The contribution of fiscal policy to inflation and cross-country inflation differentials has gained renewed interest since the rollout of large spending programmes since the Covid-19 pandemic. Our comprehensive empirical analysis covering the 19 euro area countries over the period 1999-2019 shows that it is difficult to detect robust evidence of the overall fiscal policy stance or impulse impacting directly on inflation differentials. We do find, however, evidence of an indirect channel running through the output gap. There is also some indication that fiscal policy may be especially potent in influencing inflation differentials when the economy is above its potential. Finally, we find statistically significant contributions to inflation differentials of individual fiscal instruments such as value added tax (VAT) rate changes and public wage growth.

The potential of fiscal policy to contribute to inflation and inflation differentials across the euro area has gained renewed interest since the onset of the Covid-19 pandemic as governments aimed to shield their economies from the impact of the pandemic and subsequently the energy crisis. While in the pre-pandemic period the cross-country dispersion in the annual HICP inflation rates across the 19 euro area Member States had been very small and broadly stable, inflation differentials started to increase with the onset of the pandemic and have further accelerated since 2021. More recently, the outburst of Russia’s war against Ukraine and the surge in energy prices have contributed to a further rise in inflation differentials. Especially where they are substantial, inflation differentials may pose challenges in the context of a monetary union. Setting nominal interest rates according to a single inflation target may imply a too accommodative monetary policy for countries with inflation rates (well) above the euro area average, while those with (well) below-average inflation might be faced with too high tightening policy pressures. The implied divergence in real interest rates affects real returns on savings and investment and might lead to an upward spiral in divergence if it manifests itself into expectations of real rates.

Our paper (Checherita-Westphal, Leiner-Killinger and Schildmann, 2023) seeks to explore the role of fiscal policies in explaining inflation differentials in the euro area. Previous empirical work on the determinants of inflation differentials across EMU countries (notably Honohan and Lane, 2003) mostly fails to detect a significant and robust impact of fiscal policy in the considered samples. However, this work focuses on the early years of EMU, covering a relatively restricted sample in terms of both country and time dimension. It therefore abstracts from several important policy changes, such as those in response to the financial and economic crises and the subsequent period with monetary policy moving towards the effective zero lower bound. Against this background, we thus reassess which factors shape inflation differentials in the euro area, considering a broader time period (1999-2019) and country sample (EA-19). We specifically focus on the role that can be assigned to differences in fiscal policies across countries, allowing for a range of fiscal measures, capturing both the level of support coming from fiscal policies (“fiscal impulse”) and changes therein (“fiscal stance”). We also consider potential asymmetries in fiscal policy regimes, the presence of an indirect channel running through output gap differentials, and interactions with the prevalent monetary policy stance, in an echo of the monetary-fiscal interaction literature. Lastly, we document the impact of specific fiscal policy instruments, such as indirect tax and public wage changes.

In addition to the discretionary fiscal policy measures of interest, our annual panel econometric model includes covariates, which have been identified in the literature as potentially important channels determining inflation differentials: the lagged nominal exchange rate, the contemporaneous output gap and the lagged price level, capturing openness and external exposure, business-cycle (non-)alignment, and price level convergence (in line with the Balassa-Samuelson effect), respectively. Lastly, contemporaneous unit labour cost growth is considered as an additional determinant. An increase (decrease) in the fiscal impulse/stance variable, being indicative of a tighter (more expansionary) fiscal policy, is expected to dampen economic activity in the short run and have a negative impact on a country’s inflation vis-à-vis the rest of the euro area.

