This SUERF policy note is based on research content published by Goldman Sachs on 5 November 2023 and Goldman Sachs has granted permission for SUERF to re-publish this research content on a limited basis. The research content within this SUERF policy note is for information purposes only. Goldman Sachs has no liability or any responsibility whatsoever for the publication of this SUERF policy note or SUERF’s decision to reproduce any Goldman Sachs research content contained herein. This SUERF policy note is not to be construed as investment advice, a recommendation, or an offer to buy or sell or the solicitation of an offer to buy or sell any security, financial product or instrument, or to participate in any particular trading strategy. This information should not be relied upon for any reason whatsoever.

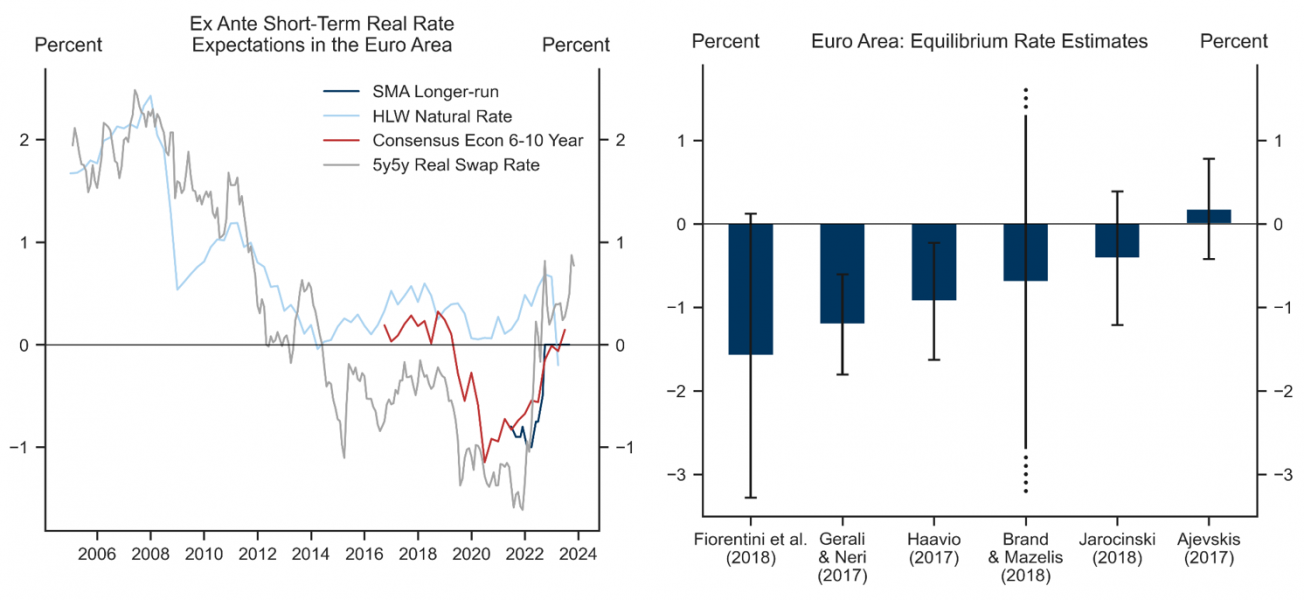

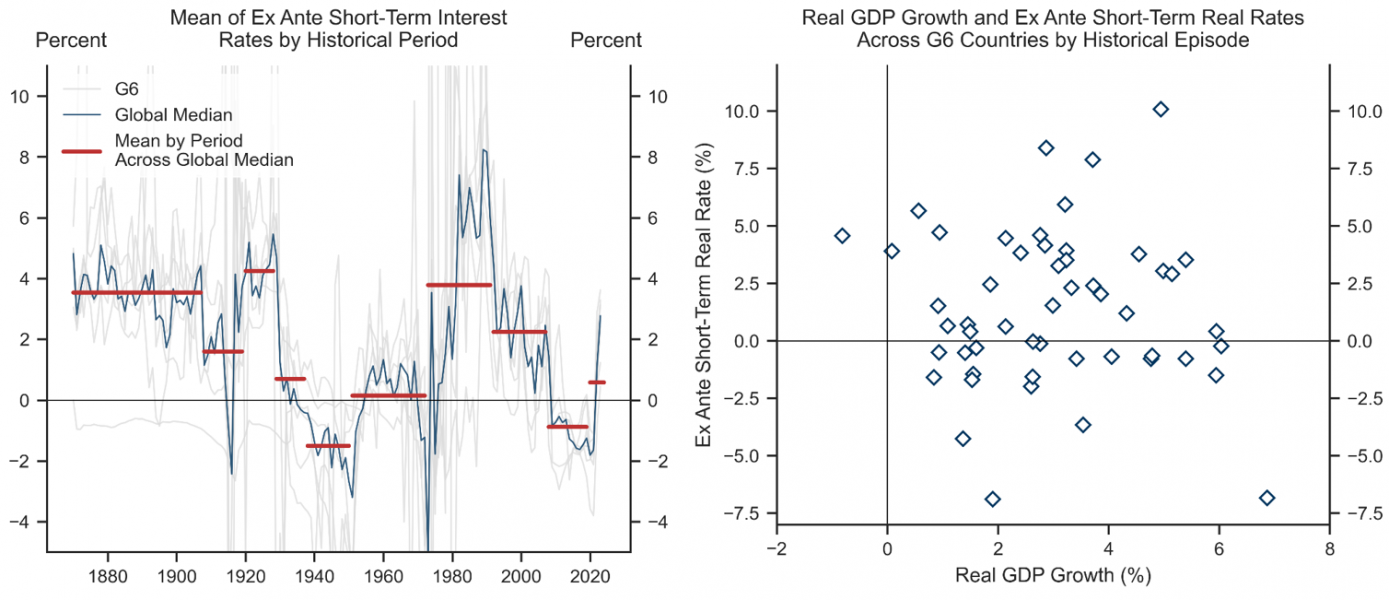

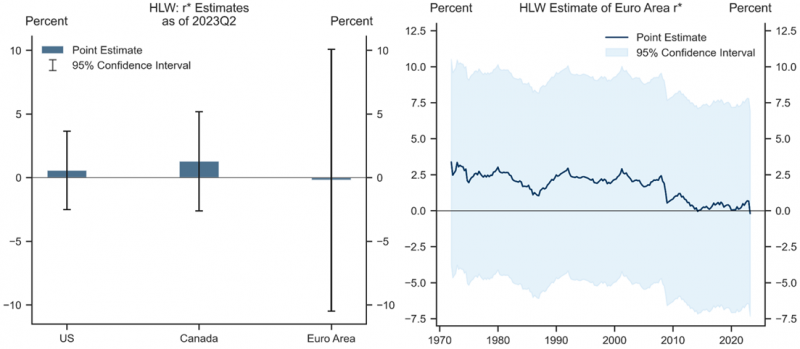

The market focus regarding the ECB has shifted to how long rates will be sustained at this restrictive level and where the deposit rate might ultimately settle. Recent estimates of the sustainable policy rate—or the equilibrium rate, r*—point to an increase since the pandemic. Exhibit 1 (left) shows some leading estimates which—following a steady decline over the last 20-30 years—have recently risen and now cluster around 0% in real terms.

Exhibit 1: Equilibrium Rate Estimates Have Risen

Source: Haver Analytics, ECB, Bloomberg, Data compiled by Goldman Sachs Global Investment Research, Consensus Economics.

The uncertainty around the level of the equilibrium rate, however, is very large (Exhibit 1, right). A review of recent studies points to a range of -1.5% to 0.5% in real terms, or 0.5-2.5% on a nominal basis with inflation at target.

This note reviews the recent evidence on the equilibrium rate and discusses to what extent the level of sustainable rates might have risen in the Euro area.

