During the last decade and especially during the COVID-19 pandemic, e-commerce has become more prevalent throughout Europe. This policy brief discusses three key implications of this for prices and inflation. First, the relationship of prices and inflation between online and offline markets depends on the delivery type, the maturity of the e-commerce market as well as its sectoral and idiosyncratic characteristics. Irrespective of that, we find that a proper sampling of online prices is of paramount importance for tracking and nowcasting offline inflation. Second, though the impact of e-commerce on inflation seems to be transitory and varied across countries, these effects will most likely continue to be discernible as long as e-commerce gains market share. Third, online prices change more frequently than their offline counterparts. Online trade might therefore lead to an overall greater price flexibility.

Business-to-consumer e-commerce becomes increasingly prevalent in Europe, with the COVID-19 pandemic having accelerated this trend especially in the retail sector. According to data underlying the German consumer price index (CPI), internet trade rose from about 11% of consumption expenditures on goods in the base year 2015 to 17% in the base year 2020 (Destatis, 2023). The growth of online markets raises several important questions for both academics and policy makers, including central banks. (How) does e-commerce affect inflation rates? Do price dispersion or price dynamics change? If so, will these effects be transitory or persistent?

To shed more light on these questions for Europe, Strasser et al. (2023)1 draw on several diverse and complementary data sources, including CPI microdata for Germany, which encompasses also information on online trade, web-scraped prices for Poland, which can be compared with their offline microdata analogue, and household-level price and quantity data on online and offline fast-moving consumer goods (FMCG) purchases in France, Spain and the United Kingdom, collected by GfK and Kantar.2 Our datasets are far from complete, but nevertheless allow us to put an interesting spotlight on important areas of e-commerce in Europe.

Overall, the specific structure of the online retail market differs by market segment and country. The e-commerce basket is still clearly dominated by more durable goods. Home delivery is most common, but in some sectors and countries purchases are picked up by the customer in-store.

Is it cheaper to shop online? In other words, does the online price level differ from its offline counterpart, e.g. due to lower retailing costs? The findings in the literature on online price levels are mixed, as the characteristics of the online market change over time and depend fundamentally on the distribution model. For many sectors, research finds only minor differences between online and offline prices.

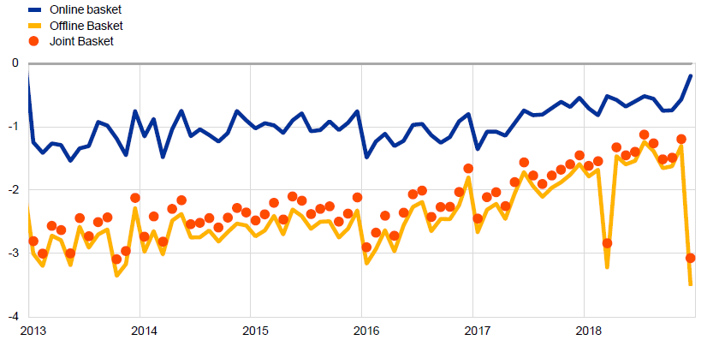

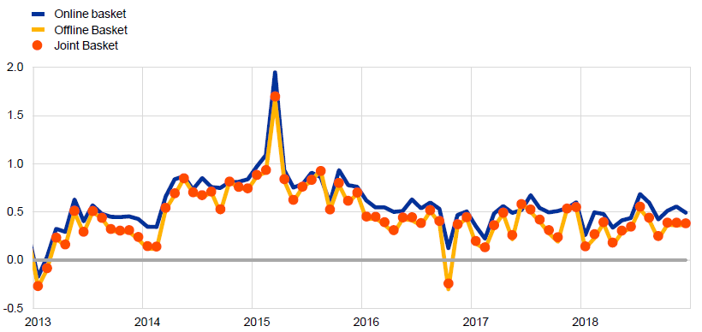

We find that in the FMCG market prices tend to be higher online if the purchase is delivered to the dwelling place. For instance, in the United Kingdom over most of the sample period, FMCG prices were higher online than offline (upper panel of Chart 1). In France, in turn, where the “click and collect” distribution channel dominates, online prices were lower than their offline counterpart throughout the same period (lower panel of Chart 1).