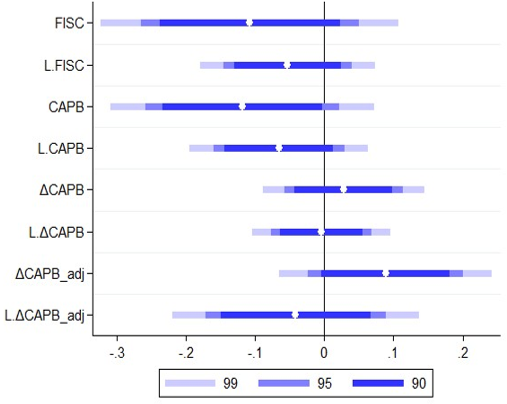

We estimate the main regression specification on the balanced EA-19 sample over 1999-20191 with generalized method of moments (GMM) and start by including various measures for the fiscal impulse and fiscal stance (either contemporaneous or lagged), once at a time. We find that none of these aggregate measures is significantly contributing to HICP inflation differentials (see Figure 1). We thereby confirm earlier estimates on restricted samples. Our results concerning the influence of the other factors under consideration are also in line with the literature: nominal effective exchange rate effects on inflation differentials are great in magnitude and highly significant. Business cycle non-alignments measured via the output gap as well as price convergence dynamics also robustly contribute to inflation differentials. Beyond this, unit labour cost growth is found to be an important driver of HICP inflation differentials across the euro area countries.

Figure 1: Baseline fiscal impulse/stance coefficient estimates

Source: Authors’ calculations. Notes: This figure plots estimated fiscal impulse/stance coefficients from separate regressions alongside the respective confidence interval (the legend links the colour scheme to the 99%-,95%-and 90%-confidence levels). Dependent variable: HICP inflation rate. Fiscal impulse indicators: FISC: deviation of the primary budget from its past 5-year moving average. CAPB: cyclically-adjusted primary balance. Fiscal stance indicators: ΔCAPB: annual change in the CAPB. ΔCAPB_adj: fiscal stance cleaned for support measures to the financial sector. L. denotes one-year lagged variables. All models have been estimated with two-step feasible GMM using the controls described in the main text and additionally controlling for year and country fixed effects. The output gap and contemporaneous fiscal impulse are treated as endogenous and instrumented with their first lag (exact identification). Driscoll-Kraay standard errors.

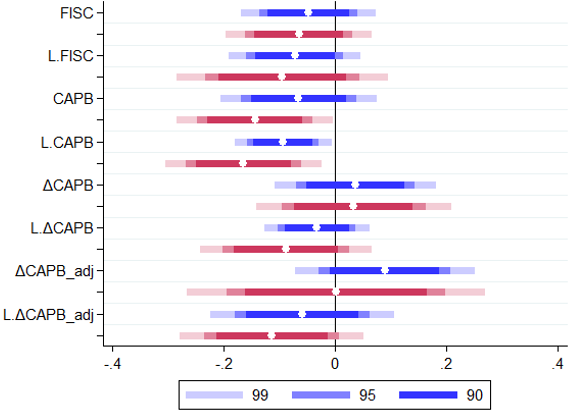

Conjecturing that expansionary fiscal policy in an economy that is relatively more overheated (i.e. being subject to a positive output gap differential) is more likely to raise the inflation differential of this country vis-à-vis the rest of the euro area, we repeat the above analysis, allowing the impact of fiscal impulse/stance to vary with the contemporaneous output gap direction (positive versus zero/negative). Indeed, compared to the baseline estimates when the output gap is zero or negative (see Figure 2, blue confidence intervals), the coefficients are often significantly negative in periods when the contemporaneous output gap is positive (red confidence intervals). Thus, especially discretionary budgetary tightening in levels (fiscal impulse) seems to bring down HICP inflation differentials and, conversely, an expansionary policy in levels fuels inflation and raises the differential vis-à-vis the sample average relatively more in periods when the economy operates above potential than when it is operating at or below potential.

Figure 2: Fiscal impulse/stance coefficient estimates by output gap direction

Source: Authors’ calculations. Notes: This figure plots baseline estimated fiscal impulse/stance coefficients (in blue) and interacted with a positive output gap dummy (in red) from separate regressions alongside the respective confidence interval (the legend links the colour scheme to the 99%-, 95%- and 90%-confidence levels). Dependent variable: HICP inflation rate. All models have been estimated with two-step feasible GMM using the controls described in the main text and additionally controlling for year and country fixed effects. The output gap is treated as endogenous and instrumented with its first lag (exact identification). Driscoll-Kraay standard errors. Confidence levels displayed in the legend.