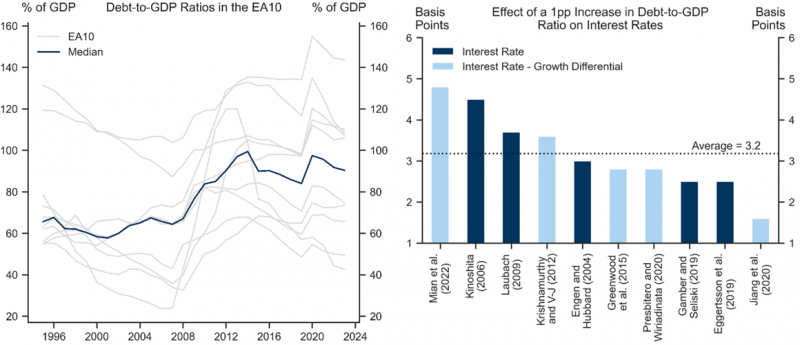

We see a number of economic reasons to believe that the neutral rate has increased and now stands at the upper end of the range of estimates presented above. First, changes in European fiscal policy point to higher interest rates. Public debt ratios have risen sharply in Europe (and across advanced economies), up about 10pp of GDP, on average, across the Euro area since the pandemic. The empirical evidence suggests that interest rates usually rise by around 3bp per 1pp increase in the debt/GDP ratio. Given the recent increase in European debt ratios, this would point to a 30bp rise in interest rates since Covid.

Exhibit 2: Higher Debt

Source: Data compiled by Goldman Sachs Global Investment Research, Haver Analytics.

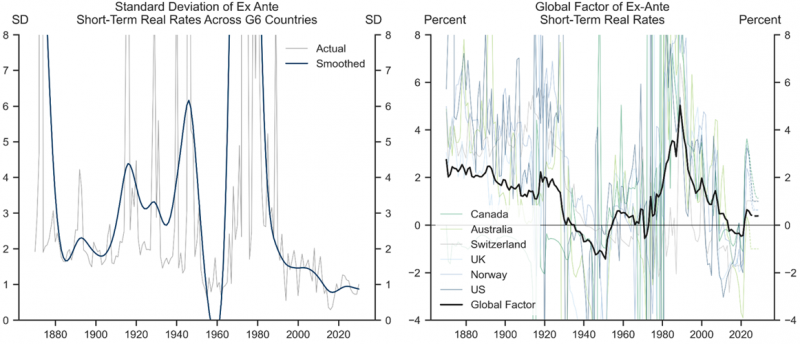

In addition, higher investment spending in coming years is likely to entail higher yields. The European Recovery Fund entails around EUR 800bn (or 5% of EU GDP) of public investment and the green transition will require very large investment outlays in coming years. Our utility analysts, for example, estimate that the EU’s transition to carbon neutrality might require (public and private) investment of up to EUR 10tr by 2050.1 As a result, academic estimates point to a 25bp rise in interest rates due to stronger investment spending associated with the green transition.

Exhibit 3: Investment Effects on Interest Rates

Source: Data compiled by Goldman Sachs Global Investment Research.

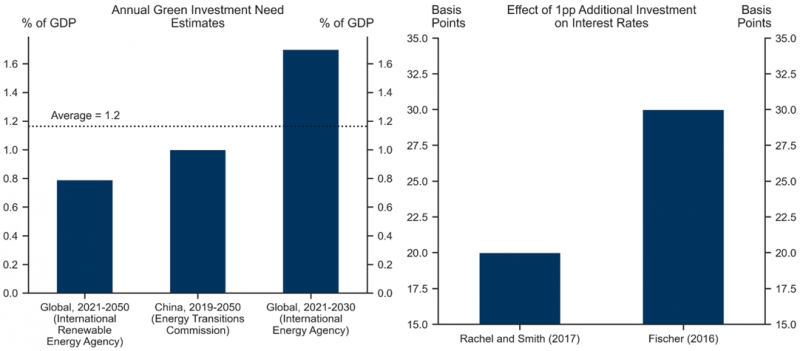

Second, the global co-movement between interest rates tends to be strong and has risen over time. Using a very long-run dataset of real interest rates shows that the dispersion of rates across advanced economies has fallen sharply since the 1980s, as financial markets have integrated and monetary policy has become more systematic (Exhibit 4, left). As a result, a simple estimate of the global interest rate—measured with the global common component of rates—has risen notably since the Covid pandemic (Exhibit 4, right).2

