References

Ahmed, M. F., Gao, Y., and Satchell, S. (2021). Modeling demand for ESG. The European Journal of Finance, 27(16), 1669-1683.

Anderson, A., Robinson, D.T. (2021): Financial Literacy in the Age of Green Investment. Review of Finance, 63,1572–3097.

Chapron, G. (2017). The environment needs cryptogovernance. Nature, 545(7655), 403-405.

Ciaian, P., Cupak, A., Fessler, P., and Kancs, A. (2022a). Environmental and Social Preferences and Investments in Crypto-Assets. National Bank of Slovakia, Working Paper No. 3/2022.

Ciaian, P., Cupak, A., Fessler, P., and Kancs, A. (2022b). Environmental-Social-Governance Preferences and Investments in Crypto-Assets. Oesterreichische Nationalbank, Working Paper No. 243.

Foley, S., Karlsen, J. R., & Putniņš, T. J. (2019). Sex, drugs, and bitcoin: How much illegal activity is financed through cryptocurrencies?. The Review of Financial Studies, 32(5), 1798-1853.

Fujiki, H. (2021). Crypto asset ownership, financial literacy, and investment experience. Applied Economics, 53(39), 4560-4581.

Krause, M. J., & Tolaymat, T. (2018). Quantification of energy and carbon costs for mining cryptocurrencies. Nature Sustainability, 1(11), 711-718.

Lewbel, A. (2012). Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models. Journal of Business & Economic Statistics, 30(1), 67-80.

OECD (2018): OECD/INFE toolkit for measuring financial literacy and financial inclusion. Tech. rep., OECD Publishing, Paris.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2021). Sustainable investing in equilibrium. Journal of Financial Economics, 142(2), 550-571.

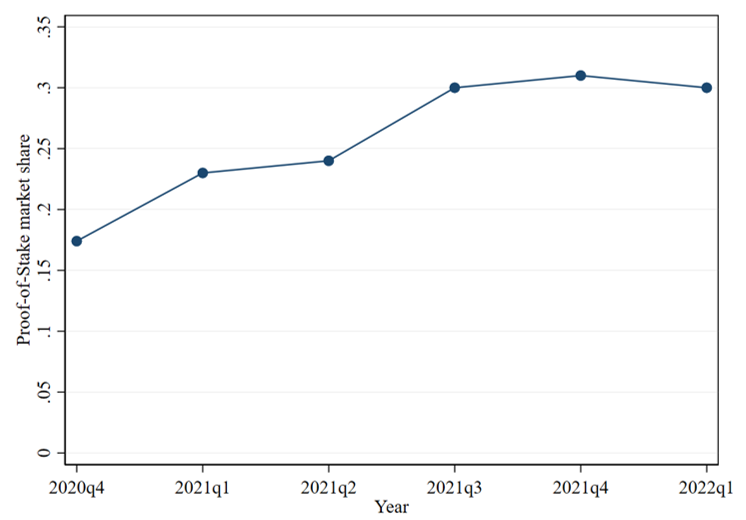

Saleh, F. (2021). Blockchain without waste: Proof-of-stake. The Review of Financial Studies, 34(3), 1156-1190.

Stix, H. (2021). Ownership and purchase intention of crypto-assets: survey results. Empirica, 48(1), 65-99.