Money growth, as measured by the M3 aggregate, has reached an all-time high in recent months, reflecting the ECB’s activist response to the coronavirus pandemic. This Policy Note considers whether the rapid money growth will cause a significant rise in inflation. Although much depends on policy decisions yet to be taken, past relationships between money and the price level argue that forecasting 5% inflation can be justified.

Among Milton Friedman’s many controversial statements, one stands out for its intellectual provocation. In a 1982 volume co-authored with Anna Schwartz, on Monetary Trends in the United States and the United Kingdom, he examined money supply statistics going back over a century. On their basis he said that the assumption of a constant velocity of circulation of money was “an impressive first approximation”.1 In other words, changes in money are accompanied by the same proportionate change in national income, as in naï ve statements of the quantity theory of money. If the quantity of money rises by 10 per cent in a year, then so will national income; if the quantity of money triples, then so will national income; and so on. Dozens of scholars have responded by checking the data, with the resulting consensus being that Friedman was overstating the case.2 As numerous examples can be cited of significant changes in velocity, movements in money do not always portend exactly similar movements in nominal national income or inflation. However, perhaps the critics went too far. Let us – for the purposes of this comment – suspend the disbelief and consider sympathetically the possible relevance of the quantity theory to European monetary developments.

It is important to note a qualification that Friedman inserted into the discussion. As economies advance, self-sufficient kinds of production – such as subsistence farming – diminish in importance. People, companies and regions tend to specialize and to become more interlinked. Transactions rise relative to output, enhancing the role of payment services provided by banks. In the long run bank deposits – the main form of money nowadays – therefore tend to increase faster than national output. In his 1959 Millar lectures Friedman made a bold conjecture which has proved correct. He said that a broadly-defined measure of money would rise in the USA by about 1 per cent a year more than national output because of the influence of (what might be termed) “financialization”.3

Another proviso is that the ratio of money to output depends to some extent on the rigour of financial regulation. Financial liberalization intensifies competition between banks, and forces them to narrow loan margins and to improve their services. The result may be a rise in the ratio of money to output until the impetus from liberalization has been spent. As far as Europe is concerned, there is little doubt that, in the early years of the 21st century, for several of its members – including such nations as Spain, Greece and Portugal – membership of the new single currency area constituted a major financial liberalization. (Banks were no longer instructed to keep a proportion of their assets in government securities, they started to receive interest on their cash reserves, and so on.)

Let us drop the claim of a constant velocity of circulation. Let us instead take a more cautious view, and suggest that the velocity of circulation would be roughly stable over the medium term, if it were not for the points about financialization and financial liberalization that have just been made. In other words, when we look at the data for the Eurozone we would expect velocity to fall, but – apart from occasional cyclical wobbles – we would not expect the rate of fall over the medium term to be much more than 1 or 2 per cent a year. What do the numbers say?