Exhibit 4: Stronger Global Co-Movement

Source: Goldman Sachs Global Investment Research.

Given the resilience of the US economy to high rates and our view that the Fed will sustain elevated rates for some time, these estimates would point to upward pressure on sustainable rates also in Europe.

Third, the historical record shows that interest rates tend to mean revert to historical averages over longer periods of time and show limited co-movement with growth. As we have shown in past work, global policy rates have been remarkably stable when looking at the very long-term historical record. This might be because economic crises and structural shifts tend to have long-lasting but not permanent effects on the economy. A significant increase in the equilibrium rate back towards these levels would therefore not be surprising in the historical context.

Exhibit 5: Lessons from History

Source: Goldman Sachs Global Investment Research.

Also, the historical evidence shows that the link between neutral rates and potential growth tends to be weaker than usually assumed in economic models. The Holston-Laubach-Williams model, for example, assumes a one-for-one link between r* and potential growth. Looking at the historical correlation of growth and interest rates over the cycle across many advanced economies, however, points to a much weaker link in practice (Exhibit 5, right). This matters in the current context as Europe faces a period of growth stagnation and structural growth headwinds, which might do little to hold back the equilibrium rate.3

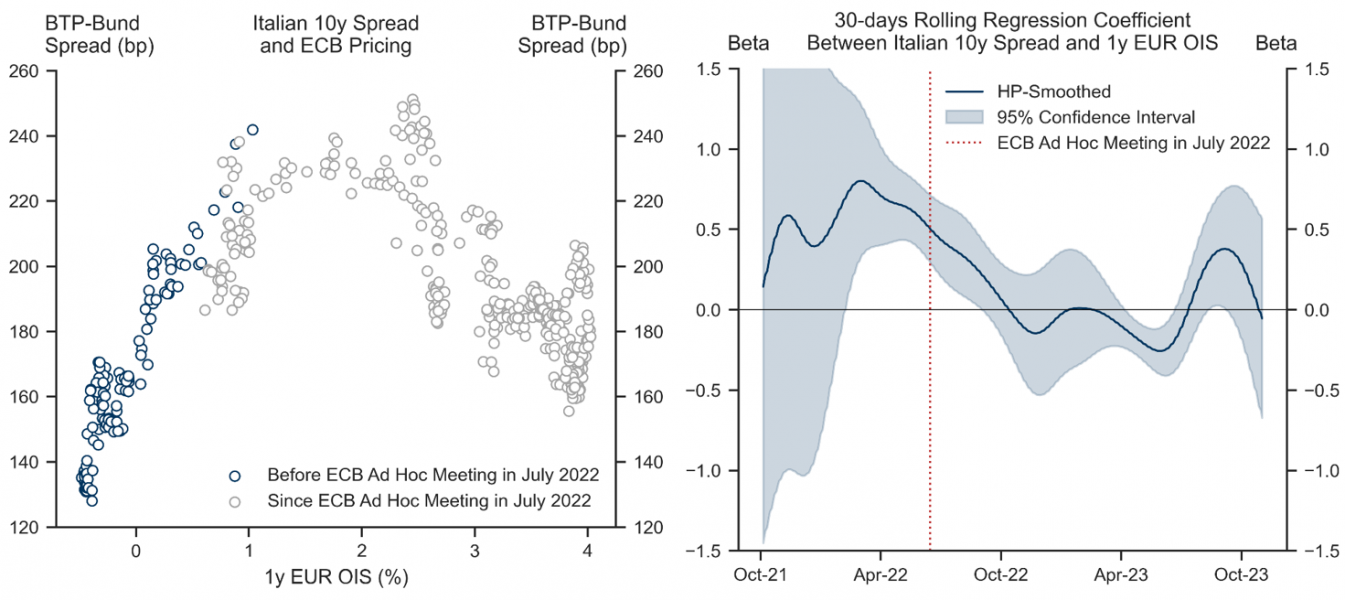

The evidence, therefore, suggests that neutral rates are likely to have risen in Europe. But could the Euro area sustain higher rates from a debt sustainability perspective? Given high debt and sluggish growth, higher interest rates risk putting debt/GDP ratios on a rising path in parts of Europe, especially in Italy. As a result, sovereign spreads have traditionally co-moved positively and strongly with higher policy rates. Exhibit 6 (left) shows how the BTP-Bund spread rose systematically with policy rates in the early parts of the post-Covid hiking cycle.

Exhibit 6: Sovereign Spreads Less Responsive to Higher Rates

Source: Goldman Sachs Global Investment Research, Haver Analytics.

The sensitivity of sovereign spreads, however, has fallen sharply since last summer, reflecting the ECB’s launch of its new anti-fragmentation tools (including PEPP reinvestment flexibility and the Transmission Protection Instrument, or TPI) in July 2022, as well as the support provided by the Recovery Fund and the expectation of looser fiscal rules.

We therefore model the effect of this change in the behaviour of sovereign spreads on the terminal policy rate with a simple macro model of the Euro area economy. In our model, growth depends on lags and long-term bond yields, where the latter are determined by the sum of the policy rate and sovereign spreads. Spreads, in turn, depend on the policy rate to a varying degree. Inflation is determined by economic slack and we assume that the ECB sets the deposit rate using a simple Taylor rule, with a response to slack and inflation.

