaker over time in both groupings, as spreads movements triggered by UMPs have significantly changed after the kick-in of the ZLB in June 2014 (Figure 3).

There exist then two important types of heterogeneity characterizing the impact of UMPs in the euro area: 1) between groups, with movements in the spreads of peripheral EA being more pronounced compared to those for core EA; 2) over time, with far less pronounced effects on spreads after June 2014, in coincidence with the hitting of the ZLB, together with a change in the relevance of the portfolio rebalancing and signaling channels.

Figure 3: Significant changes of fitted spreads, term premium spreads and expectation component spreads for 2, 5 and 10-year maturities around UMPs announcements before and after the introduction of Negative Deposit Rate

| Before Negative Deposit Rate | After Negative Deposit Rate | |||||

|

|

Notes: All figures are in basis points. Percentage figures indicate the share of total change due to changes in the subcomponents. Legend: blue: Core EA; red: Peripheral EA; dots: fitted spread; horizontally striped bars: term premium spread; slanted striped bars: expectation component spread.

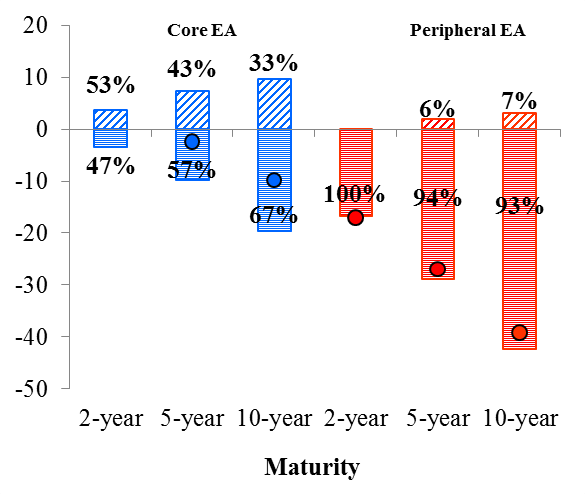

The impact of UMPs on output growth and inflation is assessed by setting up two structural monthly VAR models with time-varying parameters (TVP-VARs), one for core EA and one for peripheral EA, where UMP shocks are identified by leveraging on the event study results6. The structural identification is based on a set of “dynamic” zero and sign restrictions that are group and time-contingent. Notably, an UMP loosening: i) lowers the term premium spreads in both core and peripheral EA; ii) increases the risk-neutral yields in core EA after 2014; iii) decreases the risk-neutral yields in peripheral EA before 2014; iv) impacts output and inflation with a one-month delay, thus accommodating for possible anticipation effects of the ECB’s announcements.

