The rise of stablecoins and asset-backed tokens could drive the development of financial markets via new forms of transparency and data credibility. Taking the example of the revised proposal for the Libra global stablecoin, this column describes how supervisors could harness information in distributed ledger based-finance via “embedded supervision.” The aim is to increase the quality of data available to supervisors and reduce administrative costs for firms. The policy note concludes by discussing legislative and operational ways to promote low-cost supervision and a level playing field for small and large firms.

Authorities around the world are grappling with the rise of digital currencies and decentralised finance based on distributed ledger technology (DLT). The announcement of Libra and similar “stablecoin” projects, such as Tether, USD Coin, and TrueUSD, puts a broader set of regulatory issues on the agenda, also regarding the quality of asset backing.2 The overarching consideration is that, when faced with innovations, how best to apply technology-neutral regulation so that similar economic and financial risks are treated on par.

Yet, the fact that regulation must be technology-neutral does not preclude public authorities themselves from embracing innovation in supervision: whereas “regulation” is the process of setting the rules that apply to the regulated entities, “supervision” is the compliance monitoring and enforcement of these rules, which has to be dynamic and adaptable.

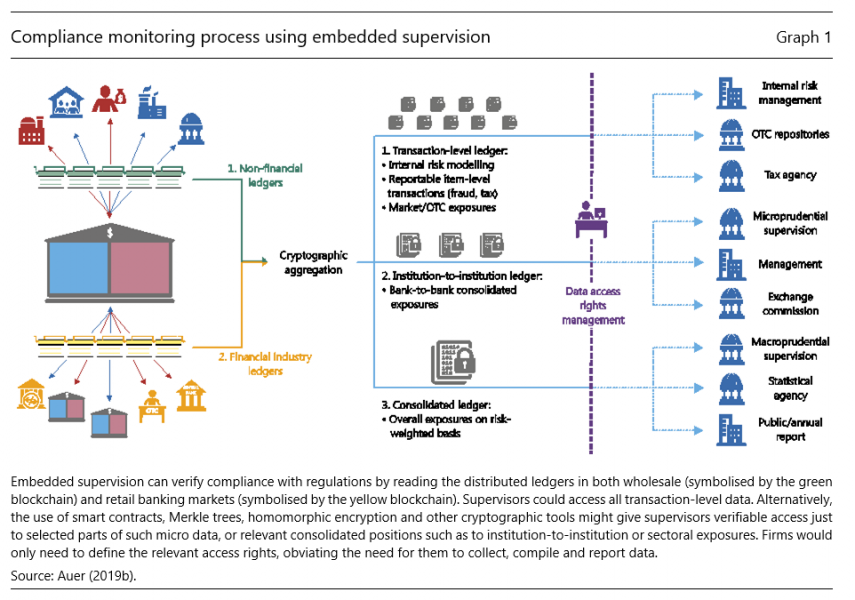

Supervision might well evolve with technology. In recent work (Auer (2019b)), I thus put forward the concept of “embedded supervision”. Embedded supervision is a framework that provides for compliance to be automatically monitored by reading the ledger of a DLT-based market (see Graph 1). The ledger of a DLT-based market contains much information relevant for supervisory purposes. As such, it can be used to improve the quality of data available to the supervisor, while reducing the need for firms to actively collect, verify and report data to authorities.

Allowing for embedded supervision could be of substantial importance for the development of so-called asset “tokenisation” – the process by which claims on or ownership in real and financial assets are digitally represented by tokens, allowing for new forms of trading and improved settlements (Bech et al, 2020).3

In particular, one key early use case of embedded supervision may be in the monitoring of the full asset-backing of a blockchain-based stablecoin.4 To exemplify both the merits and limits of embedded supervision applied to stablecoins, consider the revised Libra proposal (“Libra 2.0”, see Libra Association (2020)).5

