This policy brief is based on Broeders, de Jonge and Rijsbergen (2024). Views expressed are those of the authors and do not necessarily reflect official positions of De Nederlandsche Bank.

The transition to a low-carbon economy presents significant financial challenges as high-carbon emitting firms face increasing costs. Our research shows that transition risk is significantly priced in the European corporate bond market since the beginning of 2020, and that the size of this carbon premium has steadily increased since then. Over the full sample period, we find that a one standard deviation increase in log-carbon emissions increases the spread of the average corporate bond by 23 basis points. At the end of the sample period (2022), this effect grows to almost 49 basis points. Furthermore, we find that the size of the premium increases for bonds with a longer maturity, which indicates that investors appear to expect larger transition risks over longer time horizons. Overall, our research underscores the need for a consistent and forward-looking climate policy approach that stimulates an adequate pricing of transition risks. This helps an orderly climate transition that is beneficial for companies, investors, and financial institutions in the EU.

The transition to a low-carbon economy will change the global economic landscape. High carbon-emitting firms will face higher costs when policy, legal and technological developments as well as changes in consumer preferences render their business less profitable. This transition risk is already materializing as many firms face higher expenses due to emission taxation, pricing and legal actions. Climate litigation, for example, gains momentum, exemplified by impactful cases such as Milieudefensie versus Shell (Setzer and Higham, 2022). Financial institutions may also be exposed to this legal risk as higher expenses can negatively impact a firm’s market valuation. As such, the expectation is that rational investors demand compensation in the form of a risk premium when investing in securities issued by high-carbon emitting firms.

Adequately priced carbon emission risk on capital markets can support the transition to a low carbon economy by stimulating firms to reduce their carbon emission in order to attract sufficient financing. This will also enable effective and efficient risk management and capital allocation. If, however, markets fail to accurately price risk, assets may reprice more abruptly when transition risks materialize. This could deteriorate the credit quality of investors and banks that hold these assets on their balance sheets. Given the increasing interconnectedness of the global financial system, such shocks may reverberate and pose a threat to overall financial stability (Battiston et al., 2017; Campiglio and Van der Ploeg, 2021).

Existing literature documents various perspectives on the presence and magnitude of the carbon premium across different asset classes and regions, highlighting its complexity and nuanced dynamics (e.g. Boermans et al., 2024; Loyson et al., 2023). In general, most studies find evidence of a carbon premium in stocks and bonds, particularly pronounced in carbon-intensive sectors. Examination of a carbon premium in European markets, however, remains relatively limited with just a few studies focusing on transition risk pricing in European stock and bond markets (Alessi et al., 2019; Bats et al., 2023), despite the region’s progressive climate policies.

To fill this gap, we study the size and development of the carbon risk premium in European corporate bond prices. We examine a sample of 1,751 corporate bonds issued by 368 non-financial firms situated in Europe between January 2016 and December 2022. We use firm-level emission data from MSCI ESG Manager, and bond- and firm-level variables from Bloomberg and Refinitiv. We calculate the carbon premium by quantifying the effect of a firm’s carbon emissions on bond yield spreads, after controlling for bond-, firm- and time-specific variables. In addition, we include time-, firm and rating-fixed effects to control for unobserved heterogeneity. To assess whether investors price transition risk and whether this has changed due to (new) climate policies, we study the time-constant and monthly time-varying coefficients for the carbon premium.

Another important question pertains to the structure of the carbon premium over different time horizons, often referred to as the term structure, which delineates the premium for various maturities. Bondholders receive full repayment only upon maturity of the debt. Therefore, bondholders with different maturity profiles are subject to varying levels of default risk. Studying the term structure of the carbon premium offers insights into investors’ expectations concerning the timing of transition risks impacting corporate profitability. Xia and Zulaica (2022), for instance, find a economically and statistically significant carbon premium in the US for long-term bonds with maturities ranging from 15 to 20 years, but no evidence for such a premium for short-term maturity bonds. This trend likely reflects the perception of climate transition risk as a medium- to long-term concern.

