The Economic and Monetary Union (EMU) has irrevocably changed continental Europe over the past twenty-five years. In the early stages member states grew substantially more interconnected macroeconomically. The pressure of containing the sovereign debt crisis caused significant stress but also forged greater financial economic ties and triggered the initiation of several unconventional measures by the ECB. Being at the intersection of the macroeconomy, national and European policy making and being the transmission and increasingly the playground for the ECB’s monetary policy, the Eurozone bond market offers an empirically rich auditorium for chronicling EMU’s financial economic history. In studying the drivers of Eurozone sovereign bond spreads, we uncover the roles played by macroeconomic factors, by financial linkages, by political (un)certainty through market sentiment and by the ECB’s monetary policy in bringing these spreads together or in causing their divergence. We learn above all that they tell the tale of two different ECB policy regimes.

A CEPR Discussion Paper recently published by us empirically determines the factors that have influenced Eurozone government bond spreads and finds that there has been a growing disconnect with marco fundamentals over the course of EMU’s history. In fact, spread dynamics are much better explained by market risk-based factors. Most importantly, it is shown that the ECB has waged a mounting influence on Eurozone government bond spreads. Empirically, the transition moment is authenticated in 2012/2013. This coincides with the shift in the ECB’s monetary policy, from conventional to increasingly unconventional, that occurs under two sets of ECB Presidents, Duisenberg / Trichet and Draghi / Lagarde.

In our recent CEPR Discussion Paper (hereafter, Eijffinger and Pieterse-Bloem, 2022) we document the research journey that we have taken to establish, empirically, what the fundamental drivers of the spreads in yield of 10-year government bonds of the ten Eurozone member states relative to the Germany 10-year Bund have been, and what additionally the influence of the ECB’s policies has been on those spreads. Already some years into the monetary union, when these bond spreads converge, several authors start to explain this, mostly through macro economic factors. The importance of financial linkages and market sentiment factors swells the closer studies near the global financial crisis. When this crisis evolves in Europe into the sovereign debt crisis in 2009 and EMU convertibility risk rises (as per Eijffinger et al., 2018), a rupture between core and peripheral Eurozone countries becomes visible and an important topic for studies. From this vast field we regard Gomez-Puig et al. (2014) as a benchmark study, as they have tested the importance of macro fundamental factors for these spreads with the most comprehensive set of variables for 1999 to 2012. Another strand takes the approach to determine Eurozone sovereign bond spreads through risk factors that are commonly accepted to drive bond returns. Credit risk and liquidity risk are the main ones, occasionally complemented with international market risk or volatility risk and exchange rate risk. Afonso et al. (2015) combines such market risk factors with macro economic drivers in a similar multifactor model structure as Gomez-Puig et al. (2014) and is another benchmark study for us.

Both strands document early evidence that the ECB’s early policy response to the sovereign debt crisis tightened government bond spreads. Following Draghi’s “whatever-it-takes” statement in 2012, the impact of the ECB’s monetary policy on the spreads quickly grows into a field of its own. Studies that control for their time-varying heterogeneity in a multidimensional factor structure and still detect a sizeable effect from the ECB’s asset purchase programs such as Afonso et al. (2018) and Afonso and Jalles (2019) are good benchmark studies for us. All in all, do we determine the drivers of Eurozone government bond spreads in a multidimensional factor structure through a time-series regression model that enables factor-specific, time-specific and region-specific heterogeneities and a general-to-specific empirical approach, similar to Gómez-Puig et al. (2014) and Afonso et al. (2015). Our general unrestricted model encompasses the relevant category of factors for a Macro Fundamental-based (MF) model and a Market Risk-based (MR) model. Factors are in turn described by a set of selected variables. The general-to-specific approach to identify the best specification for the model uses all in a generally unrestricted linear fixed-effects regression, and step-wise excludes variables for lack of statistical and economic significance.