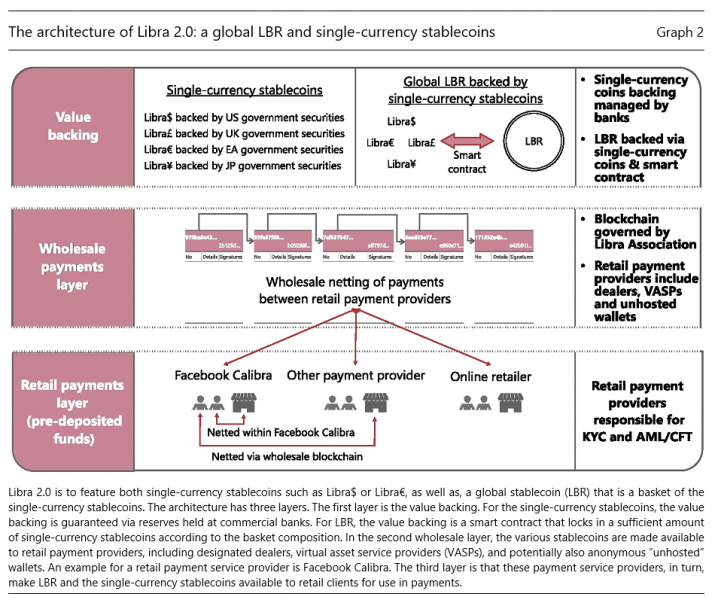

Graph 2 lays out the basic architecture of Libra 2.0, which has three layers. The first layer is the value backing of two distinct types of stablecoins, single-currency stablecoins, such as Libra$ or Libra€, and a global stablecoin (LBR), that is a basket of the single-currency stablecoins. The second layer is that these stablecoins are made available to payment service providers (PSP) and ewallet providers, such as Facebook’s digital wallet Calibra. In the third layer, the single-currency stablecoins and LBR are made available to retail clients.

The value backing of this ecosystem is two-tiered. The first tier is a traditional bank-based value guarantee for single-currency stablecoins. The second tier is a DLT-based smart contract underpinning the value of the global stablecoin, LBR.

These two tiers are interconnected. Custodian banks guarantee the value of the single-currency stablecoins: for example, bank A guarantees that for an outstanding supply of Libra$ 1 billion it indeed holds highly liquid US sovereign assets worth USD 1 billion on behalf of the Libra Association. DLT enters in the way the custodian banks make this guarantee public: rather than posting a signed letter on their webpage, they use their digital signature to cryptographically sign their guarantee into the public Libra Blockchain. In this way, the single-currency stablecoins become what is called “asset-backed tokens”: a digitally signed guarantee that an institution guarantees the value corresponding to a ledger entry.

The novel aspect is that once these value guarantees are signed into the Libra Blockchain, one can add decentral financial engineering on top of it. This is where LBR, the global stablecoin itself, comes into play. LBR is simply a smart contract combining several of single-currency stablecoins into a basket of currencies. Here, the backing is guaranteed by DLT – and nothing else! For every LBR that is created, the smart contract “locks in” the respective amount of single-currency stablecoins on the Libra Blockchain. For example, if a LBR were to be composed of two Libra$ and one Libra€, the creation of LBR 1 billion will lead to an entry into the Libra Blockchain that the supply of Libra$ has been reduced by 2 billion and that of Libra€ by 1 billion.6

This two-tier design allows for embedded supervision of LBR. On the one hand, since the value backing of the single-currency stablecoin is based on the custodian banks’ guarantees, the supervisory process will have to be traditional. Embedded supervision could however be used to monitor the asset backing of the global stablecoin LBR, as it involves reading the smart contract and the relevant ledger entries in real time and in an automated manner.

The example of Libra 2.0 highlights that when it comes to applying embedded supervision, one needs to carefully delineate the use of DLT from other traditional elements that involve technology, but still rely on the value underpinning provided by supervised institutions and the legal system. In Auer (2019b), I discuss principles that should govern a framework designed to make use of a market’s distributed ledger for financial supervision (see Table 1).

A first of these principles goes back to how the value underpinning of the single-currency stablecoins is guaranteed in Libra 2.0: it is the banks’ digital signatures in the ledger that underpins the value of these coins. Obviously, there is nothing other than the judicial system that obliges banks to honour these guarantees.

