The opinions expressed in this policy brief are the sole responsibility of the authors and should not necessarily be interpreted as reflecting the views of the European Central Bank (ECB) or the Eurosystem.

Until the recent energy price shocks that have arisen from mid-2021 onwards, the euro area recorded a persistent current account surplus with the rest of the world over a decade after undergoing a major internal rebalancing among member countries. Former current account deficit countries in the euro area, notably Spain and Italy, shifted their current account balances from deficits to slight surpluses, while Germany and the Netherlands maintained a high current account surplus. Some observers have identified a monetary policy dimension (see Galstyan, 2019) of the debate, arguing that the euro area current account surplus could have partly been a reason for inflation rates to stay at persistently low levels. We therefore seek to identify common drivers of the imbalances in linking them to GDP growth and inflation to better understand the internal and external dynamics of the euro area as a monetary union. We investigate as potential drivers changes in internal and external demand as well as changes in productivity and investment-specific developments. We examine how these macroeconomic drivers interact with monetary policy, i. e. the movements in the interest rate. High current account surpluses have been regarded as complicating the conduct of monetary policy, as they can put upward pressure on the exchange rate and thus imply lower import prices. Conversely, an accommodative policy rate could also be seen as an important driver of current account surpluses. Our findings suggest that negative preference and investment shocks increase the current account balance and lower the interest rate. By contrast, positive external demand and productivity shocks cause the current account balance and interest rate to rise simultaneously. We also find that the current account is only marginally affected by shutting off the interest rate channel, suggesting that monetary policy by setting short-term interest rates has a limited influence on the current account.

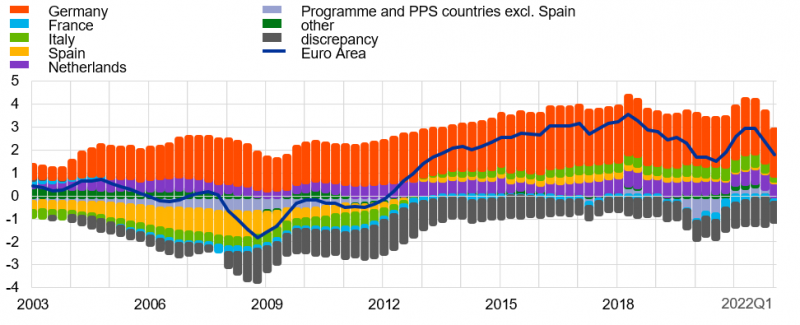

From 2013 until 2021 the euro area economy as a whole recorded the largest current account surplus in absolute values in the world, peaking at around 3% of GDP in 2018 (Figure 1). The largest bilateral surpluses were with the United States and the United Kingdom in contrast to the largest deficit with China. In the aftermath of the global financial crisis and the sovereign debt crisis, the euro area countries with large imbalances started to reduce their current account deficits and achieved a slight surplus. Balances in the surplus countries remained elevated over the last ten years so that euro area aggregate current account balances rose to a high level overall. Germany and the Netherlands were the main contributors to the aggregate surplus, while former deficit countries such as Italy and Spain largely rebalanced their current accounts.

Figure 1: Euro area current account balance as share of GDP, by country

Sources: ECB and Eurostat. Notes: Programme and post-programme surveillance (PPS) countries include Cyprus, Greece, Ireland and Portugal. The latest observations are for 2021Q4.

High current account surpluses have been regarded as complicating the conduct of monetary policy, as they can put upward pressure on the exchange rate and thus imply lower import prices. Conversely, an accommodative policy rate could also be seen as an important driver of current account surpluses in Germany and the Netherlands. When monetary policy is centralized at a supranational level as in the euro area, current account imbalances can become problematic. This was the case with the national current account deficits driven by domestic spending in the first decade following the introduction of the euro. Among others, Galstyan (2019) adds to the debate by postulating a negative correlation between the euro area current account surplus and inflation, arguing that the euro area external surplus would represent an additional source of low inflation. Taking a sectoral approach to external imbalances he claims that a trade surplus is associated with lower marginal costs in the tradable goods sector, generates lower tradable inflation, and induces a decline in non-tradable inflation through relative sectoral demand. Under this partial equilibrium approach, an improvement in trade balance results in lower aggregate inflation.

