This brief is based on the report by the same authors, titled “EIB Group support for EU businesses: Evidence of impact in addressing market failures”. The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of the European Investment Bank (EIB).

This brief presents the rationale behind EIB Group support for businesses and the evidence on the impact of SME-targeted financial instruments. It gives an overview of relevant market failures and financing gaps, and how different EIB Group instruments address them. The brief brings together the results of several impact studies, comparing the performance of firms that received EIB Group support to comparable firms that did not receive such support. These studies are based on unique firm-level datasets linking EIB Group firm-support allocation data to external information on firms, investors and the macroeconomic setting. The impacts observed after the financing are positive and significant, proving that EIBG financing for SMEs, mid-caps and innovative businesses has a real impact.

Small and medium-sized enterprises (SMEs) constitute a key part of economic activity within the European Union.1 In addition to the large share of employment provided, SMEs contribute to the European economy and its competitiveness through innovation, productivity enhancements, and the dissemination of strategic technologies. Yet, EU firms, particularly small and more innovative firms, face challenges to access the necessary financial resources for their operations and growth. The European Investment Bank (EIB) Group has been supporting annually about 400 000 SMEs and mid-caps, with €31.1 billion financing for businesses in 2023 alone, of which about €14.9 billion from the European Investment Fund (EIF). Support for businesses makes up around 43% of EIB Group activity, by volume, and contributes to achieving strategic objectives like sustainability, digitalisation, and competitiveness.

This brief presents the rationale behind EIB Group support for businesses and the evidence on the impact of SME-targeted financial instruments, building on half a decade of impact studies of its programmes.

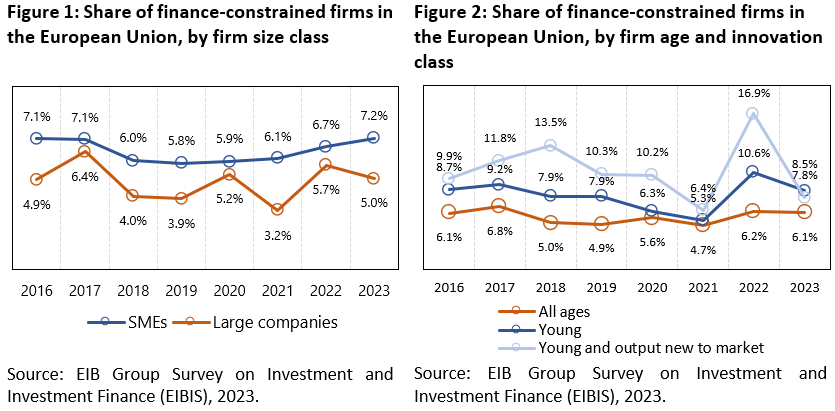

A non-negligible share of EU firms faces challenges to access the necessary financial resources for their operations and growth, with the difficulties more pronounced for smaller firms. In the European Union, the share of finance-constrained firms remains significant (Figure 1). The most recent EIB Group Survey on Investment and Investment Finance finds that more than 6% of EU firms fall into this category. However, the percentage varies across different EU countries, ranging from 3% to 18%. The share of finance-constrained firms is persistently higher among SMEs and more innovative firms.

SME growth is a catalyst for overall economic growth and productivity. As SMEs grow and innovate, they increasingly contribute to productivity and generate added value. Support for young innovative businesses — startups and scale-ups — is also critical for innovation and competitiveness. As such, it is essential to address access to finance for such businesses, for an inability to do so could impair job creation, the adoption of innovations and overall productivity growth.2

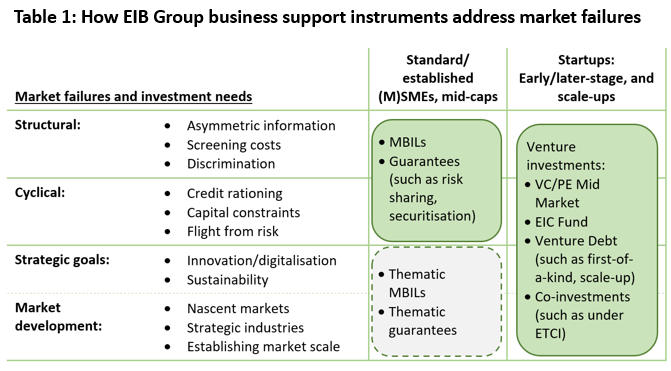

The need for public policy intervention in this area is the result of market failures and gaps. Each of these market failures and goals results in finance gaps for different types of firms or investment situations.3 Table 1 summarize the most common market failures and how EIB Group business support instruments addresses them.