We use firm-level year-on-year carbon emission data to measure the firm’s exposure to transition risk. We limit the analysis to Scope 1 and 2 emissions. Scope 1 emissions encompass all emissions originating from sources owned or controlled by the firm, such as direct combustion of fuel in furnaces or vehicles. Scope 2 emissions arise from the generation of electricity procured by the firm. Scope 2 emission levels are typically higher than Scope 1 emission levels and demonstrate more variability (MSCI, 2020). We exclude Scope 3 emissions from our study due to the challenges associated with their accurate measurement. We take the natural log of the emission data as the distribution is highly skewed and we expect the effects of emission levels on yield spreads to be non-linear. We employ one-year-lagged emission data to ensure our analysis incorporates information available at the time of price observations.

We use a three-way fixed effects panel regression model to estimate the carbon premium over the full sample for Scope 1 emissions and Scope 2 emissions, and also examine the combined effect of Scope 1 and 2 emissions on bond yield spreads. To estimate the carbon premium, we use a firm’s carbon emission level as a regressor. The panel model then controls for heterogeneity as yield spreads can be explained by a myriad of factors. We, for instance, control for the age, duration, coupon, outstanding amount, liquidity and potential call option of the bonds in our sample. On the firm level, we control for the firm’s equity return volatility and default probability as these indicators have well-documented explanatory power for bond spreads. Moreover, we control for unobserved effects using time-, bond rating- and firm-fixed effects.

We also conduct a regression analysis incorporating dummy interaction variables to capture the impact of the carbon premium across maturity length categories. Furthermore, we extend our regression model to a time-varying panel model to examine the evolution of the carbon premium over time. To achieve this, we adopt an extension of the time-varying model proposed by Li et al. (2011), who utilize a nonparametric local linear approach to estimate the trend and coefficient function of a panel regression with one-way fixed effects. This model builds upon the understanding that any function, provided it has continuous derivatives up to the second order, can be linearly approximated via a Taylor expansion.

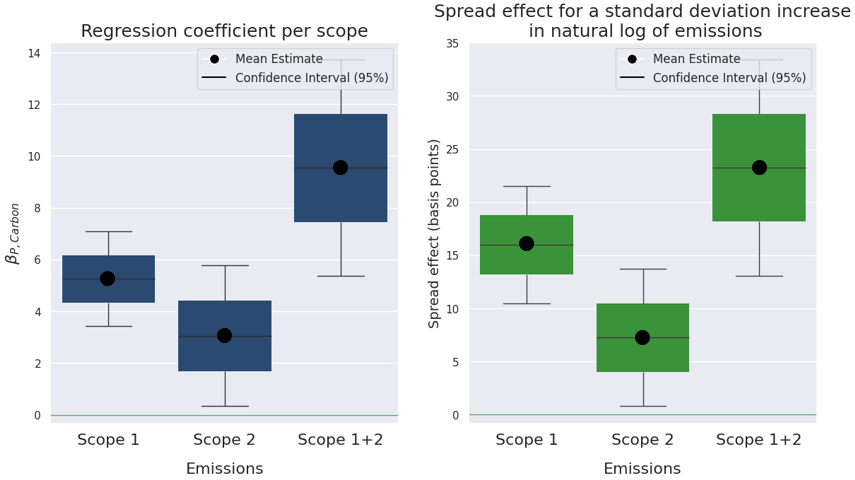

Three key findings stand out from our analysis. First, we find that transition risk is significantly priced in European corporate bonds and has a sizeable effect on yield spreads. Figure 1 shows the regression coefficients for our variable of interest (left hand panel), the one-year lagged carbon emissions, as well as the translation of those coefficients to the spread effect of a one standard deviation increase in the natural log of the emission variable (right hand panel). The results demonstrate that carbon emission levels of European firms have a sizeable effect on their bond yield spreads. A one standard deviation increase in log-carbon emissions of Scope 1 and 2, for instance, results in an increase of the average corporate bond spread by 23 basis points. This is a sizeable effect, as the average option-adjusted yield spread per bond in our sample is 150 basis points.

