References

Acharya, V. V., and Steffen, S. (2015), “The “greatest” carry trade ever? Understanding eurozone bank risks”. Journal of Financial Economics, 115(2):215–236.

Altavilla, C., Boucinha, M., and Peydró, J.-L. (2018), “Monetary Policy and Bank Profitability in a low interest rate environment”. Economic Policy, 33(96):531–586.

Altavilla, C., Barbiero, F., Boucinha, M., and Burlon, L. (2020), “The Great Lockdown: pandemic response policies and bank lending conditions”, ECB working paper, 2465, 2020.

Andreeva, D. C., and García-Posada, M. (2021). “The impact of the ECB’s targeted long-term refinancing operations on banks’ lending policies: The role of competition”. Journal of Banking & Finance, 122:105992.

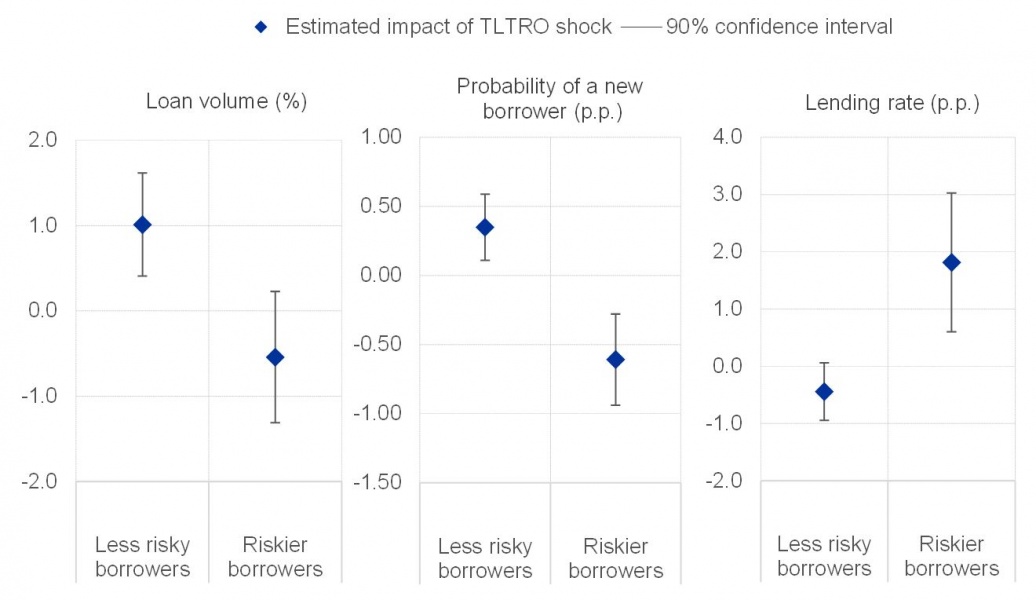

Barbiero, F., Burlon, L., Dimou, M., and Toczynski, J., (2022) “Targeted monetary policy, dual rates and bank risk taking”, ECB working paper, 2682.

Benetton, M., and Fantino, D. (2021), “Targeted monetary policy and bank lending behavior”. Journal of Financial Economics, 142(1): 404–429

Boeckx, J., de Sola Perea, M., and Peersman, G. (2020), “The transmission mechanism of credit support policies in the euro area”. European Economic Review, 124:103403.

Brandao Marques, L., Casiraghi, M., Gelos, G., Kamber, G., & Meeks, R. (2021), “

Negative interest rate policy – The experience so far”, SUERF policy note, Issue No 235.

Brunnermeier, M., and Koby, Y. (2019), “The reversal interest rate”, IMES Discussion Paper Series 19-E-06, Institute for Monetary and Economic Studies, Bank of Japan.

Bubeck, J., Maddaloni, A., and Peydró, J.-L. (2020), “Negative Monetary Policy Rates and Systemic Banks’ Risk-Taking: Evidence from the Euro Area Securities Register”. Journal of Money, Credit and Banking, 52: 197-231.

Crosignani, M., Faria-e Castro, M., and Fonseca, L. (2020), “The (Unintended?) consequences of the largest liquidity injection ever”. Journal of Monetary Economics, 112(C):97–112.

Dell’Ariccia, G., Laeven, L., and Marquez, R. (eds.) (2011), “Monetary Policy, Leverage, and Bank Risk-taking”, CEPR Press Discussion Paper No. 8199.

Jiménez, G., Ongena, S., Peydró, J.-L., and Saurina, J. (2014). “Hazardous times for monetary policy: What do twenty-three million bank loans say about the effects of monetary policy on credit risk-taking?”. Econometrica, 82(2):463–505.

Rostagno, M., Altavilla, C., Carboni, G., and Yiangou, J., (2021). “Monetary Policy in Times of Crisis: A Tale of Two Decades of the European Central Bank”. Oxford University Press.