The views expressed here are those of the authors and do not necessarily reflect those of the Bank of Italy.

Abstract

In the service sector, characterised by limited competition, burdensome entry regulation can hinder productivity growth. Using a novel indicator of entry regulation and a unique dataset of the universe of Italian firms, the paper shows that productivity and entry rates increase and prices decrease in sectors undergoing liberalisation, when compared to sectors that are not touched by these reforms. The overall effect on aggregate productivity is driven by the increase in productivity of incumbent firms and, although to a lesser extent, improved allocative efficiency. The impact of a reduction of red tape is more significant than the loosening of professional requirements, underscoring the importance of streamlined and efficient administrative processes.

In all advanced economies, governments intervene in product markets through regulatory policies. These interventions are generally motivated by market failures, including externalities and asymmetric information. However, if poorly designed, regulation may excessively affect the degree of competition between firms by raising unnecessary barriers to entry and imposing needlessly time-consuming procedures. This issue is especially important in the service sector that employs a growing share of the workforce and play a key role in driving overall economic growth and productivity.

The literature generally holds that cutting red tape and lowering barriers to entrepreneurship and firm entry could stimulate business dynamism and productivity. However, some tighter entry barriers may also lead to positive effects if new entrants are on average more productive than in an unconstrained economy. Therefore, the answer to this research question is ultimately empirical. In a recent paper (Cintolesi et al., 2024), we examine whether, and to what extent, entry regulation affects productivity growth in the service sector. We build a novel indicator of entry regulation at the 5-digit sector level, relying on a unique dataset that covers the universe of firms (i.e., including corporations, partnerships, self-employed and professionals working alone) and exploiting different reforms that changed the extent of entry regulation across sectors and over time. The results show that reducing entry regulation increase productivity and lower prices.

Regulation indicators are widely used in the literature. However, the existing indicators are available for aggregate economic sectors and do not capture regulatory variations that may occur for a specific economic activity. Collecting information for more granular economic activities allows us to conduct a more detailed econometric analysis. We collected information on two dimensions of regulation for all 5-digit economic activities in the service sector. The first dimension is related to professional requirements and measures the minimum number of years required to fulfill all the education and training requirements to practice the profession. Then, we map these occupations at the 5-digit sector level, i.e., for each economic activity we consider the strength of occupational licensing depending on whether a certain profession is essential or not to make that business. The second dimension concerns the number, complexity and length of administrative procedures, including authorisations and permits required to start-up a business (going from the absence of any formality in certain activities to the existence of authorisations and quotas in others) and health and safety administrative compliance. We identify significant variation in entry regulation across industries that has largely been overlooked in the existing literature. Failing to account for this variation could lead to biases in empirical analysis. Our entry regulation index captures this heterogeneity, enhancing the accuracy of the empirical findings.

We use firm-level data covering the entire universe of firms. This allows us to broaden the sample beyond the incorporated companies typically used in the literature, by including individual firms and partnerships, which represent a significant share of both firms and employment in the service sector. Moreover, the comprehensive data at our disposal allow to analyse how the response to the regulatory framework differs across different types of firms and markets and, by doing so, to describe the mechanisms through which product market reforms operate. They also allow to decompose the productivity variation in different components and to examine the role of the selection and reallocation processes at work (Melitz and Polanec, 2015).

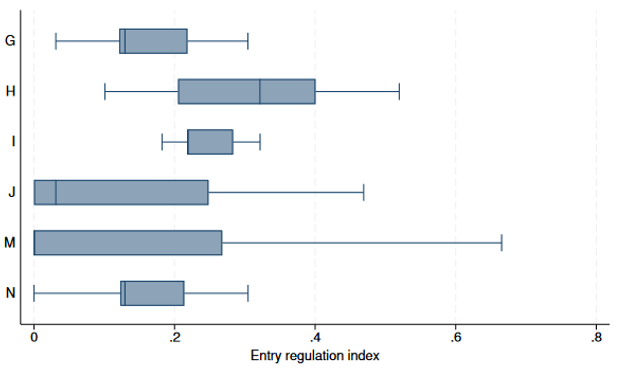

Figure 1. Entry Regulation Across and Within Industries

Note: Boxplot of entry regulation index across and within sections (average over the period 2005-2019). Lines mark the lower adjacent value, the 1st quartile, the median, the third quartile and the upper adjacent value of the distributions. The NACE sections are: G = Wholesale and retail trade; H = Transporting and storage; I = Accommodation and food service activities; J = Information and communication; M = Professional, scientific and technical activities; N = Administrative and support service activities.

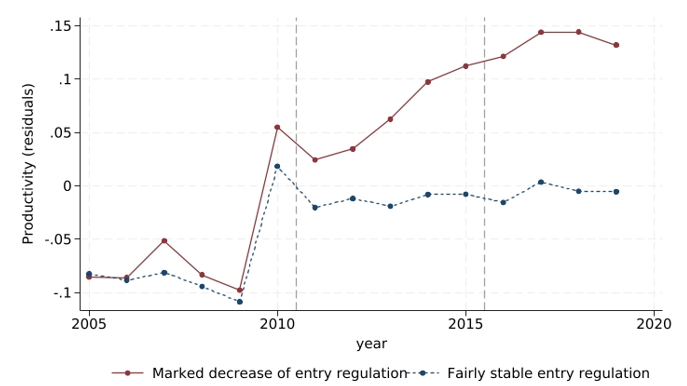

We find that a reduction in entry regulation is associated to a significant increase in labour productivity and entry rate and a decrease in prices. Namely, the liberalisations that occurred between 2005 and 2019 has led to an increase in productivity of 3 to 8 percentage points in the treated sectors during the period under review (Figure 2). We also find a positive effect on the entry rate and a negative effect on prices.

Figure 2. Labour Productivity and the Entry Regulation Index

Note: The lines represent the dynamic of labour productivity (after having controlled for sectors- and municipality-year fixed effects) of two groups of firms, i.e. those exposed to a marked reduction of the entry regulation index in the entire temporal window and those exposed to a fairly stable entry regulatory framework.

The aggregate productivity growth is attributable to an increase in the productivity of both new entrants (i.e., positive selection at entry) and established firms.

Exploring the different domains of regulation, we find that both professional requirements and bureaucratic procedures have a detrimental impact on productivity, although the effect of the latter is quantitatively more significant. Finally, the impact of entry regulation on productivity varies across firms and industries. It is stronger for larger firms and in sectors characterised by a higher «natural» entry rate – i.e., where entry barriers might have a more detrimental effect on business dynamism.

The expansion of the service sector and the growing awareness of the negative consequences of excessive regulation prompted the adoption of reforms aimed at reducing burdensome entry regulation. According to our results, a reduction in entry regulations is associated with a significant up-swing in productivity and entry rates, coupled with a decrease in prices.

Both occupational requirements and administrative burden are generally meant to solve market failures and to protect certain public interests. It is thus essential to periodically review these regulations, to ensure they remain aligned with their intended objectives and to assess whether alternative tools could achieve the same outcomes with fewer restrictions on the basis of a proportionality test.

Cintolesi, A., S. Mocetti and Giacomo Roma, Productivity and Entry Regulation: Evidence from the Universe of Firms (2024), Bank of Italy, Working Paper, No 1455.

Melitz, M. J. and Polanec, S. (2015), Dynamic Olley-Pakes Productivity Decomposition with Entry and Exit, “Rand Journal of Economics”, 46(2), pp. 362-375.