The first principle of embedded supervision is that the process of “tokenisation” must be supported by the legal system. The connection between the claim on or ownership in the underlying asset and the record of the digital token must ultimately be established by the legal system and relevant contractual arrangements. This is true for stablecoins, but also for assets such as real estate or shares in a bricks-and-mortar business. Importantly, this means that just as in today’s system, a decentralised financial system needs to be backed up by an effective legal and judicial system and supporting enforcing institutions for contractual arrangements.

The second principle relates to the trading on DLT-based markets: transactions and transfer of ownership must be irrevocable and final – otherwise its balance sheet items are not definitive for compliance assessment (see CPMI-IOSCO (2012)). Economically viable applications of DLT, including Libra 2.0, run on so-called “permissioned” DLT. In such markets, there is no central entity capable of vouching with a legally binding signature, and another criterion for transaction finality must be established.

Embedded supervision focuses on the concept of economic finality proposed in Auer (2019a), ie economic finality is the notion that a transaction is final once it is no longer profitable to reverse it.7

When it comes to applying this consideration to the case of Libra 2.0, the whitepaper does not spill out how transaction finality will be achieved. It does spells out a standard process to achieve consensus on transactions via a 2/3 supermajority among the association members. What is however missing is a set of rules that would spell out what were to happen if indeed 2/3 of the members of the association were to coordinate to fraudulently undo transactions via so-called history reversion attack. Further information is thus needed to establish economic finality.8

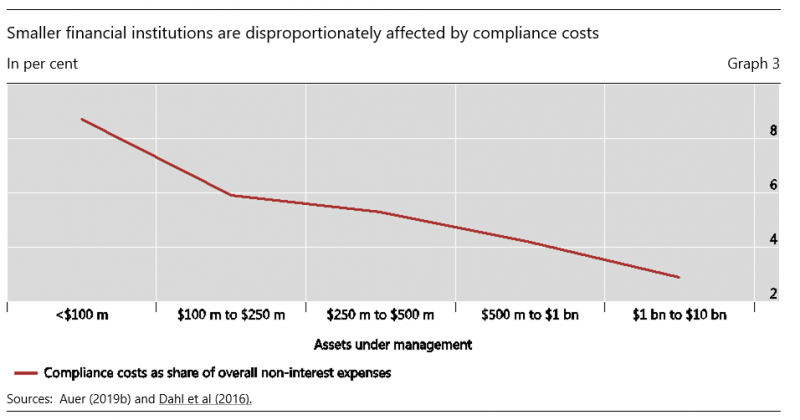

The last principle concerns the broader societal goals when designing embedded supervision. Despite substantial technological advances of recent decades, financial services have for a long time remained equally expensive (Philippon, 2015 and Bazot (2018)). This might partly reflect the high barriers to entry created by the administrative burden of complying with financial regulation. As a side effect of their focus on detailed regulation and supervision to tackle the risks of large and complex financial intermediaries, supervisors may have inadvertently favoured concentration – by creating compliance costs that weigh disproportionately on smaller intermediaries (see Graph 3).9

One goal of embedded supervision should hence be to reduce the fixed cost of the administrative burden of compliance, thus levelling the playing field for large and small institutions.10 One operational aspect is for supervisors to take an active role in the design of the market, in particular regarding standardisation of the database structure – for example, to ensure interoperability of the Libra Blockchain with other blockchains standards. Another priority might be to develop a freely available open-source suite of monitoring tools with the aim of clarifying how specific regulatory frameworks are applied in practice.

Efficient guidance of market standards to ensure contestability may also require an adequate definition of what it means to truly “decentralise” decision-making, risk-taking and system governance (see Buterin (2017) for a discussion and Walch (2019) for a critical review).11 Regulators and supervisors can steer some design elements of new decentralised markets, as they will set the market standards under which regulatory compliance can be automated (see also Auer and Claessens (2018)).

