As part of a review of its operational framework, the European Central Bank could decide to hike the minimum required reserves (MRR) for eurozone banks. Our analysis assesses the impact of such move on banking system’s liquidity and profits. We conclude that the overall impact would be moderate, providing that the increase in MRR remains modest. That said, banks’ excess reserves are unevenly distributed across the eurozone banking system and we believe higher MRR could have a more meaningful impact for some specific banks and countries. Moreover, we argue that a hike of MRR would accelerate the ongoing normalization of banks’ funding costs.

Eurozone banks’ liquidity and profits could take a hit if the European Central Bank (ECB) hikes the minimum required reserves (MRR). The ECB recently embarked on a review of its operational framework, namely, the range of instruments that it uses to manage short-term market interest rates, and it expects to conclude this review by spring 2024. This includes setting the minimum reserve requirements for banks. The reserve requirement rate is currently 1% and represents the share of deposits, debt securities, and money market paper that banks operating in the eurozone must hold at the ECB.

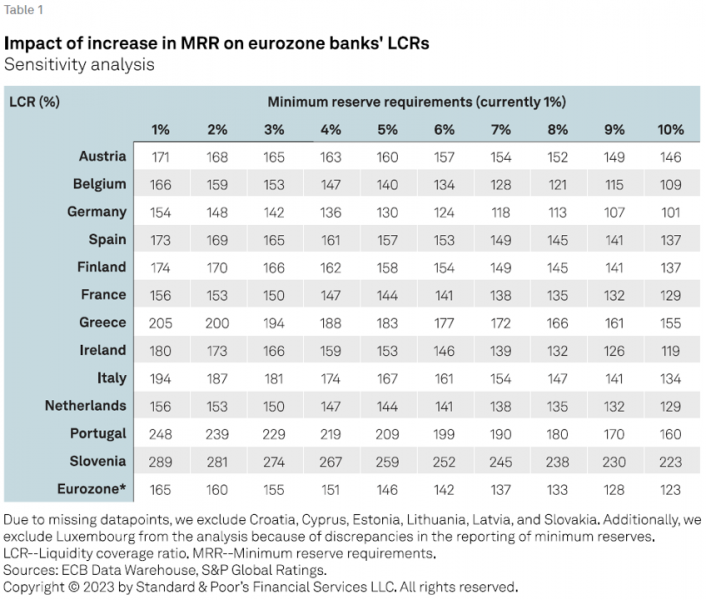

S&P Global Ratings considers that a modest increase in MRR–for instance, to the historical level of 2%–would lead to a moderate reduction in eurozone banks’ profits and liquidity. For eurozone banks in aggregate, and all else being equal, we estimate that a one percentage point increase in MRR could lead to an immediate gross reduction in profit before tax by 3.3% and in the liquidity coverage ratio (LCR) by 4.7%. Most European banks currently have comfortable profits and liquidity buffers, and, in our view, would likely take action to mitigate the impact of higher reserve requirements.

That said, such an increase could weigh on investor sentiment vis-à-vis eurozone banks. Furthermore, higher MRR could lead to a meaningful depletion of excess reserves for some banks that will also need to repay their targeted longer-term refinancing operations (TLTRO) funding by the end of 2024. This could be the case for some smaller Italian and, to a lesser extent, Greek banks. For these banks, we see the additional funding needs as manageable, but the reduction in excess reserves would contribute to the normalization of funding costs that we already see at play and expect for 2024.

We expect the ECB to act gradually and the impact to be manageable for eurozone banks. That said, there is a slight possibility that the ECB could decide to tighten banks’ liquidity materially, for instance by raising the MRR into more restrictive territory. This scenario could challenge some banks’ liquidity and funding conditions, considering the weak economic backdrop in the eurozone and the fact that recent rate hikes have yet to deliver their full effects.

