The views expressed are those of the authors and do not involve the responsibility of the Bank of Italy.

Abstract

We analyse the impact of ESG risks on the term structure of default probabilities of European non-financial corporations between 2014 and 2022. Our findings reveal that higher ESG scores reduce a company’s inherent risk implicit in its probability of default, with more pronounced effects as the time horizon for default probability increases. The impact of ESG risks on corporate viability fluctuates over time and tends to intensify after major events relating to sustainability risks, such as the Paris Agreement or the COVID-19 pandemic. Additionally, our analysis shows that ESG considerations influence not only the objective or physical probability of default but also the credit risk premium required by investors. This aligns with heightened awareness and stronger investor concerns about sustainability, especially in recent years.

Traditionally, structural models of credit risk have focused on the impact of financial and accounting metrics to analyze the determinants of firm-level probability of default. The assessment of credit risk has nevertheless evolved significantly over the years. Increasing attention is now being paid to the role that non-financial factors, particularly Environmental, Social, and Governance (ESG) metrics, can play in determining a firm’s long-term viability and creditworthiness.

ESG factors encompass a wide range of issues, including climate change, resource management, social responsibility, corporate governance, and ethical business practices. These factors can influence financial asset prices through two main channels (see Albuquerque et al., 2019, Pastor et al., 2021, Pastor et al., 2022, Pedersen et al., 2021 among many others).

First, ESG factors might capture risks not fully accounted for by traditional credit metrics, but which can have material impacts on corporate asset prices (“risk channel”). These risks include increasing compliance and operational costs due to adverse shifts in environmental regulation, risks of company assets being stranded by new low-carbon technologies, or legal and reputational costs linked to poor social performance and employee relations. As a result of these risk exposures, companies with poor ESG performance may experience lower market value, volatile cash flows, and a greater probability of default. The second channel relates to investors’ preference towards sustainable assets (“preference channel”). Some investors with strong ESG preferences derive utility from holding assets of more sustainable firms and they may be willing to pay a premium to include these assets in their portfolio or engage in negative screening of firms with poor ESG performance.

In a recent paper (Ferriani and Pericoli 2024), we analyse the interlink between ESG scores and default risk of European listed non-financial corporations from 2014 to 2022. This time frame encompasses various sustainability-related events that could impact companies’ risk profiles and profitability or influence how investors integrate ESG risks into their portfolio decisions: the 2015 Paris Agreement, the US Trump administration’s reneging on climate commitments, the global expansion of climate change protests through initiatives like climate strikes, the Covid-19 pandemic, the Russia’s invasion of Ukraine in 2022, and the subsequent European energy crisis.

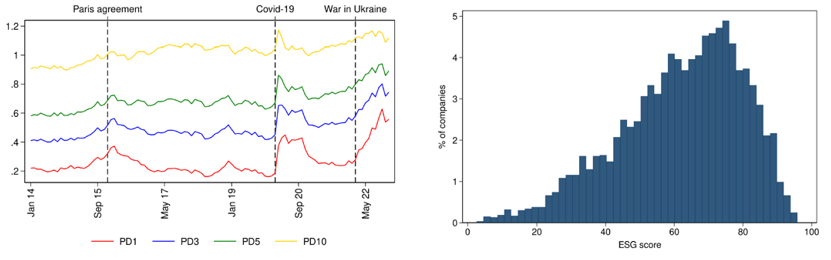

We measure firms’ probability of default using the Moody’s Expected Default Frequency (EDF) hereafter referred to as probability of default (PD). We consider four different maturities (1 year, 3 years, 5 years, and 10 years) to investigate the impact of ESG scores on the whole term structure of corporate PDs, see Figure 1 a. The Moody’s PD differs from the so-called risk-neutral probability of default used to price corporate default swaps (CDS), which is larger than the actual (physical) probability because it includes a risk adjustment, i.e., a compensation required by investors beyond that for expected losses. Corporate sustainability risk exposure is evaluated using annual composite ESG ratings obtained from LSEG which employs a rating scale ranging from 0 to 100, with higher scores indicating better ESG performance (see Figure 1 b).