The offline-online price wedge depends crucially on the products included in the comparison. The price wedge is smaller for those FMCG products which are purchased frequently online. The blue lines in Chart 1 show the average price difference if products are weighted by their online expenditure share within FMCG. We find that households – quite rationally – buy online those products that are cheaper relative to their offline analogue. In the UK, where shopping online is generally more expensive, the products actually purchased online (“online basket”) are those with the smallest online surcharge. Towards the end of the sample, online shoppers paid a premium of about 0.5% on their online purchases compared to their offline price. Had they purchased their entire FMCG basket online, the price premium would have amounted to 1.5%. Considering the convenience of home delivery, this points towards non-negligible price comparison and arbitrage relationships between online and offline markets.

Chart 1: Offline-online price level difference for FMCG baskets (percentages)

a) United Kingdom

b) France

Source: Strasser and Wittekopf (2022) based on the GfK/Kantar household panel.

Notes: Percentage excess offline relative to online price level for various baskets. The “joint basket” weights prices according to the overall purchases of the panellists, the “offline basket” according to their offline purchases, and the “online basket” according to their online purchases.

One might expect that the effect of e-commerce on price dispersion is more clear-cut, given the instant and abundant availability of information online. However, it turns out that the tools for segmenting markets have evolved as well. On the one hand, retailing brings along efficiency gains in disseminating and updating information. On the other hand, it provides a manifold of new personalized pricing opportunities. We document that in many European countries, FMCG prices are less dispersed online than offline. In France and the United Kingdom, prices charged by the same retailer for the same FMCG (identified by its barcode) are more homogeneous online than offline. Most existing studies on price dispersion focus on the USA, reporting that online prices are equally or even more dispersed than offline prices (Aparicio et al., 2021, Gorodnichenko et al., 2018). Overall, the dispersion both online and offline in Europe is smaller than in the USA.

Further, we report that within a multi-channel retailer online and offline prices often differ – some prices are higher online, while others are higher offline. Strikingly, even retailers in direct competition with each other differ in terms of how they price products online relative to offline. This suggests that characteristics of the retailer, which might include, say, delivery options in the online versus the offline channel, play a more important role in the relative price than the channel as such.

Overall, since e-commerce does not cover all parts of the economy at this time, any available online inflation statistic reflects only a fraction of the official CPI basket. The evidence on online inflation is still limited due to scarcity in micro price data for online-offline comparisons. To get a comprehensive picture for Europe, we exploit various country-specific micro-datasets.

Using the FMCG household panel, we find that online and offline inflation rates tend to be similar once the online market is sufficiently mature. But in earlier phases online and offline inflation rates may differ. One reason might be, for example, that temporary marketing discounts at early stages of market development lead to a temporarily higher online inflation as online prices converge back to offline prices when the market matures.

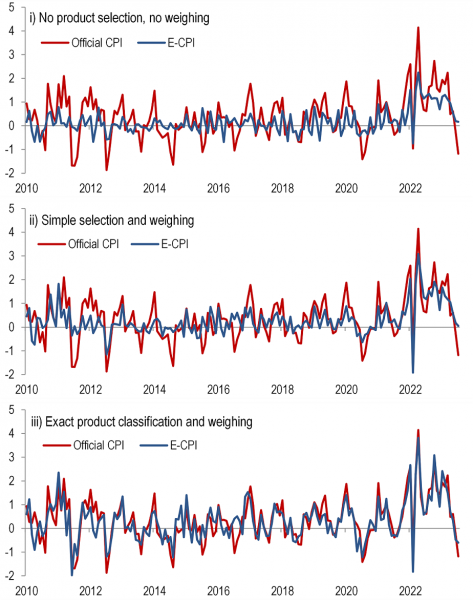

Despite these differences, online prices can be very helpful in tracking and forecasting inflation. Evidence in Macias et al. (2023) shows that in order to successfully replicate aggregate CPI data with web-scraped prices a meticulous selection of products, their classification to consumption groups and application of the official product expenditure weighing scheme are key. Chart 2 compares the official CPI monthly rate of change for food and non-alcoholic beverages with its online counterparts calculated in three ways. First, using raw data (i.e., without proper selection and weighing), second, selecting and weighting data based on simple dictionary rules, and third, selecting and weighting data based on the exact product classification. Only in the last case, online and offline inflation are closely related, especially at seasonal peaks and troughs or during extreme market events (such as COVID-19 or following the Russian invasion of Ukraine).