A further operational goal is to reduce the marginal cost of doing business by facilitating access to trustworthy official information. One measure that could be easily implemented would be for public authorities to directly offer digitally signed and time-stamped information that could be fed into relevant market ledgers. In many cases, financial contracts may reference data originating from the official sector, such as the central bank’s policy rate or data releases from the national statistical office. Moreover, in many jurisdictions, firm and land registries are operated by the government. Low-cost tokenisation of the underlying firms and real estate would be facilitated if these registries were to make their information accessible in a digitally signed, time-stamped and publicly available form.

A last operational aspect concerns the handling of disputes. Regulatory frameworks or standards could guide arbitration processes if any information referenced in smart contracts turns out to be fraudulent. This could happen where the smart contract has a security flaw (as is frequently the case; see Luu et al (2016) and Fro wis and Bo hme (2017)) or in other unforeseen events, such as if a smart contract depends on an interest rate benchmark that ceases to exist. Ultimately, though, the world is sometimes too complex to be put into code. Thus, the more intractable cases may always need to be handled via an old-fashioned legal process. In this light, the added value of decentralised automation should be seen as simplifying the standard execution of a contract.

In the context of current developments, where many authorities concern themselves with the regulation and supervision of Libra 2.0 and other large-scale projects, the long-run benefits of embedded supervision might be disproportionally higher for smaller entrants – a welcome side effect.

Auer, R (2019a): “Beyond the doomsday economics of ‘proof-of-work’ in cryptocurrencies”, BIS Working Papers, no 765.

——— (2019b): Embedded supervision: how to build regulation into blockchain finance”, BIS Working Papers, no 811.

Auer, R and S Claessens (2018): “Regulating cryptocurrencies: Assessing market reactions”, BIS Quarterly Review, September.

Basel Committee on Banking Supervision (2017): “Basel III: Finalising post-crisis reforms”, December.

Bazot, G (2018): “Financial consumption and the cost of finance: Measuring financial efficiency in Europe (1950–2007)”, Journal of the European Economic Association, vol 16, no 1, February.

Bech, M, J Hancock, T Rice and A Wadsworth (2020): “On the future of securities settlement”, BIS Quarterly Review, March.

Bonneau, J (2016): “Why buy when you can rent?”, International Conference on Financial Cryptography and Data Security, Springer.

Budish, E (2018): “The economic limits of bitcoin and the blockchain”, NBER Working Papers, no 24717, June.

Broeders, D and J Prenio (2018): “Innovative technology in financial supervision (suptech) – the experience of early users”, FSI Insights, no 9, July.

Bullmann, D, J Klemm and A Pinna (2019): “In search of stability in crypto-assets: are stablecoins the solution?”, ECB Occasional Paper Series, no 230, August.

Buterin, V (2017): “The meaning of decentralization”, Medium.com, 6 February.

Carstens, A (2018): “Ten years after the Great Financial Crisis – where do we stand?”, lecture at the People’s Bank of China, Beijing, 19 November.

Cecchetti, S, and K Schoenholtz (2019) “Libra: A dramatic call to regulatory action”, VoxEU.org, 28 August 2019.

Chiu, J and T Koeppl (2017): “The economics of cryptocurrencies – bitcoin and beyond”, Economics Department, Queen’s University, working paper, no 1389.

Committee on Payments and Market Infrastructures and International Organization of Securities Commissions (2012): CPMI-IOSCO Principles for financial market infrastructures, April.

Coelho, R, M De Simoni and J Prenio (2019): “Suptech applications for anti-money laundering”, FSI Insights, no 18.

Dahl, D, A Meyer and M Neely (2016): “Scale matters: community banks and compliance costs”, Federal Reserve Bank of St Louis, The Regional Economist, July.

Fatás, A and B Weder di Mauro (2019): “The benefits of a global digital currency”, 30 August.

Fröwis, M and R Böhme (2017): “In code we trust? Measuring the control flow immutability of all smart contracts deployed on Ethereum”, in J Garcia-Alfaro, G Navarro-Arribas, H Hartenstein and J Herrera-Joancomartı́ (eds), Data privacy management, cryptocurrencies and blockchain technology, Springer, pp 357–72.