Policymakers can employ a wide range of instruments to support SMEs in the presence of market failures, with each instrument addressing a distinct financing need. For example, access to affordable credit lines and guarantee programmes enables SMEs to invest, expand and mitigate liquidity shocks, particularly during economic downturns. Guarantees reduce the risks for investors, encourage private-sector participation and can be instrumental in directing investment towards projects of strategic importance for the implementation of EU policies and priorities. By bundling financial assets (such as loans) into securities, securitisation allows banks to manage and offload credit risk, allowing them to expand their credit supply and making them more resilient to financial shocks and economic downturns. Equity and quasi-equity financing is particularly beneficial for startups and high-growth enterprises in need of patient capital to support innovation.

A large share of smaller European businesses is affected by adverse financing conditions and even the rationing of credit. Intermediated lending and loan guarantees are the two main instruments used by the EIB Group to address these market failures. Impact studies by both the EIB and the EIF, comparing loan recipients with peer firms with similar characteristics but no EIB funding, provide evidence of the success of these instruments in promoting investment and the creation of jobs.

Intermediated lending is a way for public promotional banks to address market failures affecting credit availability and conditions. In this case, commercial banks with extensive branch networks are used as intermediaries to on-lend liquidity provided by an institution such as the EIB. Central to this arrangement is a contractual agreement on the transfer of financial advantage from the promotional bank to the final beneficiary firms. This typically takes the form of lower interest rates or longer loan tenor periods than the commercial bank would otherwise be able to supply.

The EIB Group has carried out a number of impact studies on its financial instruments. These use unique firm-level datasets linking EIB Group firm-support allocation data to external information on firms, investors and the macroeconomic setting. For example, to assess the impact of the EIB’s intermediated lending on firms, data on EIB final loan beneficiaries were linked to firm-level data providing balance sheet and other economic information. A counterfactual analysis was then carried out by selecting a control group of firms with comparable financial and other characteristics from data on over two million firms. The analysis compared the firms before and after the treated firms received an EIB-backed loan using quasi-experimental evaluation designs.

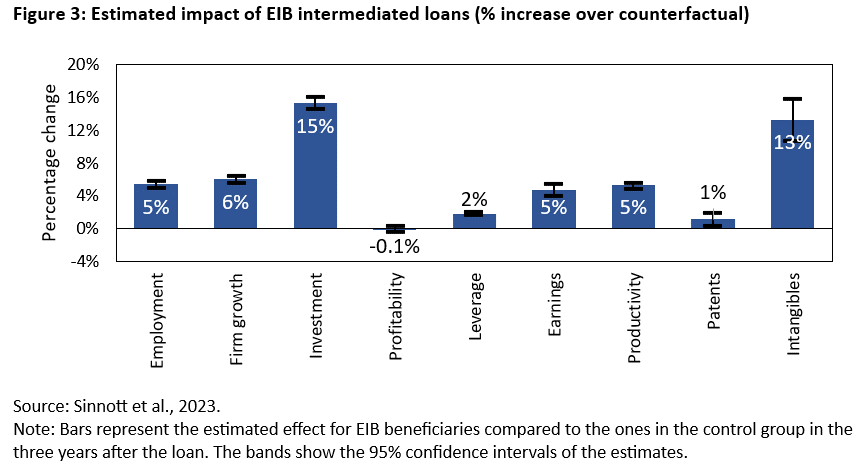

Figure 3 shows the estimated and statistically significant impact of EIB intermediated loans to 96830 firms in the European Union between 2008 and 2017, over the three years after funding. Businesses that benefitted from EIB financing experience 5% higher levels of employment and productivity, as well as 15% higher levels of investments after three years. Moreover, the effect of EIB lending was found to be higher for smaller and younger firms and in EU cohesion regions.4

