A European Unemployment Benefit Scheme can stabilize international consumption differentials and increase welfare. However, this column argues that following productivity or government spending shocks its effects are detrimental. The scheme should therefore only be activated in response to certain disturbances or be accompanied by structural reforms following productivity or government spending shocks.

Since the emergence of the European sovereign debt crisis, the policy debate in the euro area has centered on potential mechanisms to stabilize the economy in the face of asymmetric shocks (see, among others, Bénassy-Quéré et al. 2018). A prominent example for such an international stabilization capacity is a European Unemployment Benefit Scheme (EUBS). The evaluation of its macroeconomic effects is an important task, as this scheme constitutes a novel mechanism for international risk sharing. Structural macroeconomic models allow for the incorporation of such a scheme and therefore provide a suitable framework for the analysis. However, there are only a few studies so far that have considered the effects in a structural model (see, e.g., Moyen et al. 2019, Abrahám et al. 2019, Jung et al. 2020).

In a new study (Enders and Vespermann 2021), we examine the introduction of a EUBS with a specific focus on the effects of the cross-country transfers induced by unemployment differentials on consumption risk sharing, production efficiency, and welfare. In other words, we evaluate how the pie of European goods and services is distributed across countries and whether this pie gets baked efficiently.

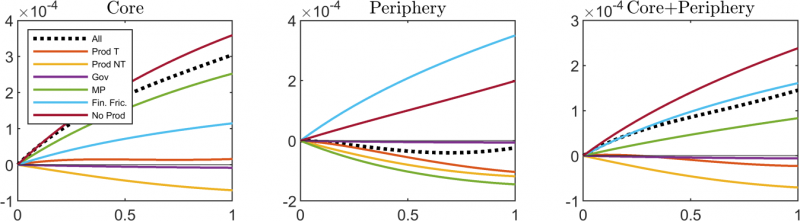

After analyzing the role of cross-country transfers in a simple analytical model, we implement a counterfactual scenario with a EUBS in a two-country dynamic stochastic general equilibrium model. The model is calibrated to the Core (AU, BE, DE, FI, FR, NL) and the Periphery (GR, IR, IT, SP) of the euro area and successfully captures European business cycles. The EUBS is designed to rule out cross-country transfers on average. We also consider cases in which only a fraction λ of contributions to the unemployment benefit scheme is pooled at the European level. Thus, λ=0 captures the status quo without a EUBS, λ=1 refers to the fully international EUBS, and intermediate cases take values between 0 and 1. The counterfactual analysis shows that a EUBS would increase welfare in the Core and overall welfare, while welfare in the Periphery would remain almost unchanged. This effect is displayed in Figure 1 by the dotted lines. Moreover, Table 1 shows that, after the implementation of a EUBS, GDP and consumption will be less volatile in both country aggregates and the corresponding cross-country correlations are larger compared to the status quo.

Figure 1: Changes in welfare after the introduction of a EUBS

Notes: The x-axis refers to the fraction λ of contributions that is pooled at the European level. The y-axis shows the welfare effects measured in percent of average consumption. The different lines refer to scenarios in which only certain shocks are present. ‘Prod’: Productivity. ‘T’: Traded goods sector. ‘NT’: Non-traded goods sector. ‘Gov’: Government spending. ‘MP’: Monetary policy. ‘Fin. Fric.’: Financial frictions. ‘No Prod’: All but productivity.

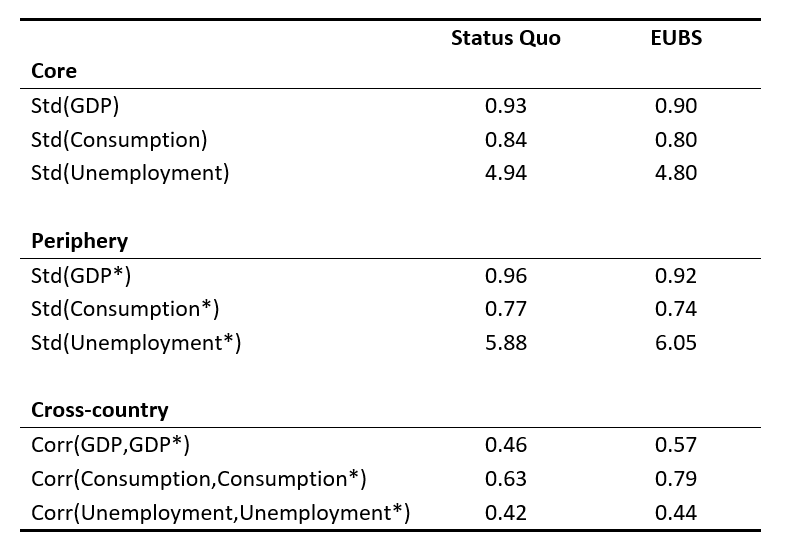

Table 1: Volatilities and cross-country correlations of selected variables in the status quo and after the introduction of a full EUBS

Notes: Volatilities refer to standard deviations multiplied with 100. Variables in the Periphery are denoted by an asterisk.