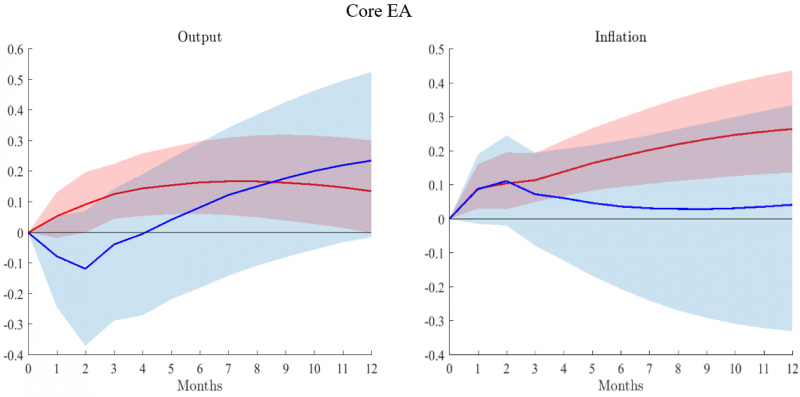

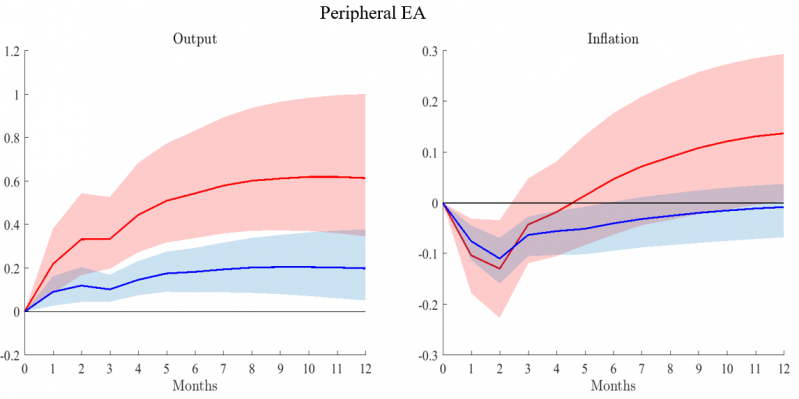

According to the results, the macroeconomic impact of ECB’s UMPs has significantly declined over time (Figure 4). In core EA, an UMP loosening has an expansionary effect on the economy only before June 2014, with industrial production and inflation increasing on average by 0.1pps and 0.2pps respectively one year after the shock. For peripheral EA, on the other hand, the impact of UMPs remains significant over time, although the macroeconomic response is more muted after June 2014, with output growth being much more impacted than inflation7. Against this background, a counterfactual experiment shows that the ECB’s UMPs implemented over the period 2014-2017 have helped attenuate the economic downturn in peripheral economies. Absent these measures, indeed, industrial production growth in these countries would have been on average about 0.7pps lower between January 2014 and June 2017.

After the 2007-2008 financial crisis, the ECB, like other major central banks, has employed a variety of unconventional monetary measures to address the freeze on the inter-bank market and, later on, to avert a severe sovereign debt crisis in the peripheral Member States. Starting from 2013, the ECB has implemented additional measures to boost the stagnating economic activity in the Eurozone and avoid a deflation spiral, thus providing stimulus for the recovery.

Pagliari (2021) sheds additional light on the macroeconomic impact of ECB’s UMPs, by showing that: i) the impact of UMPs on both core and peripheral economies has decreased over time, especially for the former group; ii) this trend has been mainly driven by a shutting down of the signaling channel of transmission after the introduction of the negative deposit rate in June 2014; iii) the measures implemented over the period 2014-2017 have avoided a more severe contraction in economic output for peripheral countries.

Figure 4: Median IRFs of output (left panels) and inflation (right panels) to a decrease in 10-year term spreads by 100bps.

Legend: red line: before June 2014; blue line: after June 2014. Notes:Shaded areas are 68% confidence bands. Source: Author’s calculations.

Andrade, P. and Ferroni, F. “Delphic and Odyssean monetary policy shocks: Evidence from the euro area”. Journal of Monetary Economics, 2020.

Ciccarelli, M. and Osbat, C. “Low inflation in the euro area: Causes and consequences”. Occasional Paper Series 181, European Central Bank, Jan. 2017.

Corsello, F., Neri, S., and Tagliabracci, A.“Anchored or de-anchored? That is the question”. European Journal of Political Economy, 69:102031, 2021.

Gambacorta, L., Hofmann, B., and Peersman, G. “The effectiveness of unconventional monetary policy at the zero lower bound: A cross-country analysis”. Journal of Money, Credit and Banking, 46(4):615–642, 2014.

Hasenzagl, T., Pellegrino, F., Reichlin, L., and Ricco, G. “Low inflation for longer”. Voxeu article, VoxEU.org, January 2018.

Hasenzagl, T., Pellegrino, F., Reichlin, L., and Ricco, G. “The inflation puzzle in theeuro area – it’s the trend not the cycle!”. Voxeu article, VoxEU.org, October 2019.

Jarocínski, M. and Karadi, P. “Deconstructing Monetary Policy Surprises – The Role of Information Shocks”. American Economic Journal: Macroeconomics, 12(2):1–43, April 2020.

Nakamura, E. and Steinsson, J. “High-Frequency Identification of Monetary Non-Neutrality: The Information Effect”. The Quarterly Journal of Economics, 133(3):1283–1330, 01 2018.

Pagliari, M.S. “Does one (unconventional) size fit all? Effects of the ECB’s unconventional monetary policies on the euro area economies,” Working papers 829, Banque de France, Sep. 2021.

Rogers, J. H., Scotti, C., Wright, J. H., Ellison, M., and Kara, H.“Evaluating Asset-Market Effects of Unconventional Monetary Policy: A Cross-Country Comparison”. Economic Policy, 29(80):749–799, 2014.

Contact: maria-sole.pagliari@banque-france.fr. This policy brief should not be reported as representing the views of the Banque de France (BdF) or the Eurosystem. The views herein expressed are those of the author and do not necessarily reflect those of the BdF or the Eurosystem.

Refer to Galí (2015) for details.

In Pagliari (2021), government yields are decomposed using four different arbitrage-free affine term structure models (TSMs). The best model is then identified as the one minimizing the root mean square error of the 1-year risk-neutral yields against the EONIA 1-year implied expectations (Lloyd (2017)).

Core EA includes: Austria, France, Germany, the Netherlands. Peripheral EA includes: Ireland, Italy, Portugal, Spain.

See Table 2 in Pagliari (2021).

The endogenous variables are: the 10-year term premium and expectation component spreads, the annual growth of industrial production and the annual HICP core inflation.

There results could be contextualized within the debate on the so-called “missing inflation puzzle” in peripheral EA (see Ciccarelli and Osbat (2017), Hasenzagl et al. (2018,2019), Corsello et al. (2019)).