This policy brief is based on Deutsche Bundesbank, Discussion Paper, No 02/2025. The views expressed in this Policy Brief are those of the authors and do not necessarily reflect those of the Deutsche Bundesbank or the Eurosystem.

Abstract

The European Union and China pursue different approaches to pricing CO2 emissions: while the EU relies on a cap-and-trade system, China limits emissions per unit of output using a tradeable performance standard. A new study analyses the effects of both systems on the economy and welfare using the environmental multi-sectoral general equilibrium model EMuSe. The results show that the Chinese system causes fewer production and welfare losses at first glance. However, these advantages disappear when the government uses revenues from the European system to reduce distortionary taxes, such as labour income taxes.

Climate change and the reduction of greenhouse gas emissions are among the most pressing challenges of our time. Effective pricing of CO2 emissions is crucial to reduce emissions and promote the transition to a climate-neutral economy. Different countries employ various approaches in this regard. The European Union has established a cap-and-trade system since 2005, while China takes a different path with its tradeable performance standard (TPS) since 2021. How do these systems differ in their impacts on the economy and welfare? What conclusions can be drawn for climate policy? This policy brief summarizes the results of Burgold et al. (2025), who analyse these questions in a multi-sectoral general equilibrium model.

The European cap-and-trade system (CaT) directly limits the total amount of CO2 emissions by setting the number of available emission allowances. Companies must present an allowance for every ton of CO2 they emit. These allowances are auctioned and generate revenue for the government. The system thus sets a price for CO2 emissions and creates financial incentives for companies to reduce their emissions or invest in low-emission technologies.

In contrast, the Chinese system is a tradeable performance standard (TPS), which limits the emission intensity per unit of production. Companies receive allowances based on their actual production multiplied by a predetermined average emission intensity. Companies that produce more efficiently and therefore emit less CO2 per unit of output can sell surplus allowances. Companies with higher emission intensities must purchase additional allowances. Since allowances are allocated free of charge, the government does not generate revenue from this system.

From an operational point of view, TPS appears more complicated as it requires detailed knowledge about the production technology as well as supply and demand functions in order to choose the appropriate allowed emissions intensity. The achievement of a specific emissions reduction at a given point in time seems more uncertain than under CaT. In our model analysis, we abstract from these issues and assume perfect information.

To analyse the effects of both systems, we use the dynamic environmental multi-sector general equilibrium model EMuSe (see Hinterlang et al. 2023) with two types of households: optimizing households and rule-of-thumb (RoT) households. Optimizers can save and invest, while RoT households consume all their income.

The model considers eleven sectors with different emission intensities and production technologies. It features a detailed production network, where each sector uses intermediate inputs from the other sectors for production. Consumption and investment are bundled over all sectoral goods. Emissions occur as a by-product of production and firms can engage in costly abatement in order to reduce emissions. They do so, if the carbon price is larger than zero. Damage from the world-wide emissions stock reduces productivity of the firms.

We compare the two policy approaches in three stages, each with different assumptions regarding the use of revenues from CO2 pricing under CaT. While the TPS does not generate any government revenues, given the allocation of certificates to companies free of charge, the allocation of certificates depends on each company’s output. This, on average, dampens the increase in the marginal costs of production relative to CaT. In all cases, we assume the same emission reduction of 20% compared to the initial equilibrium.

We calibrate the model once for the EU plus UK (EU hereafter) and once for China using the World Input-Output Database (WIOD; see Timmer et al., 2015). In both versions, we examine the effects of both CaT with different uses of revenue and TPS.

