This brief should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

While parliamentary hearings are a fundamental tool to hold central banks accountable, an analysis on what type of information central banks provide in these fora has not been conducted so far. In Fraccaroli et al. (2022) we explore this issue focusing on the case of the European Central Bank (ECB). Based on different text analysis techniques, we compare the communication of the ECB in the European Parliament hearings to its communication in the regular press conferences that follow monetary policy decisions.

We find that the ECB uses parliamentary hearings to proactively discuss topics that are less covered in press conferences. Our evidence also shows that the ECB does not use the hearings to communicate new policy stances or to use simpler language that is more understandable to the wider public. Overall, the ECB mainly uses the hearings to further explain its policy decisions first presented in press conferences and to put them in a broader context.

The regular hearings of the European Central Bank (ECB) in the European Parliament (EP) are arguably the main mechanism in place to hold the central bank accountable (BIS 2009; Fraccaroli et al. 2018). Although during these hearings the ECB President faces the Members of the European Parliament (MEPs), the central bank potentially communicates to multiple audiences. Since the hearings are streamed live on a freely accessible online platform and the introductory statements of the ECB President are published, the potential audience includes not just MEPs, but also the media, financial markets and, more broadly, European citizens.

But what does the ECB use its speeches in the parliamentary hearings for? While there has been growing interest in exploring central banks’ parliamentary hearings (Fraccaroli et al. 2020; 2022; Schonhardt-Bailey 2022; Ferrara et al. 2021), the way that the central bank proactively uses those hearings is still unexplored. There are three different hypotheses. The ECB could use the hearings to explain with a simpler language its monetary policy decisions as it addresses the broader European public. Second, the ECB could use the hearings as another tool to signal shifts in policy stances. Under this hypothesis, the function of the hearings would be similar to that of the press conferences. While this may seem odd in an accountability context, the Federal Reserve announced new policies during its congressional hearings, setting a precedent (Claeys et al. 2014). Third, the ECB could use the hearings to further explain its monetary policy decisions while discussing in more details topics that are less the focus of press conferences.

In a recent paper, we test these hypotheses using text analysis techniques on the introductory statements of the ECB President before the regular hearings at the EP (Fraccaroli et al. 2022). We compare the text-based scores of these statements with those of the ECB President’s statements during press conferences. In this way, we can identify how the ECB speaks differently in terms of language complexity, policy stances and sentiments, and topics when in parliament compared to press conferences. The comparison of the ECB’s introductory statements at the EP and in press conferences is helpful to understand how the central bank decides to communicate in its main accountability forum.

To this end, we collect the text of the transcripts of the hearings and press conferences from the very first press conferences and hearings, starting in 8 July 1998, up to 27 September 2021. The final dataset contains 339 statements, 249 of which are press conferences, and 90 of which are hearings, which are less regular.

We obtain a quantitative indicator of language complexity based on the number of sentences, syllables and words in each text (see Kincaid et al. 1975). We compute a similar index that considers how complex each word in a text is (Gunning 1952).1 In order to capture policy stances and sentiments we look at the co-occurrence of key terms that may suggest a hawkish or dovish policy stance as well as a positive or negative interpretation of the economic outlook. To measure how much the ECB focuses on a specific topic, we look at the frequency at which certain key terms occur in a text. For instance, to assess how much the ECB talks about price stability we count words like ‘inflation’ or ‘prices’.

Our findings show that when in parliament the ECB speaks more about topics that are less covered in press conferences.