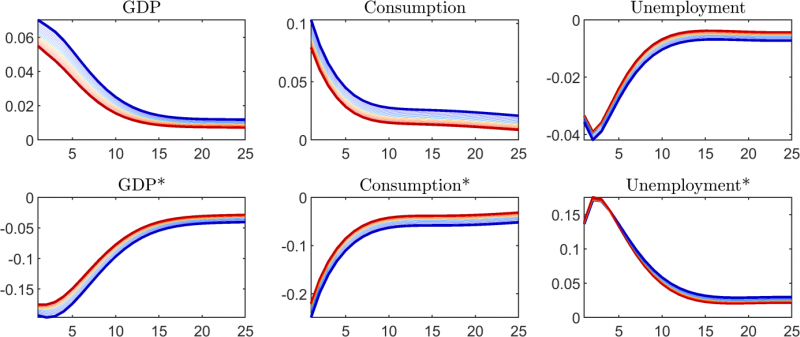

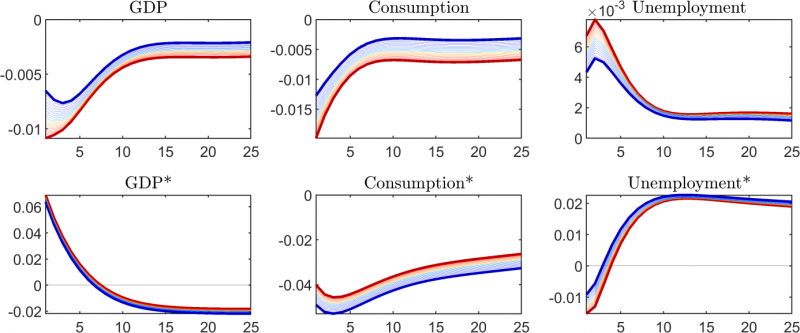

The effects on welfare and efficiency, however, depend on the specific cause for international unemployment differentials. In case of diverging demand, e.g., due to financial frictions (captured by a wedge between the monetary policy rate and the interest rate offered to consumers in the model) or changes in the consumers’ preferences or expectations, a EUBS both reduces international consumption differentials and increases production efficiency at the same time. Figure 2 shows the responses to an increase in consumer interest rates, keeping policy rates constant, in the Periphery. Blue and red lines show the responses in the status quo and with a EUBS, respectively, while lines in between refer to increasing values of λ. The adverse developments in the Periphery reduce demand and increase unemployment there. This triggers positive transfer payments from the Core to the Periphery that stabilize demand and bring production closer to its efficient level. That is, a EUBS leads to a more efficient distribution of consumption and production in this case.

Figure 2: Responses to a decrease of demand in the Periphery

Notes: Decrease of demand induced by financial frictions (increase in the wedge between consumer interest rate and the monetary policy rate by one standard deviation) in the Periphery. Status quo: blue. EUBS: red. In between: partial EUBS. Variables in the Periphery are denoted by an asterisk. X-axis: Quarters after shock. Y-axis: Percentage deviations from long-run trend (percentage-point deviations for unemployment).

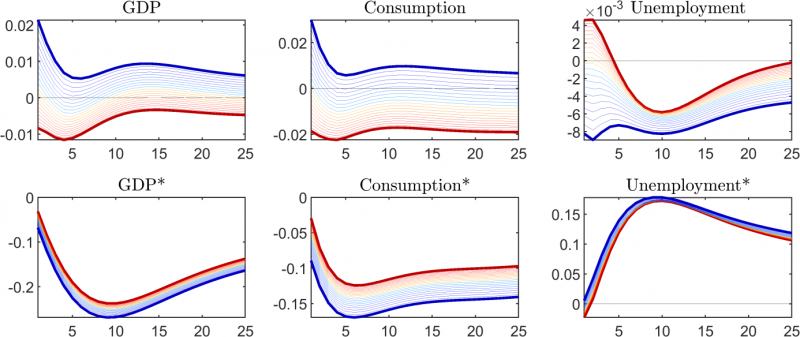

Importantly, we obtain different results in response to productivity shocks. Consider a temporary decline in Periphery productivity which leads to lower production of goods and services for a given amount of labor input. The relative deterioration of productivity decreases consumption and increases unemployment in the Periphery (see Figure 3). The EUBS triggers transfer payments from the Core to the Periphery, which initially reduce cross-country consumption differentials.