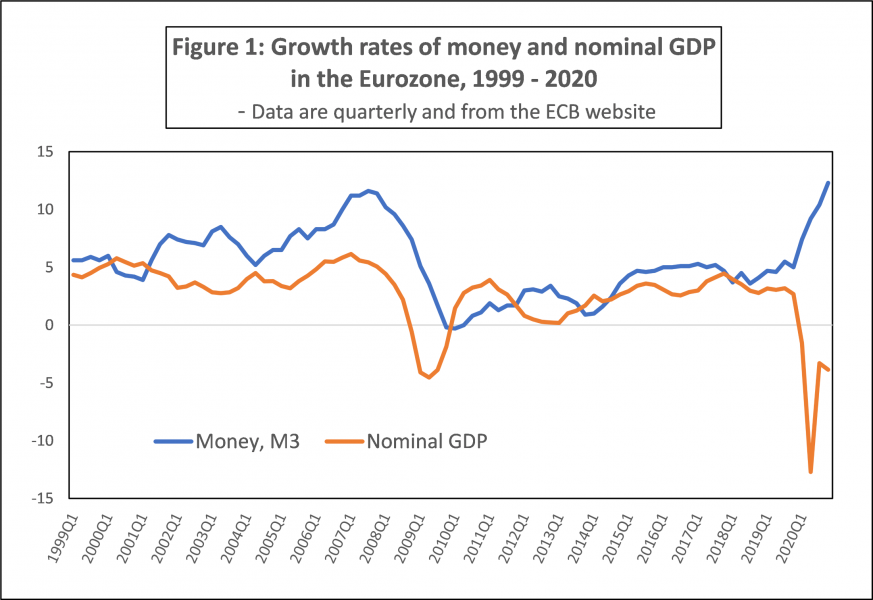

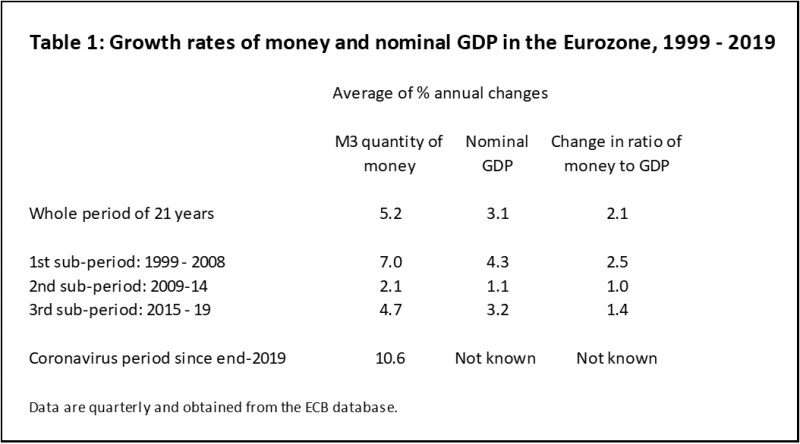

A chart of the annual changes in money and nominal gross domestic product is provided in Figure 1, with the M3 measure adopted for the present discussion. The year-by-year correlation is poor, but the series are still related.4 Money has on average risen more rapidly than national income, in line with the argument in the opening section, and the excess growth was particularly evident in the euro’s first decade. This agrees with the idea that the introduction of the new currency involved financial liberalization, which helped banking – and bank deposits – to grow faster than the whole economy for some years. Another salient feature is that a plunge in money growth coincided with the Great Recession, prompting the hypothesis of a causal connection of some sort.5

As far as money growth is concerned, the 21 years of the euro’s existence until the end of 2019 split into four periods. The first, from the beginning of 1999 to the third quarter of 2008, had an annual rate of money growth of 7.0 per cent; the second, from the onset of the Great Recession to the end of 2014, saw the annual rate of money growth dip to a tiny 2.1 per cent; and the third covered the five years to end-2019, when annual money growth averaged 4.7 per cent. A final period is remarkable. It runs from the start of 2020 and corresponds to the period of the coronavirus epidemic. In this final brief period of five quarters money’s annual rate of increase has been in the double digits per cent, plainly very high by the Eurozone’s previous standards.