Figure 1. The left plot displays the sample average probability of default across different time horizons (1, 3, 5, and 10 years). The right plot shows the frequency distribution of the LSEG ESG composite score.

As a first exercise, we consider static regressions over the whole sample and include the ESG score as a systematic factor, along with company’s expected P&L variables and current balance sheet indicators, and measure its impact on corporate PDs. This allows to obtain an estimate of the first channel, i.e., the influence of ESG risks on firms’ creditworthiness.

We find that companies’ ESG scores significantly affect corporate PDs especially at longer maturities, confirming the idea of sustainability as a long-term risk factor for corporate viability (e.g. Gao et al., 2021, Li et al., 2022, Kanno, 2023). A one standard deviation increase in the ESG score is linked to a reduction in the PD of around 4 basis points at the 1-year horizon and up to approximately 15 basis points at the 10-year horizon. In economic terms, this corresponds to up to a 15% reduction in the average PD, depending on the specification.

Our results are robust to i) the use of alternative ESG ratings obtained from Bloomberg, Sustainalytics, and Robeco; ii) the exclusion of the energy and the utility sectors; iii) the inclusion of Moody’s credit ratings; iv) the use of different time frequencies of data. We also analyse the influence of the three dimensions of sustainability separately using LSEG scores for the individual Environmental (E), Social (S), and Governance (G) risk profiles and find that the governance score has little impact on corporate PDs compared to the environmental and social scores.

We also investigate the dynamic evolution of how ESG considerations affect firms’ creditworthiness. This aspect is crucial as both the regulatory approach towards sustainability, particularly climate and environment, as well as investors’ and consumer preferences evolve over time. Episodes of green enthusiasm and wake-up calls for ESG considerations such as the 2015 Paris agreement or the Covid-19 recovery alternate with periods of retrenchment of the green agenda such as that resulting from the advent of the US Trump Administration in 2016 or the recent backlash against ESG criteria (e.g. Eskildsen et al., 2024, Matos, 2023, Tang et al., 2024).

