Communication by central banks can support the maintenance of price stability. This empirical study assesses whether ECB’s communication on the balance of risks to price stability and to growth have helped to guide interest rate expectations. It shows that communication at press conferences provided useful orientation to observers concerning future policy decisions. In the absence of systematic forward guidance, the balance of risks to price stability conveyed in the Introductory statements was the best indicator to predict the ECB’s monetary policy decisions.

To achieve its price stability objective and to enhance the monetary policy transmission, the ECB communicates its assessment of the balance of risks to price stability and to growth at its regular press conferences. Our analysis estimates non-linear policy reaction functions and introduces novel ordinal indicators on the balance of risks to price stability and risks to growth, which have been coded from the ECB’s Introductory statements at press conferences.

The Governing Council’s collective assessment on risks to price stability and to growth can be captured with ordinal communication indicators, which have been coded from the indications of Introductory Statements for 224 meetings (January 1999 to December 2018). At press conferences, the President of the ECB regularly communicates the balance of risks looking forward, and states whether these risks are balanced, on the upside or on the downside. Conceptually, this communication differs from the signal provided by the ranges surrounding staff projections, which only capture the uncertainty concerning the outlook for economic growth and inflation. We follow the approach of previous papers examining the risks to price stability for the euro area (Gerlach, 2007; Fischer, Lenza, Pill and Reichlin, 2009) and focus on communication at press conferences immediately after the Governing Council decision meetings, which provides the cleanest communication signal (Ehrmann and Fratzscher, 2009).

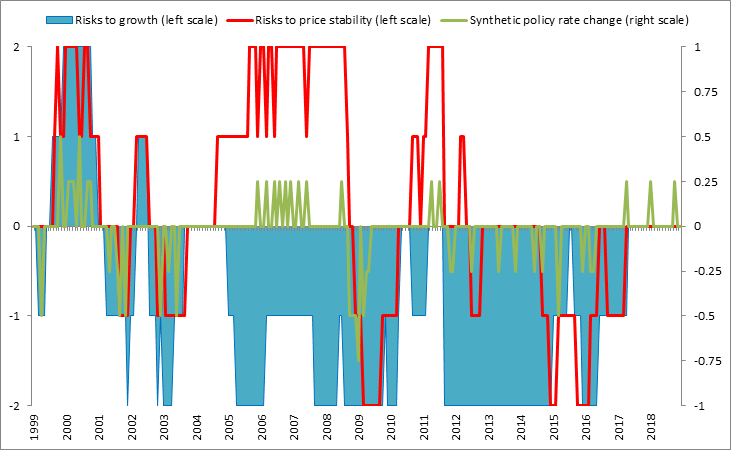

Our indicators (see Figure 1) map the balance of risks on a discrete scale with five values from -2 to +2. The value 0 means that the Governing Council judges that, accounting for the monetary policy measures possibly taken on that day, the risk assessment is balanced. A value of -2 corresponds to large downside risks, -1 to downside risks, +1 refers to upside risks, and +2 to large upside risks to price stability and economic growth, respectively. The distinction between risks and “large” risks is based on an overall reading of the Introductory statement, if it was not explicitly stated therein.

Figure 1: The ECB’s balance of risks and changes in the synthetic policy rate

(ordinal scale (lhs); percentage points (rhs))

Notes: The balance of risk indicators are lagged by one month and changes in the synthetic policy rate are relative to the previous month. Source: ECB and own calculations.

A comparison of ECB policy decisions with the lagged balance of risks (see Figure 1) reveals a close match between ECB post-meeting communication (“words”) and actions (“deeds”) at the next meeting. The ECB typically responded to upside (downside) risks to price stability with hiking (lowering) interest rates in line with its primary objective of price stability. Although risks to price stability and to growth have often pointed in the same direction, we identify some episodes when both risks gave contradicting indications (i.e., during 2005-2009 and 2010-2012). In case of conflict, the ECB decisions typically followed the indications from the risks to price stability.

For robustness, we also considered alternative indicators to capture the Governing Council’s risk assessment. Other metrics exist in the literature, applying linguistic algorithms to measure the sentiment of policy deliberations in the form of quantitative communication indicators of central bank communication. As alternative measure, we considered the KOF monetary policy communicator (Lamla and Lein, 2011). It is, however, only available for the risks to price stability, and displays inferior performance relative to the ECB’s balance of risks to price stability.