In such a downside scenario, the ECB would still be able to address the liquidity needs of specific banks with its standard bank refinancing operations under the full allotment procedure, which we think it is unlikely to discontinue in the short term. However, the associated rise in funding costs could lead the affected banks to react aggressively to curb their funding needs, for instance, by cutting lending even further. This could have a knock-on effect on lending conditions and on banks’ own asset quality in countries where banks have weaker funding and liquidity positions.

Higher MRR would have two direct effects. First, it would lead to a reduction in banks’ LCRs, all else being equal. This is because the ECB and national central banks (NCB) have agreed that only excess reserves can be considered as high-quality liquid assets–mandatory reserves cannot be withdrawn at any time during stress conditions and are therefore excluded from liquidity buffers. The ECB and NCB could change this stance and allow banks to count (a part of) their mandatory reserves as liquid assets, therefore (partly) neutralizing the impact on LCRs.

Second, banks would see a direct loss of interest income on the additional cash covering the increased MRR, because, as of last month, the ECB no longer remunerates minimum mandatory reserves. We have also found a negative correlation between banks’ level of liquidity and their deposit pass-through rate, meaning that the impact of increased MRR on liquidity could compound these direct effects on lost income (see “Protecting Liquidity Will Come At An Increasing Cost,” published June 29, 2023).

Our sensitivity analysis using ECB data shows that a moderate increase in MRR would not test most banking systems’ liquidity unduly (see table 1). For eurozone banks in aggregate, we estimate that a one percentage point increase in MRR would lead to a 4.7% gross reduction in the LCR. This does not include any offsetting measures that the ECB could take (for instance, to recognize some required reserves as liquid assets) nor any reactive measures that banks could take to offset the negative impact on their LCR. With the aggregate LCR standing at 165% at end-March 2023, we consider that eurozone banks have ample room to absorb an increase in MRR.

That said, an increase in MRR beyond 2% could drag the LCR well below what we have seen in the past two-to-three years–for example, an increase to 4% MRR could lead the aggregate LCR to 150%. Although we do not see this as an issue per se, we consider that banks might decide to limit the LCR impact and avoid adverse market reactions, such as by being more selective in their lending decisions.

Additionally, banks have room to shore up their liquidity buffers using unencumbered assets or generating new ones. The reason why TLTRO repayments have had little impact on banks’ liquidity ratios so far is that banks have made use of the large amount of collateral coming back onto their balance sheets as a consequence of the repayments. We estimate that about 80% of this collateral comprises level 1 assets and less than 5% comprises level 3 assets with limited regulatory value.

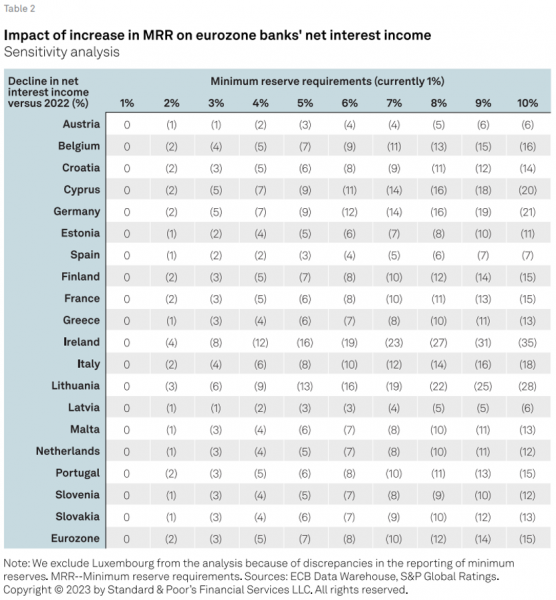

The absence of remuneration on minimum mandatory reserves implies a drag on banks’ profits. However, we see the negative effect as manageable since it would occur as most eurozone banks’ profits benefit from rising interest rates.