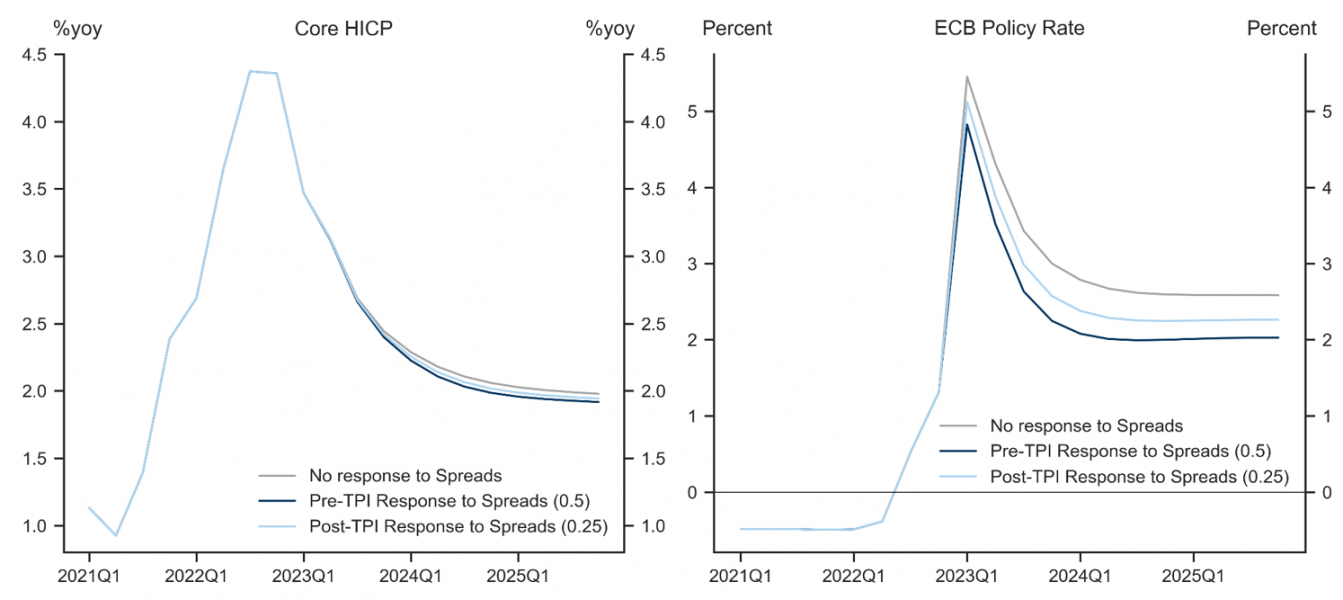

We then use this setup to explore the required interest rate path to return inflation to 2% under different assumptions for how sovereign spreads co-move with the policy rate. In a first scenario, we assume that sovereign spreads respond with a coefficient of 0.5 to the policy rate, consistent with the experience before last summer (ie, where spreads rise 50bp per 100bp of policy rate increase). In a second scenario, we assume that the observed institutional changes have cut this response in half. Lastly, we include a scenario where there is no response of spreads to policy rates; that is, where the Euro area’s institutional advances completely remove the co-movement between policy rates and spreads.

Exhibit 7 shows our simulations for inflation and the deposit rate under these three assumptions. Our results show how a weaker response of sovereign spreads to policy rates implies that the Governing Council needs to set a higher deposit rate to return inflation to target at the same speed, leading to a higher terminal policy rate. Intuitively, spread widening has historically amplified policy rate tightening. So, with a weaker response of spreads to policy rates, the ECB needs to maintain a higher deposit rate to return inflation to 2%, implying a higher equilibrium rate, all else equal.

Exhibit 7: Simulating R(ome)*

Source: Goldman Sachs Global Investment Research.

Taken together, our analysis suggests that the neutral interest rate in the Euro area has likely risen since the covid pandemic. We therefore mark up our estimate of r* towards the upper end of the range implied by recent studies, pointing to an equilibrium rate of 0-0.5% in real terms, or 2-2.5% in nominal terms.

That said, we would not overweight the importance of the neutral rate for the policy outlook. The reason is that the uncertainty around any numerical estimate of the equilibrium rate is very large, especially in Europe. The latest observation of the popular Holston-Laubach-Williams model, for example, has a standard error of 160bp for the US and 525bp for the Euro area.4 It is therefore very difficult to have confidence in any particular estimate of the equilibrium rate.

