This is an abridged version of a longer article, published as a Financial Stability Institute Occasional Paper, No 19, August 2022. The views expressed are those of the authors and do not necessarily represent those of

the Bank for International Settlements. The authors thank Fernando Restoy for insightful discussions on this topic and John Caparusso, Jonathan Dixon, Neil Esho, Marc Farag and Ulf Lewrick for valuable comments on an earlier draft.

We propose a framework for classifying regulatory measures with a financial stability objective as activity-based (AB) or entity-based (EB). AB measures constrain an activity on a standalone basis, whereas EB measures constrain a combination of activities at the level of entities. Since such combinations underpin much of financial intermediation, financial stability regulation features EB measures at its core, even though its ultimate objective is to make financial activities more resilient. In discussing the relative merits of AB and EB measures, we apply our framework to the regulation of banks, collective investment vehicles and big techs. When addressing systemic risk, neither AB nor EB regulation need be consistent with a level playing field, contrary to a widely held view.

The long-standing policy debate about the relative merits of entity-based (EB) and activity-based (AB) regulation is marred by imprecision. This imprecision has impaired the interpretation of catch phrases such as “same activity, same risk, same regulation”. It has also misleadingly led to general statements that regulation – especially of the AB type – needs to contribute to a level playing field.

In a recent paper, we try to clarify this debate by proposing a framework for classifying regulatory measures as either EB or AB. Our focus is on financial stability regulation, which comprises measures that work through entities but ultimately target the resilience of activities crucial for the real economy. We apply our framework to regulatory measures for banks, nonbank financial intermediaries and big techs.

We classify regulatory measures according to what they constrain. AB regulation strengthens the resilience of a systemically important activity directly, by constraining entities in their performance of that activity alone through calibration with reference only to it. EB regulation is calibrated with reference to more than one part of an entity’s balance sheet in order to impose restrictions on the combination of activities. It thus strengthens the resilience of activities indirectly, by reducing the likelihood and repercussions of entities’ failure, which we define to include insolvency as well as any disruption to the entities’ functioning that may affect financial stability.

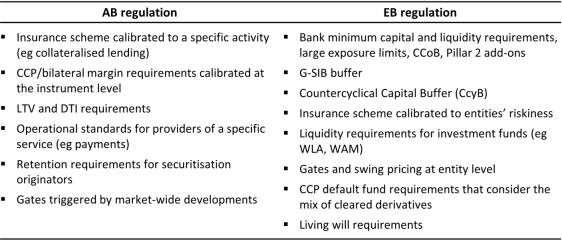

To illustrate the taxonomy, we consider regulatory measures that are widespread or feature prominently in policy discussions and allocate them to either AB or EB regulation (Table 1).

Examples of AB requirements. Operational standards for payments provision that abstract from the other activities of the service provider. Requirements on securitisation retentions calibrated only with respect to features of the securitisation activity (eg tranches). LTV or DTI requirements that vary only with the growth rate or riskiness of specific types of lending.1

Examples of EB requirements. Banks’ minimum capital requirements, which impose constraints on one balance sheet item (capital, linked to the funding activity) relative to another (risk-weighted assets, stemming from credit provision). Tightening such requirements for entities whose failure is deemed to be systemic – as is the case of the G-SIB buffer – is EB as well. Also EB are liquidity requirements on banks or investment funds, as they impinge on the whole balance sheet. In addition, CCP default fund requirements are EB to the extent that they change with the mix of derivatives contracts cleared (and thus refer to various derivatives trading activities).

The same regulatory measure can be calibrated to features of both activities and entities. This is the case, for instance, with the countercyclical capital buffer (CcyB). The CcyB is a constraint on capital relative to the risk-weighted assets of an entity, but is adjusted over time in relation to the evolution of economy-wide lending activity (excessive credit growth or the threat of a credit crunch). We classify the CcyB requirement as EB because its calibration refers to more than one activity of the bank (lending and choice of liabilities structure) and its tightness depends on the bank’s overall balance sheet. By contrast, gates on investment fund redemptions triggered by market-wide developments would be AB, as would countercyclical margin requirements calibrated with reference to the level of derivatives trading, without reference to traders’ balance sheets.

The suitability of AB or EB regulation depends on the specific threat to financial stability. AB regulation is the better choice when the disruption of an activity is the root cause of financial instability and when effective constraints on the activity need not refer to other functions of the regulated entities. In turn, EB regulation works better in preventing systemic events due to the failure of entities performing a combination of activities. Such combinations underpin leverage and liquidity mismatches, putting EB measures at the core of financial stability regulation. That said, deploying both AB and EB measures in a belt-and-braces approach can reinforce their effectiveness. One example is the combination of LTV and bank capital requirements (AB and EB, respectively).

Our framework sheds light on issues that tend to invoke calls for the application of the “same risk, same activity, same regulation” principle. In applying this principle, it is necessary to qualify whether “risk” refers to the failure of an entity, of an activity or of several activities. In addition, it is key to justify the type of regulation and not presume suitability of AB measures by mechanically inserting a “same activity” clause. Thus, a more meaningful statement would be “same risk, same AB (or EB) regulation”.