Recent research also shows that EIB intermediated lending to SMEs in the Western Balkans creates 15 additional jobs for every €1m of EIB loan issued, and that the impact is larger for firms without previous access to finance.5 Moreover, longer maturities and more advantageous loan pricing of EIB-supported loans are associated with larger employment and investment effects.6

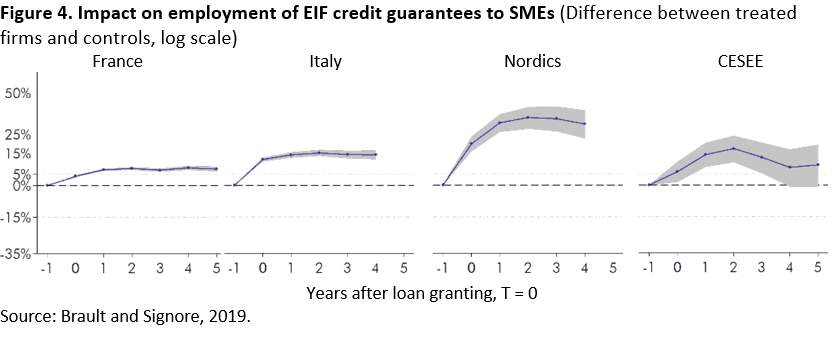

Credit guarantees are another important policy tool to support credit availability for SMEs, particularly during economic downturns, but also to mitigate structural market failures. By absorbing risk from the lender, guarantees act as a substitute to increased collateral requirements. They also enable intermediaries to offer better conditions: more financing, longer maturities, lower cost to creditworthy but risky firms, including younger and more innovative firms with little collateral. This function becomes critical at times of heightened risk and/or risk aversion, for example during a credit crunch.

Analysing 360 000 guaranteed loans by the EIF to SMEs across 19 EU countries between 2002 and 2016, statistical evidence using quasi-experimental methods shows that firms receiving EIF-guaranteed loans saw a decrease in bankruptcy rates by about a third by as much as a half in some regions and increases in employment by 8 to 30% depending on the region (Figure 4).7 The positive economic impact of credit guarantees also appeared to be stronger for younger and smaller firms, which typically experience more severe credit rationing in times of economic stress.

With young European firms struggling to find the right financing to support their innovation efforts, the impact of EIB and EIF support via venture capital and venture debt products is crucial. The lack of a fully developed venture capital ecosystem has led European startups and scale-ups to resort to other sources of financing that are less suited to high-growth enterprises and pushing them to relocate or search for foreign buyers.8 The EIF’s investments into venture capital (VC) and private equity (PE) funds, for example, aim at fostering a European VC/PE ecosystem.