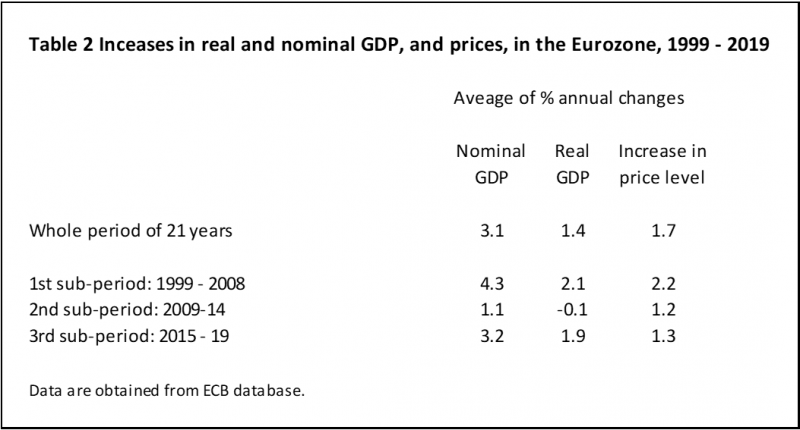

The quantity theory of money implies that the first and third periods should have had the highest increases in nominal national income, and the middle six-year period the lowest. The middle period might also have experienced negligible increases in the price level or even occasional falls. After all, if the trend behaviour is for velocity to fall by 1 per cent a year, a 2 per cent increase in money implies a 1 per cent increase in nominal national income, as was in fact recorded. Further, if an annual increase in output of about 2 per cent is achieved (which might be seen as normal in mature industrial societies), a 1 per cent increase in nominal national income means falling prices. In the event output did not grow at all in the 2009 – 14 period and some falls in the price level did happen. The Eurozone’s outcomes in the early 2010s were not exactly as the quantity theory might have predicted, but they were certainly open to interpretation from a quantity-theoretic perspective.

The plunge in the growth of credit and money after the Great Recession was so severe that by mid-2011 the Eurozone faced an existential crisis. Mario Draghi assumed the job of ECB president on 1 November 2011. He realized that radical steps had to be taken to ease the pressures on the most vulnerable banks in the weakest countries. Within a few weeks of his appointment he announced what became known as “the Draghi bazooka”, a huge programme of long-term, low-cost loans (a.k.a., “long-term refinancing operations”, or LTROs) from the ECB to any bank in the Eurozone that might want the money.

Here was the first of two vital crutches for the seemingly crippled Eurozone. Banks were given more time to meet official demands for higher capital ratios, and by 2014 the mood of emergency and fears of financial disintegration had gone. But the Draghi bazooka enabled banks only to fund their existing levels of business. Although it did prevent too sharp declines in loans and deposits, it did not spark renewed growth in banks’ asset portfolios or the quantity of money. In April 2014 Draghi started to speculate in public about the case for large-scale ECB asset purchases, citing the success of comparable schemes already implemented under the “quantitative easing” label in the USA and the UK. An increase in money growth might not fully restore the happy conditions in the first period of the Eurozone’s existence, from 1999 to 2008, but it might improve demand and output, and combat the vicious deflationary processes then being visited particularly on Greece and Cyprus.

The ECB started buying assets on an immense scale in early 2015. For a time these purchases ran at a rate of €80 billion a month, equivalent at an annual rate to almost €1 trillion. When a central bank buys assets from non-bank companies and financial institutions, and funds those purchases by issuing cash reserves to commercial banks, the effect is to boost the bank deposits held by the companies and financial institutions selling the assets. In other words, the effect is to increase the rate of growth of the quantity of money. The ECB asset purchases – the second crutch for the Eurozone’s struggling banking system and economy – explain why money growth revived to an almost 5 per cent annual rate in the third period of the single currency’s existence. In line with quantity-theoretic principles, the higher rate of money growth was accompanied initially by above-trend growth of demand and output, and rising employment. The asset purchases (Eurozone QE, in effect) seem to have revitalised the patient. Instead of hobbling around on its last legs, the single currency area recorded good economic growth. Output was up by 1.8 per cent in 2016 and 2.3 per cent in 2017, fully matching the performance of the United States of America.

Christine Lagarde became ECB president on 1 November 2019. Within weeks, the spread of the Covid-19 virus from China upended macroeconomic forecasts around the world. Lockdown and social distancing restrictions had devastating effects on certain economic sectors, and the ECB faced the new challenge of combating recession and mitigating unemployment. Given the apparent effectiveness of LTROs and asset purchases during the Draghi presidency, Lagarde secured the support of the Governing Council for the return of these measures on an even larger scale.

