The views in this policy brief are solely those of the author and should not be interpreted as reflecting the views of the Deutsche Bundesbank or the Eurosystem.

Fragilities in the financial sector can result in large macroeconomic downside risks, as it has also been remarkably emphasized by the financial crisis of 2007-2008. To better assess these tail risks and the emergence of endogenous financial crisis, there has been a large growing body of empirical work on growth-at-risk – the link between macrofinancial conditions and the future distribution of output growth – starting with Adrian et al. (2019). At the same time, the structural model-based perspective on the evolution of growth-at-risk has been neglected. However, such an approach can shed additional light on the sources of downside risk and helps to assess the impact of policy interventions on the build-up of financial fragility.

In recent research (Rottner, 2022), I provide a novel estimation approach of macroeconomic downside risk through the lens of a microfounded nonlinear model. The developed quantitative model features endogenous financial crises and is taken to U.S. data with the objective of estimating and analyzing financial fragility and the associated macro risk. Focusing on the financial crisis of 2007-2008, my results suggest that the estimated financial fragility and the economic downside risk increase considerably from 2005 onwards and peak in 2008.

The employed analysis also offers a new angle for appraising policy counterfactuals with regard to growth-at-risk. Using counterfactual scenarios, I assess the impact of alternative monetary and macroprudential policy on the estimated probability of a financial crisis. Specifically, macroprudential policy could have reduced the build-up of financial fragility and could have averted the run on the financial sector in the fourth quarter of 2008. In addition to this, the results show that the threat of a financial crisis is associated with severe downward risk for inflation, which is exacerbated by the zero lower bound.

To evaluate and quantify endogenous financial fragility, I develop a new non-linear macroeconomic model with financial intermediaries and runs.1 The possibility of a run on the financial system is state-dependent and relies on economic circumstances. Importantly, the model features endogenous boom-bust dynamics. In addition to this, the model is embedded in a New Keynesian setup with an occasionally binding zero lower bound.

The framework accounts for key empirical observations concerning financial crises as a run is preceded by a credit boom, low pre-crisis credit spreads, not every boom results in a bust as well as elevated leverage in the shadow banking sector as observed around 2008. The model highlights that there is a substantial increase in financial fragility prior to a run. The probability of a run for the next quarter peaks in the period before the run. The median observation based on a large simulation is around 5%, corresponding to 20% as an annualized rate, after this downside risk has increased steadily in the periods before.

The quantitative model also sheds light on the connection between monetary policy and financial crisis in a low interest rate environment. The zero lower bound, which limits potential rate cuts during a run, increases the likelihood of an endogenous financial crisis as well as the real repercussions of such a crisis. Furthermore, the build-up of financial fragility in combination with the threat of encountering the zero lower bound results in deflationary pressure during a boom and creates substantial downside risk for inflation in line with the empirical results of Lopez-Salido and Loria (2020).2

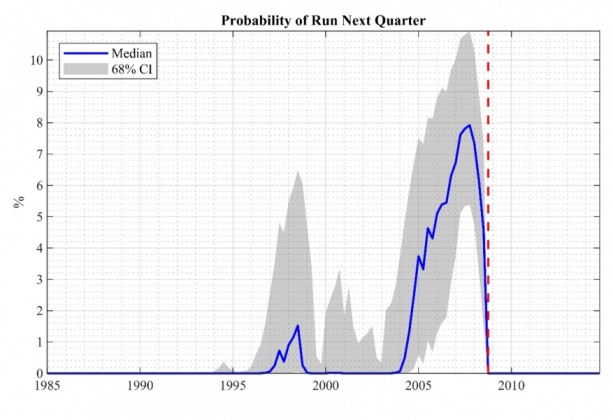

Figure 1: Model-based financial fragility measure – Estimated probability to observe a run on the financial sector in the next period. The median together with the 68% confidence interval is shown.

The model is taken to the data to obtain a structural estimate of the endogenous build-up of financial fragility and economic downside risk in the U.S. around the great financial crisis. For this purpose, I first fit the framework to salient features of the U.S. economy. I then condition the model on selected data to estimate the endogenous probability of a run through the lens of a structural nonlinear model. Therefore, the approach provides a model-based growth-at-risk approach that links current macrofinancial conditions to the distribution of future output growth using a microfounded nonlinear framework with endogenous financial fragility.

