This brief is based on the paper entitled “Stress testing with multiple scenarios: a tale on tails and reverse stress scenarios“, and it was published as ECB Working Paper Series, No 2941.

Abstract

In the wake of the global financial crisis (GFC), stress testing emerged as a crucial regulatory tool to ensure the resilience of financial institutions. While traditional single-scenario stress tests have been instrumental, they often fall short in capturing the full spectrum of risks. This policy note introduces a novel approach to stress testing that employs multiple plausible scenarios to provide a comprehensive assessment of the banking sector’s vulnerabilities. This approach not only enhances the accuracy of risk identification but also supports more informed policy decisions.

Regulatory stress testing offers essential benefits to both regulators and markets. Firstly, it offers a forward-looking perspective that empowers regulators to act swiftly. By examining the financial health of institutions under challenging economic conditions, regulators can mandate protective measures in advance. Secondly, stress testing simplifies complex information from institutions with intricate business models and often opaque balance sheets into easy-to-understand metrics. This boosts transparency, aids in shaping effective policies, and enhances regulatory credibility.

And yet, the effectiveness of a regulatory stress test is only as good as the underlying scenario. Such a scenario must put to fore negative developments in the economy and financial system. At the same time, it must remain plausible, emphasising risks which are likely to occur. And last, the scenario must be meaningful, relying on a convincing economic narrative, preserving theoretical and historical relationships, and addressing the concerns of policymakers and the public.

The large regulatory stress tests, such as the Comprehensive Capital Assessment Reviews led by the Federal Reserve, and the EU-wide stress tests led by the European Banking Authority (EBA)1, typically involve a single adverse macro-financial scenario. The EU-wide stress test follows a bottom-up approach that requires each participating bank to estimate the impact of a three year ahead baseline and an adverse macro-financial scenario on their balance sheets.2 Both scenarios project the outlooks for economic activity, asset prices, and labour markets, with the baseline scenario based on the most recent Eurosystem projections.

The adverse macro-financial scenario of the EU-wide stress test is a hypothetical situation usually reflecting a consensus among involved authorities. The narrative is anchored in the financial stability risks identified by the General Board of the European Systemic Risk Board (ESRB). It is translated into macroeconomic shocks, such as those affecting confidence, financial variables like bond yields and foreign exchange rates. These shocks are fed into a multi-country model to project the economic outlook for the EU.

However, the process of agreeing on adverse scenarios in the EU stress test can make their severity, plausibility, and relevance difficult to ascertain. While expert insights and selective cross-country comparisons refine the adverse scenario, there is no systematic assessment of its severity. In fact, this refinement process often reduces the adversity of macroeconomic outcomes to make them more comparable across countries. The likelihood of the scenario’s realization is generally unknown, and it may not include the most relevant risks at any given time. These pitfalls have led to scrutiny of many past stress tests by both regulators and markets.

We look at a stress test as a process consisting of two components: knowledge of plausible futures and policy preferences. The knowledge of plausible futures entails covering the entire probability space with thousands of potential scenarios, ranging from highly positive to highly negative possibilities. Each scenario is characterized by a unique combination and intensity of risks and depicts the corresponding financial outcomes. These scenarios must all be plausible, consistent with historical data, and aligned with economic interdependencies. The key challenge of this stress test element lies in finding the best model and obtaining accurate forecasts for the future.

Policy preferences, on the other hand, define the focus for policymakers and determine the desired severity of a stress test. For instance, policy preferences dictate whether the stress test should focus on solvency or liquidity, and whether the evaluation should target individual bank outcomes or system-wide effects. Stress test practitioners must then translate these preferences into the design of the stress test.

We depict the concept and applications of multi-scenario stress testing using a semi-structural model for the euro area, which covers individual euro area economies and banks (Budnik et al., 2023). Stochastic simulations of the model generate scenarios that are plausible in at least in two ways. They are internally consistent due to the model’s disciplined structure, and statistically plausible because they rely on estimated distributions of shocks and parameters.