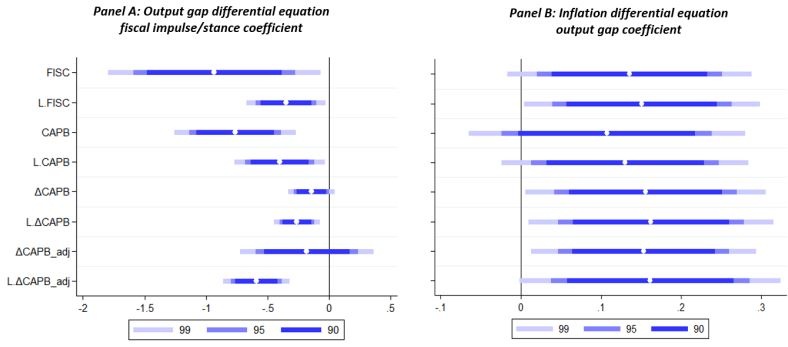

Next, building on the fiscal multiplier literature, we examine whether fiscal policy influences inflation differentials via an indirect channel through the output gap. We therefore build a small simultaneous 2-equation model, in which the equation determining inflation differentials

πit = φt + α1 ∆NEERit-1 + α2outputgapit + α3fiscalpolicyit + α4Pit-1 + α5unitlabourcostgrowthit + θi + εit

is complemented by an equation allowing explicit feedback from fiscal policy to the output gap. As exogenous instruments capturing developments in input factors of potential output (denominator of the output gap) we include the lagged change in private investment and the lagged change in the labour force participation rate. Additionally, the contemporaneous change in the unemployment rate is included as a proxy for demand effects determining actual output differentials (numerator of the output gap).

outputgapit = µt + β1∆investmentit-1 + β2∆lfparticipationit-1 + β3unemplrateit + β4fiscalpolicyit + χi + ϵit

Panel B of Figure 3 shows that business cycle non-alignments across countries are indeed an important determinant of HICP inflation differentials, in line with results found in the baseline regressions. Turning to Panel A, the contribution of fiscal policy to output gap differentials reveals strongly significantly negative coefficients in most cases, indeed pointing to the prevalence of an indirect effect of discretionary fiscal policy on HICP inflation differentials via the output gap differentials.

Figure 3: Simultaneous equation coefficient estimates

Source: Authors’ calculations. Notes: Three-stage least squares estimation with heteroskedasticity- and autocorrelation-consistent weighting matrix and standard errors using Bartlett kernel with 2 lags. Panel A reports the fiscal impulse/stance coefficients of the output gap equation, with further controls being the lagged change in private investment, the lagged labour force participation rate and the contemporaneous change in the unemployment rate. Panel B presents the output gap coefficient of the inflation equation with controls as in the baseline. Both equations contain time and country fixed effects. The unemployment rate, the output gap and the contemporaneous fiscal impulse are instrumented with their first lag.

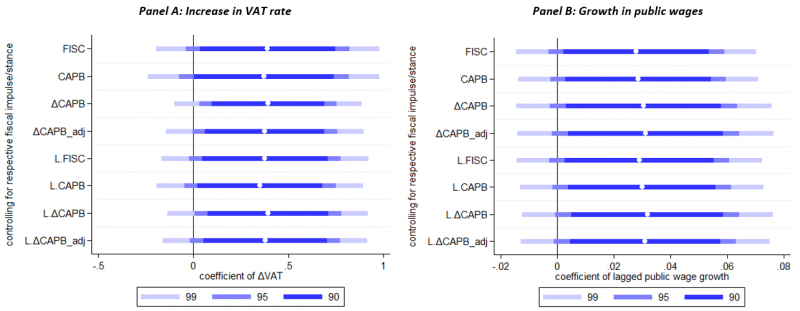

Certain tax or spending instruments can add insights into the inflationary effects of fiscal policy that measures of the fiscal impulse/stance, which reflect net budgetary impacts, alone cannot offer. In particular, the composition of the fiscal stance might be such that two policies that are equally associated with a looser stance yield opposing effects on inflation. Examples of two such expansionary fiscal policy instruments with heterogeneous effects on inflation are changes in the VAT rate and public wages. While reductions in indirect taxation have been shown to temporarily lower inflation, expansion of expenditure-side items such as compensation of public employees have been found to positively influence private sector wage dynamics. We therefore assess the question whether these two policies also significantly contribute not only to the level, but also to inflation differentials across countries. We do so by including them separately as additional regressors in the baseline HICP inflation differential equation.