Table 1: Illustrative allocation to AB and EB regulation

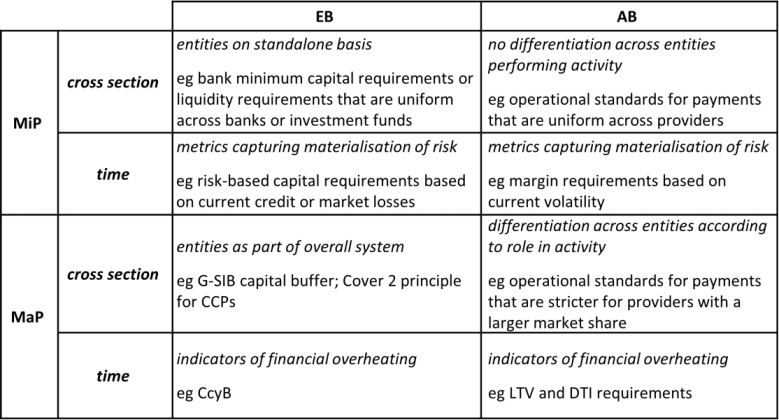

The micro- vs macroprudential (MiP vs MaP) distinction provides a perspective on regulation that differs from the EB vs AB one (Table 2). As is well known, regulatory measures have a MaP or MiP orientation depending on whether they are calibrated to systemic risk or by considering the object of attention on a standalone basis (Crockett (2000), Borio (2003)). In addition, the distinction between MiP and MaP depends on the dimension of risk considered.

The first dimension is the distribution of risk within the financial system at a point in time, ie the “cross-sectional dimension”. Within the universe of EB measures that target this dimension, MiP measures tend to equalise the risk of failure across entities. By contrast, MaP measures seek to equalise contributions to systemic risk across entities and are thus stricter for entities with a larger systemic footprint (eg G-SIB surcharges). The distinction between AB measures along the cross-sectional dimension is similar. For instance, operational standards for payments that apply uniformly to all payment providers are MiP and those that are stricter for providers with a larger market share are MaP.

The second dimension is the evolution of systemic risk over time – the “time dimension”. Along this dimension, MiP measures can end up constraining entities or an activity more tightly in bad times than in good (eg banks’ minimum risk-based capital requirements (EB) or margin requirements based on current market volatility (AB)). MaP measures seek to have the opposite impact because they recognise that (i) exceptionally easy financial conditions reflect and encourage the build-up of risk and (ii) collective retrenchment can exacerbate strains when the system is under stress. Examples include banks’ CcyB (EB) and LTV or DTI requirements (AB).

Importantly, combining the EB-AB classification with the distinction between MiP and MaP measures reveals a pitfall with the conventional view of the level playing field as a target of financial stability policy. When of a MaP nature, both EB and AB measures should impose stricter constraints on entities of greater systemic importance, eg systemic banks or big techs that dominate in (some) payment markets. Thus, not just EB but also AB regulation need not be consistent with a level playing field.

Table 2: MiP vs MaP and EB vs AB: calibration concepts and examples

NBFIs. The NBFI category comprises various entities – from mutual and hedge funds to insurance companies, to CCPs – that perform a wide range of activities, from lending to trading on capital markets to insurance underwriting. In making recommendations for the regulation of NBFIs, the FSB has focused on credit intermediation activities that give rise to unaddressed financial stability risks. A notable example is the activities performed by various forms of collective investment vehicles. The FSB states that its intended approach is distinctly AB: it refers explicitly to “activity-based policy measures” (FSB (2015)) that would seek to enhance the resilience of asset management activities by mitigating maturity/liquidity transformation and leverage (FSB (2017)).

Policymakers’ statements notwithstanding, key aspects of NBFI regulation are largely EB. A notable example is (minimum) liquidity and leverage requirements for mutual funds, which are calibrated at the level of funds’ balance sheets. Seeking to protect the investors of individual funds, these measures are conceptually equivalent to regulatory requirements for banks and structured in a very similar way. And they are, in both cases, MiP. In times of stress, mutual fund liquidity requirements lead to liquidity hoarding or deleveraging that exacerbates market swings, thus undermining financial stability.

AB margining requirements are another example of tools whose design could be improved to better support financial stability (see also Cunliffe (2022)). Despite concerns about their procyclicality (FSB (2017), p 24), they are still calibrated largely without regard to systemic risks. As shown most recently in March 2020, margin requirements induce each entity to preserve its own liquidity position but can compromise the overall systemic activity (eg derivatives trading). Moreover, since they reflect short look-back periods and do not try to anticipate stress down the road, they are MiP measures. By contrast, financial stability would call for a MaP perspective along the time dimension.

Overall, the dominance of investor-protection objectives in the investment fund sector and the consequent focus on entities on a standalone basis result in a policy gap from a financial stability perspective (eg Borio et al (2020)).

Big techs.2 Big techs have expanded into financial services in recent years and are poised to expand further. Even though their financial activities (eg payment services) are a small part of their overall business, big techs may already be large players in some systemic activity, or soon could be. AB regulation would be a natural starting point to ensure that big techs are subject to the same financial stability measures as other entities performing the same activities. As argued above, MaP considerations would call for imposing tighter constraints on big techs that dominate a specific activity. This would tilt the playing field against them.

