The COVID-19 crisis was a major economic shock to both the euro area and the United States. The US suffered a larger impact on human health but a smaller economic contraction. Both regions experienced a faster recovery than during the global financial crisis. Despite the larger decline in GDP, the labour market in the euro area remained resilient as job retention schemes protected employment, while the US saw more volatile outcomes. From a longer-term perspective, divergence in per capita incomes grew after the global financial crisis, driven by a decline in euro area TFP growth. Although the employment rate in the euro area reached historically high levels before COVID-19, it remained lower than in the US. Private investment in the US has also proven more dynamic. Learning from the COVID-19 crisis, this brief draws some policy lessons for the euro area.

The impact of the COVID-19 crisis on human health has been bigger in the US than in the euro area, but the euro area suffered a larger economic contraction. Both regions however experienced a faster pace of the recovery than during the 2008 global financial crisis. The different nature of the two crises, as well as the different policy responses, nevertheless limits direct comparison. Uncertainty around the future course of the pandemic remains high, especially given the large dispersion in vaccination rates across Member States and globally. In this brief, we highlight differences in economic adjustment in the euro area and in the United States, based on Licchetta, Mattozzi, Raciborski and Willis (2022). First, we discuss the economic impacts of the COVID-19 crisis in both regions. Then we look at the role of longer-term factors (investment, labour supply) in explaining differences in growth performance. Finally, we put forward some initial lessons for the euro area.

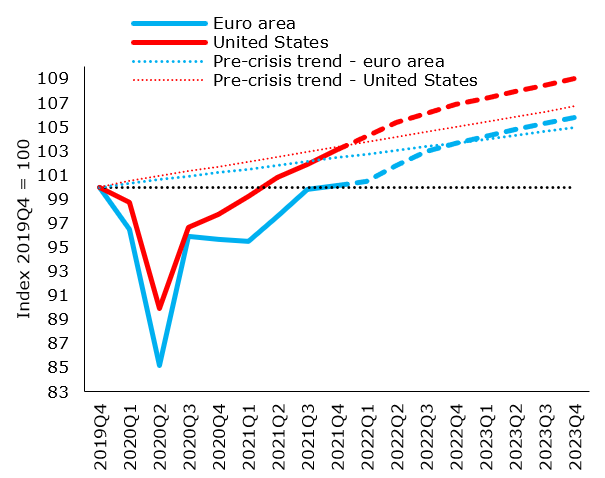

The euro area experienced a larger economic contraction in 2020 than the US, but the adjustment in employment and unemployment was far larger in the US. Real GDP in 2020 declined by 6.4% in the euro area and by 3.4% in the United States (Graph 1). In both cases, the GDP contraction was much larger than during the 2008 global financial crisis, but both have recovered much more quickly. While the US had already passed pre-pandemic levels by mid-2021, the euro area reached its pre-pandemic output at the end of 2021. Several factors can explain the difference in the GDP impact, including the public health policy response (lockdown measures and voluntary distancing), the structure of the economies (Chatelais, 2021 and Brussevich et al 2020) and to a lesser extent macroeconomic policies (IMF, 2021a).

| Graph 1: Level of GDP in the euro area and in the US | Graph 2: Unemployment rate in the euro area and the US (15-74) | |

|

|

| Source: Eurostat (outturns for euro area and United States), Commission Winter 2022 Forecast (euro area) and Commission Autumn 2021 Forecast (United States). Commission Autumn 2019 Forecast (trend lines for euro area and United States). |

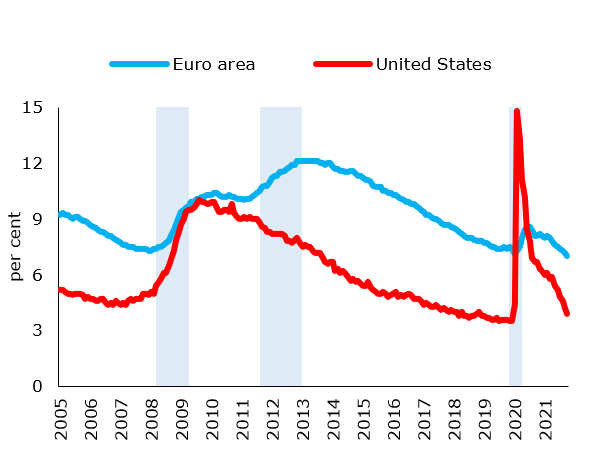

Source: OECD Database. Note: Shaded area refers to euro area recessions (CEPR). |

There have been marked differences in the way labour markets reacted to the COVID-19 crisis, though the recovery has been speedy in both regions (Graph 2). The employment rate in the United States fell sharply in the early months of the pandemic, and the unemployment rate spiked to 15% in April 2020. The unemployment rate fell back rapidly in 2020 and stood at 3.6% as of April 2021 (compared to 3.5% pre-pandemic). Meanwhile, despite a much larger hit to GDP, the unemployment rate in the euro area remained broadly stable through the pandemic (although classification differences make direct comparison difficult). In 2020, the unemployment rate in the euro area increased by only 0.3 ppt. up to 7.9%, then falling to 6.8% in March 2021 (0.6 ppt. lower than the pre-crisis level).