The aim that we set out for ourselves is to identify a general model that can describe the determinants of Eurozone government bond spreads over the past twenty-five years. We set out to identify the best specification of the MF model with variables for macroeconomic, financial linkages and market sentiment factors, firstly for the period 1999-2012 to then extend this to 2013-2021. However much we try with different variable combinations and permutations, we are not able to identify a specification for the MF model for this period of a satisfactory quality. Specifications are unstable and particularly a structurally significant constant term indicates an omitted variable problem. When we extend our best specification of the MF-model to 2013-2021, it performs worse. We do however also learn a couple of things. For example, that market sentiment factors perform better, that panel data for the Eurozone countries performs better than comparable variables at regional or global level, and that Greece is such an outlier that it should actually be omitted.

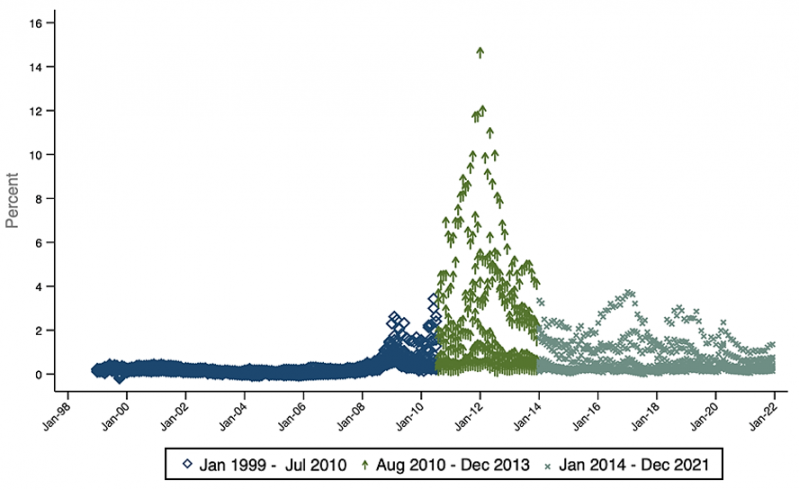

In the course of our empirical journey we notice that spreads behave differently in different periods. We use the methodology developed for panel data in Ditzen et al. (2021) and Karavias et al. (2021) based on the Bai-Perron (1998) sequential test to determine the presence of unknown breakpoints. Our reformulation of this sequential test to capture significant alterations in the distribution of spreads over time, has, to the best of our knowledge not previously been applied to Eurozone sovereign spreads, and over the full length of EMU’s existence. Through this sequential test we find two major breakpoints, in August 2010 and January 2014. The figure below, copied from Eijffinger and Pieterse-Bloem (2022), displays the three regimes that are identified through our break point test. In the first regime, spreads mostly converge. They visibly widen somewhat following initial signs of the global financial crisis in 2008. Spreads only react severely when Greece announces a larger-than-expected budget deficit in 2009, but not severe enough to break the trend in their joint distribution. This only occurs in August 2010 when the Eurozone is more deeply emerged into its debt crisis. In this second regime, Eurozone’s convertibility risk (as defined by Eijffinger et al., 2018) spikes in early summer of 2012. Draghi’s “whatever-it-takes” moment occurs at the peak of the spreads which subsequently decline but, distribution-wise, settle into a new regime only in January 2014. In this third and last regime spreads decline but do not regain the lows of the first regime.

Figure 1: Regimes in Eurozone sovereign bond spreads, defined by sequential breakpoint analysis

The findings with the fitting of the MF model motivate us to switch to the MR model. The findings of different regimes lead us to focus on the post-2013 period. We use CDS par spreads for single-name Eurozone sovereigns to describe credit risk, and the bid-ask spread in their bonds to describe liquidity risk. The specification with just these two risk factors alone already yields satisfactory explanatory power. We extend this base-line specification with the inclusion of various variables to describe interest rate risk, volatility risk, exchange rate risk and EMU (break-up) risk. Again following a general-to-specific approach, we find that the difference between the Federal Reserve’s and the ECB’s target rate, stock returns in the individual Eurozone equity market amplified by their volatility and outstanding balances of Eurozone countries in Target2 relative to their GDP add the most to the explanatory power of model.