Financial Stability Board (2020) “Addressing the regulatory, supervisory and oversight challenges raised by “global stablecoin” arrangements” Consultative document, 14 April 2020.

Libra Association (2020) “White Paper V 2.0”, the Libra Association Members, 16 April.

Luu, L, D Chu, H Olickel, P Saxena and A Hobor, (2016): “Making smart contracts smarter”, in Proceedings of the 2016 ACM SIGSAC Conference on Computer and Communications Security, pp 254–69.

G7 Working Group on Stablecoins (2019): “Investigating the impact of global stablecoins”, October 2019.

Möser, M, R Böhme and D Breuker (2013): “An inquiry into money laundering tools in the Bitcoin ecosystem”, in Proceedings of the APWG eCrime Researchers Summit (ECRIME), San Francisco, pp 1–14.

Philippon, T (2015): “Has the US finance industry become less efficient? On the theory and measurement of financial intermediation”, American Economic Review, vol 105, no 4, pp 1408–38.

Walch, A (2019): “Deconstructing ‘decentralization’: exploring the core claim of crypto systems”, in C Brummer (ed), Cryptoassets: legal and monetary perspectives, Oxford University Press.

The views expressed in this policy note are those of the author and not necessarily those of the Bank for International Settlements. I thank Stijn Claessens, Giulio Cornelli, Jon Frost, and Leonardo Gambacorta, Tara Rice, and Takeshi Shirakami for comments.

See Fatás and Weder Di Mauro (2019), Cecchetti and Schoenholtz (2019), G7 Working Group on Stablecoins (2019), and FSB (2020).

Embedded supervision in these markets for tokens could for example entail monitoring compliance with capital standards, such as Basel III (see BCBS, (2017)). It would involve automatic verification by computing the borrowing and lending balances and the associated risk weights within the relevant market ledgers.

There are many concerns with Libra that go beyond the discussion of the value backing discussed here (see G7 Working Group on Stablecoins (2019) and FSB (2020)). They include risks around financial stability and monetary policy and competition, data privacy, consumer protection, and tax compliance issues. One particular concern is money laundering via digital currencies (Möser et al. (2015)). An additional key requirement must hence be a watertight and globally coordinated AML/KYC identity framework that keeps illicit activity out of this novel ecosystem. Coelho et al. (2019) show how technology might help here.

Other examples include MakerDao’s DAI, as well as other “on-chain” stablecoins in the terminology of Bullmann et al. (2019).

These numbers are chose only for the sake of easy exposition. The revised Libra proposal mentions a 50% weight for Libra$, 18% for Libra€, and 11% for Libra£ (the remaining 21% is not spelled out).

Auer (2019a) examines economic finality for the case of proof-of-work-based consensus schemes used in Bitcoin. Bonneau (2016), Chiu and Koeppl (2017) and Budish (2018) offer closely related, but probabilistic concepts and analyse the conditions under which blockchain transactions become prohibitively expensive to reverse via a so-called 51% brute force attack.

In Auer (2019B), I also extends the theoretical considerations regarding transaction finality to the impact of the supervisors’ actions on the regulated market. Regulated firms incur a cost in complying with regulation that they would not incur voluntarily. By the same token, in the DLT world, this creates incentives for a regulated firm to cheat the supervisor by altering the transaction history in the blockchain. I thus also model the supervisor’s impact on the market.

In particular, following the Great Financial Crisis, politicians, legislators and supervisors have focused on increasing the resilience of the financial system and, in particular, of the large banks that account for the bulk of total positions and thus aggregate risk, an effort that is still ongoing (see eg Carstens (2018)).

See Broeders and Prenio (2018) for a general assessment of suptech in bringing down the cost of compliance.

Even with the most decentralised systems, many aspects of centralisation remain, for example when it comes to the evolution of the code (core developers etc.). Further to this, as shown by the concentration of the mining power of all of the world’s major cryptocurrencies in the hands of only a few companies or mining pools, even systems that are intended to be decentralised have a tendency to centralise, owing to unforeseen returns to scale. Regulators and supervisors could counter this, for example, by setting standards that guide or encourage entry into the verification market.