On 18 March 2020 the ECB announced the launch of a Pandemic Emergency Purchase Programme (PEPP), covering both private and public sector securities, to counter – in the words of one of its press releases – “the negative forecast for the Eurozone caused by the outbreak and expansion of the coronavirus pandemic”. The PEPP was accompanied by an expansion of the LTRO scheme. Between 13 March 2020 and 19 March 2021, the ECB’s total assets went up €4,704.2 billion to €7,162.2 billion. “Securities held for monetary policy purposes” rose within these assets from €2,697.4 billion to €3,906.4 billion, while the figure for LTROs climbed from €724.6 billion to €1,792.2 billion. The increase in the size of the ECB’s balance sheet was therefore larger than the increase in M3 in the year to March, which was €1,263.7 billion. Indeed, the marked acceleration in money growth could not have occurred without the ECB’s operations.

The ECB pays no attention to money growth in its current decision-taking. Arguably, the indifference to money growth is worrying for at least two reasons. First, evidence can be provided – as in this note – that in the Eurozone a medium-term relationship obtains between the growth of M3 money and nominal GDP. The relationship recalls themes of the monetarism championed by Milton Friedman in a long and influential career. Admittedly, the short-term volatilities in the velocity of circulation are obvious in the data. But over periods of several years velocity tends to revert to a figure consistent with underlying stability in money-holding behaviour, where this stability is qualified by the “financialization” thesis. Secondly, the ECB has rejected the Bundesbank’s approach to inflation control in the 30 years before the euro. In that approach money growth was targeted, and slow and stable growth of the quantity of money was deemed essential to limit inflation and reduce macroeconomic instability. The so-called “monetary pillar” of ECB policy-making was dropped in 2003 and has now been largely forgotten by the ever-changing membership of the Governing Council.

Eurozone M3 growth was 12.3 per cent in the year to end-2020. Announcements have been made in 2021 that the ECB plans to step up asset purchases within the PEPP “envelope” of €1,850 billion now agreed by the Governing Council. In other words, asset purchases are to run at a higher level than in the first quarter. Since M3 rose by just over 1.4 per cent in the first three months of the year (i.e., at an annualised rate of 5.8 per cent), a reasonable view is that M3 growth in the year to end-2021 might be 8 per cent. Let us assume that medical normality is resumed in early 2022 and that in the three years 2022 to 2024 inclusive M3 growth proceeds at the same rate as in the five years to end-2019, that is, at 4.7 per cent a year. The average annual growth rate of M3 in the five years to end-2024 comes out – from these assumptions – at just under 7 per cent.

Suppose we retain the “financialization” assumption and expect money to grow 1 per cent a year higher, on average, than nominal GDP. Then the implied average growth rate of nominal GDP in the five years 2020 to 2024 inclusive is 6 per cent. The annual increase in price level will be equal, more or less, to the annual increase in nominal GDP minus the annual increase in real output. The increase in the real output in the 2021-24 period is of course uncertain. But a big bounce-back from 2020’s output drop of 6.6 per cent is to be envisaged when vaccination programmes become fully effective, probably in 2022. Let us conjecture – for the sake of argument – that the average rate of output growth in the five years will be 1½ per cent. This may seem pessimistic, but it is in fact slightly above the 1.4 per cent average in the decade 2010 – 2019, while a more pessimistic view could be justified by the Eurozone’s increasingly adverse demographic position.

On this basis the average inflation rate in the five years would be about 4½ per cent a year. The Eurozone’s harmonised index of consumer prices fell in the year to December 2020 by 0.3 per cent. By implication, some catch-up would be expected in the four years to 2024, and inflation of 5 per cent or more at some stage emerges as a result.

