The paper is available at: IADI Sponsored Paper 2.pdf. The paper is published in the International Association of Deposit Insurers (IADI) Sponsored Paper Series. The views expressed in the paper are those of the author (s) and do not necessarily represent the views of IADI.

This Policy Brief Paper focuses on the European responses to the COVID-19 pandemic and the unprecedented degree of public and private intervention to avert a social, economic and financial crisis. EU member states, and especially participating member states of the European Banking Union (EBU), introduced a broad set of measures, including public guarantees, moratoria and amendments to the European Commission State Aid framework, to contain the negative effects of the pandemic on the economy. The EU suspended its fiscal rules and the European Central Bank increased its monetary operations. The paper analyses the impact of public support on the Single Supervisory Mechanism (SSM) banks and the acutely exposed participating EBU member states because of their significant increase in government debt levels. Our research focused on the COVID-19 stress impact in 2020, and findings for the SSM significant banks and several member states of the EBU are presented. We argue that the containment of the crisis creates a major uncertainty, namely a possible insolvency lag once the benefits of the public support subside and insolvencies start to materialise. This uncertainty is associated with non-financial corporates, the safety and soundness of the SSM significant banks and sovereign debt sustainability, forming a new ‘doom loop’. We suggest the design of a ‘transition phase’ as a mechanism of accountability to improve the understanding of those uncertainties to ensure financial stability.

The outbreak of coronavirus disease in 2019 (hereinafter COVID-19) forced the European Union to implement extraordinary measures to contain the impact of the pandemic on the real economy. The primary rationale for such measures was to safeguard the social fabric by ensuring people had access to COVID-19 healthcare, and also to protect jobs, homes and education.

The European response to the COVID-19 pandemic was still in a phase of ‘crisis containment’ at the time of this research through four principal means: public guarantees (PGs), moratoria, state aid, and the targeted longer-term refinancing operations (TLTRO III). The focus of this research was on PGs, moratoria and state aid. The scale of public intervention gives rise to significant uncertainties associated with bank credit risk, leading to concerns about a potential EU sovereign-bank doom loop.1 The possibility for the creation of a ‘doom loop’, as Isabel Schnabel, member of the ECB Executive Board, explains, is prevalent: the corporate sector ‘has become more dependent on the domestic sovereign’s fiscal support’ and its withdrawal ‘could trigger corporate defaults’ and ‘a rapid rise in NPLs’.2 As Schnabel goes on to explain, ‘the interlinkages between banks, sovereigns and corporates, which were crucial for stabilising the economic and financial situation during the pandemic, could turn into a vicious circle, giving rise to destabilising feedback loops’.3

The use of PGs during financial crises is the option of choice when market and other private sector mechanisms are unable to contain a crisis. The contingent nature of the guarantee means that the guarantor does not need to offer any financial support up front. Guarantees come in two primary forms: explicit and implicit. We argued that the current containment phase has elements of an implicit guarantee to the European Banking Union (EBU) system. The European Central Bank (ECB) issued a statement on the scope of the explicit PG, which indicated ‘supervisory flexibility’4 that allows banks to ‘fully benefit from guarantees and moratoriums’.5

The staggered expiration of public guarantees is important, but it equally exposes the risk of ‘evergreening’ loans.

The temporary suspension of debt repayments was another important tool in responding to the COVID-19 pandemic. The moratoria extended to the servicing of personal, household and corporate debts. The immediate benefits of debt suspension minimise disruption to the real economy and households by reducing foreclosures, but the medium- to long-term impact on banks still remains to be determined. In contrast, the immediate impact on banks of the moratoria was a temporary loss of income on these loans in the form of interest and/or capital repayments, depending on the arrangements introduced by the member state and the banks. Moreover, the time lag between the take-up of such support measures and their ending means that the ability to service loans may materialise some time after the expiration of the support if the recovery is not sustainable. This suggests that a deterioration in asset quality on banks’ balance sheets against income may not be apparent until some time later.