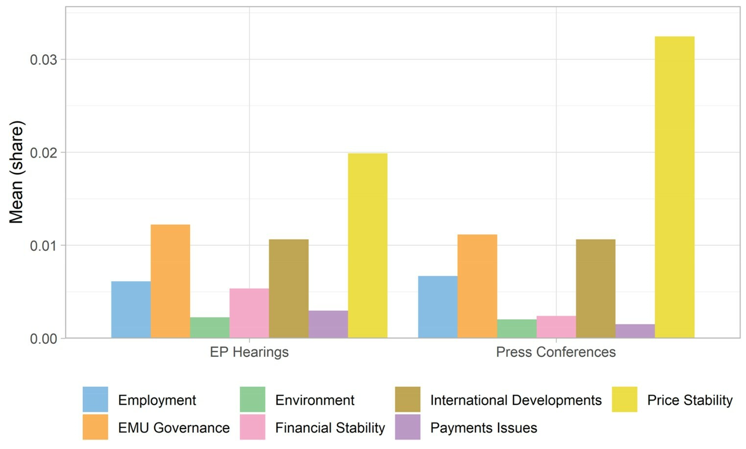

Figure 1 shows that price stability is the most frequent topic in both the hearings and press conferences, which confirms that the hearings retain a key focus on explaining the rationale for monetary policy decisions in line with the ECB’s primary mandate of preserving price stability and the EP’s role as primary counterpart for ensuring accountability.

But the figure also shows that topics such as financial stability and payment issues represent a higher share of terms used in hearings, signaling that additional weight is placed on those topics in the EP context, consistent with the ECB’s role in advising the EU legislator on financial legislation.

All in all, it thus emerges that the ECB uses the hearings to further explain its monetary policy decisions, while discussing in more details topics that are less the focus of press conferences.

Figure 1: Average Focus on Topics in EP Hearings and Press Conferences

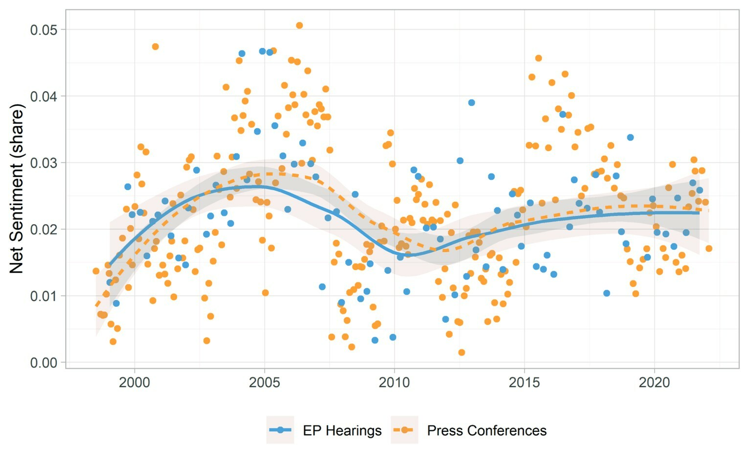

Figure 2: Net sentiments in EP Hearings and Press Conferences, 1998-2021

On the other hand, we do not find major differences in the ECB’s policy stances in the two fora. This means that the ECB displays a policy stance in the hearings that reflect that of press conferences. We find a similar result for sentiments (Figure 2), thus indicating that the ECB does not use the hearings, whose main function is accountability, to communicate new policy stances to markets.

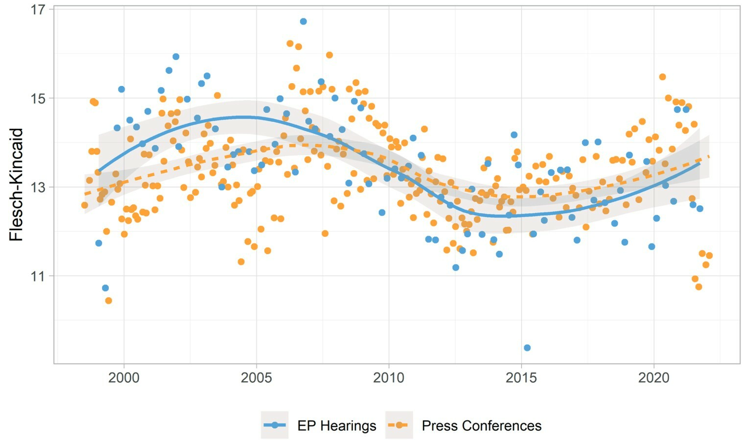

Language complexity also presents very similar trends across the two types of speeches (Figure 3). In both fora, language complexity progressively decreased from 2005 onwards. However, this decline was sharper for parliamentary speeches, that reached the lowest complexity score of the whole sample in 2015. While in the period before the Great Recession (1999-2007) parliamentary speeches tended to be more complex than press conferences, they became on average less complex in the years that followed.