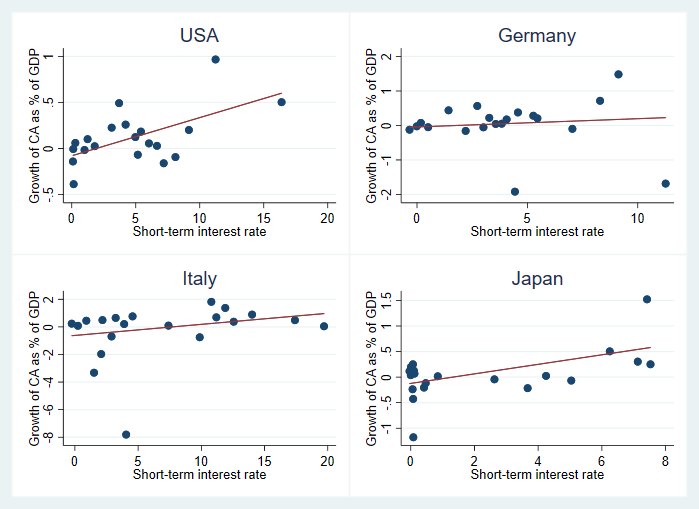

When we look at data across countries, we find that the dynamics of the current account balances and monetary policy interest rates are in general positively correlated. This is shown in Figure 2, which plots the percentage point changes in the current account in terms of GDP against nominal short-term interest rates in the United States, Germany, Italy and Japan. For all countries except for Germany the curve is upward sloping, while for Germany it seems rather flat. In the following we aim to systematically investigate potential interactions between the current account and the interest rate.

Figure 2: Current account and interest rates

Sources: Macro-financial history database provided by Jordà, Schularick and Taylor (2017); sample shows annual data from 1980 to 2017. Notes: X-axis: short-term nominal interest rate. Y-axis: annual growth rate of current account as percentage of GDP. The binscatter groups the x-axis variable into equal-sized bins and computes the mean of the y and x-axis variables. CA stands for current account.

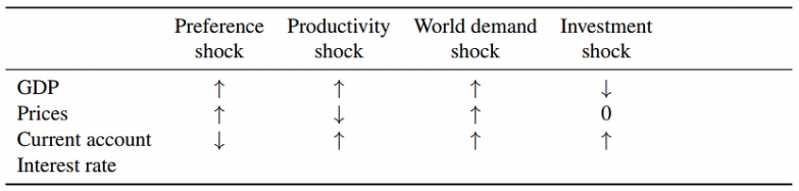

In order to investigate the nexus between current account and interest rates, we disentangle those drivers that simultaneously increase the current account and the interest rate from those that push the two variables in opposite directions. We subsequently quantify the importance of the effects. We first inspect the impact resulting from simulations of a multi-region theoretical model (dynamic stochastic general equilibrium, or DSGE, model) and then use the results on the direction of the drivers of macroeconomic variables as sign restrictions for shock identification in an empirical (vector-autoregressive, VAR) model. We jointly identify two aggregate demand shocks (consumer preference, i. e. a shock to household’s preferences to consume more or less, and world demand) and two aggregate supply side shocks (productivity and investment1) The direction of the movement of macroeconomic variables depending on the impulse (shock) is summarized in Table 1.

Table 1: Sign restrictions for macroeconomic shocks

Note: The table reports sign restrictions based on the DSGE model. Note that ↑ and ↓ denote that the restriction was set explicitly. The restriction horizon is derived from the DSGE model. We apply impact plus one for all variables except prices, where the restriction is set on impact to disentangle supply from demand shocks.