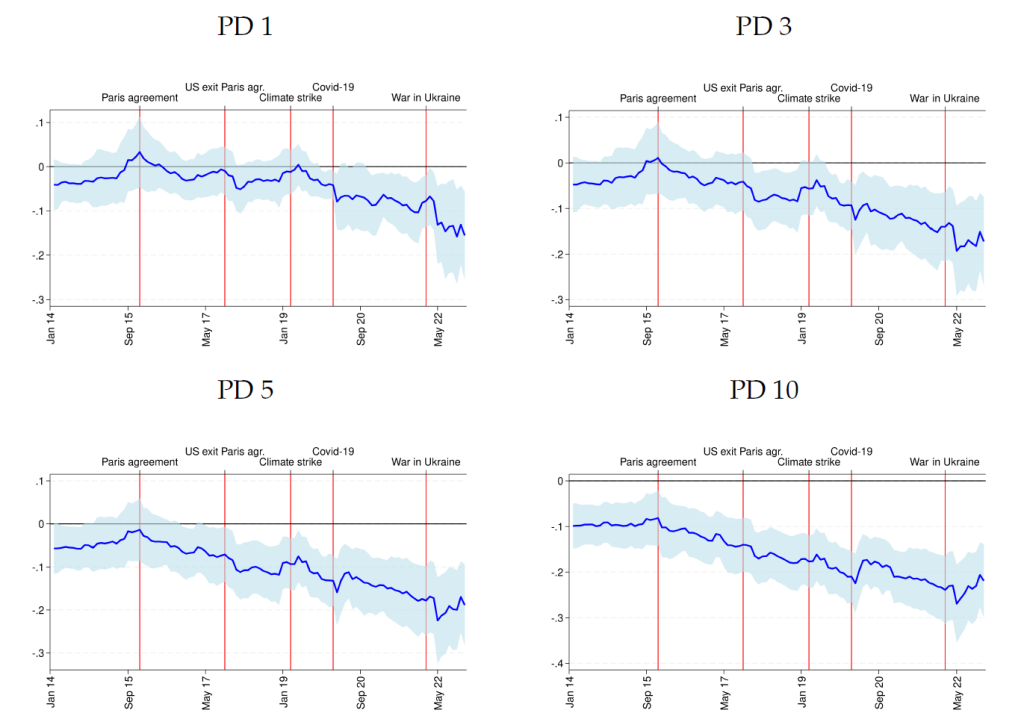

Figure 2. The figure displays the time-varying impact of sustainability (regression coefficient) on the corporate PDs. A positive value of the coefficient would imply a positive impact of sustainability on corporate PDs.

Figure 2 shows that the magnitude of the sustainability effect on corporate PDs has increased in absolute terms over time, with a noticeable trend beginning from the 2015 Paris Agreement. This event marked a critical juncture in how heightened exposure to sustainability risks, such as climate regulatory risks, may have impacted corporate viability. The Covid-19 shock in 2020 had a positive upside impact, particularly for medium to long-term maturities. The increase, probably explained by investors’ focus on corporate liquidity and viability rather than to risk-factors beyond balance-sheet fundamentals during the most acute phase of the crisis, was nevertheless short lived and quickly reverted after a couple of months. Lastly, a strong negative reaction of PDs to sustainability scores was observed after the 2022 war in Ukraine, particularly for short-term horizons. A possible explanation for this result lies in firms’ sustainability exposure, especially regarding environmental factors. This likely acted as a mitigating factor during the European energy crisis, arguably due to stronger expected policy responses supporting the green transition.

As a second exercise, we present an estimate of how ESG factors influence the credit risk premium. This part of the analysis focuses on the preference or non-pecuniary channel of ESG investing and is essential to understand how a shift in investor preferences and consumer preferences towards the ESG paradigm can have significant asset pricing implications.

To this purpose, we rely on CDS spreads which incorporate both firms’ credit risk and investors’ required compensation to hold risky assets. We filter out the intrinsic risk component implicit in corporate PDs along the methodology described in Berndt et al. (2005) and obtain a proxy of the credit risk premium.

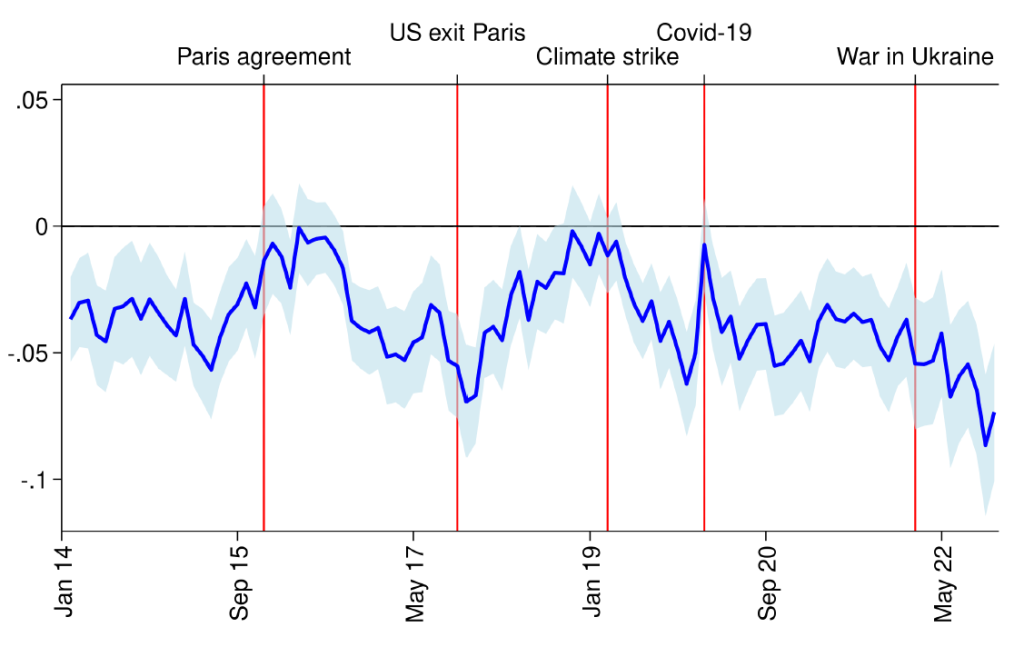

Figure 3. The figure reports the time varying average sensitivity of corporate risk premia to ESG scores. A positive value of the coefficient would imply a positive impact of sustainability on risk premia.