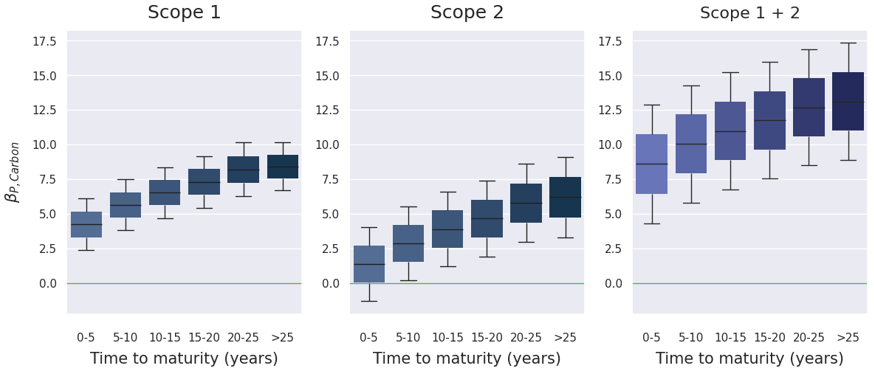

Second, we find that the size of the carbon premium tends to increase for bonds with a longer maturity. Figure 2 visualizes the term structure of the carbon premium in European corporate bonds. We observe that the carbon premium is higher for bonds with longer maturities. This holds for Scope 1 and Scope 2 emissions, as well as for the combined effect. Hence, investors seem to expect larger transition risks over longer time horizons. Unlike the term structure found by Xia and Zulaica (2022) for US corporate bonds, the premium we find is also significant and positive for short-term maturity bonds. Regardless of the bond duration, investors appear to demand a premium for their exposure to climate transition risk.

Figure 1: The Carbon Premium per scope

Notes: The left figure shows the regression coefficients and confidence intervals (at 95% confidence) for Scope 1 emissions and Scope 2 emissions separately, as well as for Scope 1 and 2 emissions combined for the full sample. The premium is statistically significant for both scopes and highest for the combined Scope 1 and 2 emissions. The right figure shows the spread effect of a standard deviation increase in log-carbon emissions, as translated from the regression coefficients.

Notes: The left figure shows the regression coefficients and confidence intervals (at 95% confidence) for Scope 1 emissions and Scope 2 emissions separately, as well as for Scope 1 and 2 emissions combined for the full sample. The premium is statistically significant for both scopes and highest for the combined Scope 1 and 2 emissions. The right figure shows the spread effect of a standard deviation increase in log-carbon emissions, as translated from the regression coefficients.

Figure 2: Term structure of the carbon premium

Notes: The carbon premium increases for bonds with a longer maturity, reflecting investors’ expectation of potentially larger transition-related losses over a longer time horizon. Since the panel regression controls for credit risk and various other variables such as the age of the bond, the structure visualized here does not reflect a term structure of credit risk.

Notes: The carbon premium increases for bonds with a longer maturity, reflecting investors’ expectation of potentially larger transition-related losses over a longer time horizon. Since the panel regression controls for credit risk and various other variables such as the age of the bond, the structure visualized here does not reflect a term structure of credit risk.

Third, we find that the carbon premium in European corporate bonds is statistically significant since early 2020, and steadily since then. Figure 3 presents the development of the carbon premium over the sample period for Scope 1 and Scope 2 emissions, as well as for the combined effect. The lines represent the various maturity buckets in order to visualize the development of the term structure over time. A few notable things stand out. For one, we observe that the carbon premium becomes statistically significant from late 2019 (Scope 2) or early 2020 (Scope 1). We also find that the premium rises steadily from early 2020 onwards. This increase in the carbon premium may be caused by climate policies implemented within the European Union (EU) at several moments, leading to a heightened perception of transition risk among investors. We, for instance, observe an increase in the premium from early 2020, which coincides with the EU’s announcement of the European Green Deal. Subsequently, the introduction of additional climate policies, namely the ‘fit for 55’ package, may have further increased awareness among investors regarding transition risks. Additionally, we see that the term structure converges between 2016 and 2022, indicating that the difference in premium between bonds with a long-term and short-term maturity declines (Figure3, lower panel). This could suggest that investors perceive reduced policy uncertainty in the long term. Conversely, it could be argued that the perceived transition risk in the short term has further increased, potentially due to lingering inadequacies in policy effectiveness.