Labour force participation declined in the wake of the COVID-19 crisis in both regions and it remains below pre-pandemic levels in the US. The participation rate dropped in both the euro area and the US at the height of the pandemic. The euro area has re-absorbed its inactive population, with activity rates in the fourth quarter of 2021 exceeding pre-crisis levels by 0.7 ppt., though differences across member states exist. By contrast, despite an earlier and faster recovery in output, the US has seen a weaker rebound in activity rates, with a high level of early retirement, and record-high levels of voluntary quits from jobs, a phenomenon dubbed the ‘great resignation’. It remains uncertain whether the great resignation reflects a more persistent structural change that could hold US activity rate at a subdued level for longer. By April 2022, the rate was still 0.5 ppt. below the pre-crisis levels.

In both economies, a large part of the policy response was directed towards protecting household incomes, although through different approaches. In the euro area, short-time working schemes preserved employment relationships by subsidising workers’ wages and protecting jobs and human capital, supported by the EU-level SURE. The widespread use of short-time work schemes in the euro area was an important factor behind the relatively mild impact on the unemployment rate in this region. Policies in the US instead relied to a large extent on direct income support to households through stimulus cheques, largely non-means-tested, as well as expanded unemployment insurance programs under the CARES Act. However, unlike in the previous crisis, a large-scale work retention scheme via the Paycheck Protection Programme (PPP) was also introduced, albeit its effectiveness might have been lower than hoped (Granja et al., 2021).

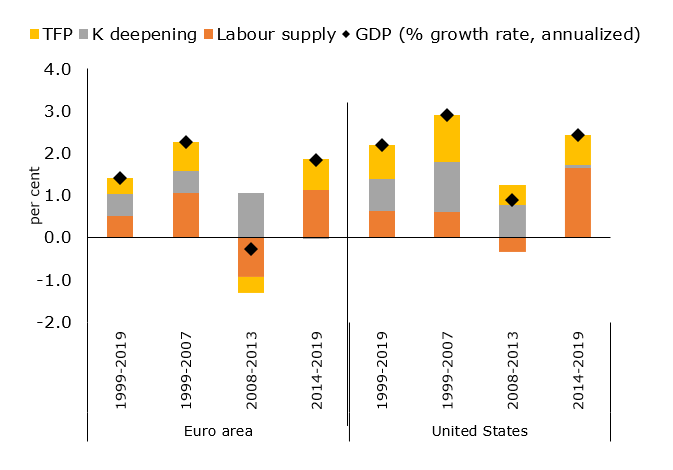

The developments in output and employment during the pandemic should be seen in the context of longer-term trends. In the two decades prior to the COVID-19 crisis (1999-2019), euro area GDP increased on average by 1.4% per year in real terms (Graph 3), compared to an average increase of US GDP by 2.2% per year. The difference is, however, partly explained by faster population growth in the US. Taking into account different population growth rates, euro area GDP per capita increased by a cumulative 22% over this period, with US GDP per capita rising by 29%. The design of successful post-crisis policies in the euro area will not be possible without a better understanding of the structural factors behind this difference.

3.1 Total factor productivity (TFP)

A secular decline in TFP growth has been the single most important factor behind the slowdown of output growth (Graph 3). Average annual TFP growth in the euro area has been lower than in the US, particularly since the global financial crisis. The divergence in TFP growth in the two areas during the 1990s and early 2000s can be partly attributed to the faster adoption of ICT technologies in the US and stronger investment in intangibles (McMorrow, 2013). The euro area’s productivity growth after the global financial crisis was further impeded by the euro area sovereign debt crisis and slow recovery, with reduced investment, amplified skill mismatches and slower reallocation of labour to more productive sectors. In addition, the ‘churn rate’ – the rate at which businesses default and are replaced by new ones – tended to be lower in the euro area than in the US, which may have affected the pace of innovation and creative destruction and the level of competition.