In March 2020 the European Commission adopted a temporary framework for state aid to ease conditions under which EU Member States can grant aid to corporates. As of 30 September 2021, ‘the Commission has taken more than 650 decisions in all Member States, including based on the Temporary Framework, to enable necessary and proportionate support worth more than in total €3 trillion to companies affected by the coronavirus outbreak’.6 The temporary framework has been amended multiple times and extended to 30 June 2022. That phase-out has to be seen in light of the heterogeneity of the recovery, with specific sectors and regions in different Member States still lagging behind others.’7

We agree that the COVID-19 crisis is an exogenous shock to the banking system. Furthermore, we believe that in a turbulent geopolitical and economic environment with probable additional exogenous shocks, understanding the aspects and scope of the effects of the shock is particularly relevant. Considering the effects of COVID-related information on financial markets – including general information diffusion about economic expectations and government interventions – caution and reliability are of utmost importance.

The four composite indicators for activity, credit risk, solvency and profitability – constructed at the level of 114 banks deemed significant for the SSM and aggregated to the Member States and the EU/SSM – aim to help understand the specifics of this situation by providing data to inform policy decisions. The composite indicators reflect relative changes in 20 variables observed in 2020 in comparison to the preceding stable period 2015-2019. Granular information about variables during 2015-2020, relative changes between 2020 and the stable period, and composite indicators for the SSM 114 entities is available in Annex 1.

Fortunately, trends in the stable period preceding the COVID-19 crisis have led to improvements in crucial areas after the Global Financial Crisis (GFC). This is largely due to the implementation of the initial Basel III reforms coupled with the weakening of the bank–sovereign doom loop upon the establishment of the EBU and the general economic recovery. Thus euro-area banks entered the ‘COVID-19 stress’ with solid solvency and liquidity positions.

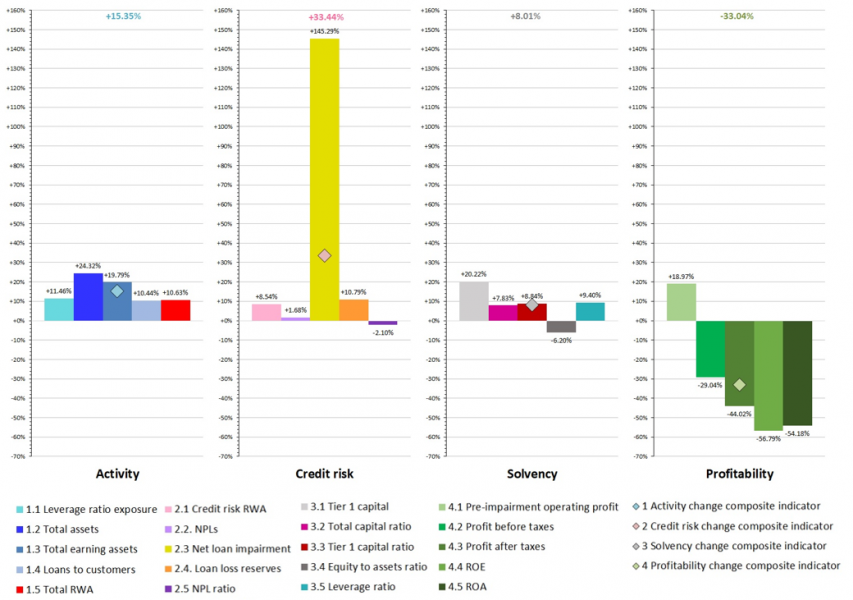

Our research focused on the stress impact in 2020 and findings for the EU/SSM level are summed in Figure 1.

Figure 1: EU/SSM – Four composite indicators (asset-weighted Δ% for individual banks)

Sources: Orbis Bank Focus, The Banker database, EBA transparency and stress test exercises, banks’ financial statements and Pillar 3 reports, and authors’ calculations and estimates.