Figure 3: Responses to a productivity decline in the Periphery non-traded goods sector

Notes: Decrease of demand induced by financial frictions (increase in the wedge between consumer interest rate and the monetary policy rate by one standard deviation) in the Periphery. Status quo: blue. EUBS: red. In between: partial EUBS. Variables in the Periphery are denoted by an asterisk. X-axis: Quarters after shock. Y-axis: Percentage deviations from long-run trend (percentage-point deviations for unemployment).

However, the efficiency of the international distribution of production hinges on the origin of the consumption goods that are financed by the transfer payments. Empirically, domestic goods and services account for the largest share of consumption expenditures of a country. In combination with a certain degree of price rigidities, this so-called home bias decreases production efficiency substantially. If prices do not move one-for-one with the cost increases induced by lower productivity, prices of goods and services are ‛too low’ and do not longer reflect the true cost of production. Consequently, demand for the corresponding goods and services is ‛too high’, seen from an efficiency perspective. In other words, a large share of the additional demand induced by the international transfer falls on relatively inefficiently produced goods and services. This finding is related to a ‛zombification’ of inefficient sectors that survive in spite of considerable productivity decreases. Price rigidities and home bias are especially pronounced in the non-traded goods sector, such that the risk of a ‛zombification’ after a decline in productivity is particularly high in this sector.

Overall, the transfer payments of a EUBS that are triggered by productivity differentials would decrease European welfare (see yellow lines in Figure 1). Thus, from an efficiency point of view, the EUBS should not be activated in case of international productivity asymmetries. If the underlying reasons for unemployment differentials cannot be clearly identified in real time, it could still be beneficial to accompany the transfer payments with structural reforms to enhance productivity in the negatively affected countries.

Relative changes in public demand lead to similar conclusions as in the case of productivity shocks. Consider a temporary increase of government spending in the Periphery. In the short run, the increase in aggregate demand reduces unemployment. In later periods, however, consumption decreases and higher taxes raise unemployment (see Figure 4).

Figure 4: Responses to an increase in Periphery government spending

Notes: Increase by one standard deviation. Status quo: blue. EUBS: red. In between: partial EUBS. Variables in the Periphery are denoted by an asterisk. X-axis: Quarters after shock. Y-axis: Percentage deviations from long-run trend (percentage-point deviations for unemployment).

The main difference relative to other demand changes lies in the direction of transfer payments over the whole business cycle. In total, the EUBS triggers net transfers from the Core to the Periphery and production efficiency is again negatively affected due to price rigidities and the home bias. The public demand increase in the Periphery puts upward pressure on production costs which are not adequately reflected in the prices of goods and services. Additionally, a large share of transfer payments falls on goods and services with inefficiently high production costs. This finding leads to similar conclusions as in the case of productivity shocks. The EUBS would stabilize international consumption differentials, while simultaneously decreasing production efficiency and European welfare. Besides a selective EUBS that is only active after certain shocks, these findings would call for a restriction of the increase in public spending in this scenario.

In addition to the analysis in the quantitative structural model, we also analytically derive the trade-off between consumption risk sharing and production efficiency. We use a simple two-country model to demonstrate that this trade-off exists after the mentioned shocks and that, in certain scenarios, international transfers can reduce welfare.2 These findings underline that the suspension of cross-country transfers after diverging developments of international productivity or public spending should be considered if a EUBS were to be introduced. If the underlying reasons for unemployment differentials cannot be clearly identified in real time, it might nevertheless be beneficial to accompany the transfer payments with structural reforms in the receiving countries, as discussed above.

Abrahám, Arpád, João Brogueira de Sousa, Ramon Marimon, and Lukas Mayr (2019). „On the Design of a European Unemployment Insurance System”. Mimeo.

Bénassy-Quéré, Agnès et al. (2018). „Reconciling risk sharing with market discipline: A constructive approach to euro area reform”. CEPR Policy Insight No. 91.

Enders, Zeno and David Vespermann (2021). „Cross-country unemployment insurance, transfers, and trade-offs in international risk sharing”. CESifo Working Paper 8965.

Farhi, Emmanuel and Iván Werning (2017). „Fiscal Unions”. American Economic Review 107 (12), 378–3834.

Jung, Philip, Keith Kuester, and Marek Ignaszak (2020). „Federal unemployment reinsurance and local labor-market policies”. CEPR Discussion Paper 15465.

Moyen, Stéphane, Nikolai Stähler, and Fabian Winkler (2019). „Optimal Unemployment Insurance and International Risk Sharing”. European Economic Review 115, 144–171.

Corresponding author, E-mail: zeno.enders@uni-heidelberg.de

This finding is in line with Farhi and Werning (2017). We extend their analysis for additional types of shocks and show that some of their conclusions are not valid for certain parameter constellations.