The similarity in the degree of complexity suggests that the ECB does not use the parliamentary hearings to communicate in simpler terms to MEPs or the broader public.

Figure 3: Language Complexity in EP Hearings and Press Conferences based on the FK index of language complexity, 1998-2021

In the final part of our paper, we analyze how these measures have behaved during the Covid-19 period.

Although it is early to assess how the ECB’s communication has changed with the Covid-19 pandemic, we show some preliminary trends. The focus on price stability, financial stability and employment has rapidly increased in both types of speeches at the beginning of 2021. This likely stems from the volatility that the pandemic shock has implied for inflation dynamics, employment and financial markets. In line with the previous results, policy stances in the hearings tend to reflect those of the press conferences. We document a sharp reduction in language complexity both in press conferences and in the hearings in 2021, likely reflecting the outcome of the ECB’s Strategy Review. Future works could assess whether these changes will be sustained over time.

The comparison of the ECB’s introductory statements at the EP and in press conferences is helpful to understand how the central bank decides to communicate in its main accountability forum. This decision is not trivial, as the audience of the hearings is heterogeneous and includes MEPs, market participants, the media, and the European public. In this article we have shown that the ECB uses the hearings to provide more information on aspects of its policy that are less covered in press conferences, such as the implications of its policy for financial stability, EMU governance or the environment.

In addition, our findings are helpful in showing what the ECB does not do in the hearings. The ECB does not use much simpler language in hearings and the recent simplification in the language used by the central bank has affected both press conferences and parliamentary hearings. Moreover, the ECB tends not to use the hearings to signal shifts in its policy stance. While this is likely to decrease the media attention to the hearings, it is not necessarily a negative sign for accountability. If the central bank were to use the hearings to signal changes in its policy intentions, it would certainly attract more attention, but not for accountability purposes.

Bank for International Settlements. (2009). Issues in the governance of central banks. BIS Report, 18 May.

Claeys, G., Hallerberg, M., & Tschekassin, O. (2014). European central bank accountability: How the monetary dialogue could be improved. Bruegel policy contribution. Issue, 2014/04, 1–12.

Ferrara, F., & Angino, S. (2021). Does clarity make central banks more engaging? Lessons from ECB communications. European Journal of Political Economy 74, 102146. https://doi.org/10.1016/j.ejpoleco.2021.102146

Ferrara, F., Masciandaro, D., Moschella, M., & Romelli, D. (2021). Political voice on monetary policy: Evidence from the parliamentary hearings of the European central bank. European Journal of Political Economy 74, 102143. https://doi.org/10.1016/j.ejpoleco.2021.102143

Fraccaroli, N., Giovannini, A., & Jamet, J. (2018). The evolution of the ECB’s accountability practices during the crisis. ECB economic bulletin. Issue, 5/2018), Article 1, European Central Bank.

Fraccaroli, N., Giovannini, A., Jamet, J., & Persson, E. (2020). Central banks in parliaments: A text analysis of the parliamentary hearings of the bank of England, the European central bank and the federal reserve. ECB Working Paper, 2442, European Central Bank, July 2020, 1–52.

Fraccaroli, N., Giovannini, A., Jamet, J., & Persson, E. (2022). Ideology and monetary policy: The role of political parties’ stances in the European central bank’s parliamentary hearings. European Journal of Political Economy 74, 102207. https://doi.org/10.1016/j.ejpoleco.2022.102207

Fraccaroli N, A Giovannini, J-F Jamet and E Persson (2022). Does the European Central Bank speak differently when in parliament? The Journal of Legislative Studies, DOI: 10.1080/13572334.2022.2107809

Gunning, R. (1952). The technique of clear writing. McGraw-Hill.

Kincaid, J. P., Fishburne, R. P., Rogers, R. L., & Chissom, B. S. (1975). Derivation Of New readability formulas (automated readability index, Fog count And flesch reading ease formula) For navy enlisted personnel. Research Branch Report 8/75. Chief of Naval Technical Training: Naval Air Station Memphis.

Schonhardt-Bailey, Cheryl. (2022). Deliberative accountability in parliamentary committees. Oxford University Press.