The composite indicator for ‘activity’ has increased by 15.35%, primarily due to an increase in total assets (24.32%). The ‘credit risk’ indicator has grown by 33.44%, and the net loan impairment charges increased by 145.29%. The ‘solvency’ indicator shows that capital adequacy remained at pre-COVID-crisis levels, but taking into account the longer stable period (i.e. post-GFC recovery) and observing it as relative changes in risk-based and not-risk sensitive ratios and capital amounts led to an increase in the composite indicator of 8.01%.

The most challenging area for EU banks is profitability, and our composite indicator shows a decrease of 33.04%. It should be noted that the pre-impairment operating profit component increased by 18.97%, but due to significant provisioning, all other components decreased –profit before and after taxes, return on assets (ROA) and return on equity (ROE). This was addressed in the European Banking Authority’s (EBA) risk dashboard, indicating that in Q2 2021 EU banks benefited from the economic recovery and profitability stabilised, mostly due to lower impairment costs. However, the EBA pointed out that ROE still decreased to 7.4% in Q2 2021 from 7.7% in the previous quarter.

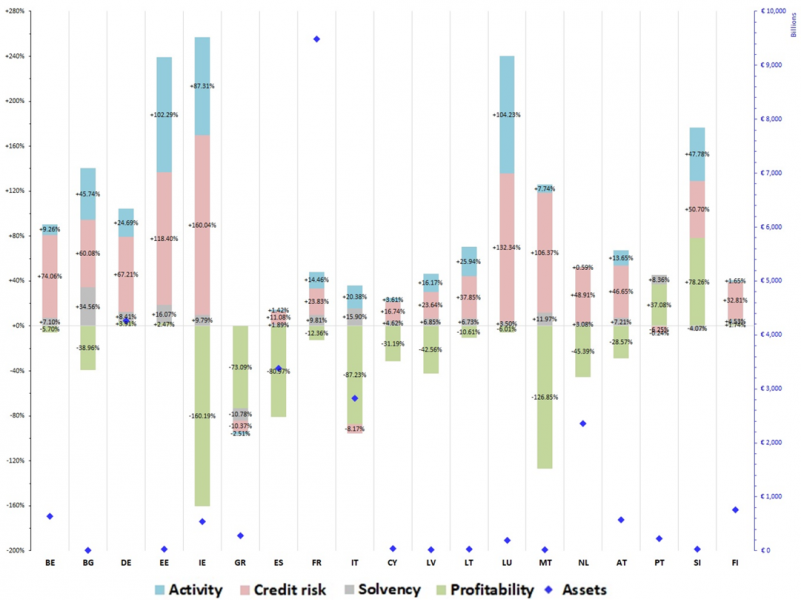

To put each country in the EU-wide SSM context, the size of that Member States’ significant banks’ assets was considered. An outline of all countries is provided in Figure 2 and Annexes 2 and 4, while the individual country sheets are given in Annex 3 and individual bank sheets in Annex 1.

Figure 2: EU/SSM – Four composite indicators per member state (asset-weighted Δ% for individual banks) and member state bank assets

Sources: Orbis Bank Focus, The Banker database, EBA transparency and stress test exercises, banks’ financial statements and Pillar 3 reports, and authors’ calculations and estimates.

Overall, our composite indicators at country levels also show a remaining increase in ‘activity’, a drastic increase in the non-performing loans (NPL) component and provisioning in ‘credit risk’, an overall still slightly improving ‘solvency’ and a problematic drop in ‘profitability’. This encompasses relative changes in pre-impairment operating profit, operating profit, profit before taxes, ROA and ROE observed in 2020 in comparison with the preceding stable period. There are discrepancies among countries, and we have looked at some specific developments in five potentially most exposed countries: Greece, Spain, France, Italy and Portugal.

