This Policy Brief is based on Banco de España Documentos de Trabajo. N.º 2408. The views expressed are those of the authors’ and do not necessarily reflect those of the Banco de España or the Eurosystem.

The proper functioning of monetary policy requires that changes in the risk-free curve be transmitted to benchmark rates, like sovereign bond yields. In this context, it is key to disentangle the movements in spreads resulting from macroeconomic factors from the rest. This task has proven to be complex in practice, as the estimated contribution of these factors to the evolution of sovereign spreads is subject to significant model uncertainty. We address these challenges by estimating a wide range of models that explain the 10-year sovereign bond spreads with respect to the German bond yield as a function of macroeconomic (and other) variables. According to our results, these drivers play a key role in determining the dynamics of sovereign bonds. For instance, the debt-to-GDP ratio explains almost 40% of the evolution of spreads over the period 2000-2023. However, in certain moments, such as the sovereign debt crisis, the deterioration of macroeconomic conditions can only account for about one fourth of the peak in the spreads of non-core countries.

As discussed by Lane (2020), for the proper functioning of monetary policy, it is essential that changes in the risk-free curve are transmitted to the benchmark rates that matter for the pricing of financial instruments and bank credit. One such class are sovereign bond yields. As members of a monetary union issue debt in a currency that is not under their full control, they are subject to liquidity crises in sovereign markets as noted by De Grauwe and Ji (2012). The volatility induced by these episodes can blur the signals of monetary policy and difficult its transmission.

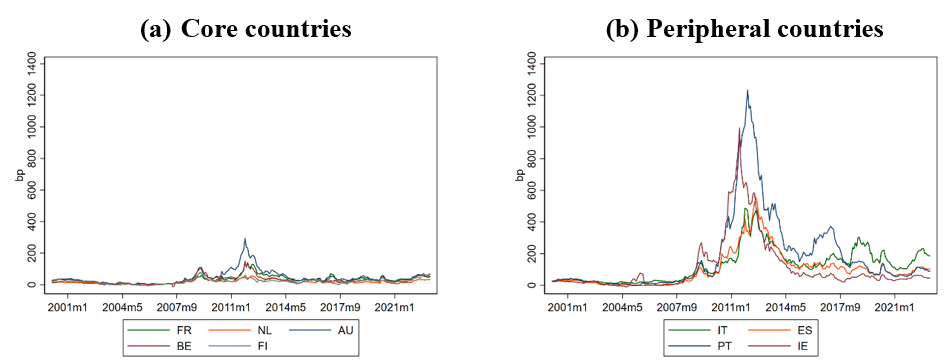

During the first decade after the adoption of the euro, these concerns were only theoretical. Sovereign yields remained relatively low and stable inside the euro area, as shown in Figure 1. However, spreads dynamics changed with the Global Financial crisis (GFC) of 2007-09 and the subsequent euro area’s sovereign debt crisis in 2011-12, which led to a striking jump in sovereign spreads inside the euro area, as noted comparing panels in the figure.

Figure 1: Euro Area Average 10-year Bond Spreads against German Bund

Source: Refinitiv and own calculations.

Note: the list of countries includes France (FR), The Netherlands (NL), Austria (AU), Belgium (BE), Finland (FI), Italy (IT),Spain (ES), Portugal (PT), Ireland (IE).

The remarkable lower increase in sovereign spreads for core countries during that crisis period raised questions about how much of these differences could be explained by the contribution of macroeconomic factors. This has proved to be a complex task. The literature shows that the contribution of macroeconomic variables (such as the government debt-to-GDP ratio, GDP growth, and public deficit-to-GDP ratio) to the evolution of sovereign spreads in these estimations is subject to significant model uncertainty. In particular, it depends on the number of countries in the sample, the sample period considered, the existence of structural breaks in the series, the definition of macroeconomic variables, or the particular econometric specification.

In a recent paper, Burriel et al (2024), we try to overcome these problems by proposing a novel estimation of the sovereign spread level consistent with the country’s macroeconomic determinants. We estimate a wide range of models explaining the 10-year sovereign bond spreads with respect to the German bond yield as a function of macroeconomic variables as well as other variables, such as liquidity risk measures or market sentiment, which potentially affecting sovereign spreads, but do not directly impacting the government’s ability to service their debt. The specifications considered differ across five dimensions: i) only past or only expected data on the macroeconomic variables (or both); ii) different combinations of period interactive variables to control for structural breaks in the impact of fundamentals; iii) idiosyncratic factors (fixed effects by country or by groups of countries), iv) monetary policy purchase programs; and v) different sample period (full sample or excluding the COVID-19 crisis period). Once we have estimated the set of models we adopt a thick modelling approach (Granger and Jeon (2004)) and compute the average spread determined by macroeconomic variables across all models estimated. By averaging across models, we take into consideration the fact that spread estimations and fitting are generally sensitive to model specification, and could vary across countries. The main advantage of this approach is the reduction of the influence of modelling choices on the expected outcome.