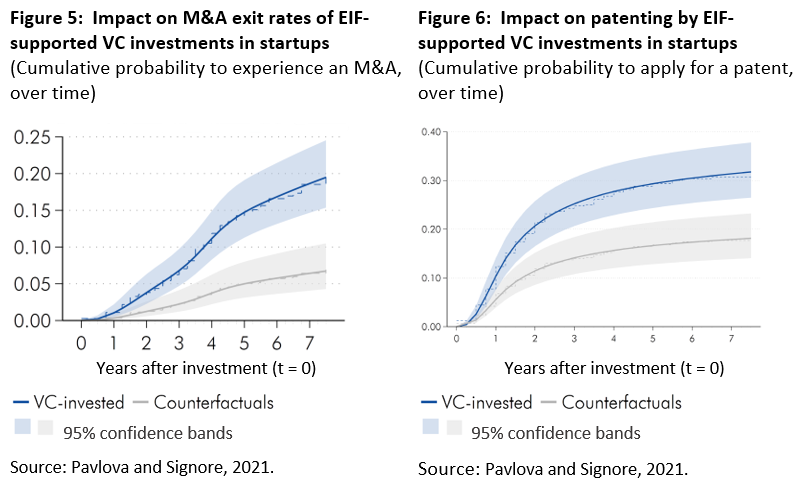

Analysis of EIF-supported indirect venture capital investments, comparing venture capital-backed firms with comparable new technology-based firms without such financing, show that these interventions had a positive impact on the startups’ growth.9 Over five years, supported firms achieved higher capitalisation and assets, as well as significantly higher revenues and employment growth.10 After five years, startups backed by EIF-supported VC funds also had a higher likelihood of a successful exit, with a 10.3 percentage points higher chance of being acquired (Figure 5) and 1.7 percentage points higher rate of going public. EIF venture capital-supported startups also issued more patents (Figure 6).

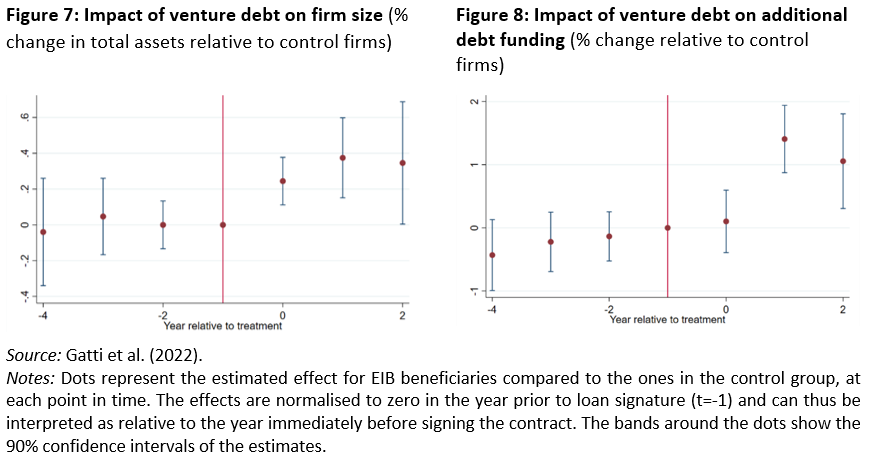

The EIB’s direct investments (incl. venture debt) help fill the financing gap faced by high-growth, innovation-focused companies scaling up production. The effect of EIB venture debt on innovative firms is striking. Not only do EIB venture debt recipients grow faster than their peers (Figure 7), but they also benefit from much better funding structure when they later go to the market for funding (Figure 8), as the EIB venture debt product is perceived as a stamp of quality.

Business dynamism and the reallocation of resources from older, less efficient firms to younger and more innovative firms is a key driver for innovation, productivity growth and competitiveness. In addition, SMEs and mid-caps also play a vital role in the green and digitalisation transition. Therefore, it is essential to address barriers to the access to finance of such businesses. There is a need to ensure access to finance for SMEs and mid-caps is sustained going forward given the large investment needs. Europe needs to be competitive and “future-proof”.

By addressing critical market failures, the EIB Group’s business support instruments are crucial to achieving the EU’s strategic objectives around sustainability, digitalisation, and competitiveness. InvestEU and other mandates given to the EIB Group by the European Union and other important mandators have enabled the provision of needed finance to the enterprise sector. Business support instruments provide vital ways to promote investments by the private sector that achieve public goods (positive externalities), which the private markets might not otherwise achieve. Examples include public support for green investments and market-shaping investments in equity finance and strategic industries.

This brief presents evidence on the impact of the business-targeted financial instruments of the EIB Group. The findings show that EIB Group financing to support business across the EU – SMEs, mid-caps and innovative businesses – has a material effect on their growth. The evidence also underlines the EIB Group’s countercyclical role, maintaining access to finance for viable businesses even when private credit contracts during economic downturns.

Going forward, the net-zero transition will require a substantial increase in green investment by businesses, including for more energy-efficient buildings and equipment, alternative fuels, the circular economy and low-emissions vehicles, all of which need to be accompanied by the rapid adoption of new digital technologies. The findings in this brief highlight that the public sector can play a pivotal role in bridging credit gaps, supporting the growth potential of enterprises.