Figure 3 displays the evolution of investors’ sensitivity to ESG concerns. Compared to the time-varying estimates of the risk channel displayed in Figure 2, we do not find evidence of a clear-cut negative trend. However, on average, we find that corporate ESG scores are negatively related to the risk premium, indicating that investors demand compensation for firms with higher sustainability risks. Moreover, the estimate of the ESG premium is also quite volatile, and its magnitude is increasing in absolute value after periods of major shocks to ESG concerns such as the 2015 Paris Agreement, the Covid-19 recovery and the subsequent “green wake-up call”, or the 2022 war in Ukraine, when greener firms less reliant on fossil fuels were less exposed to the energy shock. Conversely, the ESG premium decreases in absolute magnitude during period of major financial distress (e.g. the Covid-19 financial turmoil in February-March 2020) when investors’ focus was on liquidity and short-term viability rather than sustainability or when less climate-friendly political administrations take office.

We examine the impact of ESG risks on the term structure of PDs of European non-financial corporations over the period 2014-2022. We document evidence of a negative correlation between firms’ sustainability profiles and their creditworthiness, with a more pronounced effect observed as the time horizon of default probability increases. The relationship between ESG risks and PDs displays significant time variation, particularly intensifying during periods marked by mounting ESG concerns, such as those following the 2015 Paris Agreement and the Covid-19 pandemic. We also find that both firms’ inherent credit risk and investor compensation are affected by sustainability risks, emphasizing the importance of capturing a broader set of risk factors, alongside conventional financial risk factors.

Albuquerque, R., Y. Koskinen, and C. Zhang (2019): “Corporate social responsibility and firm risk: Theory and empirical evidence,” Management science, 65, 4451–4469.

Berndt, A., R. Douglas, D. Duffie, M. Ferguson, and D. Schranz (2005): “Measuring default risk premia from default swap rates and EDFs,” BIS Working paper.

Eskildsen, M., M. Ibert, T. I. Jensen, and L. H. Pedersen (2024): “In search of the true greenium,” Available at SSRN.

Ferriani, F., Pericoli, M. (2024): “ESG risks and Corporate Viability: Insights from Default Probability Term Structure Analysis”, Occasional paper, Bank of Italy, forthcoming.

Gao, F., Y. Li, X. Wang, and Z. K. Zhong (2021): “Corporate social responsibility and the term structure of CDS spreads,” Journal of International Financial Markets, Institutions and Money, 74, 101406.

Kanno, M. (2023): “Does ESG performance improve firm creditworthiness?” Finance Research Letters, 55, 103894.

Li, H., X. Zhang, and Y. Zhao (2022): “ESG and Firm’s Default Risk,” Finance Research Letters, 47.

Matos (2023): “Greenwashing and ESG investing at a crossroads,” ECGI and Indiana University public lecture series on corporate governance.

Pastor, L., R. Stambaugh, and L. A. Taylor (2021): “Sustainable investing in equilibrium,” Journal of Financial Economics, 142, 550–571.

Pastor, L., R. Stambaugh, and L. A. Taylor (2022): “Dissecting green returns,” Journal of Financial Economics, 146, 403–424.

Pedersen, L. H., S. Fitzgibbons, and L. Pomorski (2021): “Responsible investing: The ESG-efficient frontier,” Journal of Financial Economics, 142, 572–597.

Tang, O., X. Shi, and L. Jiu (2024): “Value Creation or Political Trick? An Event Study on Anti-ESG Regulations,” Finance Research Letters, 105530.