That said, an AB approach will generally be insufficient. Because big techs provide a gamut of services, the systemic repercussions could be substantial should one of these entities fail. EB measures with a MaP orientation, as in the case of G-SIBs, would thus be warranted. For such regulation to be effective and efficient, notably avoiding the imposition of financial stability measures on non-financial activities, big techs may need to adopt a holding company structure and engage in financial activities through designated legal entities within it. With the subsidiary well identified, the optimal set of additional EB and/or AB measures will depend on the mix of its activities. In addition, regulation will need to ensure that problems at the parent company do not undermine the subsidiary’s viability.3

While these principles apply to all conglomerates with financial subsidiaries, the unique features of big techs warrant special attention.

Given the network externalities stemming from the combination of big techs’ many services – notably those involving the collection and use of data – financial stability measures may fall short of attaining their objectives. If data collected from non-financial businesses (eg social media, search, online commerce etc) can be used for financial services provision, there is a risk that a few big techs would quickly come to dominate (some) markets. Combined with centralised technology structures, this concentration might jeopardise financial stability (BIS (2021)). Thus, several large jurisdictions have taken far-reaching steps to address the challenges associated with big tech platforms, notably seeking to prevent abuse of market dominance (Carstens et al (2021), Crisanto et al (2021)). Ultimately, proper limits on the collection and use of data across big techs’ multiple services will probably be needed to attain public policy objectives, including financial stability ones.

The distinction between EB and AB regulation reflects the calibration of policy measures. AB regulation is calibrated with exclusive reference to a given (systemic) activity, regardless of the characteristics of the entities that perform it. By contrast, EB regulation is calibrated to the combination of activities within an entity.

Neither AB nor EB regulation is a priori the optimal choice. AB is superior when (i) the failure of an activity – as opposed to that of the entities performing it – can create a systemic event; and (ii) this activity can be effectively regulated directly on a standalone basis. That said, when financial stability requires constraining the combination of different activities within entities, authorities need to resort to EB measures. This is often the case because of the very nature of financial intermediation, notably in the presence of leverage and liquidity transformation, which are at the root of key financial vulnerabilities. Importantly, EB and AB regulation can reinforce each other in a belt-and-braces approach.

Comparing the EB vs AB classification with the MiP vs MaP one yields important insights. For one, although AB measures target systemic activities, they are not MaP if they do not take into account the relative importance of individual entities within the system. When AB regulation does adopt a MaP perspective, it will be stricter for entities that perform a larger share of a systemic activity, putting them at a competitive disadvantage, all else the same. Thus, AB measures are not necessarily consistent with a level playing field, in contrast to a common view.

Bank for International Settlements (2021): CBDCs: an opportunity for the monetary system, Annual Economic Report, Chapter 3.

Borio, C (2003): “Towards a macroprudential framework for financial supervision and regulation?”, CESifo Economic Studies, vol 49, no 2/2003, pp 181–216. Also available as BIS Working Papers, no 128, February.

Borio, C, M Farag and N Tarashev (2020): “Post-crisis international financial regulatory reforms: a primer”, BIS Working Papers, no 859.

Borio, C and R Filosa (1994): “The changing borders of banking: trends and implications”, BIS Economic Papers, no 43.

Carstens, A, S Claessens, F Restoy and H S Shin (2021): “Regulating big techs in finance”, BIS Bulletin, no 45, August.

Crisanto, J, J Ehrentraud, A Lawson and F Restoy (2021): “Big tech regulation: what is going on?”, FSI Insights, no 36.

Crockett, A (2000): “Marrying the micro- and macroprudential dimensions of financial stability”, BIS Speeches, 21 September.

Cunliffe, J (2022): “Learning from the dash for cash – findings and next steps for margining practices”, speech at the Futures Industry Association (FIA) & Securities Industry and Financial Markets Association (SIFMA) Asset Management Derivatives Forum, 9 February.

Financial Stability Board (2015): “Next steps on the NBNI G-SIFI assessment methodologies”, Press release, July.

——— (2017): “Policy recommendations to address structural vulnerabilities from asset management activities”, January.

Restoy, F (2022): “Big tech regulation: in search of a new framework”, Presentation at the EBA Board of Supervisors’ Away Day, 12 July.

In practice, LTV and DTI requirements may apply only to certain types of entity, notably banks. While this practice may reflect systemic considerations, it creates scope for regulatory arbitrage.

Given this article’s focus on financial stability, the discussion of big techs is largely complementary to that in Carstens et al (2021), who consider mainly market dominance and data governance issues.

Given the tight and complex interconnections between big techs’ financial and non-financial activities, Restoy (2022) argues for an ambitious policy framework in which EB measures play a key role in addressing risks to financial stability, business conduct and operational resilience. A key question in this context is the extent to which the firewalls and additional group-wide restrictions, eg on the use of data across subsidiaries (as noted below), could undermine the business model that underpins big techs’ activities. This is a well-known general issue with such constraints (eg Borio and Filosa (1994)).