(Figure 1) shows the distribution of scenarios projected for the euro area for the end of 2022. Over the medium term, expected GDP growth and inflation return to their long-term averages, just below 2%, with the 3-month EURIBOR stabilizing accordingly. The likelihood of the EURIBOR returning to the historic lows seen during the low inflation environment of 2020–2022 is less than 10%. Government bond yields are expected to remain more than two percentage points above the 3-month EURIBOR, reflecting time and risk premiums. Meanwhile, euro area stock and house price indices are projected to follow an upward trend.

Figure 1. Full distribution of plausible scenarios

Notes: YER_yoy – annual euro area GDP growth rate, HIC_yoy – euro area HICP inflation rate, STN – 3-month EURIBOR, LTN – 10-year euro area bond yields, ESX – euro area equity price index, IHX – euro area house price index. Red line – median, black line – mean, dark grey field 60%, lighter grey field 80% probability span.

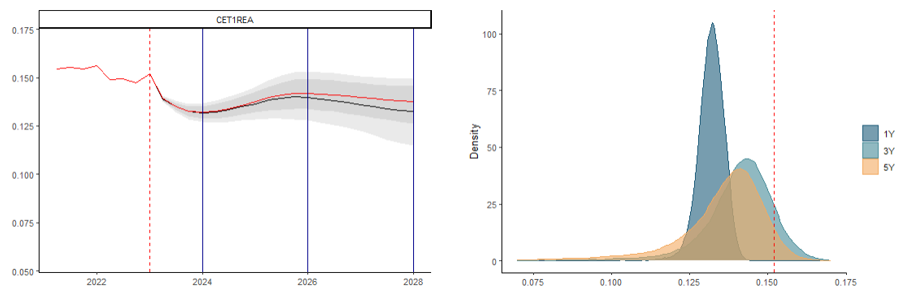

The availability of multiple scenarios enables the implementation of distributional stress testing. The core of distributional stress testing lies in examining the tails of the distributions for variables of interest to policymakers. To illustrate this, (Figure 2) zooms into bank solvency from the scenarios in (Figure 1). The ratio of CET1 capital to risk-weighted assets is expected to decline slightly over the longer term, which conceals a steady increase in CET1 capital and the expansion of bank assets, including loans to the non-financial private sector. The fan chart of the CET1 ratio widens and becomes more asymmetric over time. As time passes, the left tail of the distribution grows longer and thicker, reflecting an increasing probability of scenarios involving stress amplification mechanisms.

In this context, the lower percentiles of the CET1 ratio distribution directly measure the sensitivity of the banking system to macro-financial conditions. The probability of the CET1 ratio falling 1.5 percentage points below regulatory thresholds within one year is below 1%. In three years, this probability exceeds 1% but remains below 5%, and in five years, it increases to 5%. These relatively low probabilities suggest that the euro area banking system has a strong capacity to withstand stress.

Figure 2. CET1 ratio at three horizons: 1-year, 3-years and 5-years

Notes: LHS chart: red line – median, black line – mean, dark grey field 60%, lighter grey field 80% probability span. Blue horizontal lines mark, starting from the left-hand side, 1-year, 3-year and 5-year forecast horizon. Red dashed horizontal line – the starting point (end 2022). RHS: Gaussian kernel estimates of the probability density of CET1 ratios at different forecast horizons.

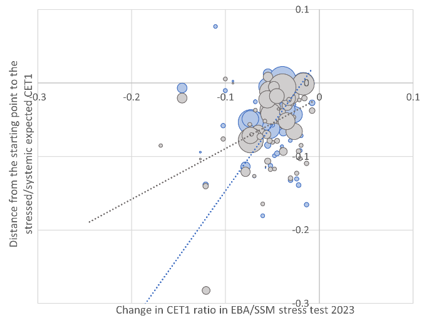

Metrics derived from distributional stress tests can also be used to assess the resilience of individual banks. (Figure 3) compares two such metrics with the results from the EBA/SSM 2023 stress test.3 The stressed CET1 ratio corresponds to the 10th percentile of the CET1 ratio distribution for individual banks, summarizing both idiosyncratic and systemic vulnerabilities. The expected systemic CET1 ratio, related to the SES of Acharaya et al. (2017), reflects the mean bank-level CET1 ratio when the system-wide CET1 ratio falls to its 10th percentile. This metrics highlights banks’ relative performance during periods of systemic strain.