From this extended baseline specification, we want to determine if the ECB’s monetary policy actions have, separately and independently, influenced spreads. Note that we already tried for the ECB’s target rate among our set of interest rate risk variables, which is also the main conventional monetary policy tool, and found no significant effect. We add stock variables for the ECB’s main refinancing operations (MRO), long term refinancing operations (LTRO) and asset purchases under its various quantitative easing programs (QE), defined as monthly growth rates. Adding them in different combinations reveals that MRO has too little explanatory power to justify inclusion in the best fit specification, that LTRO has very small and that QE has overwhelming explanatory power on spreads. The significance of previously identified variables remains and the model’s performance overall improves for 2014-2021 with the inclusion of these ECB variables. When we run this best-fit specification of the MR model on the other regimes, we find, somewhat to our surprise, that it also performs well in the prior periods.

Our best-fit model reveals, in line with previous literature that Eurozone government bond spreads increase with credit and liquidity risk, while investor risk appetite and growing linkages between member states decrease spreads. Specifically, Target2 balances impress the cost of the Eurozone’s break-up upon investors, but no longer significantly so in the third regime. The synchronisation of Fed and ECB short term interest rate setting is not significant in the period August 2010 to September 2013 when both policy rates are at the zero lower bound. When the Federal Reserve rate is consistently above the ECB rate in the period afterwards, it has an increasing effect on spreads. As for the ECB’s policies, the negative interest rates set have been an impotent tool for spreads. LTROs have some effect in bringing spreads down but only very modestly in the crisis and post-crisis periods. The asset purchases by the ECB through its QE programs has had by far the largest dampening effects on spreads.

Overseeing the total of our empirical results, we repeat the conclusions made in our CEPR Discussion Paper (Eijffinger and Pieterse-Bloem, 2022), namely that the determinants Eurozone sovereign bond spreads tell the tale of different regimes which are predominantly characterized by the ECB’s transferal from conventional to increasingly unconventional monetary policy and that this transferal coincides with the change from the first two Presidencies of Duisenberg and Trichet to that of Draghi and Lagarde. We infer from this that both sets of Presidencies have interpreted and implemented the mandate of the central bank in a very different way. While under Duisenberg and Trichet the ECB only acted in the Eurozone money market, under Draghi – Lagarde the central bank increasingly acts in the capital market. The growing detachment of sovereign bond spreads with macro fundamentals, detected through our fitting of the Macro Fundamental-based factor model and significantly better ability of the Market Risk-based factor model to explain the drivers in Eurozone sovereign bonds with ample explanatory power of the ECB’s QE purchases all speak to this tale.

Afonso, A., Arghyrou, M.G., Bagdatoglou, B. and Kontonikas, A., 2015. On the time-varying relationship between EMU sovereign spreads and their determinants. Economic Modelling, 44, 363-371.

Afonso, A., Arghyrou, M. G., Gadea, M. D. and Kontonikas, A., 2018. “Whatever it takes” to resolve the European sovereign debt crisis? Bond pricing regime switches and monetary policy effects. Journal of International Money and Finance, 86, 1-30.

Afonso, A. and Jalles, J. T., 2019. Quantitative easing and sovereign yield spreads: Euro-area time-varying evidence. Journal of International Financial Markets, Institutions and Money, 58, 208-224.

Bai, J. and Perron, P., 1998. Estimating and testing linear models with multiple structural changes. Econometrica, 66, 47–78.

Ditzen, J., Karavias, Y. and Westerlund, J., 2021. Testing and Estimating Structural Breaks in Time Series and Panel Data in Stata. arXiv:2110.14550v2

Eijffinger, S.C.W., Kobielarz, M.L. and Uras, B.R., 2018. Sovereign default, exit and contagion in a monetary union. Journal of International Economics, 113, 1-19.

Eijffinger, S.C.W and Pieterse-Bloem, M., 2022. Eurozone Government Bond Spreads: A Tale of Different ECB Policy Regimes, CEPR Discussion Paper Series, DP17533, CEPR, 7 September 2022.

Gómez-Puig, M., Sosvilla-Rivero, S. and del Carmen Ramos-Herrera, M., 2014. An update on EMU sovereign yield spread drivers in times of crisis: A panel data analysis. North American Journal of Economics and Finance, 30, 133–153.

Karavias, Y., Westerlund, J. and Narayan, P., 2021. Structural Breaks in Interactive Effects Panels and the Stock Market Reaction to COVID-19. Journal of Business & Economic Statistics, online access.