Exhibit 8: Very Large Error Bands Around the Equilibrium Rate

Source: Goldman Sachs Global Investment Research.

We therefore also place weight on broader considerations and expect the ECB to do the same. First, an estimated Taylor rule framework considers both levels and changes in economic variables, and therefore downplays the importance of r*. Second, considering the effect of broader changes in financial conditions and their effect on growth can allow one to sidestep the level of r* completely.

We estimate a simplified version of a model developed by Fed economists del Negro et al. (2019) for the ex-ante short-term rate of six developed economies. Specifically, we estimate a dynamic factor model whereby the global trend is a factor following an AR(1) process. We proxy for inflation expectations by following the approach of Norges Bank economists Brubak et al. (2018). In particular, we estimate a time-varying parameters vector auto-regression (TVP-VAR) of real GDP growth, inflation, and the policy rate, with Bayesian methods. We then compute the long-run inflation level implied by the time-varying parameters to proxy for inflation expectations.

Demographics could also have started to exert upward pressures on interest rates. The academic literature has found a positive relationship between interest rates and the dependency ratio, that is the younger and older share of the population. Intuitively, the propensity of households to save is very low until they start working, but then increases throughout their career, before falling again during retirement. According to UN demographic projections, the share of middle-aged households is due to have peaked in Europe in the late 2010s and would now be falling as baby-boomers gradually retire. This would, all else equal, decrease the supply of savings and exert an upward pressure on interest rates.