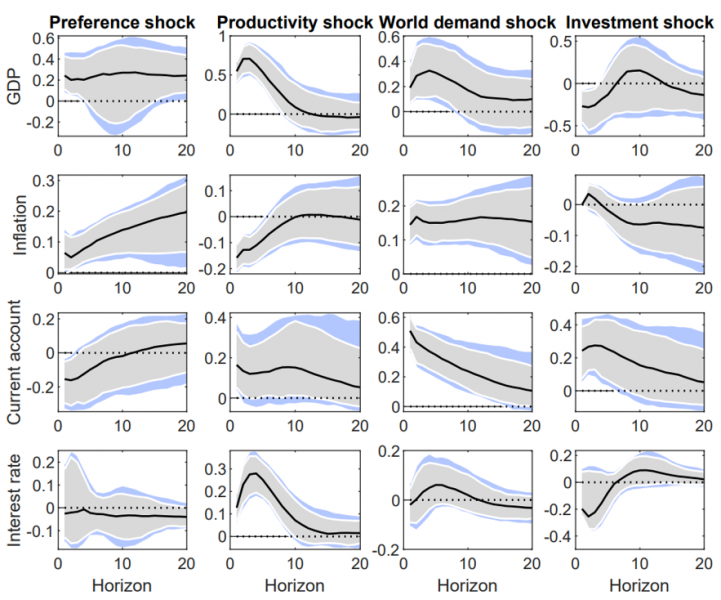

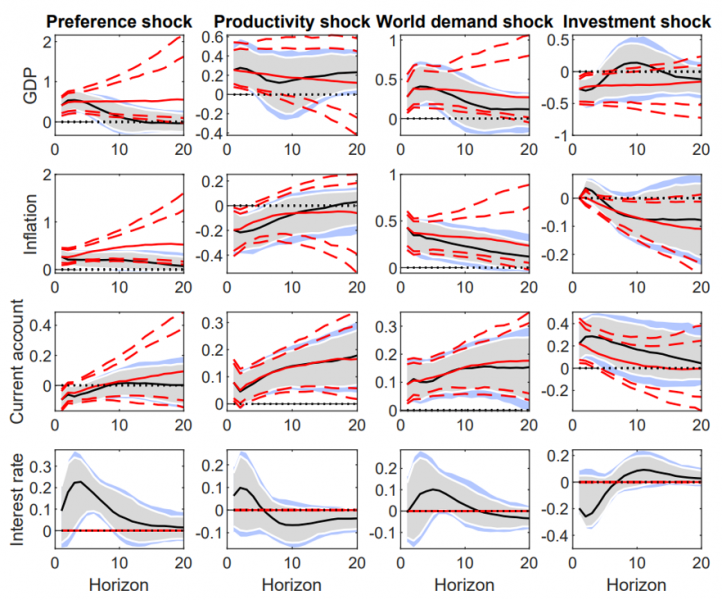

We estimate the impulse responses for Germany, Italy and Spain as well as their spillover effects from the US economy to the euro area. Figure 3 shows the estimated impulse responses to the four shocks for the Germany economy.

Figure 3: Empirical impulse responses (Germany)

Notes: IRF from the estimated VAR. The solid line represents the median IRF model. The shaded area represents the 16% and 84% (grey) or 10% and 90% (blue) quantiles of the posterior distribution.

In the baseline, we find that world demand shocks and productivity shocks drive both the interest rate and the current account balance up, while investment-specific shocks2 and preference shocks drive the current account and the interest rate in opposite directions. Our findings suggest that negative preference and investment shocks increase the current account balance and lower the interest rate. By contrast, positive external demand and productivity shocks cause the current account balance and interest rate to rise simultaneously. The shocks imply a similar direction for interest rates both for Germany and for the rest of the euro area, specifically Italy and Spain.

In order to shed light on the importance of monetary policy impact on the variables in the VAR model we perform a counterfactual exercise by restricting the coefficients of the underlying VAR in such a way as to force the response of interest rates to shocks to zero. The restricted impulse responses error bands in red are then compared with the unrestricted ones for all other endogenous variables, also shown in Figure 4. In the event of a preference shock, GDP and inflation no longer return to zero. However, the current account reacts similarly, with a widening of error bands at the end of the response horizon. With regard to the productivity shock, the interest rate has limited influence on the current account. The same result is also valid for the world demand shock, which is an external shock with little interaction with monetary policy. The investment shock counterfactual exhibits a somewhat lower path for the current account reaction. Overall, the current account is only marginally affected by shutting off the interest rate channel, suggesting that monetary policy by setting short-term interest rates has a limited influence on the current account.3

Figure 4: Empirical impulse responses with counterfactual (Germany)

Notes: IRF from the estimated VAR. The solid line represents the median IRF model. The shaded area represents the 16% and 84% (grey) or 10% and 90% (blue) quantiles of the posterior distribution. Red dashed lines represent the 16% and 84% quantiles of the posterior distribution in case of the counterfactual with the interest rate channel shut.

We use a similar framework of sign restrictions to specify a two-region model with the US economy impacting the euro area economy. We find that US preference shocks have spillovers to GDP and interest rates in the euro area. Thus, monetary policy decisions in the United States influence interest rates in the euro area.

In this analysis we identified four macroeconomic shocks that drive jointly current account balances and interest rates of a currency union. Our results suggest that a lack of consumer demand and low corporate investment could be potential reasons for the high surplus in Germany and low interest rates in the euro area. By contrast, positive shocks in the form of world demand and productivity-enhancing shocks tend to drive up interest rates. In the latter cases, an increase in the current account balances tends to be concomitant with interest rate increases. While the results regarding investment shocks are less significant, they point to the important role of domestic investment conditions in reducing the current account surplus. As for Italy and Spain similar results hold, which illustrate the importance of weaker internal demand in turning their current account deficits into surpluses. Overall, we find that the current account is only marginally affected by shutting off the interest rate channel, suggesting that monetary policy by setting short-term interest rates has a limited influence on the current account.

The recent energy price shocks starting from mid-2021 have led to a major shrinking of the euro area current account surplus as inflation surged and euro area interest rates increased. In this case, (imported) inflation reflecting deteriorated terms of trade from the energy price increase is rising, which is causing the current account surplus to decline (Gunnella and Schuler 2022). It remains an open question whether the euro area will eventually return to the high current account surplus in case energy prices moderate.

Galstyan, Vahagn (2019) “Inflation and the Current Account in the Euro Area”, Economic Letters 4/EL/19, Central Bank of Ireland.

Gunnella, Vanessa and Tobias Schuler (2022) “Implications of the terms-of-trade deterioration for real income and the current account”, Economic Bulletin Issue 3.

Schuler, Tobias, and Yiqiao Sun (2022) “The current account and monetary policy in the euro area”, ECB Working Paper No. 2696.

The investment shock is expressed as a negative one exerting a positive effect on the current account.

Investment-specific shocks affects the investment variable which enters the capital stock.

We also estimated the empirical model with shadow rates which result in very similar impulse response functions.