The EBA/SSM stress test results generally align more closely with the systemic expected CET1 ratios than with the stressed CET1 ratios, which is both intuitive and reassuring. This alignment validates that the adverse scenario of the EBA/SSM stress test captures plausible and severe system-wide outcomes, similar to what could be derived by systematically exploring all potential unfavorable futures for the euro area banking sector.

A further observation is that large banks, in general, experience sufficient stress in the EBA/SSM exercise, while results for smaller banks are more varied. Banks to the right of the lines in (Figure 3) were exposed to a relatively mild stress as compared to their 10th percentile distributional stress test metrics, while those to the left were adequately stressed. Most large banks fall to the left of the lines, whereas smaller banks are dispersed on both sides.

Figure 3. Distributional stress test versus EBA/SSM stress test changes in CET1 ratio over 3-year horizon

Notes: Blue balls: stressed CET ratio for 10th percentile, grey balls – systemic expected CET1 ratio for 10th percentile. The size of balls corresponds with the size of banks’ assets at the end of 2022. The dashed lines represent the bank-level regression outcomes between the two metrics from the distributional stress test and the results of the EU-wide stress test.

Reverse stress testing seeks for plausible scenarios that put the financial system under sufficient stress. Although, this technique promises to develop scenarios with optimal severity, its real-life use is hampered by substantial practical challenges. Reverse stress testing turns out very complex for scenarios involving multiple macro-financial factors, many periods, and possibly nonlinear risk transmission.

This is where multiple-scenario stress testing offers an elegant solution to otherwise numerically heavy problems. By starting from the complete space of scenarios, we can systematically inspect alternative futures and identify those that push the banking system or individual banks below the pre-set severity threshold. It then suffices to separate sufficiently the pinpointed severe scenarios from other plausible realities to arrive at a reverse stress test solution.

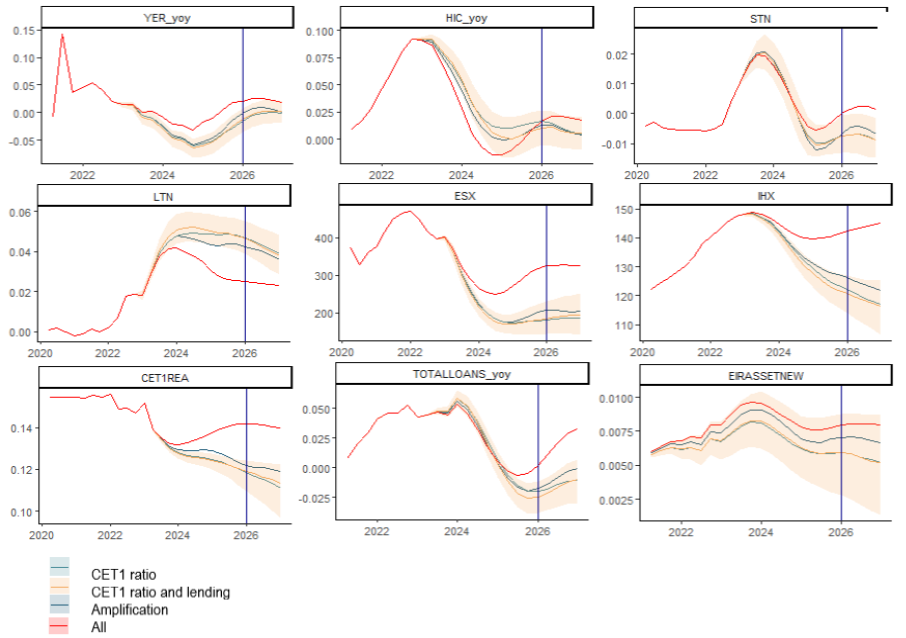

We demonstrate the effectiveness of reverse stress testing within a multiple-scenario framework by designing three alternative stress tests delivering on a macroprudential mandate. The first stress test focuses on system-wide solvency rate. The second test simultaneously stresses bank solvency and lending, while the third examines the banking system’s ability to absorb, rather than amplify, macro-financial shocks. The three stress tests offer an increasingly holistic perspective. The second and third designs, in particular, address the critical question of whether banks can continue providing credit in adverse conditions.