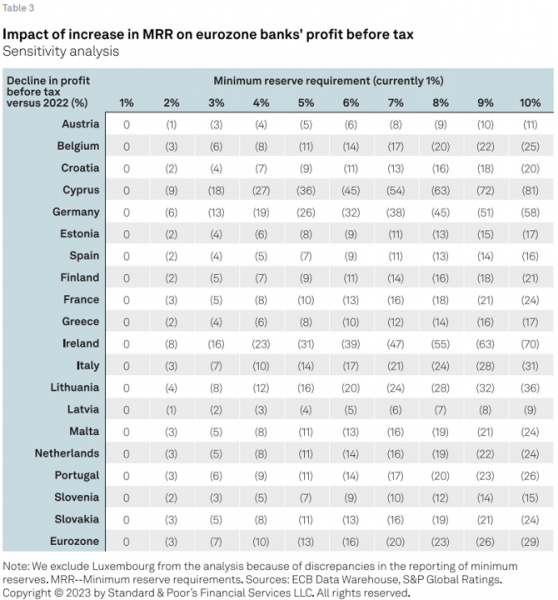

Raising the minimum reserve requirement by one percentage point would represent an average gross loss of about 1.7% of eurozone banks’ 2022 net interest income and about 3.3% of their 2022 profit before tax (see tables 2 and 3). We see some discrepancies between banking systems, with those in Ireland and Lithuania seeing the greatest impact, followed by Cyprus, Germany and Italy.

Our analysis focused solely on the direct impact of higher MRR on revenues and left aside some less predictable consequences, such as an increase in funding costs as competition among banks for deposits and wholesale funding becomes fiercer. For simplicity’s sake, we consider that eurozone banks would cover any increase in MRR using their ECB deposit facility, where they hold about €3.6 trillion of excess reserves. In contrast to the minimum mandatory reserves, the deposit facility itself is remunerated, currently at a rate of 4%.