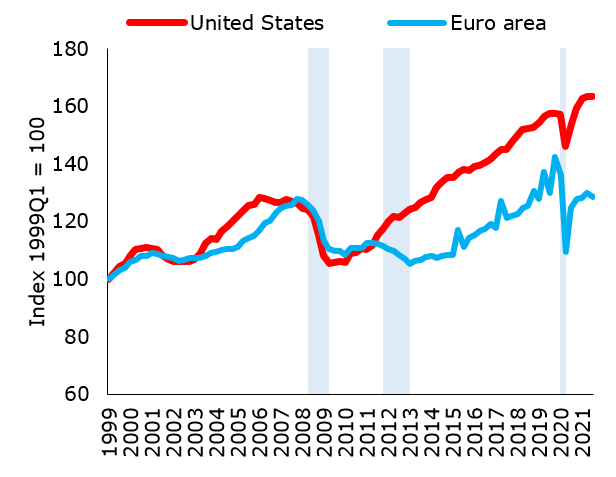

| Graph 3: GDP growth decomposition in the euro area and the US (1999-2019) | Graph 4: Gross Fixed Capital Formation in the euro area and the US (1999-2021) | |

|

|

|

| Source: AMECO. | Source: OECD Note: Gross fixed capital formation, volume estimates, fixed PPPs. Shaded area refers to euro area recessions (CEPR). |

There is substantial uncertainty over the medium-term impact of COVID-19 on TFP growth. Investment contracted during the pandemic and there may be some “scarring” impacts – for example on younger workers – that will affect future productivity growth. But the pandemic may also have accelerated the adoption of ICT technologies and induced productive changes in working practices, business models and organization. Investment in intellectual property (e.g. investment in software and research and development) is highly correlated with TFP growth and has held up better than investment in machinery and equipment, in particular in the US. Furthermore, in the euro area, most Recovery and Resilience Plans (RRP) under the EU’s RFF promote digitalisation across public and private sectors (especially SMEs) and will add impetus to that trend.

3.2 Capital accumulation

Capital accumulation was sluggish in the euro area in the decade following the global financial crisis (Graph 4). Euro area gross fixed capital formation (GFCF) took about 10 years to return to its pre-crisis level after the global financial crisis (ECB, 2020). By comparison, capital investment in the US led the recovery from the slump in 2009 and continued to grow at a healthy pace until COVID-19. A part of the explanation may be provided by tighter credit conditions and weak corporate balance sheets that further reduced investment in intangibles such as R&D, organization capital, and training in Europe. In addition, low private investment in some areas may be partly explained by a less rich infrastructure of credit and risk-sharing markets (fewer seed capital and venture capital funds etc.).

Public investment has also been low since the global financial crisis. The government investment-to-GDP ratio fell in the early 1990s and even more steeply in the aftermath of the global financial crisis. Compared to 1991, in 2019, the government investment-to-GDP ratio was 1.2 ppt. lower in the former 12 euro area countries (at 2.8% of GDP in 2019) and 1.3 ppt. lower in the US than in 1991 (at 3.5% of GDP in 2019).

The Euro area’s investment was relatively more affected by the COVID-19 shock. Gross fixed capital formation (GFCF) has rebounded in both regions but it remained below pre-pandemic levels in the euro area by 2021Q4 (Graph 4). By contrast, in the US, GFCF decreased by less than in the euro area and has recovered at a much faster pace, so that it returned to its pre-crisis level at the end of 2020. In the euro area, the impact of COVID-19 on GFCF (along with other components of GDP) reflects in part the intensity of lockdown measures to contain the spread of the virus, with more stringent lockdowns (and consequent lower mobility) associated with lower investment (Licchetta and Meyermans, 2021). Going forwards, there is the risk that the large corporate debt burden accumulated during the pandemic might act as a drag on investment.