The conclusion just drawn – which is intended only to be for discussion and, as has been made clear, depends on assumptions – may seem impossibly pessimistic. Admittedly, money growth from now on may be lower than conjectured in the last section. It cannot be overlooked that the burst of rather high money growth since early 2020 has been the result of ECB activism, and stimulatory activism could give way to activism which is restrictive in intent. Much will indeed depend on policy decisions yet to be taken. Nevertheless, statements from leading figures on the Governing Council signal considerable official determination to boost activity and employment, regardless of the inflation risks. Perhaps surprisingly, some members of the ECB’s executive board are on record as favouring – or at least seeming to favour – more inflation.6

Friedman warned on many occasions that changes in money growth might sometimes affect inflation only after “long and variable lags”.7 The coronavirus pandemic has played havoc with well-established macroeconomic relationships as well as causing dramatic changes in policy. All the same, the medical emergency will come to an end at some point and those well-established relationships will return. The money injection since March 2020 has reflected unprecedented ECB balance-sheet expansion and been on a truly extraordinary scale. Although the connection between money and the price level may take several quarters before it is fully re-asserted, a significant rise in inflation is to be expected. Sure enough, the rise in inflation could still be halted, but only by the abrupt and sudden withdrawal of the money injection. That would come as an unwelcome shock to financial markets and the real economy, and as of now forms no part of the ECB’s agenda.8

The Institute of International Monetary Research (www.mv-pt.org) at the University of Buckingham, UK, follows money growth developments in the world’s leading economies every month. If you would like to receive the monthly updates, please contact Gail Grimston at enquiries@mv-pt.org or 0044 (0) 1280 827524.

Milton Friedman and Anna Schwartz Monetary Trends in the United States and the United Kingdom (Chicago and London: University of Chicago Press, 1982), p. 215.

The criticism in Neil Ericsson, David Hendry and Stedman Hood ‘Milton Friedman and data adjustment’, Vox EU, CEPR Policy Portal, 4 May 2017, accessed at https://voxeu.org/article/milton-friedman-and-data-adjustment, is one of the best known. They expressed particular concern about Friedman’s references to changes in “financial sophistication” as an explanation for secular shifts in velocity.

Milton Friedman A Program for Monetary Stability (New York: Fordham University Press, 1960, 10th printing 1992), p. 91. Over the 60 years 1960 to 2019 inclusive the average rates of increase in money and nominal GDP were 7.3 per cent and 6.4 per cent respectively. In his 1959 lectures Friedman said that his favoured policy rule was for broadly-defined money to grow at a roughly constant rate of between 3 to 5 per cent a year, with this intended to deliver price stability after an allowance were made for “a secular decrease in velocity” of 1 per cent a year.

If the rate of change of nominal GDP is regressed on that of M3, the coefficient of determination (r2) is a disappointing 0.23 and the regression coefficient on the money term only 0.36. But the t statistic on the regression coefficient is over 5.

The subject is explored in Juan Castañeda and Tim Congdon, ‘Have central banks forgotten about money?: The case of the European Central Bank, 1999 -2014’, pp. 101 – 29, in Tim Congdon (ed.) Money in the Great Recession (Cheltenham, UK, and Northampton MA, USA: Edward Elgar Publishing, 2017).

“..[H]opes that inflation would sustainably recover to levels closer to 2 per cent have been repeatedly and persistently disappointed, despite highly favourable financing conditions. Years of subdued price pressures have raised the spectre of low inflation becoming entrenched in people’s expectations.” Speech by Isabel Schnabel on ‘Unconventional fiscal and monetary policy at the zero lower bound’, given at a conference organized by the European Fiscal Board on 26 February 2021, accessed at https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210226~ff6ad267d4.en.html.

Chapter 15 of Edward Nelson Milton Friedman and Economic Debate in the United States, 1932 – 72 (Chicago and London: University of Chicago Press, 2020), on pp. 232 – 39 of the second volume, has an outstanding discussion of the role of lags in Friedman’s view of the transmission mechanism.

In qualification, Reuters carried a report on 3 May 2021 as follows, “The European Central Bank can start to phase out emergency stimulus measures when the pace of coronavirus vaccinations reaches a critical level and the economy picks up speed, Luis de Guindos, the bank’s vice president, told an Italian newspaper. The ECB will next meet on 10 June and conservative policymakers are already calling for a cut in bond purchases, while others, particularly from the bloc’s south, are arguing for continued patience in clawing back support.” The debate is evolving.