Akba, O., Betz, F. and Gattini, L. (2023), “Quantifying credit gaps using survey data on discouraged borrowers”, EIB Working Paper 2023/06.

Barbera, A., Gereben, Á. and Wolski, M. (2020), “Estimating conditional treatment effects of EIB lending to SMEs in Europe”, EIB Working Papers 2022/03.

Brault, J. and Signore, S. (2019). “The real effects of EU loan guarantee schemes for SMEs: A pan-European assessment”. EIF Working Paper 2019/56. EIF Research & Market Analysis.

Buchetti, B., Miguel-Flores, I., Perdichizzi, S. and Reghezza, A. (2024). “Greening the economy: how public-guaranteed loans influence firm-level resource allocation”. ECB Working Paper, 2916. European Central Bank.

Cornille, D., Rycx, F. and Tojerow, I. (2019). “Heterogeneous effects of credit constraints on SMEs’ employment: Evidence from the European sovereign debt crisis,” Journal of Financial Stability, 41(C), 1-13.

EIB (2023). EIB Investment Survey 2023 — European Union Overview, European Investment Bank.

EIB (2024). EIB Group support for EU businesses: Evidence of impact in addressing market failures, European Investment Bank.

European Commission (2023). Annual Report on European SMEs 2022/2023, European Commission.

Fratto, C., Gatti, M., Kivernyk, A., Sinnott, E. and van der Wielen W. (2024). “The scale-up gap: Financial market constraints holding back innovative firms in the European Union”, European Investment Bank.

Gatti, M., Schich, S., van der Wielen, W. and Sinnott, E. (2022). “Impact assessment of EIB venture debt”, EIB Impact study.

Gatti, M., Sinnott, E., Weiers, G., Fratto, C. and van der Wielen, W. (2023). “The impact of the EIB’s intermediated lending to businesses in the Western Balkans”, EIB Impact study.

Gerlach-Kristen, P., O’Connell, B. and O’Toole, C. (2015). “Do Credit Constraints Affect SME Investment and Employment?,” The Economic and Social Review, 46(1), 51-86.

Moscalu, M., Girardone, C. and Calabrese, R. (2020). “SMEs’ growth under financing constraints and banking markets integration in the euro area,” Journal of Small Business Management, 58(4), 707-746.

Pavlova, E. and Signore, S. (2019). “The European venture capital landscape: an EIF perspective. Volume V: The economic impact of VC investments supported by the EIF”. EIF Working Paper 2019/55, EIF Research & Market Analysis.

Pavlova, E. and Signore, S. (2021). “The European venture capital landscape: an EIF perspective. Volume VI: The impact of VC on the exit and innovation outcomes of EIF-backed startups”. EIF Working Paper 2021/70, EIF Research & Market Analysis.

Rahaman, M. (2011). “Access to financing and firm growth,” Journal of Banking & Finance, 35(3), 709-723.

Sinnott, E., Gatti, M. and van der Wielen, W., (2023), “Impact assessment of the EIB’s intermediated lending to businesses”, EIB Impact study.

See e.g., European Commission (2023).

Rahaman, 2011; Gerlach-Kristen et al., 2015; Cornille et al., 2019; Moscalu et al., 2020.

One credit gap estimate is provided by EIB research using firm firm-level data from the Enterprise Survey. See EIB (2023: 123-5). The methodology is also reported in full in Akba, Betz and Gattini, 2023.

Cohesion policy characterises European regions at the NUTS2 level based on their GDP per capita relative to the EU average. Regions are classified as less developed if their GDP per capita is below 75% of the EU average and as transition regions if it is between 75% and 100% of the EU average.

Gatti et al., 2023.

Barbera et al., 2020.

On the bank side, there is also evidence that public-guaranteed loans can be leveraged to change banks’ lending behaviour, promoting greener industries’ growth and supporting the global economy’s decarbonisation (Buchetti et al., 2024).

Fratto et al., 2024.

The analysis employs machine learning tools to scan through startup business models and identify promising entrepreneurial ideas as well as geospatial data and airline routes to better simulate the investment selection process of European venture capital firms.

Pavlova and Signore, 2019.