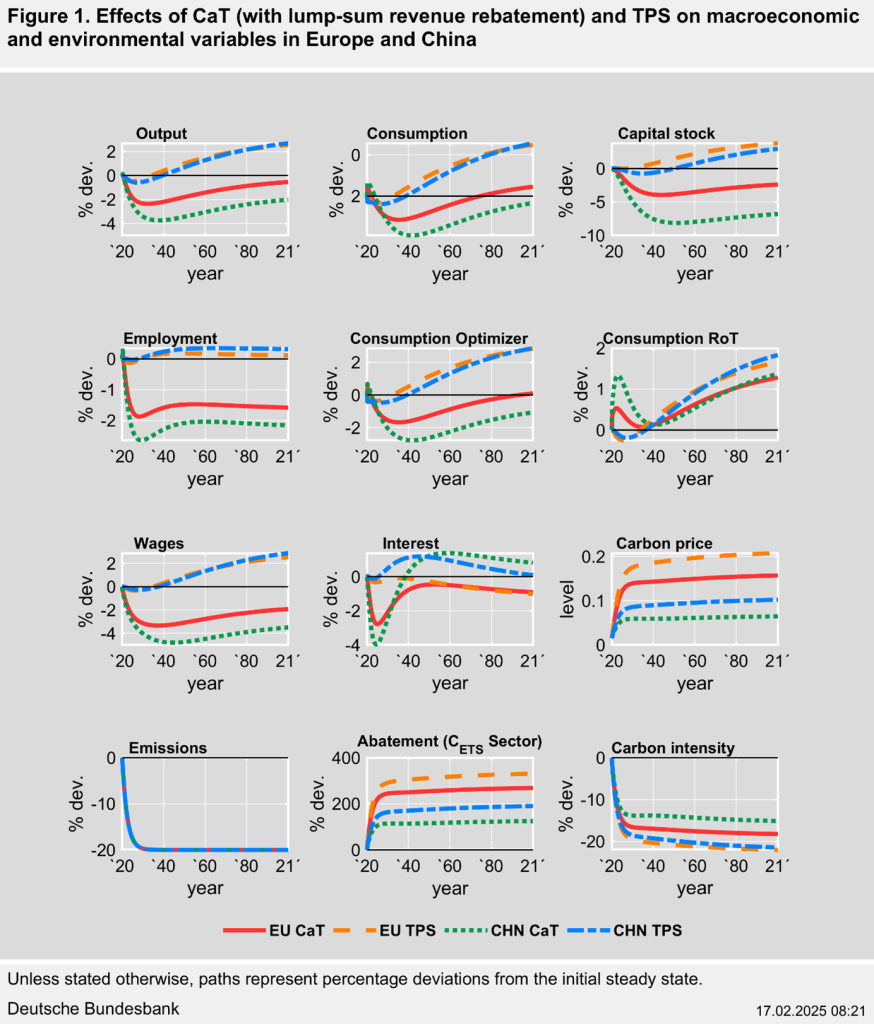

An initial comparison shows that under TPS, both welfare and output are higher than under CaT when the revenues from the sale of allowances are returned to households as lump-sum transfers (see Figure 1). The reason for the lower output losses under TPS is the reduction in marginal costs for firms due to the link between individual output and allocation of certificates. Both Europe and China experience persistent output declines under CaT because the additional emission costs outweigh the positive effects of reduced emission damages. Under TPS, however, the output losses during the transition phase are smaller, and there are long-term gains.

This difference is attributable to the lower marginal costs compared to CaT. The lower marginal costs increase the incentive to produce. This, in turn, results in a higher allowance price to achieve the same emission reduction. The higher allowance price provides more incentives for emission abatement, which is what enables the higher production under TPS with the same level of emissions.

However, the differences between the two systems critically depend on how the government uses revenues from the sale of allowances in the CaT system: If it returns them to firms proportionally to their production volume, the results of CaT and TPS are identical. Firms directly benefit from the funds, re-aligning their marginal costs and production incentives under both regimes.