The estimated financial fragility measure is shown in Figure 1. The probability of a financial crisis starts to increase significantly from 2005 onwards and peaks in 2008. The framework predicts in 2008:Q3 that the risk of a roll-over crisis in the next quarter is close to 5%, which would correspond to 20% in annual terms. The estimation highlights the importance of high leverage of financial intermediaries because it makes the financial system prone to instability. The run alone explains around 70% percent of the severe output drop in 2008:Q4 of more than 8% in annual terms. This emphasizes the importance of considering nonlinear dynamics in accounting for the data. Furthermore, the framework also formalizes the evolution of macroeconomic downside risk over time, providing structural guidance for empirical growth-at-risk approaches.

The quantitative analysis also offers a new angle for appraising policy counterfactuals with regard to financial fragility. Using the results from the estimation, the counterfactual paths under alternative policies can be constructed. I investigate the impact of a monetary as well as macroprudential policy instrument on the build-up of financial fragility prior to 2008 and the occurrence of the financial crisis.

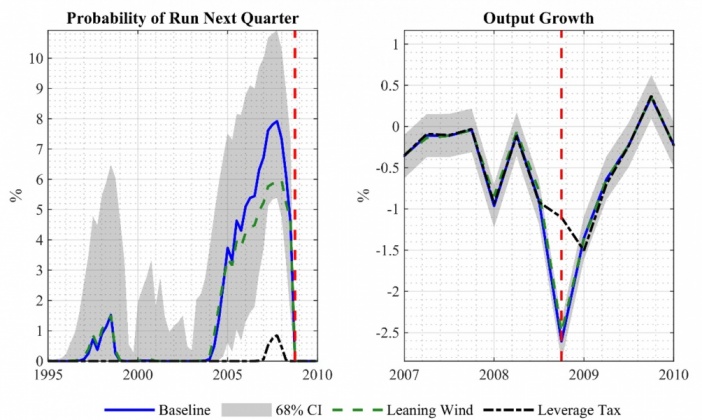

Figure 2: Counterfactual policy analysis of “leaning against the wind” and the leverage tax – Estimated probability to observe a run on the financial sector in the next period and and output growth is compared to the baseline scenario.

Figure 2 displays these counterfactual scenarios. With regard to monetary policy, I evaluate a “leaning against the wind policy”, which prescribes a tighter monetary policy stance during a credit boom to lower financial fragilities. The analysis shows that a “leaning against the wind” would have reduced the probability of a run slightly during its peak in 2008. However, I find that it would not have succeeded in averting the run on the financial system. The macroprudential instrument follows the idea of a leverage tax for shadow banks. The leverage tax, which is a tax on deposit holdings, reduces financial fragility more substantially. The counterfactual analysis suggests that such a macroprudential policy could have reduced the build-up of financial fragility and could have averted the run on the financial sector in 2008:Q4 and the associated drop in GDP itself. The potential of macroprudential policy to avert endogenous financial crisis is in line with Gertler, Kiyotaki and Prestipino (2020b).

The outlined concept for estimating macroeconomic downside risk and analyzing policy counterfactuals through the lens of a structural nonlinear model is general and can be adapted to a variety of countries, scenarios and policies. For instance, the approach can provide a real-time structural estimate of financial fragility and can help to quantify the potential financial stability impact of different policy scenarios such as an increase in the interest rate after a prolonged period of low rates or the tapering of asset purchase programs. Additionally, this microfounded approach offers guidance for more stylized macroeconomic modeling approaches that capture the macroeconomic downside risk with an ad-hoc specified vulnerability function.

Adrian, T., Boyarchenko, N., & Giannone, D. (2019). Vulnerable growth. American Economic Review, 109(4).

Bianchi, F., Melosi, L., & Rottner, M. (2021). Hitting the elusive inflation target. Journal of Monetary Economics, 124.

Gertler, M., Kiyotaki, N., & Prestipino, A. (2020a). A macroeconomic model with financial panics. The Review of Economic Studies, 87(1), 240-288.

Gertler, M., Kiyotaki, N., & Prestipino, A. (2020b). Credit booms, financial crises, and macroprudential policy. Review of Economic Dynamics, 37.

Lopez-Salido, D., & Loria, F. (2020). Inflation at risk. FEDS Working Paper No. 2020-013.

Nuno, G., & Thomas, C. (2017). Bank leverage cycles. American Economic Journal: Macroeconomics, 9(2).

Rottner, M. (2022). Financial crises and shadow banks: A quantitative analysis. Deutsche Bundesbank Discussion Paper No. 15/2022.

The model incorporates features from Nuno and Thomas (2017) and Gertler, Kiyotaki and Prestipino (2020a).

For a quantitative analysis of the zero lower bound’s impact in the absence of financial fragilities, see e.g. Bianchi et al. (2021).