The newly originated exposures subject to PGs should be seen in the context of increasing government debt, as shown for all five countries in the subsample. This confirms the likely formation of the sort of sovereign-bank ‘doom loop’ that was one of the characteristics of the GFC (and the European sovereign debt crisis). The ECB promptly warned about a similar doom loop materialising.

Moreover, banks should not disregard the other challenges that already lie ahead of the banking sector and society. In her keynote speech on COVID-19’s impact on the financial industry, Claudia Buch stressed that ‘the financial sector will face new potential risks going forward’, specifically climate change and climate policy, higher private and public sector debt, and international political risks that could spill over into the financial sector. Additionally, the interaction of the pandemic and climate-related shocks is already having a material effect on financial markets, and there are moves towards including climate risks in the Basel framework.

On the regulatory front, even before the COVID-19 crisis, the European banks were warning about the potential adverse impact of the final Basel III package, mainly because of the new output floor. The Basel Committee on Banking Supervision (BCBS) postponed the initial implementation deadline from 2022 to 2023. However, according to the proposals (CRR3/CRD6) published by the European Commission, EU implementation will be further delayed until 2025. Based on 2021 estimates, just to maintain the minimum capital requirements EU banks would have a €27 billion capital shortfall. In our opinion, the Commission’s proposal may be interpreted as political awareness about the need for a longer transition period in light of the COVID-19 crisis and pre-existing conditions (especially in regard to profitability), as well as high reliance on banks in the economy.

The use of public support mechanisms to contain a crisis does not imply a loss of democratic accountability.8 States are not in a position to act in a way that sets aside public accountability of decision-making during such shocks. The significant use of public funds requires political scrutiny to ensure fiscal discipline and debt sustainability. However, the acute nature of such an exogenous or endogenous shock means accountability as we know it is limited, with political and public resources shifted to crisis management. As Engler et al. point out: ‘High uncertainty caused by COVID-19 pushes [states] towards adopting measures that, during normal times, contradict fundamental democratic principles.’9 The lessons-learnt process is critical for democratic accountability, but the timing of it is politically contentious. The public interest concern of managing the crisis overshadows normal engagement and consultation.10 The transition phase is a process of unpicking the implications of the containment phase. Equally important is the response takes a holistic approach, which means coordination and cooperation between the Official Safety Net Players during the transition phase.11

In view of this, we argue that the process of political and regulatory scrutiny is an important component of the transition stage despite the level of uncertainty that remains and the potential need for additional public resources that could further erode Member States’ fiscal capacity. This is particularly because crises can morph in different directions. Equally, the transition phase can start a review of the risk of moral hazard as a result of the public support measures and the potential to minimise it. A significant responsibility thus lies with the official safety-net players, such as to ensure better accountability of the impact of public measures on, inter alia, bank credit risk: they must improve the understanding of any insolvency risk of SSM banks firstly at the precautionary recapitalisation stage; and secondly at the stage when a bank is ‘failing’ or ‘likely to fail’, leading to resolution or national insolvency.

The ECB’s risk-based and forward-looking approach to supervision has played a significant role during the containment phase. The supervisory interventions have enabled banks to provide much-needed financial services to the real economy. The reforms to capital and liquidity requirements introduced after the GFC (and indeed the postponement of the timing of implementation) have assisted in smoothing out the shortfall.

In principle, the time limit attached to guarantees can signal a clear ending of the measure. However, unless the authorities in charge of the phasing-out have a clear understanding of the potentially negative impact of exit on banks’ balance sheets, the mere existence of a time limit does not make the exit strategy credible.

We suggest the continuation of PGs in some form, especially for the SME sector given its size and importance for the European Union. However, the research we have reviewed would suggest there are benefits of stress testing changes to the coverage level of PGs to gauge the potential response of banks to their reduction. Equally important is stress testing of SSM significant banks’ ability to repay TLTRO III funding. We appreciate that exposures still remain uncertain and the size of those exposures may not be material to trigger bank failures, let alone a sovereign default. In view of this, significant work needs to be done at the recovery planning stages to ensure the sustainability of banks’ business models.