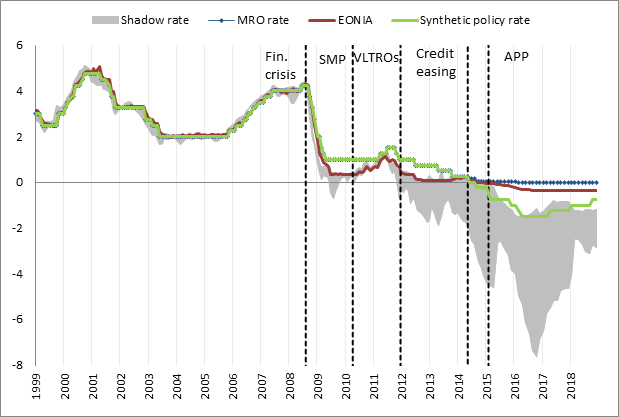

In the presence of unconventional monetary policy measures, monetary policy decisions can no longer be summarized by the adjustment of the policy rate. The ECB’s main instrument since 1999 is the interest rate on the main refinancing operations in which banks borrow money from the Eurosystem. Since the global financial crisis, the ECB has additionally taken non-standard measures to ensure the transmission of the policy rate signal to the economy.

To capture the ECB’s signal of its monetary policy stance, we construct a synthetic policy rate, which is equal to the main refinancing (MRO) rate for the period until the Effective Lower Bound (ELB) was first reached (in July 2013), as from which we use the concept of shadow rates as summary indicator (see Figure 2). We use the shadow rate of Lemke and Vladu (2017), which captures the notion of an effective lower bound at negative interest rates. Looking at available estimates, there is considerable variation across models, as illustrated by the min-max-corridor including point estimates of the shadow rate for the euro area from three different researchers.

Figure 2: ECB policy rates, the overnight market interest rate, and shadow rates

(in percentage per annum)

Notes: The synthetic policy rate is equal to the MRO rate before July 2013 and then to the shadow rate of Lemke and Vladu (2017). The corridor of shadow rates pictured as the grey area is formed by that measure as well as those of Krippner (2019), and Wu and Xia (2016) for the euro area. Source: ECB and own calculations.

A central bank reaction function allows to identify those key factors according to which policy is changed. Our approach analyzing the role of communication on risks in monetary policy decision-making rests on estimated, non-linear reaction functions for the ECB – using ordered Probit models. The approach allows testing whether certain indicators were effectively considered by ECB policymakers at policy meetings. Our benchmark model only includes variables monitored in the economic and monetary analysis of the ECB, namely projected inflation and real GDP growth, money (or credit) growth, and the federal funds rate as proxy for international interest rate linkages. However, tracking monetary policy decisions solely based on such macroeconomic variables, as in Taylor-type rules, is suboptimal, because it means focusing on a description of the euro area economy that ignores risks, thus failing to capture the risk management nature of policymaking. Therefore, our enhanced model adds indicators on the balance of risks, thereby capturing the judgmental risk assessment of the Governing Council.

The main findings of the study (for technical details see Cour-Thimann and Jung, 2021) can be summarised as follows:

Acknowledging the risk management nature of monetary policy decision-making, we show that communication at press conferences conveys information relating to risks that a selection of quantitative economic variables may not contain. In order to derive this result, we estimated non-linear empirical reaction functions for the ECB’s policy rates and augmented them with indicators on the balance of risks. We show that these indicators were a better guide to explain where the ECB was heading to in its future monetary policy decisions than macroeconomic projections or communication indicators based on media analysts’ reading of the balance of risks to price stability. Our results provide evidence that the ECB’s communication on the balance of risks at press conferences has contributed importantly to the transparency and effectiveness of its monetary policy – providing reliable information to observers on the future policy course.

Cour-Thimann, P. and A. Jung (2021): Interest-rate setting and communication at the ECB in its first twenty years, European Journal of Political Economy, in press, available at:

https://www.sciencedirect.com/science/article/pii/S0176268021000409?via%3Dihub.

Ehrmann, M. and M. Fratzscher (2009): Explaining monetary policy decisions in a press conference, International Journal of Central Banking, 5(2), 41-84.

Gerlach, S. (2007): Interest rate setting by the ECB: words and deeds, International Journal of Central Banking, 3, 1-45.

Krippner, L. (2019): Comparison of international monetary policy measures. Reserve Bank of New Zealand, available at: https://www.rbnz.govt.nz/research-and-publications/research-programme/additional-research/measures-of-the-stance-of-united-states-monetary-policy/comparison-of-international-monetary-policy-measures.

Lamla, M. and S. Lein (2011): What matters when? The impact of ECB communication on financial market expectations, Applied Economics 43 (28), 4289-4309.

Lemke, W. and A. Vladu (2017): Below the Zero Lower Bound: a Shadow-rate Term Structure Model for the Euro Area, ECB Working Paper No. 1991.

Wu, C. and F. Xia (2016): Measuring the macroeconomic impact of monetary policy at the zero lower bound, Journal of Money, Credit and Banking, 48(2-3), 253-291.

The views expressed by the authors are their own and do not necessarily reflect those of the ECB or the Eurosystem. The authors remain responsible for any errors or omissions.