Figure 3: Time-varying carbon premium by maturity

Notes: The time-varying results for the carbon premium for Scope 1 and scope 2 emissions, as well as the combined effect, are visualized in the upper graph. The premium starts to increase from early 2020 onwards. The lower graph illustrates the premium difference between short-term and long-term maturity bonds over time. Major policy introductions in EU climate policy have been indicated with dashed lines.

Notes: The time-varying results for the carbon premium for Scope 1 and scope 2 emissions, as well as the combined effect, are visualized in the upper graph. The premium starts to increase from early 2020 onwards. The lower graph illustrates the premium difference between short-term and long-term maturity bonds over time. Major policy introductions in EU climate policy have been indicated with dashed lines.

Furthermore, our analysis reveals a correlation between the carbon premium and the price of emission allowances issued within the framework of the EU Emissions Trading System (EU ETS). Figure 4 illustrates the parallel movements of these two variables, suggesting a potential interdependence between them. While causality cannot be definitively established from this observation alone, the striking similarity between the curves prompts further investigation. The observed correlation hints at a noteworthy possibility, namely that the primary driver of carbon emission risk is more correlated with the expenses associated with acquiring emission allowances rather than with factors such as technological adaptation or potential litigation costs. However, further research is warranted to elucidate the relationship between these variables and to discern the underlying mechanisms driving their co-movements.

Figure 4: Is the premium correlated with the EU carbon permit price?

Notes: The carbon allowance price for carbon emissions covered under the European emission cap-and-trade system (EU ETS) shows similarity with our found carbon premium.

Notes: The carbon allowance price for carbon emissions covered under the European emission cap-and-trade system (EU ETS) shows similarity with our found carbon premium.

Our research shows that transition risk is significantly priced in the European corporate bond markets since the beginning of 2020, and has steadily increased since then. Over the full sample period, we find that a one standard deviation increase in log-carbon emissions increases the spread of the average corporate bond by 23 basis points. At the end of the sample period (2022), this effect grows to almost 49 basis points. This highlights the sizeable effect of carbon emissions on financing costs for European firms as the average option-adjusted yield spread in our sample of bonds is 150 basis points. Furthermore, we find that the size of the premium increases for bonds with a longer maturity, although this term structure of the carbon risk premium appears to have flattened over recent years. This may imply reduced long-term policy uncertainty for investors, while short-term transition risk may have worsened due to lingering policy effectiveness issues.

Our research underscores the critical need for a consistent and forward-thinking climate policy approach that stimulates an adequate pricing of transition risks. Investors anticipate this stability and adjust the pricing of risk accordingly, while any unexpected deviations may lead to sudden debt repricing or undue risk exposure due to mispriced debt. Implementing and upholding ambitious climate policies aligned with legally binding EU goals is essential. Companies, investors, and financial institutions in the EU all stand to benefit from an orderly and forward-looking approach to this endeavor.

Alessi, L., Ossola, E., and Panzica, R. (2019). The greenium matters: Evidence on the pricing of climate risk. University of Milan Bicocca Department of Economics, Management and Statistics Working Paper (418).

Bats, J., Bua, G., and Kapp, D. (2023). Physical and transition risk premiums in euro area corporate bond markets. Working Paper 761, De Nederlandsche Bank.

Battiston, S., Mandel, A., Monasterolo, I., Sch¨utze, F., and Visentin, G. (2017). A climate stress-test of the financial system. Nature Climate Change, 7(4):283–288.

Boermans, M., Bun, M., and Van der Straten, Y. (2024). Funding the fittest? pricing of climate transition risk in the corporate bond market. Working Paper 797, De Nederlandsche Bank.

Broeders, D., De Jonge, M., & Rijsbergen, D. R. (2024). The European Carbon Bond Premium. Working Paper 798, De Nederlandsche Bank.

Campiglio, E. and der Ploeg, R. v. (2021). Macro-financial transition risks in the fight against global warming. Available at SSRN 3862256.

Setzer, J. and Higham, C. (2022). Global trends in climate change litigation: 2022 snapshot.

Loyson, P., van Wijnbergen, S., et al. (2023). The pricing of climate transition risk in europe’s equity market.

Xia, D. and Zulaica, O. (2022). The term structure of carbon premia. Working Paper 1045, BIS.