In each design, we select the 10% of scenarios with the worst outcome at the end of the three-year horizon. For the joint solvency and lending test, we take a balanced approach, assigning equal policy weight to both variables and selecting the worst scenarios along with the combined metrics. While stress testing the capacity of the banking system to sponge up distress, we select out the scenarios with the highest credit supply shocks as triggered by banks’ distress.4

The risks to system-wide solvency and lending exemplified by three stress test designs take a form of an economic recession (Figure 4). This notwithstanding, notable differences between the three designs emerge. Asset prices emerge as a key risk factor for bank solvency but are relatively less relevant for lending. Lending, in turn, appears relatively more sensitive to the monetary policy stance, specifically real interest rates. The scenarios emphasising amplification risks feature a strong contraction in loan supply reflected in low lending volumes combined with substantial lending costs. In contrast, the solvency and lending stress tests instil a higher harmful loan demand component, reflected in a relatively muscular fall in both loan volumes and interest rates.

Figure 4. Worst-case scenarios for the banking system solvency, solvency and lending and system-wide amplification

Notes: YER_yoy – annual euro area GDP growth rate, HIC_yoy – euro area HICP inflation rate, STN – 3-month EURIBOR, LTN – 10-year euro area bond yields, ESX – euro area equity price index, IHX – euro area house price index, CET1REA – CET1 ratio, TOTALLOANS_yoy – annual growth rate of bank lending volumes to the euro area non-financial private sector, EIRASSETNEW – interest rate on new bank loans to the euro area non-financial private sector. Blue vertical line – spanned of the stress test horizon.

We advocate for testing financial system resilience by considering multiple plausible economic scenarios. This approach offers a more comprehensive view of potential risks, helping to avoid two common pitfalls: overlooking possible realities, which creates a false sense of security, or focusing on implausible futures, which raises unwarranted alarm. A broadened perspective allows for pinpointing vulnerabilities in both the banking system and individual institutions without being influenced by human biases. Moreover, the use of multiple scenarios enables the identification of relevant macro-financial risks and the development of scenarios aligned with supervisory and macroprudential objectives, a process known as reverse stress testing.

Recent advancements in computational power and data availability have made stress testing with multiple scenarios more feasible. These developments allow for the construction of robust models and the use of stochastic simulations to generate a comprehensive scenario space. To illustrate, we present real-world examples showing how distributional stress testing can produce various at-risk measures, distinguish between institution-specific and system-wide risks, and offer insights into evolving risks within the banking sector. Incorporating multiple-scenario and reverse stress testing into the regulatory toolkit can significantly strengthen the robustness of stress tests. As financial systems grow increasingly complex, these advanced methodologies are essential for maintaining stability and promoting long-term financial resilience.

Acharya, V. V., Pedersen, L. H., Philippon, T., Richardson, M. (2017). “Measuring Systemic Risk. The Review of Financial Studies”. 30(1):2–47, October 2017.

Aikman, D., Angotti, R., Budnik, K. (2024). “Stress Testing with Multiple Scenarios: A Tale on Tails and Reverse Stress Scenarios”. Working Paper Series No. 2941, European Central Bank, October 2023.

Budnik, K., Gross, J., Vagliano, G., Dimitrov, I., Lampe, M., Panos, J., Velasco, S., Boucherie, L., Jancokova, M. (2023). “BEAST: A model for the assessment of system-wide risks and macroprudential policies”. Working Paper Series 2855, European Central Bank, October 2023.

The stress test is run jointly by the European Banking Authority (EBA) and the ECB Banking Supervision (SSM). The EBA develops the overall methodology, designs templates and focuses on the most significant EU banks. The SSM stress test uses the EBA methodology and applies it to all banks under direct supervision, including those not otherwise covered by the EBA. For more information, visit https://www.eba.europa.eu/risk-analysis-and-data/eu-wide-stress-testing.

In the process, bank risk and solvency estimates are challenged by supervisory authorities in order to ascertain their sufficient level of stringency and comparability across the participating institutions.

In this, we use that the starting points of our and the EBA/SSM stress test are congruent, although the latter stress test accommodates a more comprehensive update of banks’ balance sheet results at the end of 2022.

In the model this measure amounts to the appropriately weighted sum of non-linear adjustments in lending to the non-financial private sector by individual banks.