3.3 Labour supply

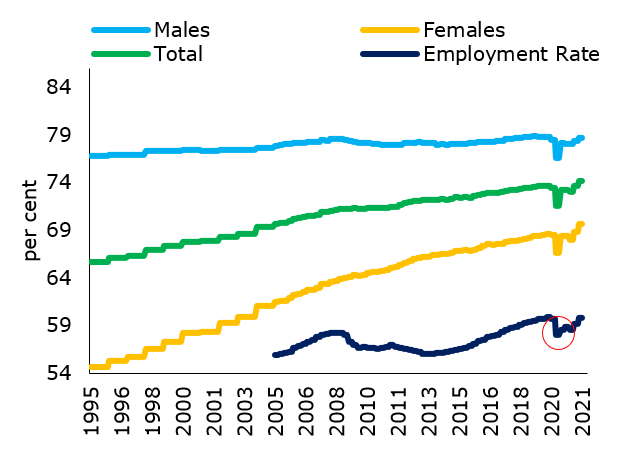

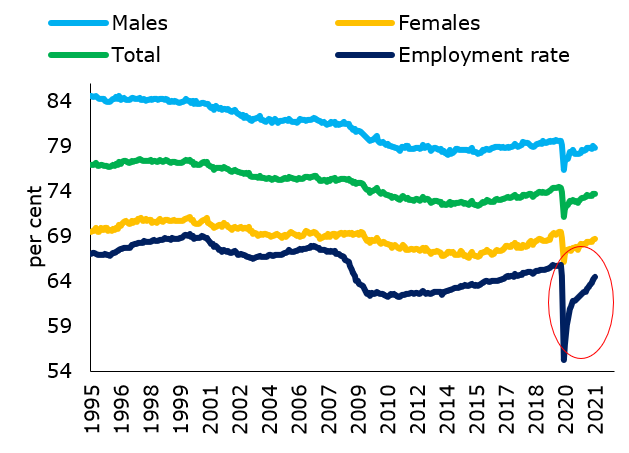

Labour force participation (activity rate) in the euro area increased over the 20 years before the COVID-19 crisis as more inclusive tax, active labour market policies and better child care provision allowed for greater integration of women into the labour market (Graph 5 & 6). This is in contrast to the US, which saw a gradual fall in activity rates from the mid-1990s until 2014. Euro area activity rates caught up to US levels around 2011 and were only marginally below US levels (0.5 ppt.) on the eve of the pandemic. From around 2014 to 2019, both the US and euro area experienced a parallel increase in labour market participation and employment that supported a higher labour contribution to output growth. Yet although the employment rate reached historically high levels in the euro area immediately before COVID-19 struck, it remained lower than in the US (as reflected in persistently higher reported unemployment).

| Graph 5: Activity rates (15-64) and employment rate (15-74) in the euro area | Graph 6: Activity rates (15-64) and employment (15-74) rate in the US | |

|

|

|

| Source: OECD. | Source: OECD. |

Some tentative lessons for the euro area emerge from this assessment:

Brussevich, Dabla-Norris, and Khalid (2020), “Who will Bear the Brunt of Lockdown Policies? Evidence from Tele-workability Measures Across Countries”, IMF WP 20/88.

Chatelais, N. (2021), “Covid-19 and divergence in GDP declines between Europe and the United States”, Banque de France Eco Notepad.

Council of the European Union (2022), “Council Recommendation of 5 April 2022 on the economic policy of the euro area”, Official Journal of the European Union, C 153, Pages 1-6.

European Central Bank (2020), ‘The scarring effects of past crises on the global economy’, ECB Economic Bulletin Issue 8/2020.

European Commission (2022), Directorate-General for Economic, & Financial Affairs (2022), European economic forecast: Winter 2022 (Interim). Publications Office of the European Union.

Granja, J, C. Makridis, C. Yannelis, and E. Zwick (2021), “Did the Paycheck Protection Program Hit the Target?” Working Paper No 2020 52 University of Chicago.

International Monetary Fund (2021a), “After-effects of the Covid-19 Pandemic: Prospects for Medium-term Economic Damage”, Chapter 2 April WEO.

International Monetary Fund (2021b), “World Economic Outlook”, October 2021.

Licchetta, M. and E. Meyermans (2021), “Gross fixed capital formation in the euro area during the COVID-19 pandemic”, Quarterly Report on the Euro Area (QREA), Vol. 20, No. 4 (2021).

Licchetta, M, G Mattozzi, R Raciborski and R Willis (2022), “Economic Adjustment in the Euro Area and the United States during the COVID-19 Crisis”, European Commission Discussion Paper 160, March 2022.

McDonnell, C., C McDonnell, J Boussard, I Justo, P Mohl, G Mourre and K Stoviceket (2021), ‘The SURE instrument – key features and first assessment’, Quarterly Report on the Euro Area, Vol. 20, No. 2, pp. 41-49.

McMorrow K. and W. Roeger (2013), “The euro area’s growth prospects over the coming decade,” Quarterly Report on the Euro Area (QREA), Directorate General Economic and Financial Affairs (DG ECFIN), European Commission, vol. 12(4), pages 7-16, December.

The views expressed in this document are solely those of the author(s) and do not necessarily represent the official views of the European Commission.