In line with the literature, we find that macroeconomic drivers are key in determining the dynamics of sovereign bonds. Previous to the GFC, their contribution to spreads was stable and consistent with observed spreads. Yet, when examining the steep rise of spreads after 2008 in non-core countries we find that the deterioration of macroeconomic conditions can only explain a small part (around 25%) of the peak in their observed spreads. After the euro area sovereign debt turmoil, observed spreads have declined significantly but display higher volatility. Amongst macro variables, the debt-to-GDP ratio explains the biggest part of spreads throughout the full sample period (37%), although its contribution is higher (above 40%) in the period after the euro area sovereign debt crisis, especially for non-core countries (above 50% for the most recent period).

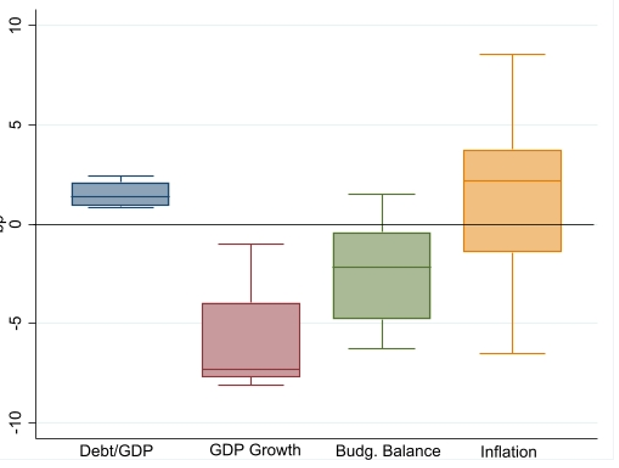

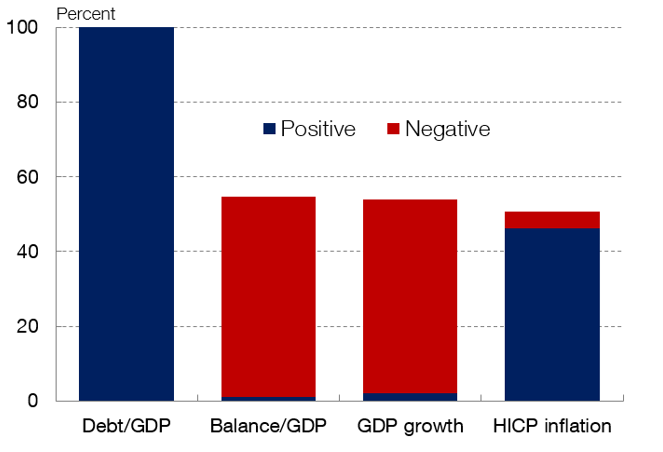

However, we find that the estimated contribution of macrofinancial drivers is not always immune to the chosen model specification. Focusing on the four most usual drivers, in Figure 2 we show that the coefficients for debt-to-GDP ratios and GDP growth are robust to different specifications, since their signs are always in line with economic theory, while the coefficients for the budget balance and, especially, for inflation, are more volatile, and often non-significant from a statistical point of view. In addition, we show that macro factors, when significant, (almost) always have the sign predicted by economic theory. Again, the debt-to-GDP ratio is the most relevant determinant, since it is statistically significant in all models, while the other three macro factors are significant in half of the models (see Figure 3). A number of additional robustness exercises confirm these key findings.

Thus we conclude that relying on a robust estimation of the contribution of macroeconomic factors to the dynamics of sovereign spreads is crucial to understand the factors driving their evolution within a monetary union like the euro area.

Figure 2: Distribution of coefficients of macro variables across Models

Source: Own calculations.

Notes: The chart includes estimated time-invariant coefficients: 24 in the case of GDP Growth and Debt/GDP, 48 for the Budget Balance and 72 for inflation. The solid boxes represent the 25th and 75th percentile, while the line inside the boxes indicates the median (outliers are omitted).

Figure 3: The sign of the determinants of sovereign spreads

Source: Own calculations.

Note: Percentage of models with p-value above 10% across both time-invariant and period-interactive coefficients and the 96 estimated models (some models have four coefficients for each variable).

Burriel, Pablo, Mar Delgado-Te llez, Camila Figueroa, Iva n Kataryniuk and Javier J. Pe rez (2024). “Estimating the contribution of macroeconomic drivers to sovereign bond spreads in the euro area”. Documento de Trabajo Banco de Espan a, 2408. https://www.bde.es/f/webbe/SES/Secciones/Publicaciones/PublicacionesSeriadas/DocumentosTrabajo/24/Files/dt2408e.pdf.

De Grauwe, Paul, and Yuemei Ji. (2012). “Mispricing of sovereign risk and macroeconomic stability in the eurozone”. Journal of Common Market Studies, 50 (6), pp. 866–880.

Granger, Clive WJ, and Yongil Jeon. (2004). “Thick modeling”. Economic Modelling, 21 (2), pp. 323–343. https://doi.org/10.1016/S0264-9993(03)00017-8.

Lane, Philip R. (2020). “The ECB’s monetary policy response to the pandemic: liquidity, stabilisation and supporting the recovery”. Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the Financial Center Breakfast Webinar organised by Frankfurt Main Finance. https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200624~d102335222.en.html.