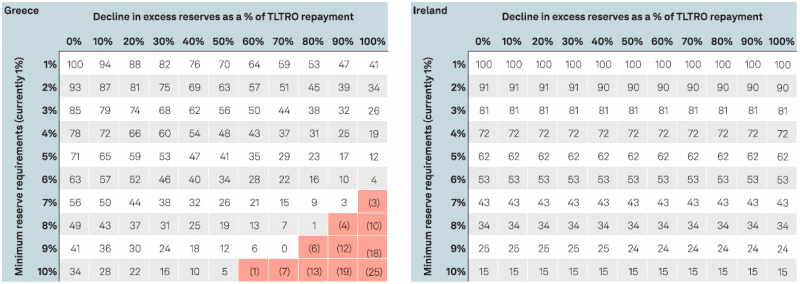

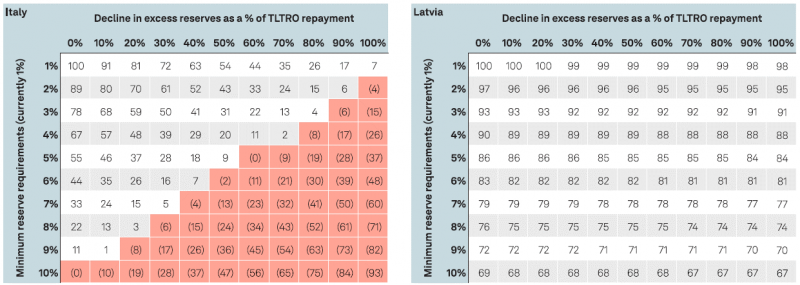

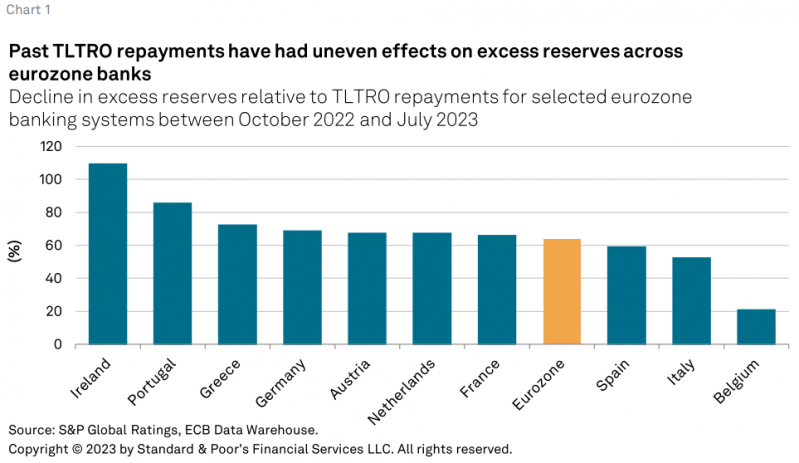

Aside from the impact on liquidity ratios and profits, an increase in MRR would likely deplete eurozone banks’ €3.6 trillion of excess reserves. The stock of excess reserves has been declining since November 2022 as banks repay TLTRO borrowings. However, the ratio between banks’ TLTRO repayments and the contraction in their excess reserves has not been 1:1. Over the past year, the pass-through rate from TLTRO repayments to the reduction in excess reserves has been 64%. This means that the repayment of €1 of TLTRO funding led, on average, to a €0.64 decline in excess reserves, with discrepancies between countries (see chart 1).