Do these good tracking properties of online prices translate into accurate nowcasting? Earlier work by Aparicio and Bertolotto (2020) indicates that online prices help forecast inflation in the short-term. Our real-time nowcasting experiment (Macias et al., 2023) shows that even simple model-based frameworks with online prices outperform substantially the most common competing approaches, especially during the initial wave of Covid-19. However, while nowcast accuracy increases with the volume of data, their quality and relevance are essential for providing accurate out-of-sample nowcasts.

Chart 2: Comparison of food and non-alcoholic beverage inflation (official CPI) with online price inflation (E-CPI) in Poland (percentages)

Source: Narodowy Bank Polski.

Notes: The updated time series in this policy brief covers the period January 2010 – July 2023.

The digitalisation of business processes, which forms the foundation of the success of e-commerce, comes with massive efficiency gains in information processing. For example, prices can automatically be adjusted in response to changes in competitor prices, other market conditions or input costs. This suggest that online prices might be more flexible than their offline counterparts.

The existing literature finds different results depending on the business model of the retailer. Studies on multi-channel retailers find no substantial difference between online and offline price flexibility in Europe. Both the frequency and the size of price changes are similar online and offline (e.g., Cavallo, 2017; Bonomo et al., 2020). Retailers who operate exclusively online change their prices more frequently than offline retailers. But whereas the frequency of these price changes is higher, their size is similar to offline changes (Gorodnichenko et al., 2018) and dominated by small changes (Hillen and Fedoseeva, 2021).

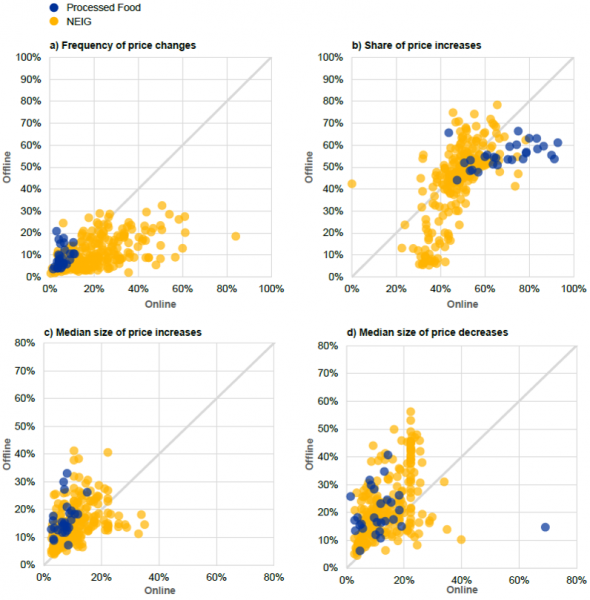

Chart 3: Frequency and size of price changes in the German CPI

Source: Bundesbank staff calculations based on German CPI microdata.

Notes: Following Gautier et al. (2022), the statistics are derived at the level of 288 online/offline products (COICOP ten-digit level) and aggregated to a given product category based on the corresponding 2015 expenditure share of the German CPI. The sample period covers 2015-2019.

German CPI microdata, which cover online and offline prices for about 290 product groups (e.g. women’s sports shoes) for industrial goods and processed food, show that online prices are changed more frequently than offline prices (see panel a of Chart 3). On average, 17% of online prices are changed in a given month, compared with 11% in offline markets. This evidence is noteworthy for semi-durable goods (such as clothing and recreational items) as well as non-durable goods (such as personal care products and stationery). By contrast, prices of processed food products are changed somewhat more frequently offline. The latter fact has to do with price changes due to sales; if sale prices are excluded from the analysis, the prices of industrial goods are still adjusted more frequently online, and the frequency of processed food price adjustments becomes more similar between online and offline markets.

There is no clear difference between online and offline products with respect to the direction of price changes, i.e., the share of price increases or decreases (see panel b of Chart 3). Only in the “processed food” category is the share of price increases higher for online trade. The size of price changes in online stores, however, is on average smaller than in offline stores – for both price increases and decreases. Indeed, most of the observations in panels c) and d) of Chart 3 are above the 45-degree line, implying a higher magnitude of price cuts and increases in the offline market. Hence, according to CPI microdata, prices in online markets change more often, but by less, than in offline markets. This is consistent with lower menu costs in online markets.

