We build a comprehensive narrative of policy decisions to deepen the European Monetary Union (EMU), by classifying documents and press releases issued by the Council of the EU and the European Council during the period January 2010 to March 2020. We find that these decisions have driven down spreads in periphery countries. We conclude that EU policy-makers have at their disposal the capacity to gain policy space and reduce fragmentation by means of a more credible and resilient institutional framework.

The incomplete nature of the European Monetary Union (EMU) affects sovereign debt spreads. On the one hand, because within the EMU, under certain circumstances, some capital destinations may be perceived as safer than others, due to diverging economic fundamentals and the lack of a common safe asset. On the other hand, because the institutional voids in the design of EMU are interpreted as a possibility that the euro area might break up and bonds – at least, some of them – might no longer be denominated in the common currency, the so-called redenomination risk.

Take the creation of a European Recovery Fund as an example. When discussions about its characteristics began, spreads between periphery and non-periphery countries were widening. The final agreement on the recovery fund was able to undo some of this increase. Why was that? Firstly, the Recovery Fund improved fundamentals of the most benefitted Euro Area countries. However, taking into account the large increase in debt from the pandemic, this effect can be considered as marginal. Secondly, once it was clear that the Recovery Fund was going to be financed with common debt denominated in euros, it created an additional channel for risk-sharing within the EMU. Finally, it signalled a strong political will to deepen the European Union and a first step towards a fiscal union, partially filling a void that the original EMU construction had left empty.

The effect of the incompleteness of the monetary union on sovereign spreads has led to a large amount of academic research. The literature has dealt with the issue of how policy announcements or actions affect financial markets mainly by focusing on some specific, salient events. Some papers include Afonso et al (2020), that studies the effect on spreads of the opening of excessive deficit procedures, Bergman et al (2019), that the effect of some important milestones during the last decade on spreads and banking CDS or Corsetti et al. (2018), that analyses changes in the conditions of official lending for Euro Area countries.

In Kataryniuk et al (2021), we take a similar but broader approach. To study how political decisions on European integration affect the sovereign bond market, we collect all documents and press releases by the Council of the EU and the European Council (in their different forms) over the past decade, and identify, within this corpus, when political decisions were made. Thus, we compile a complete narrative of European institutions’ decisions regarding economic and financial integration, crisis management and fiscal policy decisions. This allows us to study the effects of these decisions on financial markets without the need of determining, ex ante, which decisions drive sovereign yields. The dataset is public and available for researchers.

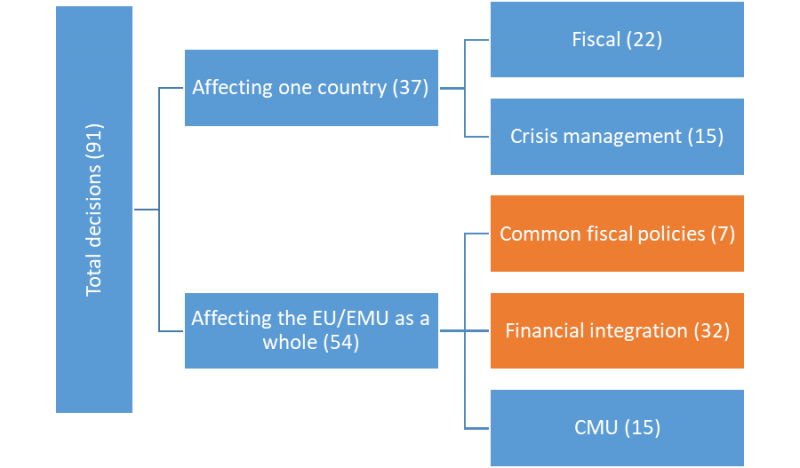

In total, we study more than 500 documents. We classify all the discussions (either ending up in a decision or not) into two main groups (see figure 1, numbers between parentheses refer to the total number of decisions in each group). The first group includes events that affect one country. Within this group, we distinguish two categories: (i) crisis management: this category involves mainly bailout programs and their revisions; and (ii) fiscal issues: all topics about national fiscal policy procedures or instruments, most notably excessive deficit procedures, either opened or closed. The second group includes events that affect all countries. Within this category we include topics related to: (i) fiscal integration, like those dealing with common fiscal resources or aimed at enhancing budgetary discipline from a cross-country perspective and/or at a supranational level, such as the approval of the so-called Six-Pack and Two-Pack, or the debates around the Budgetary Instrument for Convergence and Competitiveness (BICC); (ii) financial integration topics, like, for instance, the creation of new institutions, such as the European Stability Mechanism (ESM) or the Single Supervisory Mechanism (SSM), new standards (NPLs) or changes in the main framework governing the European financial institutions (ESM backstop); and iii) Capital Markets Union (CMU) decisions.