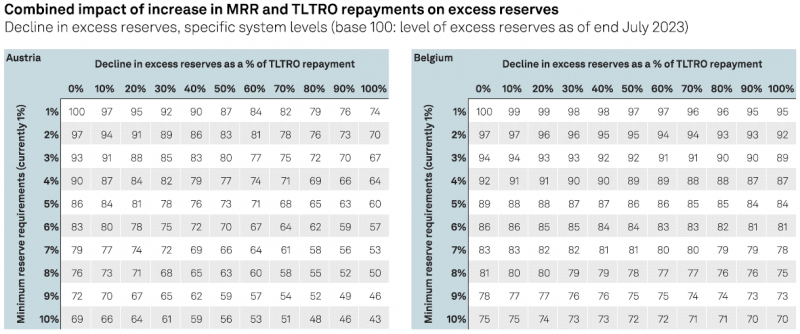

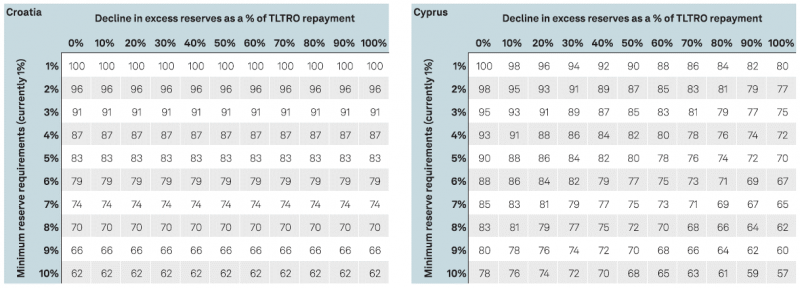

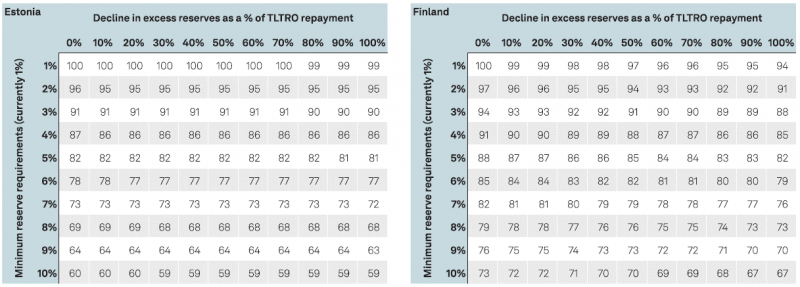

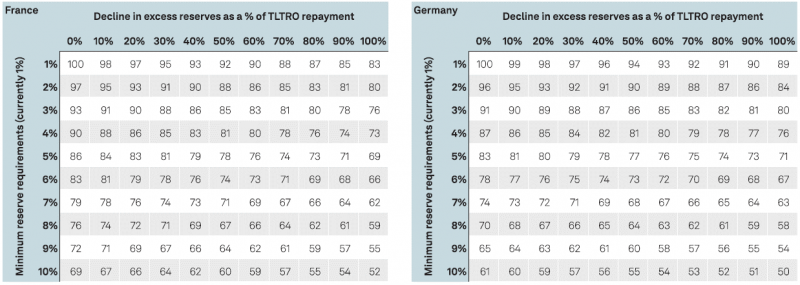

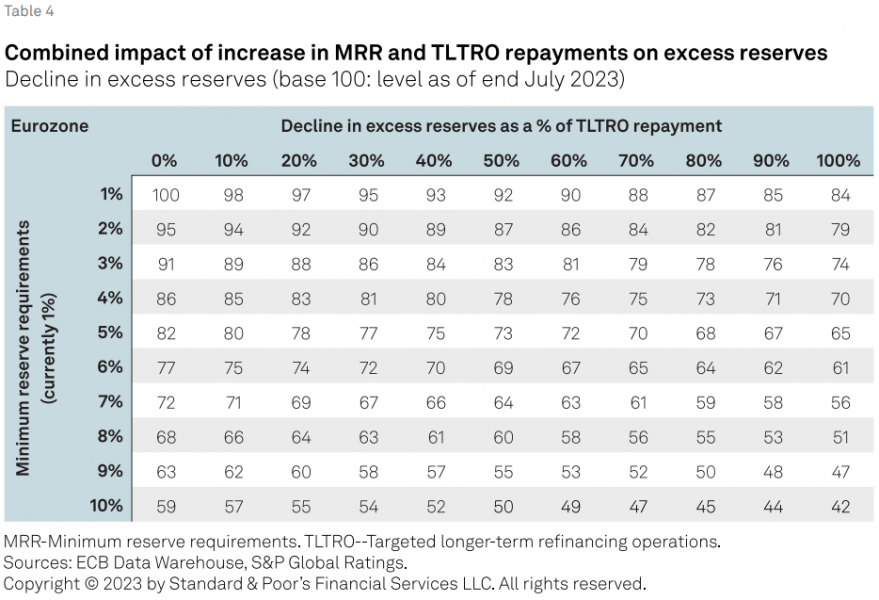

Eurozone banks still have around €500 billion of outstanding TLTRO funding to repay in full by end-2024. Starting from an indexed base of 100 (see table 4), we measured the potential impact on banks’ stock of excess reserves of:

We found that an increase in MRR to 3% would deplete banks’ excess reserves by around 20%, based on a historical pass-through rate of TLTRO repayments to excess reserve depletion of 64%. At this rate, only MRR of 9%-10% would deplete the eurozone banking system of 50% of its excess reserves, or about €1.8 trillion.