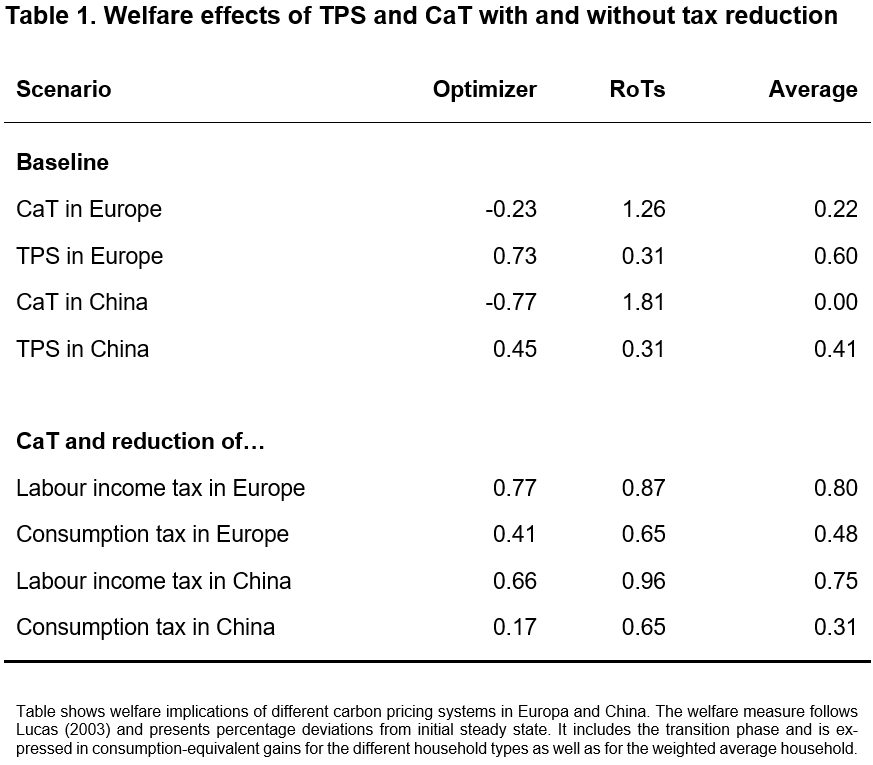

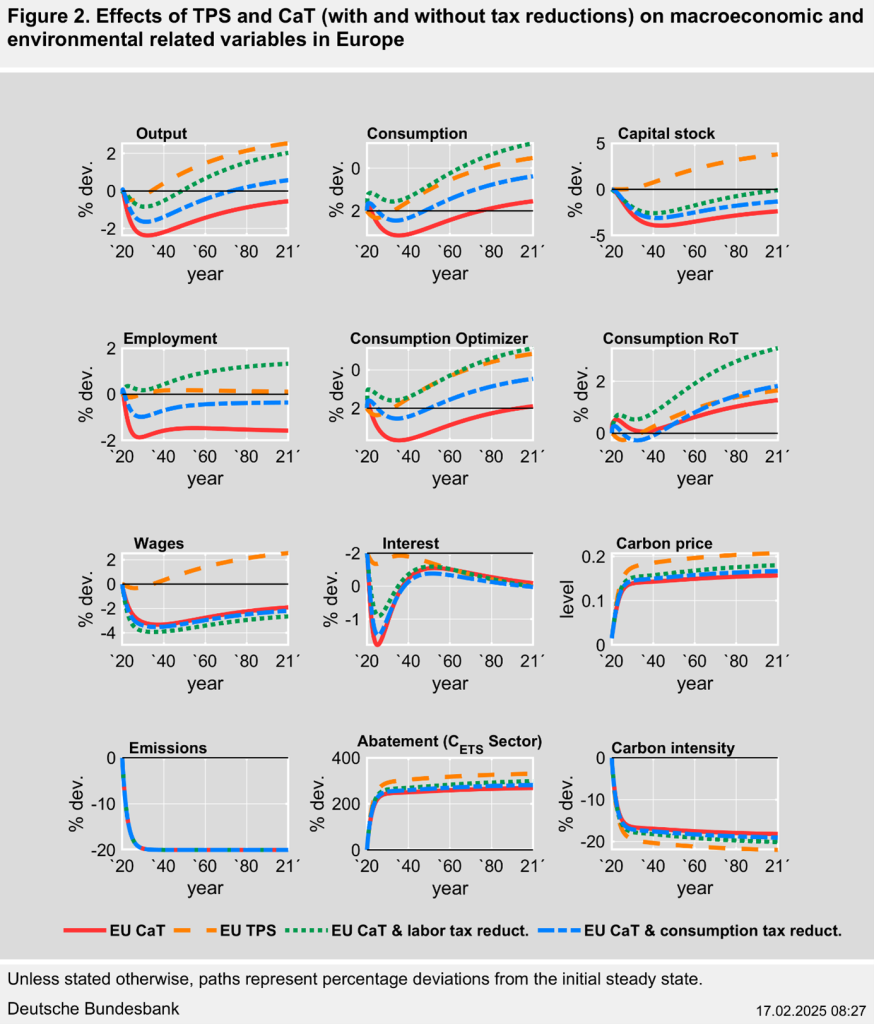

The combination of CaT with a reduction in consumption or labour income taxes improves economic activity; however, output remains below that achieved under TPS (see Figure 2). When the government uses CaT revenues to lower the tax rate on labour income, output significantly increases compared to CaT with lump-sum transfers to households. This approach addresses not only the climate externality but also reduces a distortionary tax (in this case, the labour income tax). It lowers labour costs for companies, positively affecting employment and production.

In terms of welfare, a CaT with a labour tax reduction performs best (see Table 1). This is because the gains from a CaT with a labour tax reduction are distributed most evenly be-tween the two household types. Especially, RoT households benefit more from a labour tax reduction, which increases their net income. By contrast, as they neither have capital income nor own firms, they benefit relatively little from higher firms profits under TPS.

The analysis shows that the European cap-and-trade system has several advantages over the Chinese tradeable performance standard, as long as revenues are used effectively. Targeted reduction of distorting taxes can increase welfare gains and reduce burdens on the economy. Additionally and going beyond the model analysis, the cap-and-trade system is easier to implement and allows for more precise control of total emissions.

For designing effective and efficient climate policy, it is crucial not only to choose the appropriate instrument for CO2 pricing but also to plan the use of generated revenues carefully. Our study suggests that a combination of emissions trading and using revenues to reduce distortionary labour taxes is a promising way to achieve climate goals while promoting economic growth and welfare.

Burgold, P, A. Ernst, N. Hinterlang, M. Jäger and N. Stähler (2025). Cap and Trade versus tradeable performance standard: A comparison for Europe and China. Discussion Paper 02/2025. Deutsche Bundesbank.

Hinterlang, N., A. Martin, O. Röhe, N. Stähler and J. Strobel (2023). The Environmental Multi-Sector DSGE model EMuSe: A technical documentation. Technical Paper 03/2023, Deutsche Bundesbank.

Timmer, M. P., E. Dietzenbacher, B. Los, R. Stehrer and G. J. De Vries (2015). An illustrated user guide to the world input-output database: The case of global automotive production. Re-view of International Economics 23(3), 575-605.