Figure 1: Overview of the classified decisions

Sometimes, we find that a European forum discusses several topics, but only decides on a few ones. For example, in the Eurogroup meeting of 4 December 2018 Ministers discussed about BICC, the European Deposit Insurance Scheme (EDIS), the ESM reform and the backstop for the Single Resolution Fund (SRF), but only took decisions on the last two. As a result, our database will register only two decisions in that day. For our analysis, it is important to discern between topics leading to decisions from those that were discussed but did not lead to decisions. For example, there are 16 discussions in our narrative about the European Deposit Insurance Scheme (EDIS), with no decisions taken at all. Similarly, we register 13 discussions about the treatment of Non-Performing Loans, until a decision was made on 9 April 2019.

We employ event study methods to confront our narrative with the dynamics of euro area countries’ sovereign bond yields. The hypothesis is that noteworthy decisions reduce the sovereign spreads of those countries regarded as riskier with respect to the risk-free equivalent bond. The ulterior motive is that markets are expected to behold the euro area as a true economic integrated area if political decisions in this direction are taken.

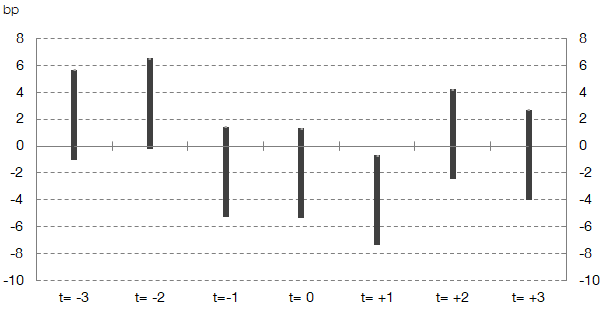

The main finding of the paper is that final Council decisions on EMU deepening (in orange in figure 1) drive down sovereign spreads in the periphery: the spreads decrease by over 4 basis points, on average, in each following day to any relevant decision about these topics is taken by the European institutions. We show the coefficients of the event variables (within two-standard deviations bands) in figure 2. In addition, some anticipation effect is visible in prior days, whereby an increase in the spread may be anticipating some uncertainty around the outcome of the policy discussion, given the traditional hurdle around decisions in the European Union. Finally, there is no reversion of the effects in the following days after the event. One could argue that this could be expected, as the events considered change the structural nature of economic integration in the European Union, and, subsequently, change the expected path of future repayments of the debt. Nonetheless, this argumentation is merely speculative, and we leave further inquiries into this issue for further research.

Figure 2: Estimated impact of narrative decisions on 10-year spreads with respect to the OIS.

Peripheral countries.

The effect is robust to the inclusion of a complete set of liquidity, fiscal, credit ratings and financial controls, and also to the consideration of several pre-identified events and ECB meetings. Moreover, we show that the effects on spreads arise mainly from the reduction in peripheral euro area countries’ yields, and not by an increase in yields in core countries. Interestingly, we do not find statistically robust effects for meetings not leading to decisions. When we only consider financial integration events, or we also include CMU events, the coefficient stays significant but its magnitude drops to around 3 basis points.

Thus, our results suggest that the political will to advance in European integration is a key factor to reduce the risks of financial fragmentation in the euro area. EU policymakers enjoy ample political space that could be used to reduce (risks of) financial fragmentation, insofar as this space is used to deepen the Economic and Monetary Union.

Afonso, A., Jalles, J. T., and Kazemi, M. (2020). The effects of macroeconomic, fiscal and monetary policy announcements on sovereign bond spreads. International Review of Law and Economics, 63, September 2020

Bergman, U. M., Hutchison, M. M., and Jensen, S. E. H. (2019). European policy and markets: Did policy initiatives stem the sovereign debt crisis in the euro area? European Journal of Political Economy, 57, 3–21.

Corsetti, G., Erce, A. and Uy, T. (2018) Debt sustainability and the terms of official support. CEPR Discussion Paper 13292.

Kataryniuk, I., Mora-Bajén, V. M., and Pérez, J. J. (2021). EMU deepening and sovereign debt spreads: using political space to achieve policy space. Documentos de Trabajo Banco de España, 2103.