We suggest that legal, regulatory, supervisory, institutional, and political matters are explored in a transition phase. See page, 51-52.

List of annexes

Annex 1: Individual bank sheets (variables, movements and changes, composite indicators)

Annex 2: Bank overview (variables and change indicators) with implied relevance of their individual ‘shock responses’ to the Banking Union according to their individual asset size

Annex 3: EU/SSM and member state country sheets

Annex 4: Member states’ overview (variables and change indicators) with implied relevance of their individual ‘shock responses’ to the Banking Union according to their aggregate banks’ asset size

See ‘The sovereign bank-corporate nexus – Virtuous or vicious?’, speech by Isabel Schnabel, member of the ECB Executive Board, at LSE conference on Financial Cycles, Risk, Macroeconomic Causes and Consequences, January 2021 https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210128~8f5dc86601.en.html. For a legal analysis of corporate, bank and sovereign debt restructuring see: Rodrigo Olivares-Caminal, Randall Guynn, Alan W. Kornberg, Eric McLaughlin, Sarah Paterson and Dalvinder Singh, Debt Restructuring, 3rd Edition, (Oxford University Press 2022).

Ibid.

Ibid.

ECB, ‘ECB banking supervision provides further flexibility to banks in reaction to coronavirus’, https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr200320~4cdbbcf466.en.html, press release, 20 March 2020.

ECB, ‘ECB banking supervision provides further flexibility to banks in reaction to coronavirus’, https://www.bankingsupervision.europa.eu/press/pr/date/2020/html/ssm.pr200320~4cdbbcf466.en.html, press release, 20 March 2020.

European Commission, ‘Commission statement on consulting Member States on proposal on the future of the State aid Temporary Framework’, press release, 30 September 2021. https://ec.europa.eu/commission/presscorner/detail/en/ip_21_4948.

Communication from the Commission, ‘Sixth Amendment to the Temporary Framework for State aid measures to support the economy in the current COVID-19 outbreak and amendment to the Annex to the Communication from the Commission to the Member States on the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union to short-term export-credit insurance’, 2021/C 473/01. https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=OJ%3AJOC_2021_473_R_0001&qid=1637742014803, para. 8.

Rosa M Lastra, ‘Accountability mechanisms of the Bank of England and of the European Central Bank’, Monetary Dialogue Papers, September 2020 https://www.europarl.europa.eu/cmsdata/211623/1_LASTRA-final.pdf.

Sarah Engler, Palmo Brunner, Romane Loviat et al., ‘Democracy in times of the pandemic: Explaining the variation of COVID-19 policies across European democracies’, 44(5/6) West European Politics 2021, 1077–1102, 1078.

In this respect the official safety-net players have utilised a significant amount of soft law to assist the process of managing risks associated with COVID-19 measures. This has been used to improve decision-making and ensure consistency of practice. See Oana Stefan, ‘COVID-19 soft law: Voluminous, effective, legitimate? A research agenda’, 5 European Papers – Journal on Law and Integration 2020, 663–670 https://www.europeanpapers.eu/en/system/files/pdf_version/EP_EF_2020_I_027_Oana_Stefan_00364.pdf; Mariolina Eliantonio and Oana Ştefan, ‘The elusive legitimacy of EU soft law: An analysis of consultation and participation in the process of adopting COVID-19 in the EU’, 12(1) European Journal of Risk Regulation 2021, 159–175.

Dalvinder Singh and John Raymond LaBrosse, Developing a Framework for Effective Financial Crisis Management, Volume 2011 Issue 2, OECD Journal: Financial Market Trends, (2012) 125-156. https://read.oecd-ilibrary.org/finance-and-investment/developing-a-framework-for-effective-financial-crisis-management_fmt-2011-5k9cswn0h042#page1