Web scraped data offers another possibility to compare the rigidity of online and offline prices. Our analysis for Poland for the years 2010 to 2020 indicates that in the food category prices in physical and online stores change at a similar frequency, with roughly 28% of prices changing every month. More than a quarter of these (8%) change due to the start or the end of a sale. Naturally, the prices of unprocessed food are more elastic, while the prices of food in restaurants tend to change infrequently. The markets for clothing, footwear and some appliances show a different picture. There, online prices change more than twice as often as in brick-and-mortar stores. This is first and foremost due to the higher frequency of sales in the online channel, but also due to the lower consumer search costs of comparing the prices of a few big-ticket items than of a manifold of relatively inexpensive products (such as food). The average price increase and decrease tends to be somewhat larger in the online channel.

In our French and UK household panels the changes in online FMCG prices are highly synchronized with their offline counterparts, with a contemporaneous correlation of well above 0.6. Prices are not changed faster in either of the two channels, and there is no evidence that online prices are leading offline prices. Overall, while a higher online repricing rate may lead to more flexibility in price levels, uniform pricing (within each channel) may mute the responsiveness of prices to local shocks. In that sense, understanding the nature of the strategic interaction between online, offline, and multi-channel retailers remains an important and policy-relevant area of research.

E-commerce is rapidly gaining market share in a growing number of sectors in Europe. Whereas some markets are maturing, others – such as food retail in many countries – evolve more slowly. This policy brief highlights three features of online prices. First, whether online prices and inflation are higher or lower than their offline counterparts depends on several factors: the distribution model, the maturity of the market, the sector and the country. Second, the effect of e-commerce on inflation is country-specific and transitory but should persist as long as e-commerce markets mature. Third, owing to this increasing penetration of e-commerce, overall price rigidity might decline as some online prices appear to be more flexible than offline ones. Overall, the difference between online and offline prices does not seem to be exceptionally large. Online price data is therefore a useful source of information for policy analysis and economic forecasting, especially during eventful periods.

Aparicio, D. and Bertolotto, M.I. (2020): “Forecasting inflation with online prices”, International Journal of Forecasting, Vol. 36, No 2, pp. 232-247.

Aparicio, D., Metzman, Z. and Rigobon, R. (2021): “The pricing strategies of online grocery retailers”, NBER Working Paper 28639.

Bonomo, M., Carvalho, C., Kryvtsov, O., Ribon, S. and Rigato, R. (2020): “Multi-product pricing: Theory and evidence from large retailers in Israel”, Staff Working Paper 12, Bank of Canada.

Cavallo, A. (2017): “Are online and offline prices similar? Evidence from large multi-channel retailers”, American Economic Review, Vol. 107, No. 1, pp. 283-303.

Destatis (2023): “WISTA – Wirtschaft und Statistik, 4/2023”, Statistisches Bundesamt, August 2023, available at https://www.destatis.de/DE/Methoden/WISTA-Wirtschaft-und-Statistik/2023/04/wista-042023.pdf?__blob=publicationFile.

Gautier, E., Conflitti, C., Faber, R.P., Fabo, B., Fadejeva, L., Jouvanceau, V., Menz, J.-O., Messner, T., Petroulas, P., Roldan-Blanco, P., Rumler, F., Santoro, S., Wieland, E. and Zimmer, H. (2022): “New facts on consumer price rigidity in the euro area”, ECB Working Paper 2669.

Gorodnichenko, Y., Sheremirov, V. and Talavera, O. (2018): “Price setting in online markets: Does IT click?” Journal of the European Economic Association, Vol. 16, No. 6, pp. 1764-1811.

Hillen, J. and Fedoseeva, S. (2021): “E-commerce and the end of price rigidity?” Journal of Business Research, Vol. 125, pp. 63-73.

Macias, P., Stelmasiak, D. and Szafranek, K. (2023): “Nowcasting food inflation with a massive amount of online prices”, International Journal of Forecasting, Vol. 39, No 2, pp. 809-826.

Strasser, G., Wieland, E., Macias, P., Błażejowska, A., Szafranek, K., Wittekopf, D., Franke, J., Henkel, L. and Osbat, C. (2023): “E-commerce and price setting: evidence from Europe”, ECB Occasional Paper 320.

Strasser, G. and Wittekopf, D. (2022): “Online shopping, consumer behavior and inflation”, European Central Bank, Frankfurt am Main, mimeo.

This work is part of a set of papers within the ECB’s Occasional Paper Series, resulting from the report of the ECB’s Price-setting Microdata Analysis (PRISMA) research network (https://www.ecb.europa.eu/pub/economic-research/research-networks/html/researcher_prisma.en.html).

FMCG are primarily food, beverages, and some personal care items.