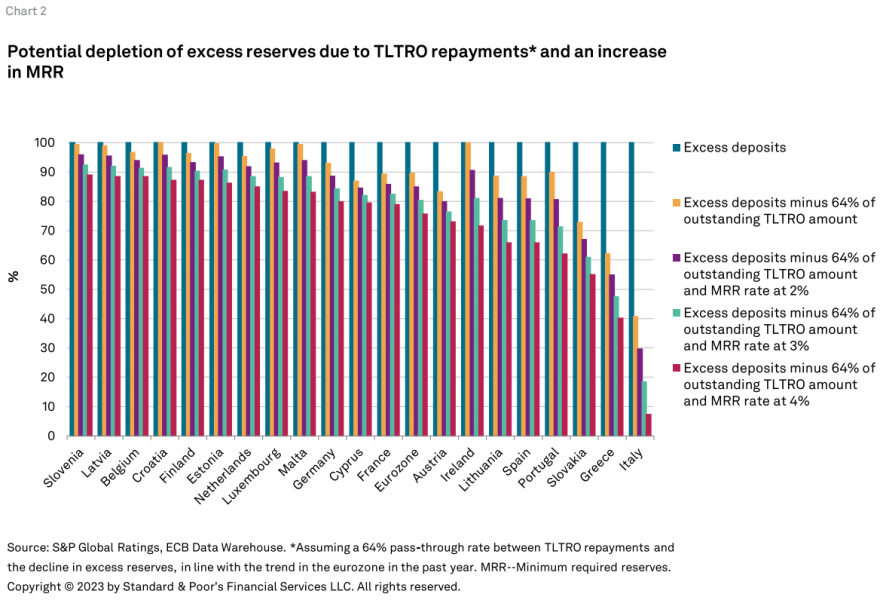

This would lead to a more drastic reduction of banks’ excess reserves in Italy, and to a lesser extent, in Greece (see chart 2). For these countries, returning MRR to its historical level of 2%, coupled with TLTRO repayments and a 64% pass-through rate, would lead to an overall depletion of excess reserves of about 70% in Italy and 45% in Greece (see chart 2). In our view, such a high level of reserve depletion would likely force some banks with weaker funding and liquidity positions to seek alternative refinancing options.

The impact on the banking systems in other eurozone countries appears more contained, as the drop in excess reserves would range between 10%-20% in most systems.

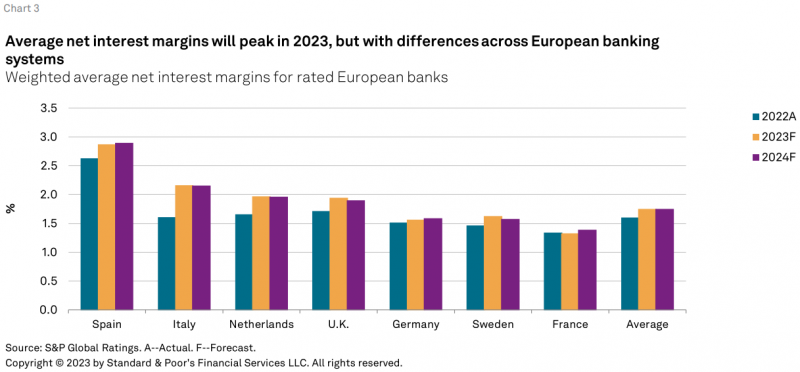

The ECB’s normalization of monetary policy is largely positive for eurozone banks. Most banks have benefited from the rise in interest rates as they have been able to reprice their assets faster than their liabilities in an environment of elevated liquidity and abundant deposits. We are seeing funding costs gradually catch up, and expect rated European banks’ net interest margins to peak this year but remain relatively high (see chart 3).

We expect the ECB to gradually take further steps to normalize its monetary policies. A return of the MRR to its historical level of 2% would complement the TLTRO repayments and passive quantitative tightening already under way. These actions will further help normalize eurozone banks’ funding costs and represent a manageable drag on earnings and liquidity.

That said, we also expect differences to emerge across jurisdictions and among banks within specific jurisdictions. Smaller players or those with weaker funding franchises are primarily at risk. Lower excess reserves could encourage fiercer competition between banks to attract new funding sources, including deposits or wholesale funding, or to reduce funding needs, for instance by curtailing lending.

We cannot exclude the slight possibility that the ECB could decide to materially tighten banks’ liquidity, either by raising the MRR beyond moderate levels, or by significantly accelerating its quantitative tightening program (see “What An Acceleration Of Quantitative Tightening Could Mean For Eurozone Banks,” published Sept. 13, 2023). This is a key risk for eurozone banks, and could lead them to act aggressively to protect their funding and liquidity positions.

The ECB would still be able to provide as much funding to solvent banks as necessary with its bank refinancing operations under the full allotment procedure. However, it could not prevent banks’ management from seeking to protect liquidity, for instance by deleveraging their balance sheets. Such actions could ultimately affect the lending conditions and banks’ asset quality in certain countries.