Independent of the overall fiscal stance or impulse, contemporaneous as well as lagged increases in the VAT rate exert strong short-term upward pressure on HICP inflation differentials (see Panel A of Figure 4). Proxying public wage growth by the growth rate of compensation per public employee and allowing for a one-year transmission lag, we find positive and mildly significant coefficients as well, albeit much smaller in magnitude.

All results concerning the role of fiscal policy remain valid when we consider core inflation (excluding energy and food prices) instead of headline HICP inflation differentials. While domestic forces are generally gaining importance in explaining core HICP inflation differentials – that is output gap differentials become more prominent and nominal exchange rate effects less so – this finding does not apply to the net budgetary effects of discretionary fiscal policy and the specific fiscal instruments we consider, whose effects remain broadly unchanged. A variety of robustness checks concerning the interaction between fiscal and monetary policy in the euro area is not found to alter the impact of overall fiscal policy (impulse or stance) on inflation differentials.

Figure 4: Specific fiscal policies’ coefficient estimates

Source: Authors’ calculations. Notes: Panel A plots estimated coefficients of contemporaneous changes in the VAT rate included as regressors in the baseline regression equation with varying fiscal impulse/stance indicators. Cyprus and Malta are excluded due to data limitations. Panel B displays estimated coefficients of the lagged growth rate of public employee compensation per public employee, included in the baseline regression equation with varying fiscal impulse/stance measures. Dependent variable in both panels: HICP inflation rate. Confidence levels displayed in the legend. All models have been estimated with two-step feasible GMM using the controls described in the main text and additionally controlling for year and country fixed effects. The output gap and contemporaneous fiscal impulse are treated as endogenous and instrumented with their first lag (exact identification). Driscoll-Kraay standard errors.

In our empirical analysis, we perform panel data estimation techniques to investigate the role of discretionary fiscal policy in determining consumer price inflation differentials across the euro area for the period 1999-2019. Rather than relying on a single fiscal indicator, we consider a variety of fiscal stance and fiscal impulse measures, and also take into account potential asymmetries of their effect along the business cycle. Moreover, we allow for the presence of an indirect channel running through the output gap and document the impact of specific policy instruments.

Our results confirm findings of earlier contributions that the aggregate fiscal stance or impulse does not appear to contribute directly to (core) HICP inflation differentials. While not the main focus of the present analysis, we also broadly confirm the importance of other factors such as nominal exchange rate movements and the output gap in shaping euro area inflation differentials. There is some evidence that the restriction to a single effect over the business cycle overshadows fiscal policy being slightly more potent in influencing inflation differentials – with fiscal tightening cooling (and fiscal expansion increasing) inflation pressures – when the economy is above its potential (i.e., in times of positive output gap).

Less ambiguous is our detection of a sizeable indirect effect of discretionary fiscal policy on inflation differentials working through the output gap. Moreover, we document that VAT rate changes significantly contribute to inflation differentials in our sample, with most of the effect being visible in the initial period of the tax change (upon implementation). Concerning public wage developments, we find that the growth rate of compensation per public employee is mildly significantly contributing to inflation differentials in the euro area sample between 1999 and 2019.

Cristina Checherita-Westphal, Nadine Leiner-Killinger, and Teresa Schildmann (2023). Euro area inflation differentials: the role of fiscal policies revisited. ECB Working Paper, No. 2774.

Patrick Honohan and Philip R. Lane (2003). Divergent Inflation rates in EMU. Economic Policy, 18(37), p. 357-394.

In order to diminish the influence of convergence effects experience by countries prior to joining the euro area, pre-EMU observations are weighted by 0.5.